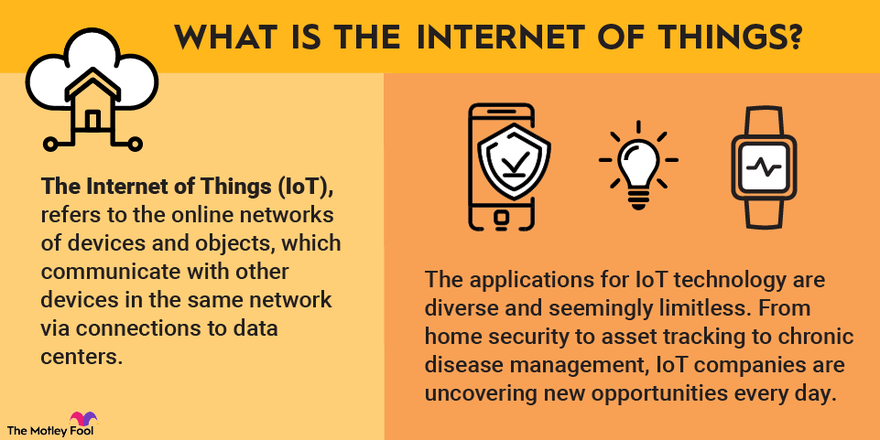

Computers and smartphones aren't the only devices connecting to the internet. Everyday objects such as lights, televisions, major appliances, cars, and even doorbells are being brought online. The Internet of Things (IoT) refers to the networks of devices and objects that communicate with other devices in the same network via connections to data centers.

What is IoT?

What is the Internet of Things?

Although there is plenty of overlap among general technology, cloud computing, and the IoT, pure-play IoT companies are relatively rare. Any company that makes consumer electronics devices, sensors, or chips for industrial or commercial purposes has at least some exposure to IoT technology. Software platforms that manage IoT devices and cloud computing companies are also engaged with the IoT sector.

Best IoT stocks in 2025

Best IoT stocks

These six top IoT stocks range from a diversified tech giant to a pure-play IoT company:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Cisco Systems (NASDAQ:CSCO) | $272 billion | 2.37% | Communications Equipment |

| Alarm.com (NASDAQ:ALRM) | $3 billion | 0.00% | Software |

| DexCom (NASDAQ:DXCM) | $26 billion | 0.00% | Healthcare Equipment and Supplies |

| Impinj (NASDAQ:PI) | $6 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Intel (NASDAQ:INTC) | $171 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Samsara (NYSE:IOT) | $23 billion | 0.00% | Software |

Companies 1 - 3

1. Cisco Systems

Cisco Systems (CSCO -0.14%) is the leading provider of enterprise networking hardware. Because its products form the backbone of the internet, the tech giant benefits from the explosion of internet-enabled devices.

Cisco sells networking hardware designed for handling large numbers of connected devices, including rugged, durable products aimed at industrial applications. On the software side, the company provides the Cisco Edge Intelligence platform and other tools for managing IoT data and devices.

Cisco is also one of the largest cybersecurity companies. The company offers hardware, software, and services aimed at securing networks against threats, including those specifically targeting IoT systems.

Cisco is a low-risk way of investing in IoT. The company is supremely profitable, having generated net income of $10.3 billion on revenue of $53.8 billion in fiscal 2025. And it's not only on the income statement that Cisco shines. In fiscal 2025, Cisco generated about $13.3 billion in free cash flow.

The company is sensitive to global economic conditions, given that its customer base includes many large companies, organizations, and governments. However, investing in the stock is a good way to gain exposure to IoT without taking big risks. Cisco remains as dominant as ever, and the company is poised to benefit from the growth of the IoT market.

2. Alarm.com

While Cisco's (ALRM -1.7%) market cap borders $274 billion, cloud software provider Alarm.com is valued at just a few billion. Its relatively small size makes it riskier than the tech giant, but the company has plenty of growth potential.

