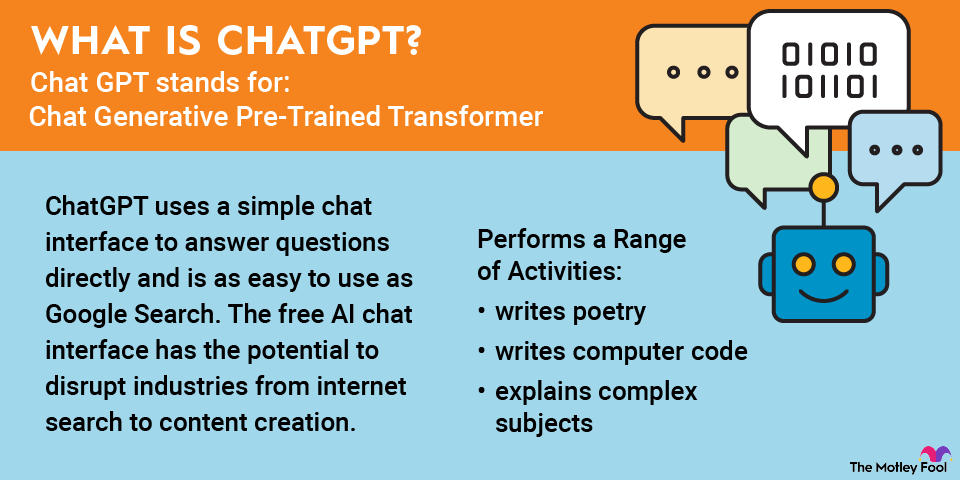

Most investors probably aren't familiar with quantum glass batteries, but the technology could revolutionize electric vehicles (EVs) and the broader renewable energy industry. If you're wondering what a quantum glass battery is, a brief explanation follows.

What are quantum glass batteries?

Quantum glass batteries, or glass batteries, offer more advanced technology than the lithium-ion batteries common in today's EVs. In glass batteries, electrolytes have a higher energy density and can deliver an equal amount of power as lithium-ion batteries, but in a smaller space.

Quantum glass batteries also don't catch fire, so they don't need the components that lithium-ion batteries have to prevent them from doing so. Quantum glass batteries charge faster, too, and their higher energy density means they can give EVs greater range.

Glass batteries are still a nascent technology, but you can see why this market would be alluring to investors, especially given the explosion in demand for EVs over the past few years and the general belief that EVs will eventually displace gas-powered vehicles.

Below, we'll explore some of the companies that hold critical patents in quantum glass batteries. Keep reading to learn more about five of the best quantum glass battery technology companies today.

Best quantum glass battery stocks in 2026

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| QuantumScape (NASDAQ:QS) | $5.3 billion | 0.00% | Auto Components |

| Toyota Motor (NYSE:TM) | $295.7 billion | 2.79% | Automobiles |

| Solid Power (NASDAQ:SLDP) | $855.8 million | 0.00% | Auto Components |

| Volkswagen Ag (OTC:VWAGY) | $35.7 billion | 5.90% | Automobiles |

| General Motors (NYSE:GM) | $75.9 billion | 0.68% | Automobiles |

1. QuantumScape

NASDAQ: QS

Key Data Points

With no material revenue and largely experimental technology, picking a leader in glass batteries is difficult. Still, QuantumScape (NYSE:QS) has attracted more investor attention than any pure-play competitor.

The company went public via a SPAC merger in late 2020 and has since refocused after an early surge in valuation during the EV boom. QuantumScape has demonstrated fast-charging single-layer cells and multi-layer prototypes, but scaling those results into full batteries remains a major challenge. As of mid-2024, it had shipped early prototypes to select automotive and consumer electronics customers.

QuantumScape’s lead commercial candidate is QSE-5, a 24-layer automotive cell, with B1 samples expected to support vehicle testing in 2026. Momentum improved in 2025 after the technology was demonstrated in an all-electric Ducati motorcycle, and the company signed a key materials partnership with Corning.

