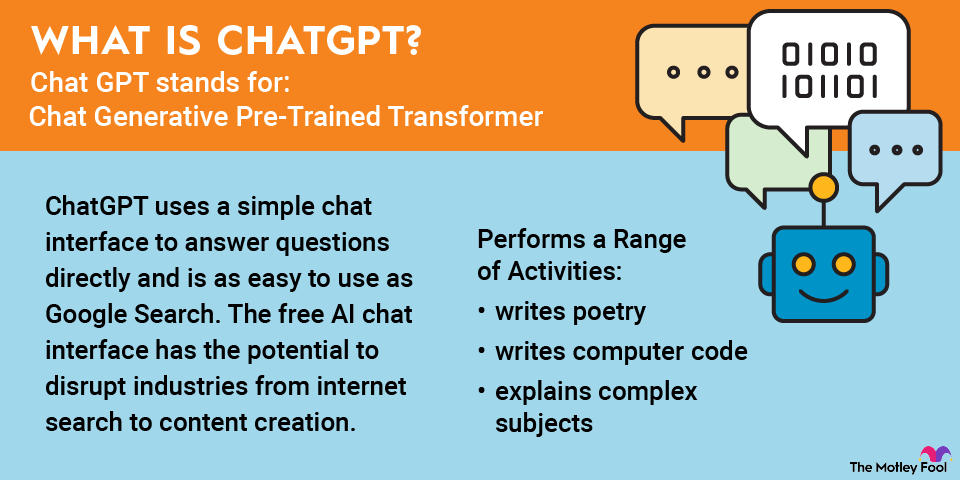

AI chatbots have gotten a ton of attention since the launch of OpenAI's ChatGPT, and they seem to have become what most people think of when they think of artificial intelligence.

However, ChatGPT is far from the only artificial intelligence (AI) chatbot on the market, and its launch sparked a parade of competitors, some of whom seemed to be waiting for such a moment to unveil their own large language models (LLMs).

In this article, we'll discuss what an AI chatbot is, review some AI chatbot stocks you can invest in, and explore whether you should invest in AI chatbot technology today. If you're wondering about the best AI chatbots on the market, keep reading.

Artificial Intelligence

What are AI chatbots?

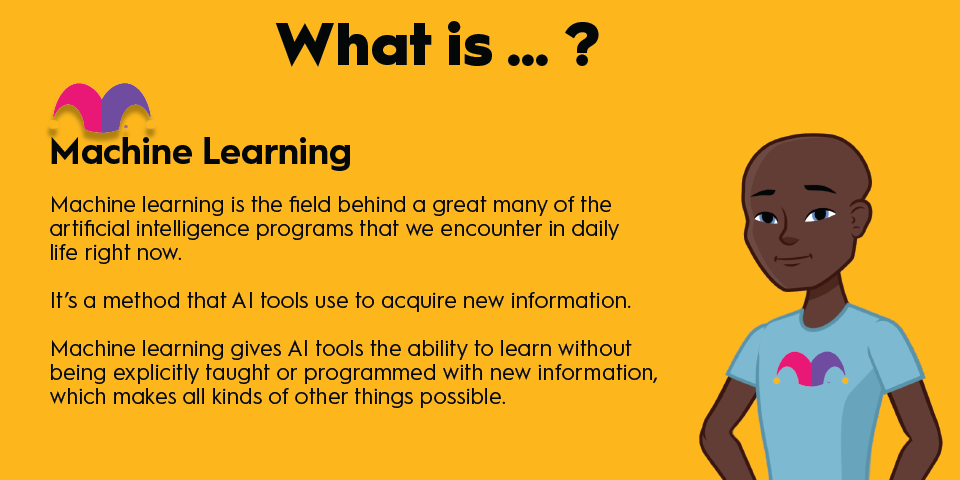

A chatbot is an AI-based computer program that uses natural language processing to communicate with humans using text. Chatbots are a common tool for customer service, internet search, and other routine tasks for internet users. Businesses also use AI chatbots internally to help automate workflows and other tasks.

Their utility has evolved in recent years as artificial intelligence has improved, and large language models have been trained to process complex questions and understand nuance. You can even make your own AI chatbot using the Python coding language.

As AI chatbots have improved, the market potential for the technology has increased, as can be seen in OpenAI's recent valuation at a reported $157 billion, with investors including Microsoft (MSFT -2.31%) and Softbank (SFTB.Y +4.75%).

With OpenAI demonstrating the capability of AI chatbots, investor interest in the technology has soared. Keep reading to see how you can get exposure to AI stocks in the chatbot space.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.3 trillion | 0.77% | Software |

| Alphabet (NASDAQ:GOOGL) | $4.0 trillion | 0.25% | Interactive Media and Services |

| Amazon (NASDAQ:AMZN) | $2.5 trillion | 0.00% | Multiline Retail |

| Baidu (NASDAQ:BIDU) | $45.2 billion | 0.00% | Interactive Media and Services |

| Meta Platforms (NASDAQ:META) | $1.5 trillion | 0.34% | Interactive Media and Services |

1. Microsoft

NASDAQ: MSFT

Key Data Points

Through its partnership with OpenAI and ChatGPT, Microsoft has established itself as a clear leader in the AI chatbot race.

