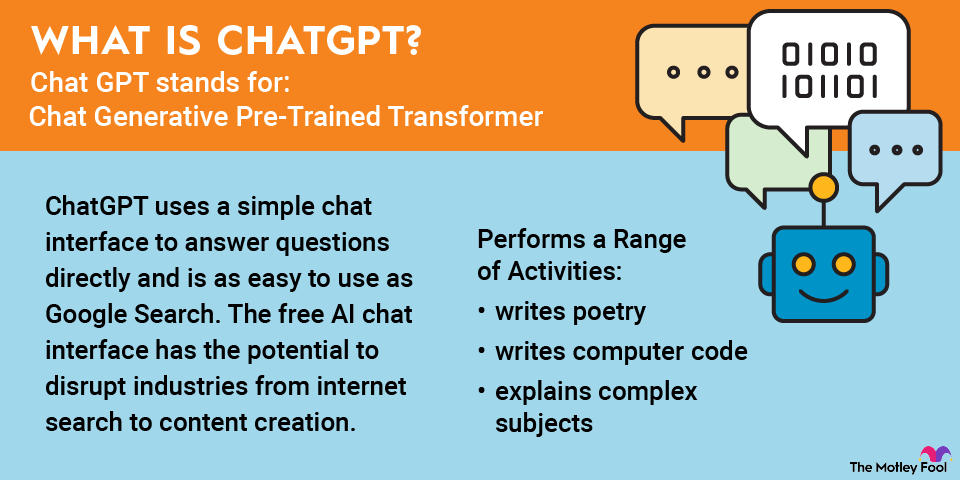

Investor interest is surging in all things AI, so it shouldn't come as a surprise that artificial intelligence (AI) start-ups are also popping up on investors' radars. Ever since the launch of ChatGPT, the potential for AI has crystallized across the business world and among investors, and the implications for the new technology are vast. AI start-ups are privately held companies that are developing AI technologies. This could include generative AI companies like OpenAI, physical AI, which includes robotics and automation like autonomous vehicles, and other types of artificial intelligence.

A new race is afoot among start-ups to challenge ChatGPT and, separately, to come up with the next big thing in generative AI.

Not surprisingly, money from venture capital firms and other investors has poured into AI start-ups, and the industry is booming.

In this discussion on AI start-ups, we'll review some of the hottest privately held companies working on artificial intelligence today, analyze the pros and cons of investing in AI start-ups, and answer some commonly asked questions about AI start-ups.

Artificial Intelligence

Best AI start-ups to watch this year

1. OpenAI

As you might expect, ChatGPT owner OpenAI has received much of the attention in AI start-ups this year, and continues to set the pace in its cohort.

OpenAI has developed other renowned products, including its image-generating AI, DALL-E, and text-to-video AI, Sora. Its success with ChatGPT and its high-profile partnership with Microsoft (MSFT -2.31%) make it the premier AI start-up these days.

AutoGPT

In March 2025, OpenAI raised $40 billion at a valuation of $300 billion, making it the largest private tech funding round on record.

The round was led by SoftBank (SFTBF +3.57%), the prolific tech investor, which invested $30 billion; Microsoft and venture capital firms made up the remaining $10 billion. The Stargate Project, a joint venture between Softbank, OpenAI, and Oracle that was announced at the White House in January, is expected to receive $18 billion. Stargate aims to invest as much as $500 billion in AI infrastructure in the U.S.

In a secondary stock sale in October, when insiders sold $6.6 billion worth of stock, the company was valued at $500 billion.

Key facts:

- Founded in 2015.

- Headquartered in San Francisco.