Most importantly, QuantumScape has a licensing agreement with Volkswagen’s PowerCo, which could mass-produce its battery designs once technical milestones are met, potentially supplying up to 1 million vehicles per year. While revenue is unlikely before 2026, the company ended Q2 2025 with about $800 million in cash, giving it a funding runway through 2029.

2. Toyota

NYSE: TM

Key Data Points

Most major car manufacturers want to partner with battery tech start-ups working to build quantum glass batteries. Toyota (TM +2.08%) is taking a different route by looking to build its own. The company has been a laggard in the EV race, but in 2021, it said it would invest $13.6 billion in batteries over the next decade, including a significant portion in quantum glass batteries.

First, it's well capitalized with a thriving core business. There's no reason to worry about the glass battery investments sinking the stock, meaning it will be less volatile than a pure-play battery stock. Toyota also plans to initially use its solid-state battery cells in its hybrid vehicles.

In September 2022, the company acknowledged that it would take longer than expected to develop glass batteries for fully electric cars. Investors should expect such setbacks since producing these batteries at scale is a monumental engineering challenge.

At its June 2023 shareholders meeting, the company touted a "technological breakthrough" in its solid-state batteries and now aims to begin selling them by 2028, pushing back an earlier target date of 2025. It's now aiming for mass production by 2030, and it expects to focus on hybrids rather than EVs since the company sees hybrids as a good technological test case.

It said its first solid-state battery would offer a 20% increase in range over its standard lithium-ion battery to more than 600 miles and a fast charging time of 10 minutes or less.

In October 2025, it announced a development agreement with Sumimoto Metal Mining to mass-produce cathode materials for solid-state batteries, showing it's making progress.

3. Solid Power

NASDAQ: SLDP

Key Data Points

OTC: VWAGY

Key Data Points

Volkswagen (VWAGY +0.08%) has made a broad range of efforts to develop a battery cell, including its subsidiary, PowerCo, which recently unveiled a new unified battery cell.

It's working on both traditional lithium-ion batteries and solid-state batteries. Solid-state batteries are further behind in the company's pipeline than other battery chemistries like nickel manganese cobalt, lithium iron phosphate, and sodium-ion, which are easier to develop.

While solid-state technology isn't expected to enter production for at least a few years, the Ducati powered with solid-state tech was a win for VW as well.

Moving ahead, its partnership with QuantumScape should provide it with an advantage, especially if the companies can deliver the new technology on schedule.

5. General Motors

NYSE: GM

Key Data Points

General Motors (GM +0.24%) has also been taking something of an "all of the above" approach with electric vehicles. In addition to traditional lithium-ion batteries, the company is also experimenting with sodium-ion and solid-state batteries.

GM is now the largest producer of battery cells in North America, in tandem with its top supplier, LG Energy Solution, and the company believes its cells cost less to produce than its rivals do.

The automaker has its battery development center, the Wallace Battery Cell Innovation Center opened in 2022, and like VW, it's experimenting with several different chemistries. Thus far, GM doesn't seem to have taken any significant steps in solid-state cells beyond research, but the company is spending aggressively on EVs and battery technology, so it should play a role in it in the future.

Revenue

How to invest in quantum glass battery stocks

If you're looking to invest in quantum glass battery stocks, the process is like buying another publicly traded stock. Just follow the directions below.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Related investing topics

Are quantum glass battery stocks right for you?

Investing in quantum glass battery stocks at this point is not much different from buying development-stage biotech stocks. We are still several years away from this technology going mainstream, and the field is wide open with no viable products available yet.

Additionally, promises of technology haven't always come true in the auto industry. Many industry insiders, including auto company CEOs, expected autonomous vehicles to be commonplace by now, but that hasn't happened.

That doesn't mean quantum batteries won't be successful, but investors may want to wait until more conclusive data comes in and a clear leader emerges. At this point, glass battery stocks are only suitable for investors with a very high tolerance for risk.