Alarm.com provides a cloud-based software platform for managing a connected home or business. Subscribers use the software to manage internet-enabled devices, including security cameras, lights, locks, thermostats, and a range of other supported products.

Alarm.com partners with service providers to sell its platform to consumers and businesses. The company currently works with about 12,000 service providers in more than 70 countries, and its products are found in about 67 million properties worldwide.

Recognizing both steady top- and bottom-line growth from 2016 through 2024, Alarm.com has increased revenue at a 17.4% compound annual growth rate (CAGR) and adjusted earnings before interest, depreciation, and amortization (EBITDA) at a 17.3% CAGR.

In addition to revenue of $990 million to $996.4 million, Alarm.com projects adjusted EBITDA of $195 million to $196.5 million for 2025. Should the company achieve the midpoints of both of these metrics, it will recognize year-over-year growth of 5.7% and 11.2%, respectively.

Revenue

Management recognizes ample growth opportunities, identifying more than 500 million serviceable properties. Since only a small fraction of homes are currently using Alarm.com’s platform, the IoT company has a long growth runway.

With the smart home trend here to stay, Alarm.com -- and its millions of subscribers -- is an early leader.

3. DexCom

The Internet of Things goes far beyond consumer devices. DexCom (DXCM -0.59%) is focused on medical devices used to continuously monitor glucose for diabetics. The company's G7 system delivers real-time data to smartphones and smartwatches without the need for finger sticks.

The number of people in the U.S. with diagnosed diabetes grew from 1.58 million in 1958 to 23.35 million in 2015, according to data from the Centers for Disease Control and Prevention. Today, about 38 million Americans have diabetes, and approximately 98 million American adults have prediabetes.

The combination of growing rates of diabetes and the transition to continuous glucose monitoring will give DexCom plenty of growth opportunities in the coming years. In 2024, revenue grew 11% year over year to $4 billion. Management projects continued growth in the coming year, forecasting 2025 sales of about $4.6 billion. With respect to adjusted EBITDA, Dexcom projects about $1.4 billion in 2025 -- about 27% higher than the $1.1 billion in adjusted EBITDA it reported in 2024.

DexCom has historically traded at expensive multiples, but for those willing to take on some risk to gain exposure to both IoT and healthcare, it's a stock to consider.

Companies 4 - 6

4. Impinj

Impinj (PI -1.56%) specializes in solutions involving radio-frequency identification, or RFID. Impinj's RFID tags are used by retailers, manufacturers, and logistics companies to track inventory and assets.

The market for RFID products, including tags, readers, software, and services, was worth $12.6 billion in 2025, according to Markets and Markets, and it's expected to grow at a CAGR of more than 9% through 2033. Apparel retail is so far one of the biggest markets by volume for RFID technology, but the technology also has applications in supply chain logistics.

Impinj had a rough go of it during the COVID-19 pandemic, partly due to retail store closures, but the company has bounced back in a big way. Sales soared from $190.3 million in 2021 to $366.1 million in 2024. The company is growing profits, too. In the second quarter of 2025, it reported adjusted EBITDA of $27.6 million, up from $26.8 million during the same period in 2024.

Impinj estimates that just 0.3% of connectable items are connected today. In the long run, trillions of consumable objects, ranging from food packaging to tires, could be tracked using RFID technology. Each RFID endpoint costs only pennies, making the technology economical for a wide array of uses.

Impinj has shipped more than 100 billion RFID endpoints over its lifetime, and the number could rise substantially in the coming years. Impinj is far from a sure thing as an investment, but it's a company to watch in the IoT space.

Total spending on consumer and industrial IoT technology is expected to pass $1 trillion in 2025.

5. Intel

IoT isn't Intel's (INTC 2.2%) core market, but the semiconductor giant's data center chips power the cloud data centers that link IoT devices. Despite rising competition, Intel still dominates the data center CPU market.

Beyond powerful chips crunching data in the cloud, Intel sells chips meant for the edge. Its Xeon D family of processors, for example, has built-in AI for IoT applications and can operate in harsh, rugged conditions.

