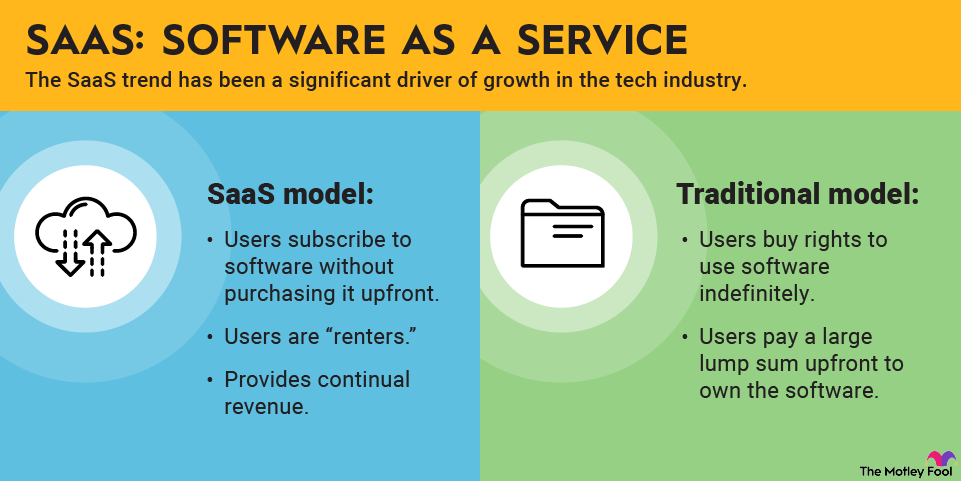

The software-as-a-service (SaaS) model now dominates much of the software industry. SaaS companies sell cloud-based software through subscriptions, delivering regular updates to customers and recurring revenue to the business.

That steady revenue has fueled strong growth across tech and strong investor interest. Many SaaS stocks still trade at premium valuations, a trend that accelerated after the pandemic. Paying too much can limit long-term returns, but not every SaaS company is priced for perfection. A handful offer more reasonable valuations alongside solid growth potential.

Best SaaS stocks in 2026

If you want to invest in SaaS companies that are reasonably valued, consider these five options:

| Company | Ticker | Dividend yield | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.2 trillion | 0.78% | Software |

| Adobe (NASDAQ:ADBE) | $119.7 billion | 0.00% | Software |

| Salesforce (NYSE:CRM) | $200.6 billion | 0.78% | Software |

| Shopify (NASDAQ:SHOP) | $187.0 billion | 0.00% | IT Services |

| Palantir Technologies (NASDAQ:PLTR) | $361.9 billion | 0.00% | Software |

1. Microsoft

NASDAQ: MSFT

Key Data Points

For 45 years, Microsoft (MSFT -9.99%) has dominated the market for traditional software. Microsoft Windows is the standard operating system for PCs, and Microsoft Office remains the productivity suite of choice.

However, Microsoft's dominance was tested by the proliferation of mobile devices that do not use Windows, as well as competition from Alphabet's (GOOG +0.71%) (GOOGL +0.67%) Google products, including Google Workspace, Docs, Sheets, and Slides.

Microsoft eventually abandoned its PC-centric strategy, bringing first-rate versions of its Office applications to mobile devices and launching Office 365, a subscription-based version of Office. With Office 365 garnering at least 84 million consumer subscribers, Microsoft has preserved its lead in the productivity software market.

Another SaaS product from Microsoft is Teams, the company's collaboration software and competitor to Slack, which quickly gained subscribers during the pandemic. Teams aims to be a one-stop shop for collaboration by offering group chats, video meetings, and similar features.

Microsoft isn't a pure-play SaaS company, and its stock has historically been expensive relative to earnings. But the company has successfully transitioned to selling subscription-based software and grown its SaaS business by double digits while maintaining its market dominance. Both revenue and earnings have been growing swiftly, driven by its success in SaaS and the emergence of artificial intelligence (AI).

2. Adobe

NASDAQ: ADBE

Key Data Points

Best known for creativity software such as Photoshop, Adobe (ADBE -2.63%) sets industry standards. Cheaper and even free Adobe alternatives are available, but that hasn't been enough to derail the software giant's market leadership.

Adobe has gone all-in on subscriptions, announcing back in 2013 that it would stop developing new versions of its stand-alone creative software in favor of selling subscription products. The move has paid off in a big way, with Adobe's revenue reaching almost $21.5 billion in its fiscal year 2024, up from just $4 billion in 2013.

Transitioning from selling one-off licenses for hundreds of dollars to selling subscriptions costing as little as $10 per month has made the company's software available to a much wider audience.

Adobe's growth rate had moderated in recent years, but the company has established a sustainable competitive advantage with products like Photoshop, Acrobat, Illustrator, and other similar programs. Revenue rose 11% in fiscal 2024, and earnings per share (EPS) rose 5% as it took a $1 billion acquisition termination charge when its acquisition of the newly public Figma (FIG -10.23%) was blocked.

The company expects similar top-line growth next year, and Adobe looks well positioned for long-term growth, despite any potential competition.

3. Salesforce

NYSE: CRM

Key Data Points

NASDAQ: SHOP

Key Data Points

Shopify (SHOP +3.41%) is one of the most valuable SaaS stocks on the market, having established itself as the clear leader in e-commerce software. Founder Tobi Lutke was early to recognize the opportunity in the space, as he originally started a snowboard shop and built his own software to run the sales apparatus when he couldn't find a suitable alternative.

