Artificial intelligence is no longer a future concept. It's already shaping how companies operate and how consumers live. From recommendation engines and logistics software to chatbots and automation tools, AI is becoming a major driver of growth across tech, healthcare, finance, and other industries.

AI exchange-traded funds (ETFs) offer a simple way to invest in that growth without relying on a single stock. Rather than trying to pick individual winners, these funds group together companies that build AI technology or benefit from its adoption. That can include chipmakers, cloud platforms, software firms, and data-focused businesses.

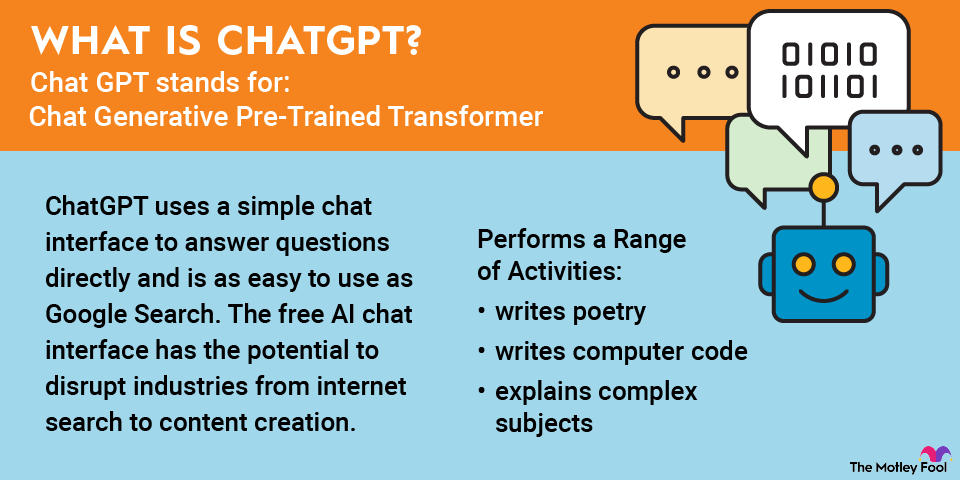

Interest in AI investing remains strong as generative AI tools like ChatGPT push adoption into the mainstream. For investors who want diversified exposure to AI’s long-term potential without the risk and research involved in picking individual stocks, the best AI ETFs can be a smart place to start.

Top AI ETFs to buy in 2026

AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

Global X Artificial Intelligence and Technology ETF (NASDAQ:AIQ) | $6.97 billion | 0.68% |

Global X Robotics and Artificial Intelligence ETF (NASDAQ:BOTZ) | $3.01 billion | 0.68% |

Robo Global Robotics and Automation Index ETF (NYSEMKT:ROBO) | $1.25 billion | 0.95% |

iShares Future AI and Tech ETF (NYSEMKT:ARTY) | $1.94 billion | 0.47% |

First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ:ROBT) | $656.8 million | 0.65% |

1. Global X Artificial Intelligence and Technology ETF

NASDAQ: AIQ

Key Data Points

Global X Artificial Intelligence and Technology ETF (AIQ +1.06%) is the largest AI ETF and a good first choice for investors looking for an AI ETF. The ETF started in 2018 and aims to invest in companies that can benefit from the development of AI technology, as well as companies that make hardware facilitating the use of AI.

According to Global X, the global AI market is expected to grow from $184 billion in 2024 to $826.7 billion in 2030, so the stocks in the fund should have a lot of growth in front of them. The ETF has 86 stocks, and the biggest holdings will be familiar to most investors. In 2025, the top 10 holdings accounted for about 33% of the fund. Here are the top five:

- Samsung (SSNL.F +56.02%): The Korean tech giant is the world's No. 2 chipmaker and is well-known for devices like smartphones. It has introduced AI features such as live translate and chat assist to help users write messages.

- Alphabet: The search giant is doing a lot more than that with AI and more these days. It owns Waymo, the leading autonomous vehicle division, profits are soaring at Google Cloud, and its Gemini is challenging OpenAI's ChatGPT.

- Micron: A leading memory chipmaker, which has benefited from demand for high-bandwidth memory (HBM) chips in the AI boom.

- Taiwan Semiconductor: The world's largest manufacturer of semiconductors, serving customers like Nvidia, Broadcom, AMD, Apple, and others.

- Advanced Micro Devices (AMD +1.52%): The leading fabless chip company has moved further into AI with several acquisitions and advanced franchises such as its Instinct graphics processing units (GPUs), EPYC data center central processing units (CPUs), and Ryzen AI CPUs for PCs.

