The metaverse is a shared, digital environment designed to blend virtual experiences with the real world. In theory, it enables people to work, socialize, shop, and play inside immersive digital spaces.

In practice, the metaverse is still taking shape. Today’s versions are fragmented and limited, closer to early internet experiments than a fully realized platform. That’s important for investors: expectations should be long-term, not immediate.

The upside? Because development is still early, investors have time to position thoughtfully rather than chase hype.

How investors can gain metaverse exposure

Rather than betting on a single outcome, investors can approach the metaverse through several overlapping layers:

- Hardware and immersive devices: Virtual and augmented reality headsets are the gateway to immersive experiences. Meta and Sony currently lead here, with future potential in haptics and sensory technology as hardware improves.

- Interactive platforms: Virtual worlds where users gather, create, and transact form the foundation of any metaverse. These platforms resemble early-stage digital ecosystems rather than finished products.

- 3D creation software: The metaverse requires tools to build environments, avatars, and digital goods. Software companies enabling 3D design and development are critical enablers.

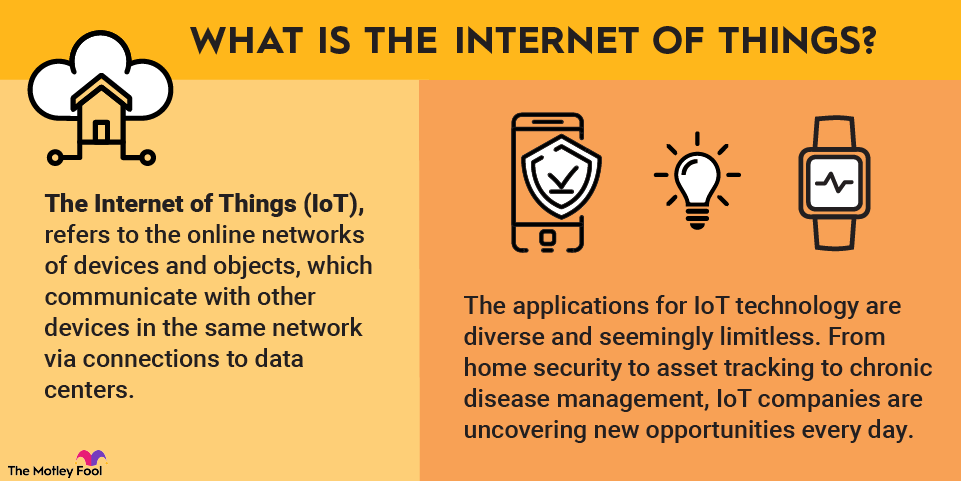

- Infrastructure and connectivity: Fast networks, cloud computing, and data delivery systems are necessary to support real-time interaction at scale.

