"Half the money I spend on advertising is wasted; the trouble is, I don't know which half," the old adage goes. Advertising is as much art as science, even in a digital age when trillions of ad impressions are served to the world's internet users on PCs, smartphones, and TVs.

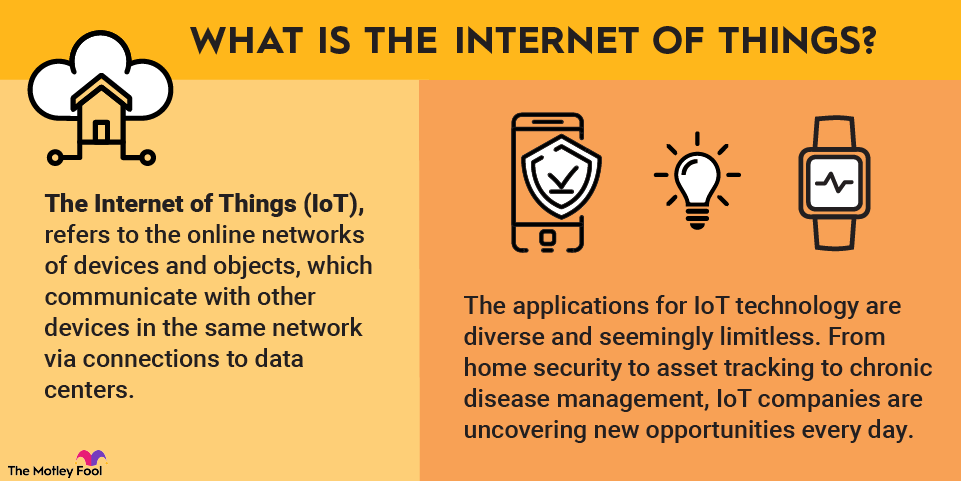

The advertising technology, or adtech, industry aims to improve the process of buying and selling ads with software and other tools. Using massive computing power and technologies such as artificial intelligence, adtech companies can help advertisers make better use of their ad spending and help publishers better monetize their content.

Best adtech stocks in 2025

There's no shortage of adtech companies looking to snag a piece of an industry worth hundreds of billions of dollars. Here are five adtech stocks that investors should consider.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| The Trade Desk (NASDAQ:TTD) | $25.4 billion | 0.00% | Media |

| PubMatic (NASDAQ:PUBM) | $400.1 million | 0.00% | Media |

| Magnite (NASDAQ:MGNI) | $2.8 billion | 0.00% | Media |

| Digital Turbine (NASDAQ:APPS) | $744.3 million | 0.00% | Software |

| DoubleVerify (NYSE:DV) | $2.0 billion | 0.00% | Media |

1. The Trade Desk

NASDAQ: TTD

Key Data Points

The Trade Desk (TTD -4.04%) serves the buy side of the digital advertising market. The company's self-service platform allows ad buyers to create and manage digital advertising campaigns across all major channels.

When the internet was young, digital advertising wasn't all that complicated. An advertiser could effectively reach audiences with display ads, and devices were limited to PCs. Today, people are spending their time using PCs, smartphones, tablets, and connected TVs, and they're consuming content through websites, mobile apps, social media, and streaming services.

The Trade Desk's artificial intelligence (AI)-powered, cloud-based platform churns through massive amounts of data to automate the ad-buying process. The company enables advertisers to reach their audience across channels, and data from one channel can be used to inform decisions about a different channel. For The Trade Desk's advertising agency and service provider customers, the platform greatly simplifies the process of launching a modern digital advertising campaign.

Not only is The Trade Desk rapidly increasing revenue, but it's also highly profitable. Through the first two quarters of 2025, the company's sales jumped 22% annually to reach $1.3 billion, and the company's diluted earnings per share (EPS) jumped 22% to $0.28.

Connected TV (CTV), a category that includes devices such as Roku (ROKU -2.02%) and Xbox, is one of the company's biggest long-term opportunities as ad-based streaming services proliferate. The Trade Desk's CTV advertising technologies are reaching more than 90 million households with more than 120 million connected televisions around the world, and there's still huge room for expansion. With global digital ad spending expected to approach $800 billion in 2025 and rise to $966 billion in 2028, The Trade Desk’s market opportunity is enormous.

2. PubMatic

NASDAQ: PUBM

Key Data Points

While The Trade Desk focuses on ad buyers, PubMatic’s (PUBM +1.86%) sell-side platform enables publishers and app developers to better monetize their content. Of course, a publisher could go it alone and sell ad space directly. But the process is time-consuming and labor-intensive, and there’s no guarantee money isn't being left on the table.

