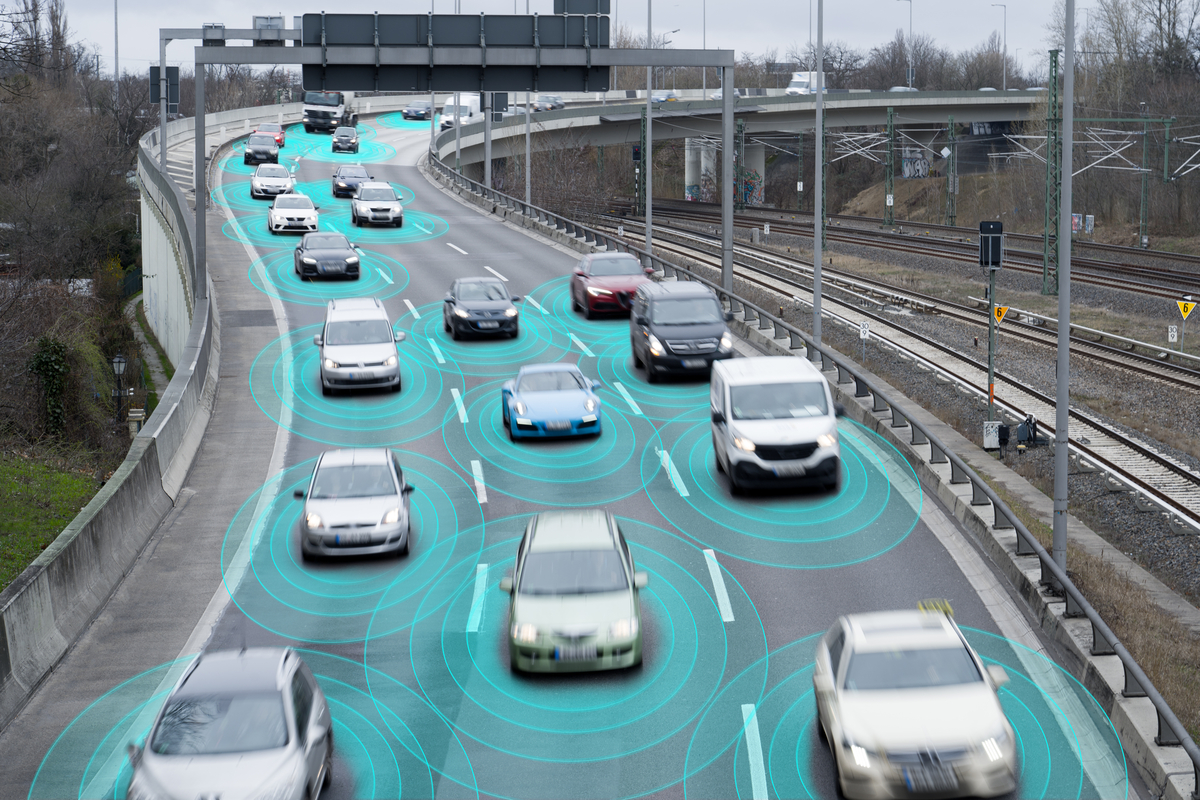

It may still be a rare sight to look at the vehicle next to you and find there's no one behind the wheel, but this may soon be changing, and this is motivating investors to consider steering into self-driving car ETFs.

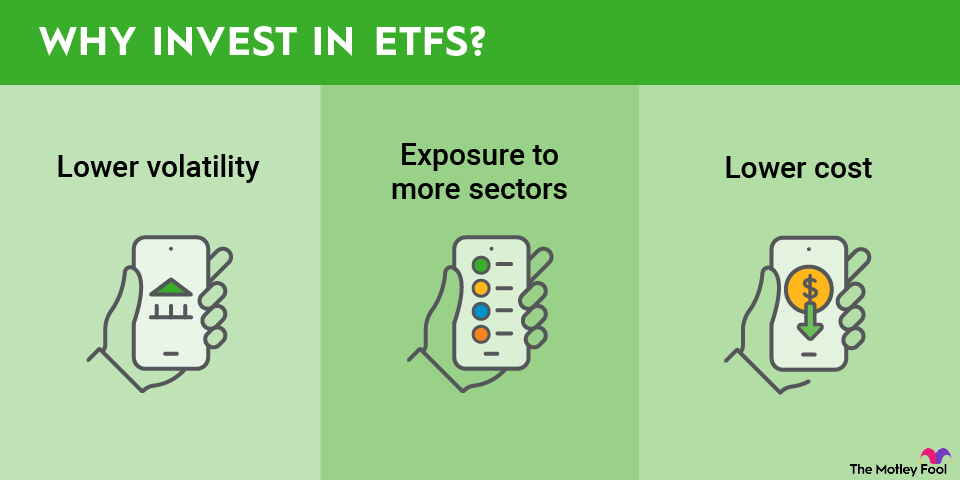

Exchange-Traded Fund (ETF)

