Some of the best stocks to buy in the past 25 years started as small-cap stocks. Amazon (AMZN +2.06%) was a $7 stock in 1998, and Tesla (TSLA -0.07%) had a market valuation of a little more than $1 billion in 2010.

Of course, not every small-cap company becomes a giant. Investing in small companies can be rewarding, but it also comes with risks that investors need to understand. Here's a close look at small-cap stocks, including our picks for some of the best.

What are small-cap stocks?

"Small cap" is short for small market capitalization, which is equal to a company's share price multiplied by the number of shares outstanding. A company is generally considered to be a small cap if its market cap falls between $300 million and $2 billion. Stocks classified by market capitalization are generally divided as follows:

Category | Market Capitalization |

|---|---|

Micro-cap companies | Less than $300 million |

Small-cap companies | $300 million to $2 billion |

Mid-cap companies | $2 billion to $10 billion |

Large-cap companies | $10 billion to $200 billion |

Mega-cap companies | More than $200 billion |

Small-cap companies are often young companies. They tend to have significant growth potential but are generally less stable than their larger, more established peers. They are often unprofitable as well.

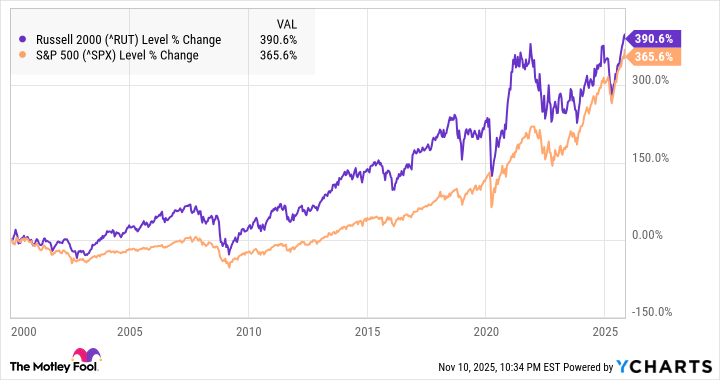

However, a comparison of the small-cap-focused Russell 2000 index and the large-cap-focused S&P 500 shows that small-cap stocks have outperformed large-cap companies since 2000. Yet large caps have narrowed the gap significantly as artificial intelligence (AI) has become more widely adopted. The chart below demonstrates the difference:

Over time, small-cap stock prices tend to be more volatile than those of larger companies, and stock values fluctuate more dramatically. Typically, small caps outperform in bull markets, but the recent one has been different. Thanks to the AI boom that began in 2023, large-cap tech stocks have paced the stock market's gains, while small-cap stocks have underperformed, in part due to high interest rates.

Small caps have also fallen sharply amid concerns about tariffs and trade wars, showing again that they're more volatile than their large-cap peers.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Magnite (NASDAQ:MGNI) | $2.2 billion | 0.00% | Media |

| Amplitude (NASDAQ:AMPL) | $1.4 billion | 0.00% | Software |

| Consolidated Water (NASDAQ:CWCO) | $593.9 million | 1.42% | Water Utilities |

| Sweetgreen (NYSE:SG) | $847.6 million | 0.00% | Hotels, Restaurants and Leisure |

| Serve Robotics (NASDAQ:SERV) | $948.9 million | 0.00% | Hotels, Restaurants and Leisure |

Best small-cap stocks to buy right now

Many small-cap companies aren't household names -- at least, not yet. Here are some small-cap stocks to consider:

1. Magnite

NASDAQ: MGNI

Key Data Points

Magnite (MGNI +2.19%) is a supply-side digital advertising platform formed by several mergers and acquisitions. The company has established itself as a leader in video and connected TV (CTV) advertising, or ad-driven streaming, catering to online publishers and streaming platforms like Walt Disney (DIS -1.99%), Fox (FOX +0.77%), and Warner Bros. Discovery (WBD +0.85%).

Magnite partners with The Trade Desk (TTD -0.73%) and other adtech companies to manage publisher inventory efficiently and keep its technology up to date. In one positive sign, the company announced in mid-2025 that the FanDuel Sports Network has seen a 25% year-over-year increase in its total impressions, thanks to Magnite.

The ad tech company could also benefit from the recent ruling finding Google to have a monopoly in adtech. While its growth has moderated since the COVID-19 pandemic boom, Magnite still has a lot of potential growth ahead of it and remains the CTV leader for supply-side adtech.

2. Amplitude

NASDAQ: AMPL

Key Data Points

Amplitude (AMPL -2.01%) is a leader in digital product analytics. The company's software allows businesses to see how customers interact with their apps and websites so they can make improvements and learn what works and what doesn't.

For example, Amplitude helped guide Burger King's "Whopper Detour" campaign. It also showed Peloton (PTON -0.43%) how social engagement was key to getting its customers to stick with its workouts.