The company is working quickly to integrate ChatGPT into a wide range of its products. That includes Azure, its cloud infrastructure service, the new Bing, and its Edge browser. It's also reportedly working on adding ChatGPT features to its Office suite, which includes products like Word, Excel, PowerPoint, and Outlook.

However, Microsoft's biggest move in AI chatbots may be the launch of its own Copilot, a digital assistant available across Microsoft's applications.

Microsoft CEO Satya Nadella has said on multiple occasions that he sees AI as a platform shift, and the company has doubled down on its relationship with OpenAI after investing more than $13 billion in the startup over the years. After a recent restructuring at OpenAI, Microsoft now owns 27% of OpenAI, a stake that was valued at $135 billion in late 2025.

After his company missed out on the shift to mobile, Nadella is committed to not making the same mistake twice. Expect Microsoft to continue to spend aggressively on ChatGPT, Copilot, Azure, and other AI tools.

If you're looking to invest in ChatGPT, Microsoft gives you the most direct way to do so.

2. Alphabet

NASDAQ: GOOG

Key Data Points

Alphabet (GOOG +1.97%)(GOOGL +2.01%) has been investing in artificial intelligence for years. It acquired DeepMind, an AI research lab, in 2014, and it's spent billions on its autonomous vehicle division, Waymo.

After the release of ChatGPT in November 2022, Alphabet moved quickly to counter what seemed to be the most serious threat to Google Search yet, calling a "Code Red" meeting and bringing back founders Sergey Brin and Larry Page to formulate a strategy.

After some missteps, Google launched Gemini in December 2023, which is available through Google's search bar. It's also added AI overviews to Google Search and enabled AI mode on search, allowing users to tap into the power of Gemini.

Alphabet is monetizing Gemini in a number of ways, including selling premium subscriptions, through application programming interfaces (APIs) that it allows developers to use, and integrating it with Google's Cloud Platform. Currently, Gemini seems like a way for Alphabet to protect its monopoly in search, and it could help monetize traffic that doesn't generate ads.

3. Amazon

NASDAQ: AMZN

Key Data Points

4. Baidu

NASDAQ: BIDU

Key Data Points

Semiconductor

5. Meta Platforms

NASDAQ: META

Key Data Points

Should you invest in AI chatbot technology?

AI chatbot technology is still in its early stages, but it seems clear from the billions being spent on the technology by the world's biggest tech companies that this will be a significant computing platform.

There's a wide range of applications for a product like ChatGPT. Its potential to disrupt internet search, a market worth hundreds of billions of dollars, shows the value of AI chat. Let's take a look at some of the benefits and risks of investing in AI technology.

Benefits:

- It's a fast-growing industry.

- AI chatbots are a disruptive technology.

- Many of the companies pioneering the technology have been big winners on the stock market.

Risks:

- Running AI chatbots is expensive.

- The technology is not yet generating a profit.

- There could be a bubble forming in AI.

While picking a winner is difficult at this point, it makes sense to get exposure to the technology, considering its potential. Like any emerging technology, investing in AI chatbots carries some risk, but many of the stocks above are already trading at reasonable valuations. If you're interested in investing in chatbot stocks, another option is to invest in an AI exchange-traded fund (ETF).

Factors to consider when investing in AI chatbots

If you're considering investing in AI chatbots, it's worth remembering first that there aren't any pure-play chatbot stocks, so you'll want to consider the strength of the valuation of the overall stocks you're buying.

However, if you're specifically interested in chatbots, there are details worth considering. Those include:

- Size of user base: Much like social media apps, AI chatbots are in a race to claim users. While chatbots don't have the same network effects that social media does, gaining users while the industry is in its early stages is key. It's worth comparing the number of users among different chatbots.

- Specializations: Some chatbots are better for different things. Some are known for casual usage and language, while others are better for specialized are professional queries. Depending on what you want exposure to, it's a good idea to understand the strengths and weaknesses of the chatbot you're investing in.

- Partnerships: Many chatbots have formed partnerships to help increase usage and financial backing. For example, OpenAI's ChatGPT works closely with Microsoft, and Claude parent Anthropic has received backing from both Amazon and Alphabet.

- Funding: Chatbots are in a race to grow, and valuations are skyrocketing. While information available on privately held companies is limited, valuations and funding rounds are generally reported on. Larger chatbot companies are likely to have deeper pockets than smaller start-ups.

Related investing topics

How to invest in AI chatbots

If you're thinking of buying publicly traded stocks with exposure to chatbots, just follow these steps to make a purchase:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.