Cloud Computing

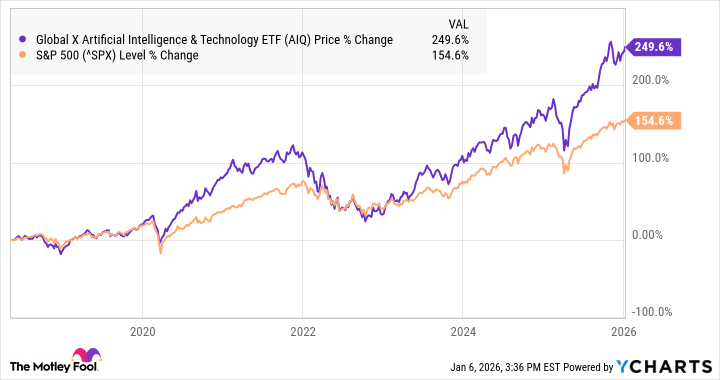

As you can see from the chart below, the Global X ETF has outperformed over its history, likely with the help of stocks like AMD and Alphabet that have soared lately.

2. Global X Robotics and Artificial Intelligence ETF

NASDAQ: BOTZ

Key Data Points

Established in 2016, the Global X Robotics and Artificial Intelligence ETF (BOTZ +0.45%) is similar to the Global X Artificial Intelligence and Technology ETF but with a focus on robotics. The fund invests in "companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence."

This includes enterprises working in industrial robotics, automation, non-industrial robots, and autonomous vehicles. According to Global X, the global robotics market was valued at more than $80 billion in 2022 and could grow to $280 billion by 2032.

The ETF held 52 stocks in late 2025, and its top five holdings made up almost 40% of the fund:

- Nvidia (NVDA +0.74%): This semiconductor maker's chips are used in a wide variety of applications -- including autonomous vehicles, virtual computing, and cryptocurrency mining -- and are central to many AI technologies.

- ABB (OTC:ABBN.Y): This Swiss company makes industrial automation and robotics products used in utilities and infrastructure.

- FANUC (FANUY +0.34%): This Japanese maker of factory automation products includes motors, lasers, and robots in its product lineup.

- Intuitive Surgical (ISRG +0.30%): This company makes the da Vinci robotic surgical system, which allows for minimally invasive surgeries with precise control.

- Keyence (KYCCF -0.69%): This Japanese company makes factory automation products such as sensors and scanners.

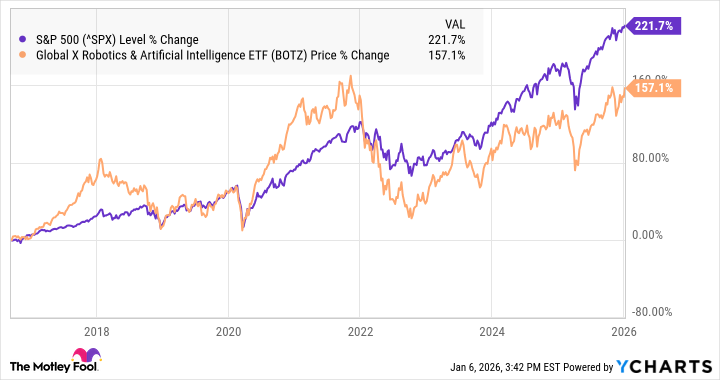

As the chart below shows, shares of the ETF have underperformed the S&P 500 index since its 2016 launch. The share price fell sharply in 2022 in line with the broad sell-off in tech stocks, although it has rebounded since then.

The ETF offered a modest dividend yield of 0.23% in January 2026, but it is better suited as a growth-oriented investment. It's an actively managed fund with an expense ratio of 0.68%, which is more than what you'd pay for most index funds.

3. Robo Global Robotics and Automation Index ETF

NYSEMKT: ROBO

Key Data Points

The Robo Global Robotics and Automation Index ETF (ROBO +0.94%) focuses on companies driving "transformative innovations in robotics, automation, and artificial intelligence." This ETF invests in companies primarily focused on AI, cloud computing, and other technology companies.

The ETF holds 77 stocks, with no single holding accounting for more than 2.5% of the ETF's value. Its top five holdings comprise only about 10% of the fund's total value. In late 2025, major holdings included FANUC, Intuitive Surgical, and three others:

- Teradyne (TER -1.19%): A maker of automated test equipment and robotics systems for applications such as testing semiconductors and other hardware.

- Ondas Holdings: A provider of private wireless data solutions and autonomous drone systems.

- Symbotic: (SYM +2.97%): A tech company that makes software and robotics for warehouses, including end-to-end systems for automation.

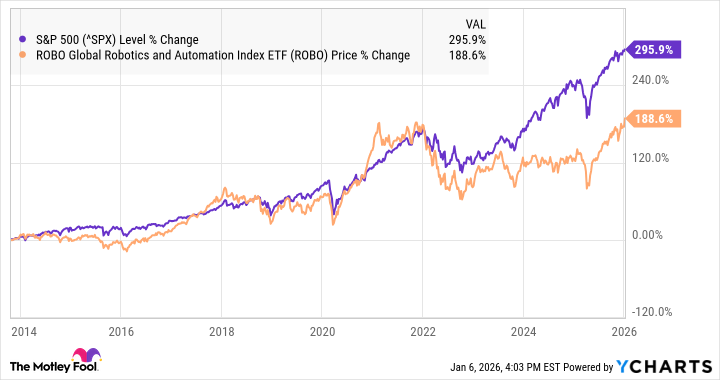

Since its inception in 2013, the Robo ETF has underperformed the S&P 500, as the chart below shows. It trails the broad market index, with dividends factored into the return. The ETF pays a dividend yield of 0.45%, and its expense ratio is 0.95%.