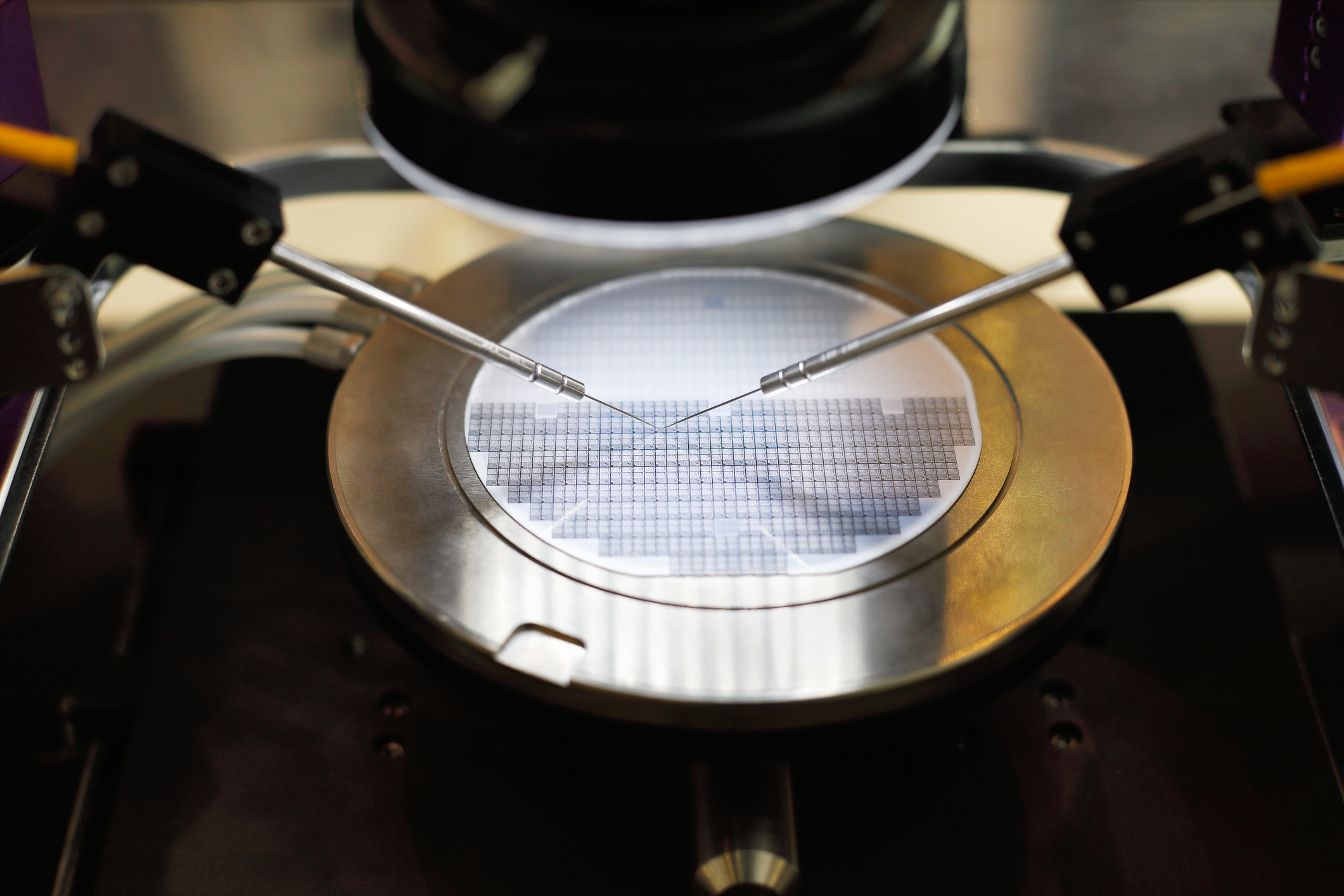

- Semiconductors and AI: Rendering 3D environments and powering AI-driven experiences requires massive computing power — making chips and AI platforms core to the metaverse thesis.

- Cybersecurity: As digital identities and financial activity move online, security becomes essential rather than optional.

With so many aspects to choose from, there's likely a metaverse stock to fit any investor's style and risk tolerance.

Top metaverse stocks to consider

As previously mentioned, it could be many years before the metaverse exists in its fullest form. So, the best metaverse stocks to buy today aren't entirely dependent on the metaverse but rather already have thriving businesses outside of the metaverse trend.

| Company name | Company ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|---|

| Meta Platforms | NASDAQ:META | $1.8 trillion | 0.29% | Interactive Media and Services |

| Roblox | NYSE:RBLX | $46.2 billion | 0.00% | Entertainment |

| Cloudflare | NYSE:NET | $62.1 billion | 0.00% | IT Services |

| Unity Software | NYSE:U | $12.5 billion | 0.00% | Software |

| Nvidia | NASDAQ:NVDA | $4.6 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

Here are some top considerations, in no particular order:

1. Meta

NASDAQ: META

Key Data Points

Formally known as Facebook, Meta Platforms (META -2.95%) is spending more on the metaverse concept than any other company in the world. Most of the company's revenue is generated by ads on the Facebook and Instagram apps.

However, Meta Platforms has another part of the business called Reality Labs, which sells hardware devices and VR content. Its Oculus VR headsets have collectively sold more than any other on the market, making Meta a top stock for immersive hardware.

The company is also investing billions of dollars annually to advance VR and AR applications -- more than most other metaverse companies could dream of. If there's a future in the metaverse, Meta will likely play an important part.

2. Roblox

NYSE: RBLX

Key Data Points

Roblox (RBLX -13.46%) is already a go-to virtual world that could be an early-stage version of a metaverse platform. Musicians and celebrities host live events on Roblox's platform, perhaps signaling that these are gaining mainstream appeal.

In the past, the platform primarily resonated with U.S. users younger than 13. But it's developed into a global company with an increasingly expanded set of older users. The metaverse will likely have multiple interactive platform destinations. However, with more than 150 million daily active users already, Roblox has a big head start.

