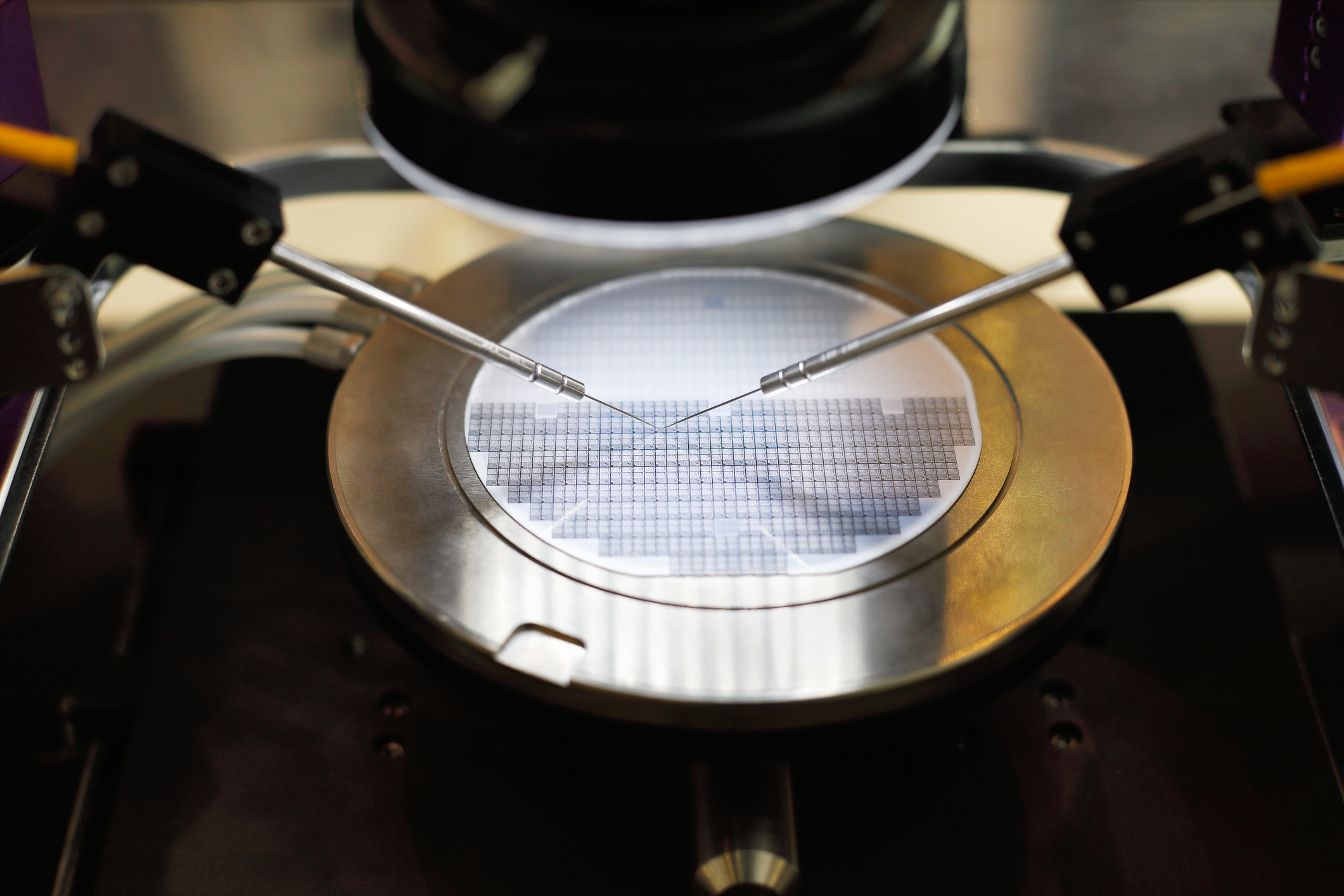

Semiconductor stocks are shares of companies that produce the microchips and electronic components used in everything from smartphones to cars.

They are part of the technology sector but are also manufacturing businesses, which means their businesses are cyclical, like any industrial business.

Semiconductor

Different types of semiconductor stocks

The Global Industry Classification Standard (GICS), a system used by investors and index providers to categorize public companies by sector and industry group, places semiconductor stocks under the information technology sector. Within this sector, GICS breaks down semiconductor-related firms into two main categories.

Semiconductor equipment

These companies provide the tools, machines, and services required to manufacture chips. This includes firms that make lithography systems, wafer inspection tools, or etching equipment used by chipmakers. These companies tend to be critical suppliers for the production process, but don’t produce chips themselves.

Semiconductor companies

These are the ones that actually design and manufacture the chips that power computers, smartphones, cars, appliances, and more. These chips can range from basic memory to high-performance processors or specialized sensors.