4. iShares Future AI and Tech ETF

NYSEMKT: ARTY

Key Data Points

The iShares Future AI and Tech ETF (ARTY +0.66%) aims to track the results of an index of developed and emerging markets companies that could benefit from long-term opportunities in robotics and AI. The ETF was formed in 2018 and has about $2.1 billion in net assets.

With 49 stock holdings, it's now well diversified. Many of its top holdings also give investors exposure to fast-growing small-cap companies. The fund's top five investments as of late 2025 accounted for about 25% of the ETF's assets and included Nvidia, Micron, AMD, and TSMC, plus:

- Naver: South Korea's leading internet portal. Like Google, it owns a search engine, maps, news, and other services.

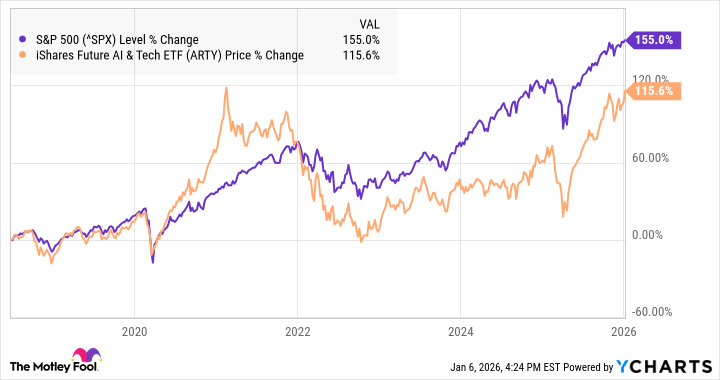

As you can see from the chart below, the ETF has underperformed the S&P 500 since its founding. The fund fell in 2022 when tech stocks crashed.

The expense ratio is competitive at 0.47%, and the trailing-12-month yield as of November 2025 was 0.15%. The fund's performance will likely be heavily influenced by the overall performance of cloud and chip stocks since they're the largest areas of exposure for the fund.

5. First Trust Nasdaq Artificial Intelligence and Robotics ETF

NASDAQ: ROBT

Key Data Points

The First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT +1.15%) tracks the Nasdaq CTA Artificial Intelligence and Robotics index, which comprises companies engaged in AI and robotics in technology, industrials, and other sectors. The fund held 110 stocks in early 2026.

Top holdings included Fanuc and four others:

- Ocado Group: A U.K.-based online grocery company. It sells groceries directly online and offers a platform that retailers can use.

- UiPath (PATH +6.69%): A maker of robotic process automation software, or AI-powered bots that handle repetitive tasks and workflows for companies.

- Serve Robotics (SERV +0.11%): Maker of food delivery robots, partnering with companies like Uber Eats and Shake Shack.

- Synopsys (SNPS -2.39%): A specialist in electronic design automation software, systems verification, and other semiconductor-related services.

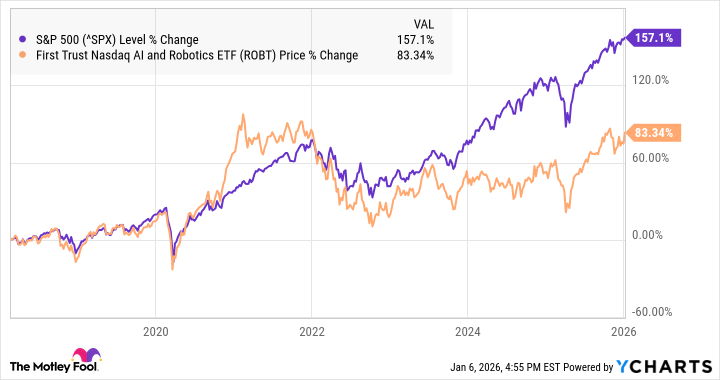

Types of AI ETFs

As the chart above shows, there are different types of AI ETFs available to investors. Here are a few of the broad categories.

- Tech-focused AI ETFs: These ETFs are more likely to carry semiconductor stocks and pure tech stocks that are influencing AI.

- Robotics and physical AI: On the other end of the spectrum are companies working on developing the real-world machines that run on AI. Relatedly, there are maintenance, equipment, and testing companies as well.

- Small-cap versus large-cap: Some ETFs focus more on large-cap companies, while others, like First Trust Nasdaq Artificial Intelligence and Robotics ETF, hold a lot of smaller-cap stocks.

- Other options: Investors can also consider related ETFs like those that carry semiconductors or are centered around other high-tech applications.

Who should invest in AI ETFs?

AI ETFs aren't right for everybody, but they're a good fit for some investors. If these descriptions fit your investing style, AI ETFs could work for you.

- You have a high risk tolerance.

- You have a long time horizon.

- You'd prefer one investment over several individual stocks.

- You like the convenience of an ETF compared to individual stocks.

- You're looking for a wide range of exposure to AI stocks.