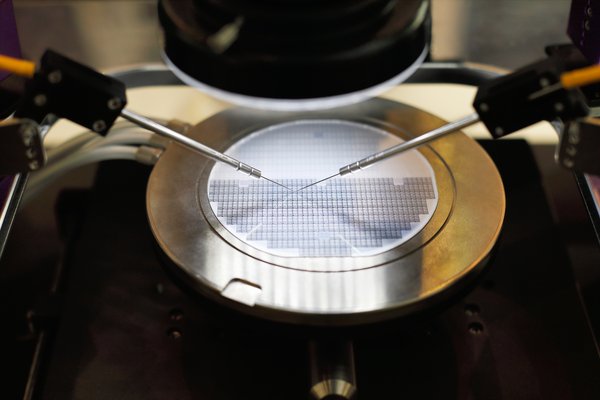

Artificial intelligence is everywhere, and GPU stocks are a great way to invest in the transformative technology. GPUs, or graphics processing units, were introduced decades ago to handle the computationally intensive task of putting graphics on a computer screen. The math necessary to calculate the color of millions of pixels can quickly overwhelm a CPU, or central processing unit. GPUs are designed to do these calculations in parallel, using hardware designed for the task.

The number crunching that must be done to train and use AI models can also be accelerated with GPUs. While gaming remains a key growth driver for the industry, AI may end up being more important in the long run.

What are GPU stocks?

What are GPU stocks?

GPU companies design semiconductor chips that feature a large number of cores capable of chewing through certain types of computational workloads. Personal computers, smartphones, gaming consoles, and anything that displays images on a screen ultimately have a GPU working behind the scenes.

In recent years, GPUs have found uses outside of graphics. In data centers, GPUs can be used to accelerate any task that can be effectively split up into chunks. This includes scientific simulations, data analytics, AI training, and AI inference.

Gaming is a huge industry that can drive growth for GPU companies in the long run, but artificial intelligence (AI) may be a bigger opportunity. Advanced large language models like ChatGPT from OpenAI require so much memory and computing power to train and run that clusters of ultra-powerful GPUs are necessary. Cloud computing providers are scooping up GPUs to offer AI services. Tech giant Microsoft (MSFT 1.58%) sees its annual AI cloud services revenue rapidly growing to $10 billion.

With demand for GPUs soaring, there are a few GPU stocks that could deliver market-beating returns for investors.

Three top GPU stocks with sky-high potential

There are plenty of companies that design GPUs in one way or another. Here are five that can tap into the booming demand for AI chips:

| Company name | Company ticker | Market cap | Industry |

|---|---|---|---|

| Nvidia | NASDAQ:NVDA | $3.8 trillion | Semiconductors and Semiconductor Equipment |

| Advanced Micro Devices | NASDAQ:AMD | $225 billion | Semiconductors and Semiconductor Equipment |

| Intel | NASDAQ:INTC | $95 billion | Semiconductors and Semiconductor Equipment |

| Arm Holdings | NASDAQ:ARM | $163 billion | Semiconductors and Semiconductor Equipment |

| Qualcomm | NASDAQ:QCOM | $178 billion | Semiconductors and Semiconductor Equipment |

1. Nvidia

1. Nvidia

Nvidia is the premier GPU stock. The company got its start designing processors used for gaming GPUs, and it continues to offer the most powerful hardware on the market. But while gaming GPUs used to account for virtually all of its revenue, rising demand for processors capable of powering data-center computations and AI software has reshaped the business.

In the first quarter of fiscal 2026, the gaming segment generated $3.8 billion of revenue for the GPU giant. However, the data center business has become far more important in recent years, and it's now the largest segment for Nvidia. Data center revenue reached $39.1 billion in the quarter, and demand for AI will drive it even higher.

Nvidia's AI-centric GPUs are incredibly powerful. For the most demanding AI workloads, thousands of these GPUs must be linked to churn through the incredible amount of data necessary to train an AI model.

Nvidia's most advanced processors are in high demand and incredibly expensive, and that's powered incredible sales growth and margins for the business. Revenue rose 69% in this fiscal year's first quarter, and net income increased 26% to reach roughly $18.8 billion.

