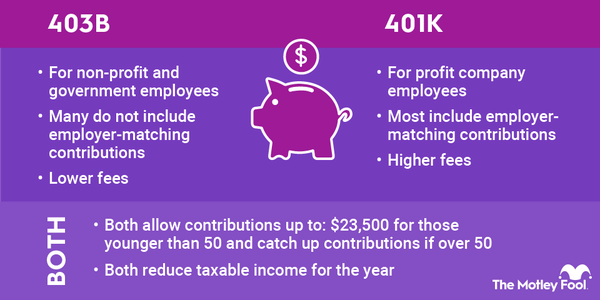

Both a 401(k) and IRA are tax-advantaged retirement accounts, but they work differently. 401(k)s are sponsored by employers and often offer limited investment options.

IRAs aren't linked to employment. You can open one with any brokerage firm or other financial institutions. IRAs have a wider variety of investment selections, but they require more hands-on management.

Because 401(k)s are offered through employers, you'll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested.

- Roll over to a new 401(k).

- Roll over to an IRA.

There are plenty of pros and cons to these options, but let's take a close look at when rolling your workplace 401(k) into an IRA may make sense for you.

When to roll over

When to roll over your 401(k) to an IRA

Rolling over your 401(k) to an IRA is possible only if you're leaving your current employer or your employer is discontinuing your 401(k) plan. It is an alternative to:

- Leaving your money invested in your existing 401(k).

- Rolling over to your new employer's 401(k).

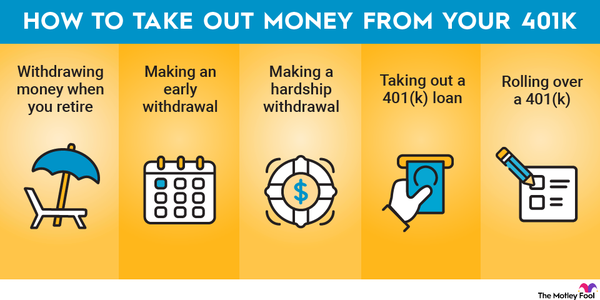

- Withdrawing from your 401(k), which would often trigger a 10% penalty unless you are 59 1/2 or older.

A rollover (either to a new 401(k) or an IRA) does not have tax consequences, so long as your new account has the same tax status (pre-tax or post-tax, often referred to as a Roth) as the account you're rolling over. But if you rolled over a pre-tax 401(k) to a Roth IRA, you'd owe taxes on the converted amount.

Rolling over a 401(k) to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn't offer a 401(k) plan.

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401(k) administrator won't allow you to stay invested for some other reason (such as having too low of a balance).

- Your new employer's 401(k) plan charges high fees, offers limited investments, or has other drawbacks.

- You'd prefer a wider choice of investment options.

However, there are some downsides to consider:

- While 401(k) loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated if you've received company stock from the employer you are leaving or have just left and it's in your 401(k) account.

If these downsides aren't dealbreakers for you, the next step is figuring out how to roll over your 401(k) to an IRA.

Employee Stock Ownership Plan (ESOP)

How to roll over

How to roll over your 401(k) into an IRA

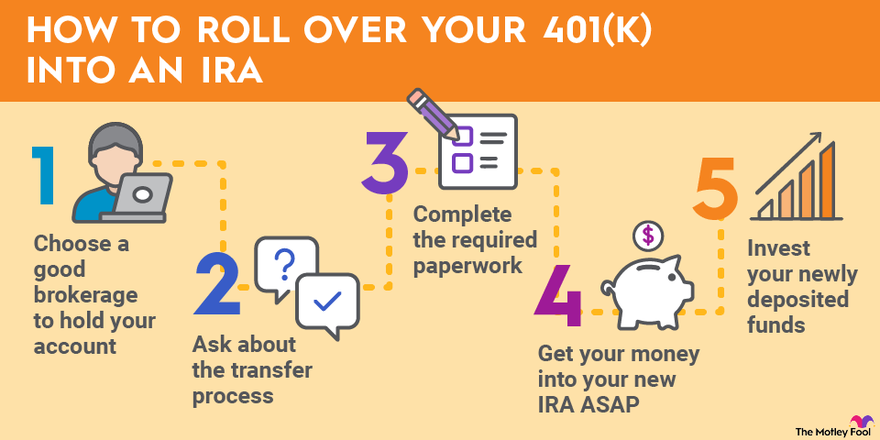

Rolling over a 401(k) into an IRA is easy. Just take the following five steps:

1. Choose a good brokerage to hold your account.

Factors to consider include cost (look for a brokerage offering $0 trading commissions and few or no other fees, such as IRA custodian fees); availability of investments; customer service; usability; and research tools.

2. Ask the brokerage and your 401(k) administrator about the transfer process.

You may need to set up an IRA first and arrange for your company to transfer funds, or you may receive a check you have to deposit yourself.

3. Complete the required paperwork.

Chances are you'll have forms to complete with your 401(k) administrator to arrange for the money to be transferred. Generally, during the rollover process, whatever investments you have will be sold and cash will be deposited into your new account.

4. Get your money into your new IRA ASAP.

If your 401(k) administrator doesn't transfer the money directly to your new IRA, you must deposit it within 60 days to avoid tax penalties associated with early withdrawals.

Related retirement topics

5. Invest your newly deposited funds.

You'll have to choose investments for your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

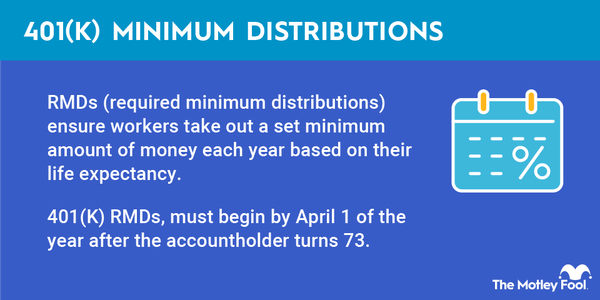

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

FAQs

FAQs: How to Roll Over Your 401(k) to an IRA

Can you roll over a 401(k) to an IRA without penalty?

You can roll over money from a 401(k) to an IRA without penalty, but you must deposit your 401(k) funds within 60 days. However, there will be tax consequences if you roll over money from a traditional 401(k) to a Roth IRA.

What are the advantages of rolling over a 401(k) to an IRA?

Rolling over money from a 401(k) to an IRA allows you to gain access to more investment options than are typically available in workplace 401(k) accounts. You may also be able to avoid account management fees associated with some 401(k) plans.

How do I roll over my 401(k) to an IRA?

When you leave your job for any reason, you have the option to roll over a 401(k) to an IRA. This involves opening an account with a broker or other financial institution and completing the paperwork with your 401(k) administrator to move your funds over.

Usually, any investments in your 401(k) will be sold. The money will then be deposited into your new account, or you will receive a check that you must deposit into your IRA within 60 days to avoid early withdrawal penalties. If your provider directly sends you the check, they'll automatically withhold 20% for taxes.