If you're 50 or older, you can take advantage of 401(k) catch-up contributions to not only boost your retirement savings but also lower your tax bill.

How 401(k) catch-up contributions work

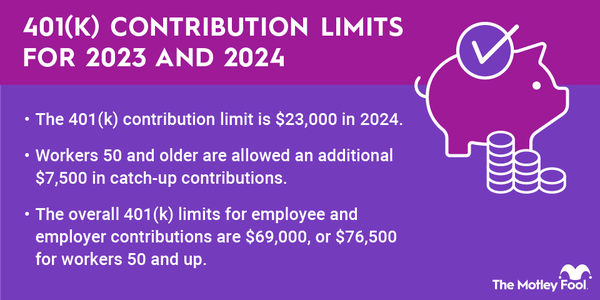

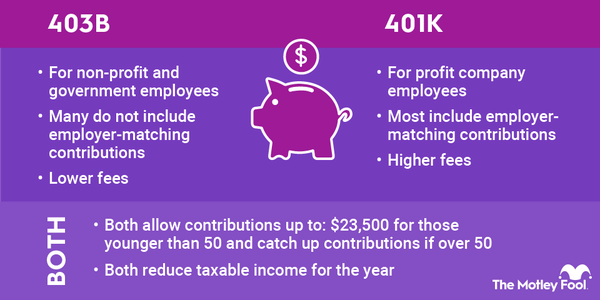

Catch-up contributions are extra retirement account contributions that those 50 and older can make each year. People younger than 50 may contribute up to $23,000 in 2024 and $23,500 in 2025 to their 401(k)s. Adults 50 and older may add an extra $7,500 to this limit in both 2024 and 2025, bringing their total contribution limit for the plan year to $30,500 (2024) or $31,000 (2025).

In 2025, workers ages 60 to 63 are also allowed to make an even larger catch-up contribution. Under the SECURE 2.0 Act of 2022, these workers can make an $11,250 catch-up contribution.

Eligible participants don't have to do anything special to make 401(k) catch-up contributions. These are the same as other regular employee contributions, but you may need to raise the deferral amount from your paycheck to your 401(k).

Catch-up contributions are taxed in the same as normal 401(k) contributions. This usually means that your contributions reduce your taxable income for the year, and you pay taxes on the withdrawals later on in retirement. But if you're using a Roth 401(k), you pay taxes on your contributions now in exchange for tax-free withdrawals later.

A few thousand dollars more per year may not seem like that much when retirement can cost well over $1 million, but you may be surprised at how much of a difference catch-up contributions can make over the long term.

401(k) catch-up contribution example

Using a 401(k) retirement plan, let's break down the impact of catch-up contributions to saving for your retirement.

Let's say a 50-year-old employee plans to retire at 67, so they have 17 years to save for retirement. Using the regular employee contribution limit of $23,500 for 2025, with an average 7% annual return rate, would result in about $725,000 in 17 years. This doesn't even include any matching contributions from employers.

What if that same employee decided to contribute the maximum $31,000 for 2024 instead? With the same average annual rate of return, an eligible participant could end up with around $956,000. That's a difference of about $231,000, and only $127,500 of that is additional employee contributions. The rest comes from investment earnings.

Keep in mind that 401(k) contribution limits can change over time, so while you're allowed to make only $7,500 in catch-up contributions for 2024 and 2025 (unless you're ages 60 to 63) you may be allowed to contribute even more in future years. Check these limits every year to make sure you're not missing out on an opportunity to save even more.

Is that enough for you to comfortably retire on? No one can say for sure. How much you need to retire depends on how long you expect your retirement to last and what you think your lifestyle will be like. But it's clear that catch-up contributions can make a significant difference in your retirement savings, especially if you start making them as soon as you're eligible.

Are catch-up contributions enough?

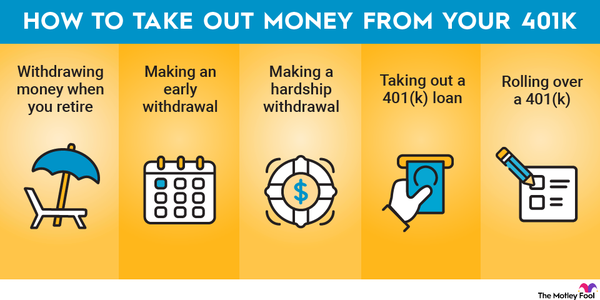

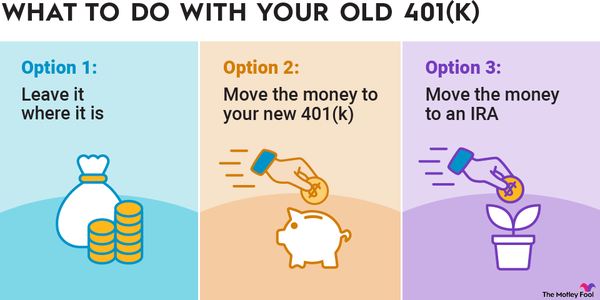

There are options if just using catch-up contributions isn't enough to reach your retirement goal. An IRA retirement plan also allows for catch-up contributions: Adults 50 and older may contribute up to $8,000 in 2024 and 2025 -- that's $1,000 more than adults younger than 50 can contribute.

Another option would be investing money in a taxable brokerage account. These don't offer tax breaks like a retirement plan would, but if you keep your holdings for longer than one year, the money become subject to long-term capital gains tax. This is a more preferable tax rate on earnings than standard income tax rates.

If you don't have extra cash to put toward retirement, you could always try delaying retirement instead. This gives you additional time to save while also reducing the length of your retirement, so you can afford to retire on less. You'll have to do the math to figure out how much longer you'd need to work, but even a few months can make a big difference.