Nvidia's market capitalization has soared past $3 trillion as excitement over AI has risen. While the stock is just as expensive as the company's GPUs, Nvidia is the best-positioned GPU company to tap into the demand for AI chips.

2. Advanced Micro Devices

2. Advanced Micro Devices

AMD is aiming to catch up to Nvidia in the AI GPU market, but it will be a long road ahead. The company unveiled its MI350 GPU in June, which features a whopping 288 gigabytes of high-bandwidth memory and AMD's latest graphics architecture. The chip is squarely aimed at generative AI workloads, like training powerful large language models. Unfortunately for AMD, Nvidia has a years-long head start building a software ecosystem around its AI GPUs.

Even with AMD playing the role of perpetual second fiddle to Nvidia in the GPU market, demand for AI chips may be strong enough to fuel solid growth in AMD's data-center GPU business.

AMD is also the No. 2 player in the discrete graphics card market for gaming and other applications. The company is competitive with Nvidia in the low-end and mid-range portions of the gaming graphics card market, but the company has difficulty competing at high price points.

Outside of PC graphics cards, AMD's semi-custom chips power both the PlayStation 5 and the latest Xbox game consoles. In each case, AMD pairs its CPU cores with a powerful GPU on a single chip. While AMD’s PC-centric business has struggled amid relatively soft computer demand, the semi-custom business fared much better.

3. Intel

3. Intel

While Intel is best known as a designer and manufacturer of CPUs, the company also offers GPUs for AI and other data center applications. The Gaudi3 AI accelerator is its current top-of-the-line processor for data centers, and the company is readying new entries that could help it gain market share in the category.

Unfortunately, Intel faces the same challenge as AMD in the AI GPU market: Nvidia's hardware and software have become de facto standards due to significant performance advantages. Demand for Intel's data center GPUs hasn't been enough to offset headwinds facing the company's PC and server CPU businesses, and investors have punished the stock due to weaker-than-expected progress. The semiconductor specialist's share price has fallen more than 70% from its high.

However, Intel's dramatic valuation pullback also helps make it a worthwhile contrarian bet for investors seeking potentially explosive turnaround plays. While it seems unlikely that the company will be able to deliver GPUs capable of matching Nvidia's top-of-the-line offerings any time soon, shares could soar if Intel makes meaningful progress on that front and benefits from overall demand in the space.

The semiconductor giant also has a second way to tap into the booming demand for GPUs. The company is investing tens of billions of dollars in building out its own foundry business that will manufacture advanced chips for customers. As Intel rapidly brings new process nodes to volume production, Nvidia and AMD may eventually see Intel as a viable manufacturing partner for their own GPUs. Intel has also been a player in the gaming graphics processing space for a long time, although it's only recently branched out into discrete GPUs.

Semiconductor

4. Arm Holdings

4. Arm Holdings

Arm Holdings is a semiconductor company that generates most of its revenue by licensing architecture designs that other companies use to build on and design their own chips. While the semiconductor specialist's business primarily focuses on architecture for CPUs, it also has a presence in the GPU category.

Arm's Mali and Immortalis GPUs may not measure up to the high-powered performance of processors used in data centers or even high-end gaming processors, but they have found adoption in mobile devices, smart TVs, and other consumer hardware. Rather than being built off the company's architecture by third parties, these processors are designed directly by Arm -- and the company is reportedly interested in designing more of its own chips.

Notably, Arm is rumored to be working on high-performance GPUs that can challenge Nvidia and Intel in the gaming processor market. If the company were to find success in the gaming space, it's possible it could ready a chip to compete in the data center market -- which is currently the holy grail in the GPU industry thanks to the importance of AI.

5. Qualcomm

5. Qualcomm

Qualcomm is a tech company that specializes in processors, connectivity chips, and other semiconductors for mobile devices and other consumer hardware. The company's chip designs are found in most modern smartphones and tablets, and its Adreno GPUs are a key part of the Snapdragon processors that are central to phones using the Android operating system.

Qualcomm has built its business on delivering high-performance, low-power-consumption chips and is also making a push to improve the adoption of its Snapdragon processors in the PC hardware market. As demand for AI-focused hardware in the consumer market continues to ramp up, the chip specialist will likely continue to tailor its Adreno GPUs to support artificial intelligence technologies.