3. Cloudflare

NYSE: NET

Key Data Points

Cloudflare (NET -1.80%) is a global content delivery network (CDN), positioning internet content physically closer to users with its network of more than 330 data centers. The proximity makes connections faster, and the company's cybersecurity solutions can make connections more secure as well. Both things are useful to the metaverse concept.

However, Cloudflare believes that Web3 could be the future of the metaverse -- decentralized metaverse applications will use blockchain technologies. The company has invested in becoming a gateway for the Ethereum (ETH -9.83%) ecosystem, allowing developers to build applications without running the underlying infrastructure.

Artificial Intelligence

4. Unity

NYSE: U

Key Data Points

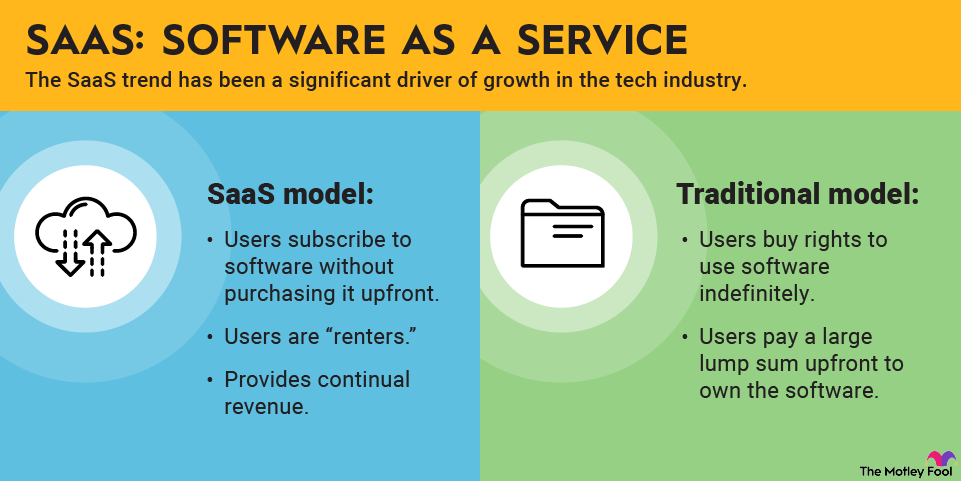

Unity Software (U -24.22%) is a leader in the 3D software space. The company's products are popular among developers, and it's reasonable to expect it to create a lot of 3D content for the metaverse.

It's also reasonable to believe the company can take market share from competitors due to its unique value proposition. Consider that two of its subscription tiers -- Unity Personal and Unity Student -- are free to start. This familiarizes content creators with Unity's software. And as these creators find financial success, they'll likely become paying Unity customers.