Over the years, the company has grown by adding new functionalities, handling everything from marketing to payments and fulfillment. These days, Shopify has also established itself as a leader in AI for e-commerce, demonstrating its consistent efforts to improve its product, which helps attract more merchants and earn higher price points.

Shopify continues to deliver solid growth, with revenue up 26% to $8.9 billion in 2024, and its runway looks promising.

5. Palantir Technologies

NASDAQ: PLTR

Key Data Points

Palantir (PLTR -3.49%) is best known for its work in counterterrorism and assisting the government, but the company's business model clearly falls into the SaaS category. It sells subscriptions to its software platforms, which help government agencies and businesses analyze large datasets and connect the dots between silos.

In 2023, the company introduced its Artificial Intelligence Platform (AIP), an AI layer that works with its other platforms. That move has supercharged its growth, with revenue accelerating to more than 60% in the third quarter of 2025, and profit margins steadily expanding.

Palantir was also the best-performing stock on the S&P 500 in 2024, and through November, it was on track to be one of the top-performing ones in 2025 as well.

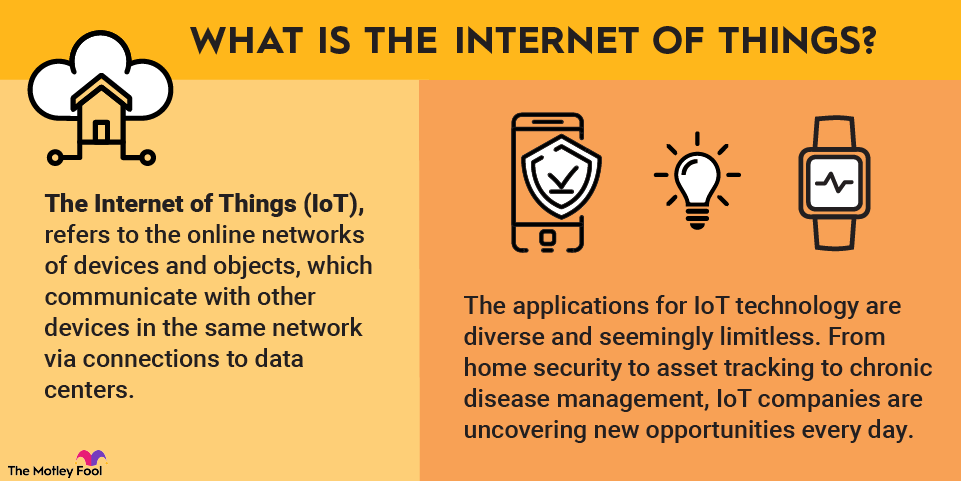

Benefits and risks of investing in SaaS stocks

Like other stock market sectors, SaaS stocks have their own set of characteristics that any investor considering them should understand. Let's take a look at some of the benefits and risks of SaaS stocks.

Benefits:

- SaaS stocks tend to have high growth rates.

- SaaS stocks tend to earn high multiples, meaning they can be worth a lot with relatively low revenue or profits.

- Saas stocks usually have gross margins and scalable business models, meaning their profit margins should improve as they grow.

- The total addressable market for SaaS stocks is promising, especially with the help of AI.

Risks:

- SaaS stocks' high multiples make them vulnerable to multiple compression and pullbacks.

- The sector is cyclical and has a history of falling sharply in bear markets.

- It's a highly competitive industry, and competitive advantages may not be as strong as they seem.

- Profits are often inflated for adjustments for things like share-based compensation.

Fast-growing SaaS companies often post large losses as they scale up their revenue.

How to pick SaaS stocks

Many investors use the price-to-earnings (P/E) ratio to evaluate a company's financial performance. However, with many SaaS companies not yet profitable, this type of analysis is not always possible. Instead, you can consider these two important metrics:

Customer acquisition cost

How much is a SaaS company spending to acquire each new customer? You can calculate the ratio of sales and marketing spending to revenue and evaluate whether that ratio is declining over time. If it's not, the company may be growing but still spending too much to bring in new customers.

Price-to-sales ratio

The price-to-sales (P/S) ratio, which equals a company's market capitalization divided by its annual revenue, is often used as a valuation metric for SaaS companies in place of the P/E ratio. A higher P/S ratio indicates optimism among investors that attractive revenue growth will continue and will eventually lead to profits.

However, an exceedingly high P/S ratio is something to view cautiously, regardless of the company's quality or growth prospects. SaaS highfliers, such as Shopify, Palantir, and Datadog (DDOG -8.81%), trade for between 15 and 133 times sales, ratios that require plenty of optimism to justify. For reference, Adobe and Salesforce trade around 6 times sales, while Microsoft's P/S ratio is about 14.

How to invest in SaaS stocks

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Don't ignore SaaS company valuations

Microsoft, Adobe, and Salesforce may not be the most exciting SaaS stocks, but they're all profitable and sport valuations that don't require mental gymnastics to justify. Growth in subscription-based software, supercharged by AI, will create plenty of winners in the SaaS industry -- but ignoring valuation could be a recipe for disappointing returns.

Palantir may be the exception that proves the rule, but as a general rule, valuation eventually needs to be justified, no matter how promising the stock is.