Other classification methods

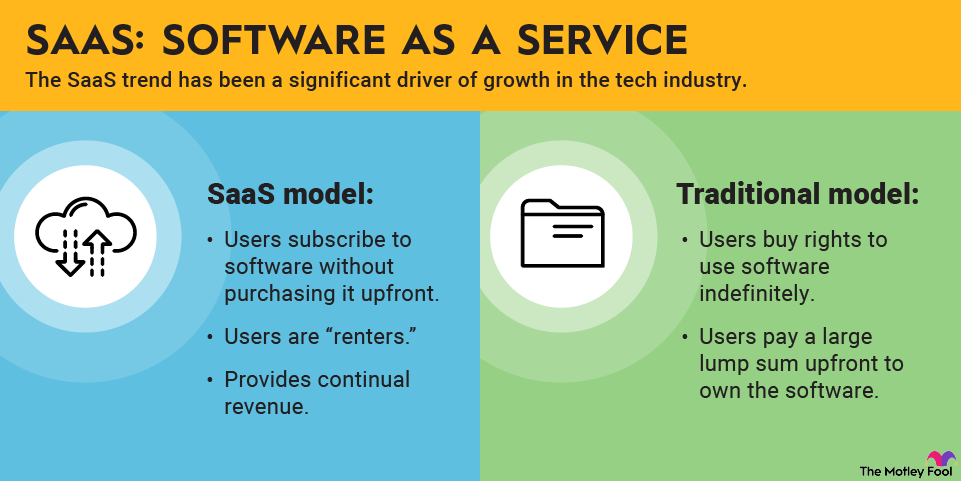

Beyond this GICS classification, semiconductor stocks can also be sorted by geography, such as U.S.-based versus international companies, or by business model.

Some are fabless, meaning they design chips but outsource the manufacturing to third-party foundries. Others operate fabs, or fabrication plants, and handle the manufacturing process in-house.

Each of these distinctions can affect how the company earns revenue, manages costs, and scales operations.

What trends drive semiconductor stocks?

Computer chips have many uses, but up-and-coming semiconductor companies will likely focus on two areas of growth in the decade ahead:

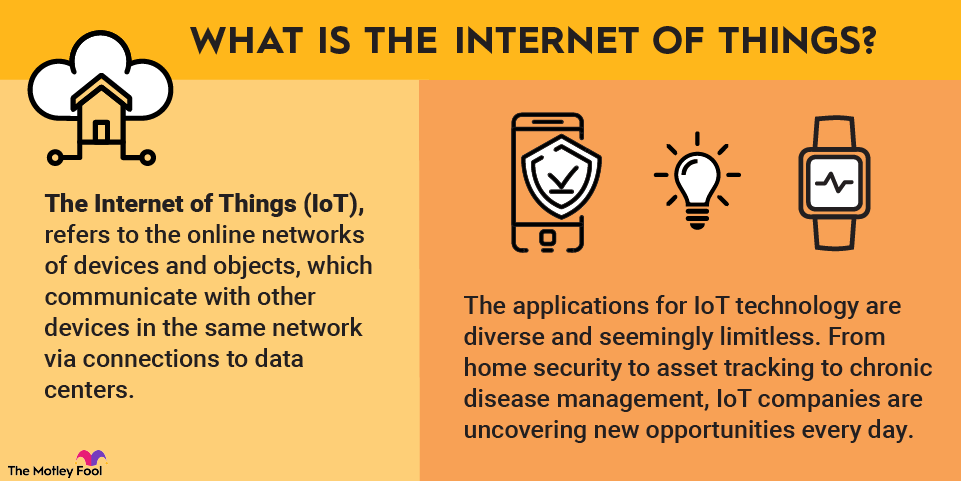

1. The Internet of Things (IoT)

The Internet of Things (IoT) refers to the network of interconnected devices that communicate and exchange data with each other.

This technology is set to revolutionize various industries by enabling smarter homes, cities, and consumer goods.

Semiconductors are crucial in IoT devices since they provide the processing power and connectivity needed for these devices to function.

As IoT applications expand, the demand for advanced, energy-efficient chips that can handle the diverse and high-volume data processing requirements will surge.

Emerging semiconductor companies focusing on IoT will need to innovate to create smaller, more efficient, and more powerful chips to meet the evolving needs of this market.

2. Generative AI

Generative AI, which includes technologies like machine learning and neural networks, is another significant growth driver for semiconductor companies.

These AI systems require immense computational power to process complex algorithms and vast amounts of data.

As generative AI becomes more integrated into applications such as search engines, autonomous vehicles, and advanced robotics, the demand for high-performance chips will increase.

