That being said, some chip designers are able to protect their work with patents that are not easy to replicate by other means. This can create a type of competitive moat for the company's long-term growth, although it doesn't completely prevent up-and-down sales cycles.

2. Above-average profit margins

Sales need to translate to profits. Companies that cannot control their expenses have low profit margins, and companies with high profit margins have a greater ability to reinvest in research and improve their operations. High gross profit, operating profit, and free cash flow generation are also positive indicators that the company is operating efficiently.

Because of the very high amount of expense needed to get into the semiconductor business, established companies tend to be able to ramp up profit margins as revenue increases over time.

3. Attractive returns on invested capital

A company's return on invested capital (ROIC) indicates how well it's able to generate profit from the cash it raises via debt and equity it receives. A high ROIC means the company is likely innovating strategically, improving operations to increase efficiency, and targeting secular growth trends with new chip designs.

4. Strong balance sheet

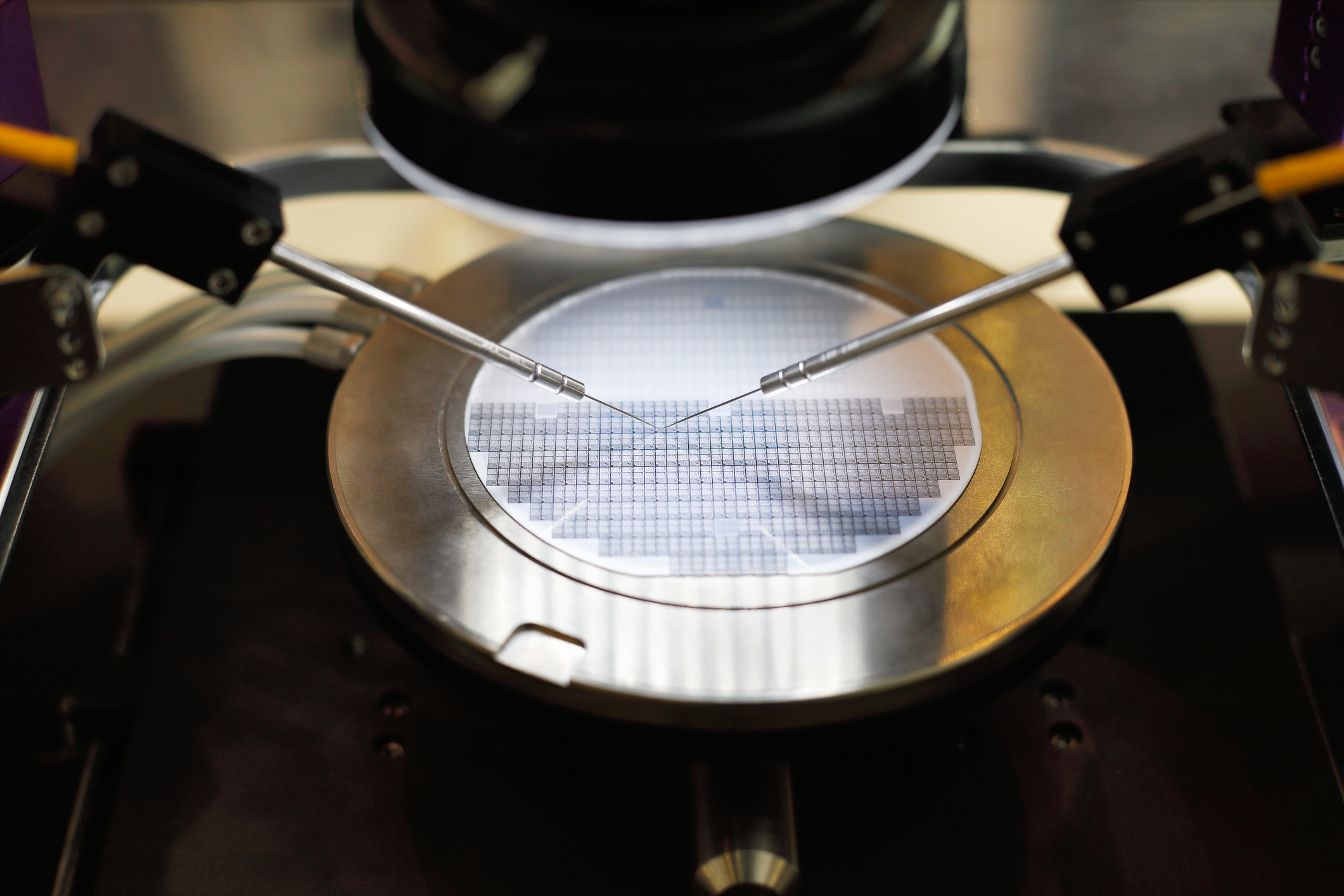

Semiconductors are arguably the most complex things ever developed by humankind. Manufacturing chips is very expensive, so it's especially important to understand how semiconductor companies obtain the necessary financial resources to expand.

For example, take chip manufacturers such as the world's largest, Taiwan Semiconductor Manufacturing (TSM +1.18%). For a chip business, the company has above-average debt compared to its revenue. However, it also has more cash and investments than it does debt, which signifies a healthy and profitable business that has no problems getting funding.

A company's balance sheet that has more cash than debt and low debt relative to operating profit is a key element to watch. Plenty of cash relative to debt means that a company is well positioned to pay interest and principal payments, even in a pinch. It can also mean the return of excess cash in the form of dividends and stock repurchases.