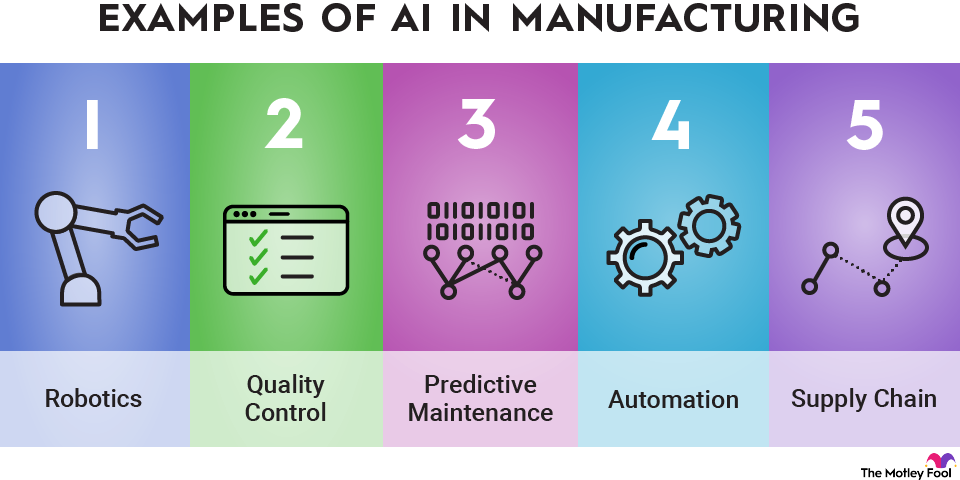

- Industries served: Technology, education, retail, manufacturing, healthcare, and others.

- Services provided: Foundation models including GPT and DALL-E, chatbots, enterprise services, and an API platform.

2. Anthropic

Anthropic is rapidly emerging as the chief start-up rival to OpenAI.

Founded in 2021 by former OpenAI researchers, Anthropic counts Google and Amazon (AMZN +0.17%) as major investors. The Alphabet (GOOG +1.97%) (GOOGL +2.01%) subsidiary took a 10% stake in 2023, and Amazon has invested $8 billion in Anthropic. After its most recent funding round in September, it's valued at $183 billion, a $13 billion increase. Anthropic also counts Salesforce (CRM +0.65%) and Zoom (ZM -0.20%) as investors.

Anthropic is best known for its generative AI chatbot, Claude, which it launched in March 2023. Some users think Claude is friendlier than ChatGPT, though others say that ChatGPT is better for analyzing and summarizing documents. It's also said to be more versatile than Claude.

According to some reviews, Claude gets better results with things like creative tasks, following instructions, and answering trivia questions.

Anthropic describes Claude as being "much less likely to produce harmful outputs, easier to converse with, and more steerable" than other AI chatbots. In other words, Claude seems designed to avoid some of the problems that have plagued ChatGPT and Google's AI chatbots.

Key facts:

- Founded in 2021.

- Headquartered in San Francisco.

- Industries served: Technology, healthcare, customer support, finance, and others.

- Services provided: Claude AI models, focus on AI safety, enterprise services, cloud partnerships.

3. Perplexity AI

Valued at $20 billion as of September 2025, Perplexity AI is another promising AI start-up.

Perplexity is backed by Softbank's Vision Fund, the prolific start-up investors known for investing in companies like Uber (UBER +0.65%), DoorDash (DASH +0.32%), Arm Holdings (ARM +6.30%), and WeWork. Perplexity has also raised money from Nvidia (NVDA +2.98%), Amazon founder Jeff Bezos, and Shopify (SHOP -4.16%) CEO Tobi Lutke.

Perplexity has differentiated itself from other AI chatbots with a focus on search tools that feature sources and citations. Some see Perplexity as the best AI alternative to a traditional Google search. In fact, both Apple (AAPL +0.43%) and Samsung (SSNL.F +56.02%) are considering integrating Perplexity's search engine into their hardware.

Perplexity said it crossed $100 million in annualized revenue in March with 6.3x growth in Perplexity Pro, its paid subscription tier.

Key facts

- Founded in 2022.

- Headquartered in San Francisco.

- Industries served: Education, healthcare, media and entertainment, travel, and others.

- Services provided: Real-time search, citations, conversational interface, file uploads, and others.