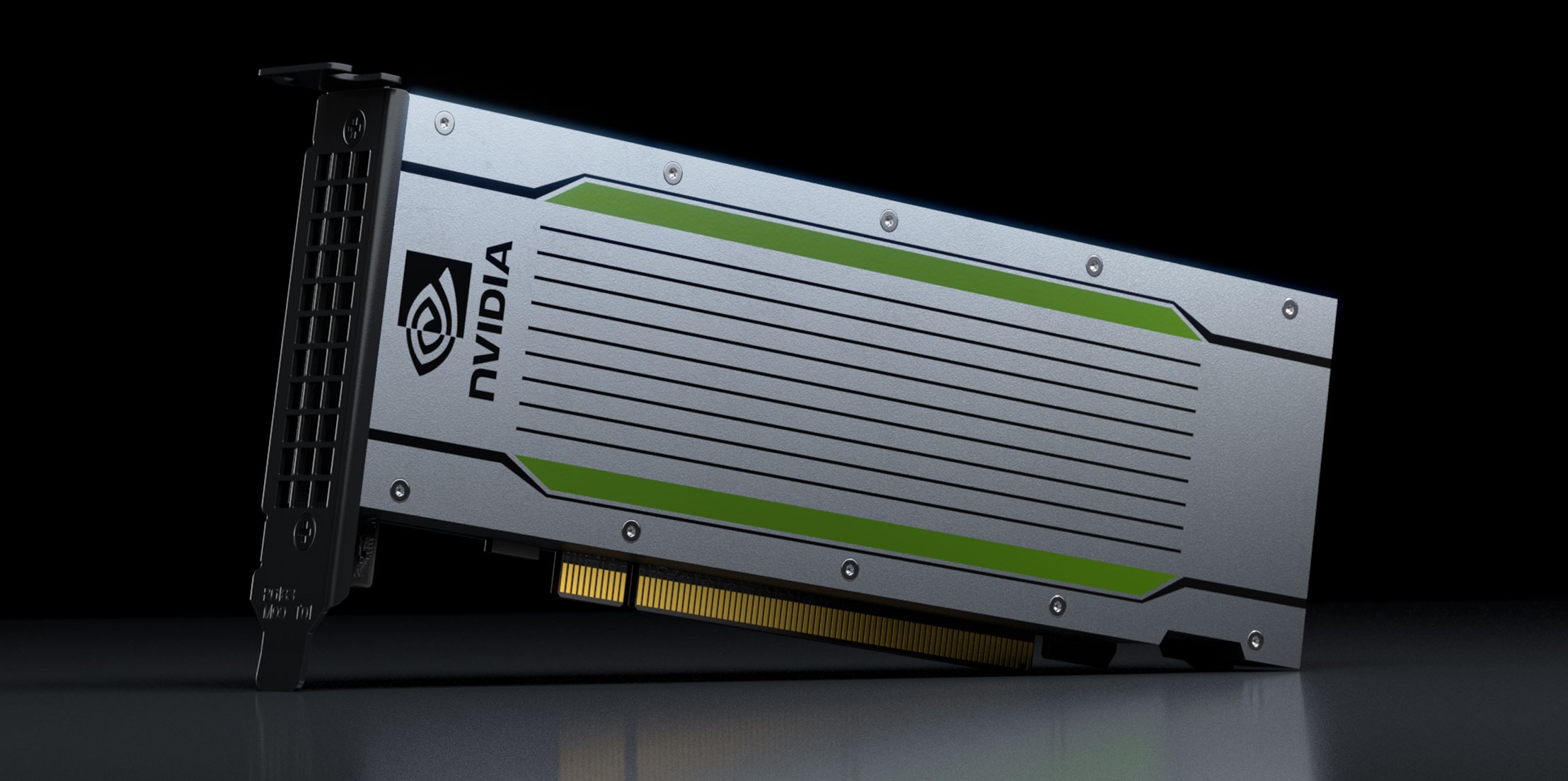

Semiconductor companies that develop graphics processing units (GPUs) and other specialized AI hardware are poised to benefit immensely from this trend. Innovations in chip architecture to improve speed, efficiency, and processing capabilities will be essential to support the growing AI industry.

Another important long-term catalyst to watch in the U.S. is the CHIPS and Science Act, signed into law in August 2022. The legislation was designed to significantly bolster domestic semiconductor manufacturing and research via billions in funding and significant tax credits.

Best semiconductor stocks to buy in 2025

Here are two top picks for semiconductor industry secular growth trends:

1. Qualcomm

2. Nvidia

NASDAQ: NVDA

Key Data Points

Best semiconductor ETFs to buy right now

If you prefer not to pick single stocks, you can also buy a semiconductor exchange-traded fund (ETF) to gain exposure to the overall sector

Two top semiconductor ETFs in terms of overall assets under management (AUM) are:

1. iShares Semiconductor ETF (SOXX)

NASDAQ: SOXX

Key Data Points

2. VanEck Semiconductor ETF (SMH)

NASDAQ: SMH

Key Data Points

Key factors to understand before investing in semiconductors

When looking for the best chipmakers and long-term undervalued semiconductor stocks to buy, consider these four key factors before you buy:

1. Sustainable revenue growth

Companies that gradually increase their sales over time are the best investments, but overall revenue growth matters even more for semiconductor stocks.