In addition to its focus on the consumer market, Qualcomm is also launching CPUs for data center customers that have been designed to easily interface with Nvidia's GPUs. So, while Qualcomm doesn't have a competitive GPU for the high-end data center market, it may still benefit from demand and adoption trends in the space.

Exchange-Traded Fund (ETF)

GPU ETFs

There are also GPU ETFs

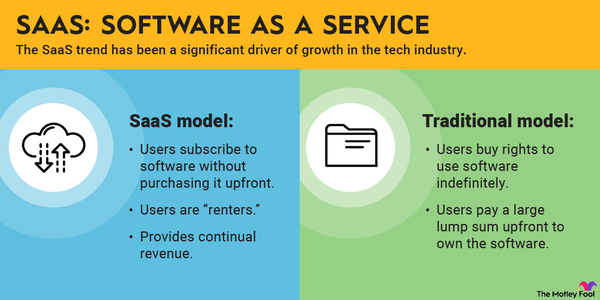

Although there aren't any exchange-traded funds focused solely on GPUs, there are some options that put GPU stocks front and center. These ETFs are focused on the tech sector, although they're weighted toward GPU stocks.

The VanEck Semiconductor ETF (SMH 0.92%) invests in the top 25 global semiconductor companies. Because Nvidia's market value has exploded, the GPU stock makes up a significant chunk of this fund. As of mid-2025, Nvidia accounted for roughly 21% of the fund's total assets; AMD and Intel each accounted for less than 5% of assets.

If you're looking for something more diversified but still focused on cutting-edge technologies, the iShares Exponential Technologies (XT 1.16%) ETF may be a better option. The ETF holds almost 200 distinct stocks, but GPUs are well represented, and Nvidia was the top holding as of mid-2025.

While some investors may want to bet directly on GPU stocks, those with a lower risk tolerance should consider these GPU-heavy ETFs.

Related investing topics

Should you invest?

Should you invest in GPU companies?

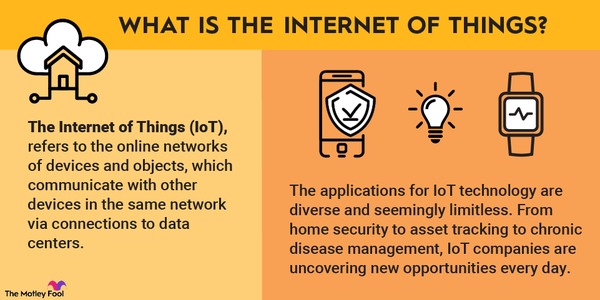

The AI revolution is already driving demand for the most advanced GPUs into the stratosphere, and it appears that this demand is here to stay. One thing to be aware of, though, is that GPUs aren’t the only option for accelerating AI workloads. Specialized chips known as Application-Specific Integrated Circuits (ASICs) are built at the hardware level for a specific set of tasks, and they can provide significant performance and efficiency gains over more general GPUs.

Despite this threat, GPUs have become the standard way to train and run AI models, and that’s unlikely to change overnight. There are many ways to invest in AI, but for investors looking for a "pick-and-shovel" option, GPU stocks are a good bet.

Why invest in GPU stocks now?

GPUs are the core hardware technology powering the artificial intelligence revolution. While AI has already made incredible leaps and bounds in a relatively short period of time, it's likely that the progression of artificial intelligence and machine learning technologies is still just getting started.

Given the strong demand outlook driven by the rise of AI and other data-center applications, GPU technologies are a promising growth market to invest in. Even better, GPUs will also continue to be used to power gaming hardware and other tech devices.

FAQ

GPU investments FAQ

What is a GPU in the stock market?

A GPU is a graphics processing unit, a specialized type of semiconductor chip used for graphics and AI tasks.

Should I invest in GPUs or CPUs?

Both GPUs and CPUs are necessary components of any PC or server, although the demand for GPUs is especially strong as companies adopt AI technology.

What is the biggest GPU company?

Nvidia is the largest GPU manufacturer by market cap. The company was valued at more than $3 trillion in mid-2024.

Which GPU company is best?

Nvidia appears to be benefiting the most from the sky-high demand for GPUs capable of running AI workloads.