In 2015, Intel acquired Altera to expand its exposure to the IoT. Recently, Intel said it is exploring the spinning off of Altera and potentially holding an initial public offering (IPO) for it in the near future.

Intel also owns a majority stake in Mobileye (MBLY 0.17%), a leading developer of autonomous driving and advanced driver assistance systems. There are more than 1 billion cars on the road globally, and the fleet will become smarter and more connected.

In addition to selling its own chips that serve various parts of the IoT market, Intel is pouring tens of billions of dollars into building out its manufacturing capacity and starting up its own foundry business. Intel can further tap into the growing demand for IoT devices by manufacturing the necessary chips for other companies.

Intel isn't a pure-play IoT stock, but the company has multiple ways to benefit from a growing IoT industry.

Semiconductor

6. Samsara

As developer of the Connected Operations Platform, (IOT -4.04%) Samsara has created a platform that integrates data from IoT devices and other connected assets to provide customers with actionable insights from the ample data that the IoT devices collect. Samsara estimates that in fiscal 2025, its Data Platform processed more than 14 trillion data points -- everything from video footage to people and motion detection to GPS location and a wide variety of other pieces of data.

The company has achieved considerable growth in the 10 years since its founding. In fiscal 2018, for example, Samsara had more than $10 million in annual recurring revenue (ARR), yet in the first quarter of fiscal 2026, the company reported ARR in excess of $1.5 billion.

Unsurprisingly, Samsara has also achieved impressive growth with respect to the income statement. From the $119.9 million that it reported on the top line in fiscal 2020 to the sales of $1.25 billion it reported for fiscal 2025, Samsara has grown revenue at a near 60% CAGR. For fiscal 2026, Samsara projects further growth, forecasting sales of $1.547 billion to $1.555 billion.

Despite the company's success in emerging as an IoT leader, it's still early in the company's development, and with management estimating it has a total addressable market approaching $200 billion, it's clear that Samsara has the potential for further growth in the years ahead.

Related investing topics

How to invest

How to invest in IoT stocks

If you think you're ready to start investing in IoT stocks, there are a few basic steps you must take.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Are they right for you?

Is buying IoT stocks right for you?

Sadly, there's no single answer as to whether IoT stocks are a good fit for your portfolio since investors have a wide variety of investing goals. It's important to drill down and clearly examine the potential rewards and risks.

Some of the potential advantages of investing in IoT stocks:

- IoT stocks have the potential for strong growth. The research provider Fortune Business Insights estimated the IoT global market was valued at $714.5 billion in 2024, and it estimates the market will grow to $4.1 trillion by 2032.

- Regardless of your investing goals, portfolio diversification is an essential element of any portfolio -- something that can be gained with an IoT investment.

- IoT solutions often help companies achieve better operating efficiencies and improve their profitability, making them a highly advantageous technology for many businesses to embrace.

Of course, investors must also recognize the risks related to IoT stock investments:

- If a downturn in the economy occurs, pressure on consumers and businesses may emerge, and the IoT market may not develop as rapidly as some pundits predict.

- Artificial intelligence (AI) technology is growing rapidly, and if IoT companies don't keep up, their solutions may become outdated. Consequently, they may have to invest heavily in research and development, which could reduce profits.

- Many IoT companies are reinvesting in their business instead of returning capital to shareholders with dividends, so those looking to generate passive income have limited options with IoT stocks.

If you'd rather not choose among individual stocks, you can still gain exposure to the IoT sector by investing in an IoT-focused exchange-traded fund (ETF). One such fund is the Global X Internet of Things ETF (SNSR -2.24%), which holds positions in dozens of IoT-related companies, including DexCom. Buying shares in an IoT-focused fund confers instant sector diversification.

If you are a risk-tolerant and patient investor, then investing in IoT companies may be a smart choice for you. Everyday objects are increasingly connecting to the internet, and while a "smart toaster" will always be gimmicky, IoT technology is useful for many important applications. Home security, asset tracking, and management of chronic diseases are among the many uses for IoT technology.