4. xAI

Elon Musk has had his hand in a wide range of emerging technologies, including electric vehicles, renewable energy, spacecraft and rockets, and satellite internet, so it shouldn't come as a surprise that he also has an AI start-up. (Musk was even a co-founder of OpenAI, although he left that company in 2018.)

xAI, his AI start-up, is one of the most valuable today, and in September 2025, was aiming for a $10 billion funding round that would value the company at $200 billion.

xAI is the creator of Grok, the chatbot featured on the social media platform X, which Musk also owns. That gives xAI something of an advantage since most AI start-ups don't have an allied platform like X that can help draw users to the product. Some users think Grok is less censored than ChatGPT.

Key facts:

- Founded in 2023

- Headquartered in San Francisco

- Industries served: Technology, finance, healthcare, autonomous vehicles, manufacturing, and others.

- Services provided: Grok chatbot, models for developers, and enterprise services.

5. Mistral AI

Mistral AI is one of the youngest AI start-ups to make a splash in the industry. The company was able to easily raise money since it was founded by execs from Meta Platforms (META +1.46%) and Google.

After a funding round in September 2025, the start-up is now valued at $14 billion, raising 1.3 billion euros from ASML. The start-up has also raised money from the likes of Andreessen Horowitz, Nvidia, and Samsung.

Mistral is unique among AI start-ups. It's based in France and has received a strong endorsement from the French government. It takes an open-source approach to AI, meaning its code is available to anyone who wants to use it. Its chatbot is called Le Chat and is known for being strong in a wide range of languages.

Key facts:

- Founded in 2023.

- Headquartered in Paris.

- Industries served: Financial services, healthcare, customer support, education, and others.

- Services provided: Large language models, API access, open-source models, and cloud-based access.

6. Scale AI

Scale AI is different from other companies on this list because it doesn't make a chatbot or a generative AI interface. Instead, the company helps prepare data for AI training, a process called data labeling.

Scale AI's technology is impressive enough that Meta Platforms spent $14.3 billion on a 49% stake in the company, hoping it will accelerate its ambitions in AI. As part of the deal, Scale's 28-year-old CEO Alexandr Wang will join Meta and will reportedly lead a research lab at the tech giant. Given that Meta didn't take a majority stake, Wang's agreement to leave is a bit odd, but the relationship could favor Scale in the long run.

Key facts:

- Founded in 2016.

- Headquartered in San Francisco.

- Industries served: Autonomous vehicles, healthcare, e-commerce, generative AI, robotics, and others.

- Services provided: Data annotation/labeling, model training, human-in-the-loop labeling, and tools for building custom LLMs.

7. Databricks

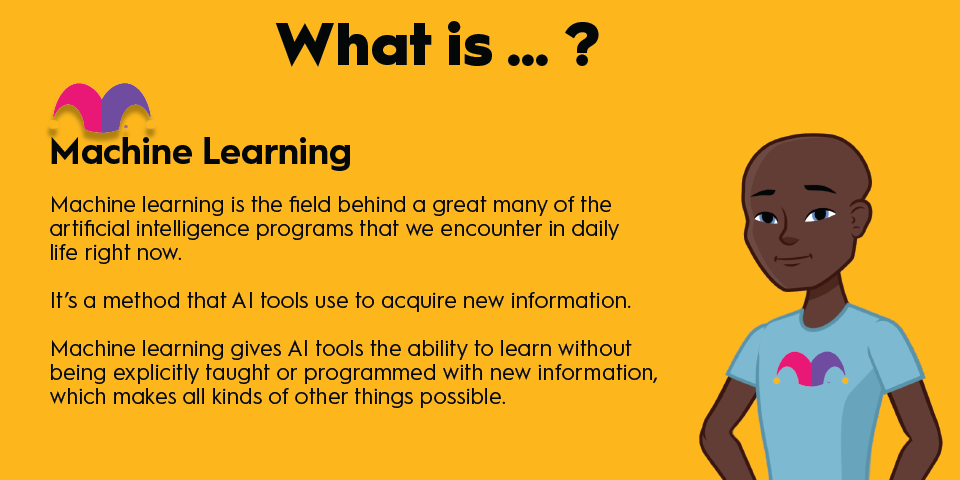

Databricks is also unlike most of the AI start-ups on this list. It's older than the ones focused on generative AI since it was founded in 2013, and its focus is primarily on data analytics. Its AI platform offers machine learning and generative AI applications to help its customers deploy AI models.