Like other software stocks, Amplitude struggled in the aftermath of the COVID-19 pandemic as many of its customers restructured their contracts. But the company has moved past that churn. It's seeing improving growth, especially in remaining performance obligations, a proxy for backlog.

Amplitude also launched a new suite of AI agents in June 2025, which has since accelerated its growth and been well received by customers. Those included a website conversion agent, an onboarding agent, and a monetization agent. The company has built out its product suite and looks poised to grab market share from Alphabet's (GOOG -0.73%)(GOOGL -0.79%) Google Analytics and Adobe (ADBE +0.45%) Analytics, the category leaders. If Amplitude can fulfill its promise, the stock could move a lot higher from here.

It's also made a number of acquisitions to boost its position in AI, including acquiring Kraftful, an AI-focused, user feedback start-up, in July.

3. Consolidated Water

NASDAQ: CWCO

Key Data Points

Utilities come in all shapes and sizes, so it shouldn't be surprising to find a water utility on this list. Consolidated Water (CWCO -1.17%) specializes in desalination, which could become a big trend in the coming years as water supplies around the world are stretched and more coastal and tropical communities turn to desalination.

The company is currently focused on the Caribbean market, with several plants in the Cayman Islands and the Bahamas. That's helped it deliver strong growth in recent years, outperforming its water utility peers. The trend should continue as it capitalizes on the desalination opportunity and water scarcity becomes a greater problem.

In June, the company raised its quarterly dividend 27% to $0.14, a sign of confidence in its future growth.

4. Sweetgreen

NYSE: SG

Key Data Points

Sweetgreen (SG +1.92%) is the leading fast-casual salad chain and has a ton of growth potential, considering it had only 266 locations as of the third quarter of 2025.

While the company has yet to deliver significant profits on the bottom line, Sweetgreen has a high average unit volume, or average sales per unit, of $2.8 million, on par with industry leaders like Chipotle (CMG +0.81%).

The company is also investing in an automated system it calls the Infinite Kitchen, a robotic assistant that helps put together orders faster, increasing throughput and saving on labor costs. Infinite Kitchen also helps differentiate the company from other restaurant operators.

Sweetgreen is expanding its base with plans to add 15-20 new restaurants in 2026. The company has significant growth potential over the long term, as it is aiming to reach at least 1,000 restaurants.

The company has struggled in 2025 due in part to weak demand from a key customer demographic, 25- to 35-year-olds. The slump has affected other fast-casual chains, but the company should get back on track over the long term.

5. Serve Robotics

NASDAQ: SERV

Key Data Points

One potentially disruptive small-cap stock worth following is Serve Robotics (SERV -3.77%), a maker of food delivery robots. Serve is still a development-stage company with a revenue run rate of less than $2 million as of the first quarter of 2025.

The company was spun off from Uber (UBER -0.30%) in 2021 and still counts it as a major investor. Its delivery robots collaborate with the Uber Eats platform, delivering restaurant orders from chains like Shake Shack (SHAK -0.37%), and it recently signed a deal with DoorDash.

Though Serve Robotics is still a small company, it's growing rapidly. Revenue was up 37% in the second quarter of 2025, and it still has a long runway to expand as it recently launched its service in Chicago, its first market in the Midwest. While Serve Robotics is a high-risk stock, it's the kind of business with the upside potential that makes small-cap stocks attractive.

Small caps versus large caps

Over the last decade, large caps have outperformed small caps by a considerable margin. That's largely due to the outperformance of the Magnificent Seven, especially during the recent AI era. The largest companies on the stock market, like Nvidia, Tesla, Meta Platforms (META +1.72%), and others, have all delivered strong or even exceptional returns over the last decade, which has favored large caps over small caps.

Let's review the advantages and disadvantages of each stock type.

Advantages of small-cap stocks:

- Allow for more upside potential, in general.

- Outperform in bull markets, in general.

- Offer a wider range of diversification.

Disadvantages of small-cap stocks:

- Tend to underperform in bear markets.

- Vulnerable to high interest rates.

- More volatile.

Advantages of large-cap stocks:

- Less volatile/safer.

- Less downside in bear markets.

- More exposure to AI, for now.

Disadvantages of large-cap stocks:

- Less upside in bull markets, historically.

- More concentration in a handful of stocks.

- Less upside if interest rates come down.

Related investing topics

Should you invest in small-cap stocks?

If you are willing to hold an investment for several years and feel comfortable with the price of a stock fluctuating significantly, then small-cap stocks might have a place in your portfolio. Owning small-cap stocks can boost your portfolio's overall growth rate, provided you commit to a buy-and-hold investing strategy.

Remember, small companies are more likely to fail than large, established businesses, as we saw during the COVID-19 pandemic. It's important to do your research before investing in any small-cap stock. You can also lower your risk by investing in a small-cap-focused fund.

How to invest in small-cap stocks

If you're looking to invest in small-cap stocks, the process is as simple as buying any other stock. Just follow the following steps.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.