Investors would be incorrect to think that it's only automotive stocks and, specifically, self-driving car stocks that are found in self-driving car ETFs. From companies that produce electric vehicles (EVs) to sensor manufacturers, autonomous vehicle ETFs include a variety of stocks that help drive the development of self-driving vehicle capabilities.

Semiconductor stocks like Nvidia (NVDA -0.41%) and Qualcomm (QCOM -0.43%) that are closely linked to artificial intelligence (AI) often represent major positions in the best self-driving car ETFs. EV makers that offer autonomous driving capabilities, such as Tesla (TSLA -2.07%), are also prominently featured in these funds, providing investors with a wide range of exposure to the burgeoning field.

Why invest in self-driving car ETFs?

Some driver assistance technologies, like cruise control, have been around for decades, but the introduction of truly autonomous features came in the early 21st century when tools like automatic parallel-parking assistance -- available in the 2003 Toyota (TM -0.19%) Prius -- emerged. Vehicles now demonstrate a wide range of self-driving capabilities, including vehicles made by Aurora Innovation (AUR -4.04%), which began operations of its self-driving trucks in May 2025.

With notable advancements in autonomous driving capabilities, there are plenty of reasons to consider a self-driving car position:

- There's still plenty of room for growth. According to business intelligence firm ResearchAndMarkets.com, the autonomous car market was valued at $1.7 trillion in 2024, and it will climb at an 8.6%compound annual growth rate (CAGR) until 2034, when it's expected to reach $3.9 trillion.

- Investing in self-driving car ETFs can help investors achieve portfolio diversification.

- Those with low risk tolerances may take advantage of an ETF option.

How to invest in self-driving car ETFs

Finding potential self-driving car ETFs is relatively easy, but finding the right fund that aligns best with an individual investor's goals requires a few extra steps. To perform their due diligence, investors should research the various options, paying attention to whether the individual fund's holdings, goals, and expense ratios align with their own interests. Here are the steps to take to invest in a self-driving car ETF:

- Open your brokerage app: Log in to your brokerage account, where you manage your investments.

- Search for the stock: Enter the stock ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select the order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Three best self-driving car ETFs to invest in 2026

1. iShares Self-Driving EV and Tech ETF

2. Global X Autonomous & Electric Vehicles ETF

NYSEMKT: ARKQ

Key Data Points

Those looking for a more measured approach to investing in self-driving cars might consider hitching a ride with the ARK Autonomous Tech & Robotics ETF (ARKQ -1.65%). Led by Cathie Wood, the ETF had net assets of $1.5 billion at the end of the third quarter of 2025. It aims to invest 80% of its assets in companies that specialize in automated technologies. With exposure to a variety of industries, such as smart devices and 3D printing, autonomous mobility (which includes smart cars) represents the largest technology in the ETF -- about 41% at the end of Q2 2025.

Tesla, the largest position, provides the lion's share of exposure with its 11.4% weighting. The ETF typically has between 30 and 50 holdings. Other self-driving car makers in the ETF include Aurora Innovation and BYD.

Investors who bought the ETF when it first launched in 2014 have enjoyed market-beating returns: the ARK Autonomous Tech & Robotics ETF had provided a total return of 498% from its inception through the end of September 2025, compared to the S&P 500's return of 313%.

The ARK Autonomous Tech & Robotics ETF doesn't presently pay a dividend, and it has an expense ratio of 0.75%.

Related investing topics

Should I invest in self-driving car ETFs?

The widespread acceptance of self-driving cars certainly won't happen overnight, and there are sure to be some bumps in the road as the industry matures. For investors looking to mitigate the risks associated with investment in individual stocks, a self-driving car ETF is a logical option.

From the concentrated exposure to EV carmakers, such as the iShares Self-Driving EV and Tech ETF, to the more diverse range of self-driving car-related companies held in the Global X Autonomous & Electric Vehicle ETF, to the various technologies represented in the ARK Autonomous Technology & Robotics ETF, investors have a range of choices that will surely meet their individual investment goals.