As of August 2025, the company was seeking a valuation of more than $100 billion. Databricks has been one of the more anticipated initial public offerings (IPOs) for a while, but the company has not given any indication of when it will go public.

Key facts:

- Founded in 2013.

- Headquartered in San Francisco.

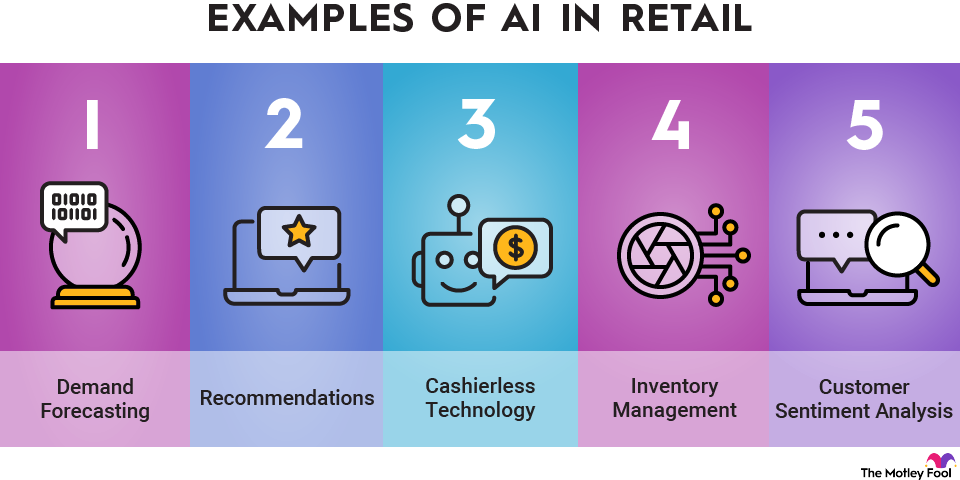

- Industries served: Financial services, healthcare, retail, media, and others.

- Services provided: Data lakehouse, machine learning platform, analytics platform.

8. Cohere

Founded in 2019 by ex-Google AI researchers, Cohere is an enterprise AI platform focused on large language models and natural language processing.

Cohere allows developers and businesses to build their chatbots and virtual assistants, and the company also provides services like data analysis and search.

The company aims to provide higher performance and accuracy with a specific focus on the enterprise market. Cohere reached an annualized revenue of $100 million in May 2025, and its valuation was $7 billion as of September 2025. It counts Nvidia, AMD (AMD +7.71%), and Cisco (CSCO +0.46%) among its backers.

Key facts:

- Founded in 2019.

- Headquartered in Toronto.

- Industries served: Financial services, healthcare, manufacturing, retail, and others.

- Services provided: LLMs, API access, text generation, summarization, and data extraction.

Related investing topics

Should you invest in AI start-ups?

Start-ups, by definition, are privately held, which means it's difficult for retail investors to invest in them.

However, there are ways to get exposure to AI start-ups. The easiest way is by investing in a publicly traded company that has a stake in an AI start-up. For instance, you could buy shares of Microsoft, which would give you indirect ownership of OpenAI. Similarly, you could buy stock in Alphabet to get exposure to Anthropic.

Investors should remember that start-ups tend to be riskier than publicly traded companies, and many start-ups won't succeed. However, if you find an AI start-up that looks promising, it's worth investigating if any publicly traded companies have a stake in it.

Investors looking for opportunities in artificial intelligence can also consider investing in AI stocks or AI ETFs.

How to invest in AI start-ups

Investing in any company before its IPO isn't so easy. You can follow the steps above and buy shares of a company that owns a stake in one of the start-ups, but that will only get you limited exposure to it.

There are platforms that can allow you to invest in a private company, such as Forge Global and EquityZen, which function as secondary marketplaces for insiders to sell shares in start-ups and private companies. However, it can be difficult to participate in these, and the sales are typically limited.

Accredited investors may be able to participate in a start-up investment through a venture capital firm or an angel investor.

Overall, investing in a privately held company isn't easy, but it can be done.