PubMatic’s home-grown cloud platform processed an astounding 78 trillion ad impressions in the second quarter of 2025 -- a 28% year-over-year increase -- for its more than 1,950 publishers. The company's platform is integrated with major buy-side platforms, including The Trade Desk, providing a vast array of ad inventory to tens of thousands of advertisers.

PubMatic’s approach to infrastructure is unique. Instead of relying on a cloud computing provider, PubMatic owns and operates its own hardware. This makes the business more capital-intensive, but it saves PubMatic from massive cloud computing bills that would eat into its profits. The company has consistently leveraged its infrastructure and used software improvements. In the second quarter of 2025, for example, PubMatic reduced its unit cost of impressions by 20% year over year for the trailing-12-month period.

The intense focus on keeping costs down has allowed the business to serve up dependable profits. While PubMatic's sales growth has slowed this year and caused volatile moves for the company's share price, the stock looks attractively valued. For investors seeking adtech stocks with explosive upside, PubMatic is certainly worth a look.

3. Magnite

NASDAQ: MGNI

Key Data Points

Like PubMatic, Magnite (MGNI +4.18%) operates a sell-side digital advertising platform. The company was formed in 2020 by the merger of The Rubicon Project and Telaria, the latter of which focused on connected TV and video publishers. With revenue of $668.2 million in 2024, Magnite is more than twice the size of PubMatic in terms of sales.

Neither Magnite nor PubMatic owns any media properties, so their interests are squarely aligned with those of their publisher customers. Unlike PubMatic, Magnite makes use of cloud computing providers to handle some of its processing. Magnite adopts a hybrid approach, mixing servers hosted at data centers around the world with cloud platforms.

Being the biggest independent sell-side player, Magnite is certainly a stock to consider, especially considering how the company continuously improves its bottom line. In 2024, the company generated net income of $22.8 million -- a marked gain over the negative $159.2 million in 2023 and negative $130.3 million in 2022. More recently, Magnite reported $0.08 diluted EPS for the second quarter of 2025, representing a stark turnaround from the $0.01 diluted loss per share it reported during the same period in 2024.

4. Digital Turbine

NASDAQ: APPS

Key Data Points

Digital Turbine (APPS +3.90%) is in the business of helping wireless carriers and device manufacturers manage and monetize devices. DigitalTurbine's solution enables app installation at activation and during the lifetime of the device. Third-party advertisers pay for each install or action, allowing carriers and original equipment manufacturers to generate additional revenue.

Various acquisitions have expanded the scope of Digital Turbine's offerings. Through the acquisitions of Mobile Posse, AdColony, Appreciate, and Fyber, the company enables broader monetization over the lifetime of devices.

Digital Turbine has powered billions of app preloads, and it has more than 40 long-term agreements with companies, including Verizon (VZ +1.09%), AT&T (T +2.11%), and Samsung (OTC:SSNL.F). The ads specialist spends little on operating costs, but the business has faced headwinds stemming from relatively soft mobile device sales, macroeconomic pressures, and other factors for the past few years.

But the company has shown signs of turning things around in fiscal 2025 thanks to management embracing artificial intelligence and machine learning. After suffering from several years of lagging sales, Digital Turbine expects improvements in fiscal 2026, forecasting both year-over-year revenue growth of 7% to 9% and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) growth of 24% to 31%.

5. DoubleVerify

NYSE: DV

Key Data Points

Pros and cons of investing in adtech stocks

Although there's no categorical answer as to whether adtech stocks are a good fit for your portfolio, there are some clear advantages and disadvantages to investing in these stocks.

Some of the potential pros of investing in adtech stocks:

- Adtech stocks have the potential for strong growth. The research provider Fortune Business Insights estimated the global adtech market size was valued at $876.2 billion in 2024 and projects it to grow from $986.9 billion in 2025 to $2.547.17 trillion by 2032.

- Investing goals may vary, but portfolio diversification is an essential element of any portfolio, and adtech stocks could help achieve this.

- Adtech companies often help businesses grow sales, making them extremely advantageous.

Naturally, investors must also recognize the risks related to adtech stock investments:

- If a downturn in the economy occurs, businesses may be inclined to reduce their marketing budgets, hindering the presumed growth of adtech companies.

- Artificial intelligence (AI) and machine learning technologies are growing rapidly, and if adtech companies don't stay up to date, their platforms may become antiquated. Consequently, they may have to invest heavily in research and development, which can reduce profits.

- Many adtech companies are making substantial reinvestments in their business in lieu of returning capital to shareholders with dividends, so those looking to generate passive income have limited options with adtech stocks.

Related investing topics

How to Invest in adtech stocks

If you think you're ready to start investing in adtech stocks, there are a few basic steps you must take.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.