5. Nvidia

NASDAQ: NVDA

Key Data Points

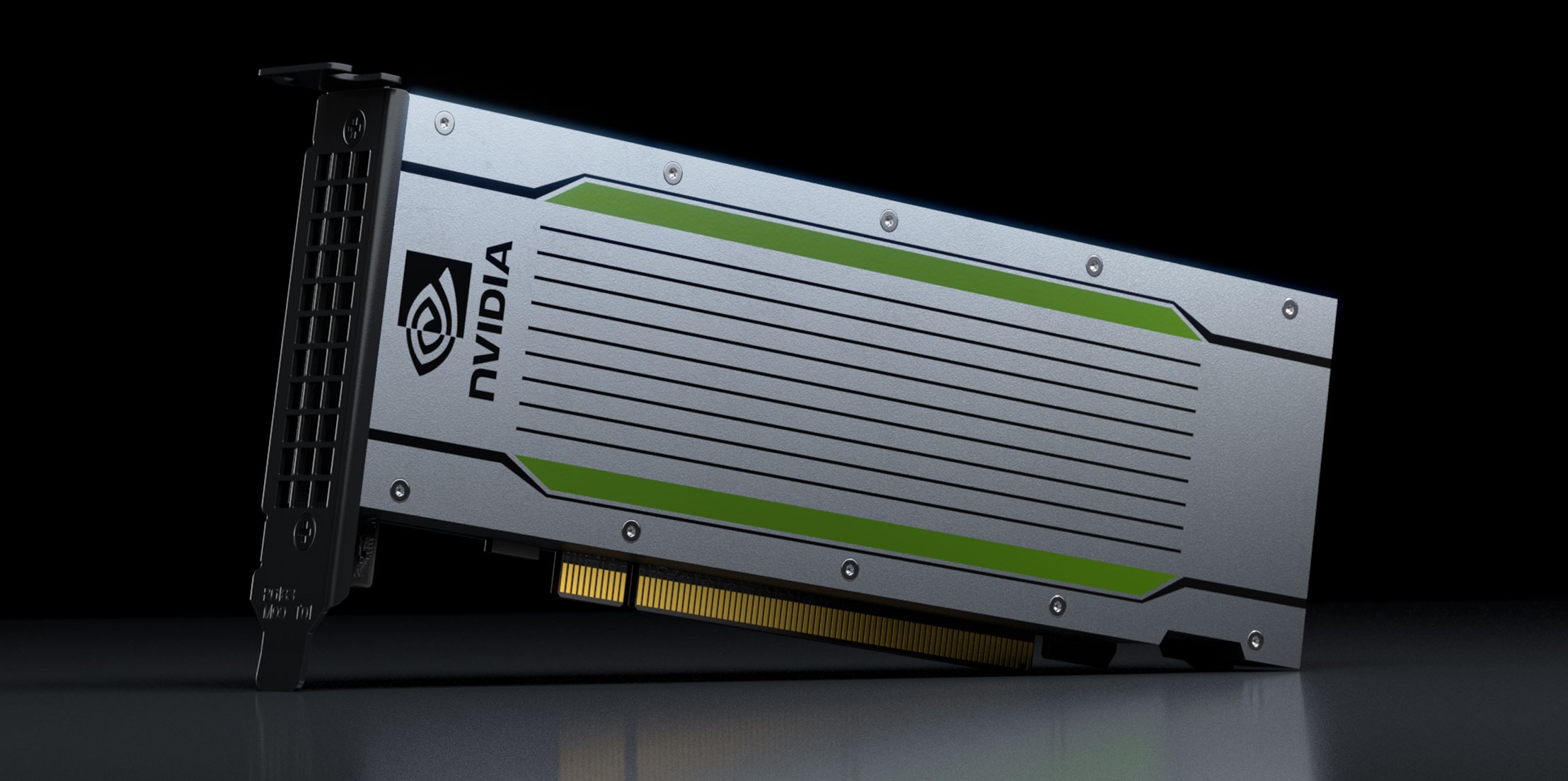

Tech giant Nvidia (NVDA -0.72%) addresses many big metaverse needs, including 3D content creation, powerful graphics rendering, AI, and more, making it a top metaverse stock as well.

Its graphics processing units (GPUs) have long been used in the video game space and are now finding plenty of use in powering AI models. Beyond hardware, the company has software with applications in creating digital worlds and 3D content.

Given its stellar stock market performance in recent years, Nvidia is quickly becoming a household name and still has a lot of potential in the metaverse trend.

A metaverse ETF to consider

Maybe you can't decide which metaverse stock to buy, or maybe you want broader exposure than a single stock. Consider buying a metaverse-focused exchange-traded fund (ETF) comprised of dozens of stocks.

The Roundhill Ball Metaverse ETF (METV -3.57%) is the largest option available and includes many of the companies listed above. While ETFs reduce company-specific risk, fees (0.59% annually) can weigh on long-term returns.

Pros and cons of investing in metaverse stocks

On the positive side, investors might consider things such as:

- A potentially transformative trend: The world forever changed when every household got a computer. It changed again when everyone got connected to the internet. Similarly, the metaverse could be a transformative trend. Imagine a world in which, every day, everyone donned metaverse hardware devices, logged on, and connected with each other. The world would change in many ways, creating numerous lucrative investment opportunities.

- An early-stage opportunity: It's fun to make an early investment in an exciting trend, and the metaverse is certainly a long way off from its potential. Moreover, investors can invest smaller sums in the most promising ideas when a trend is in its early stages. When the growth potential is substantial, even a modest investment can become consequential over time.

Investors should also consider some of the counterarguments, which include things such as:

- Questionable profitability: How will the metaverse be monetized, and which companies have the clearest path to profits? Those questions are hard to answer right now. If any company were to profit from the trend, it would seem to be Meta Platforms. However, the company has racked up billions of dollars in losses so far from its metaverse ambitions, and the situation hasn't materially improved.

- Waning interest: Meta Platforms reportedly began making spending cuts in its metaverse division in late 2025. This company was so committed to the concept that it changed its name to reflect its focus. But if even Meta Platforms is starting to lose some of its zeal, then perhaps the metaverse trend will never materialize in the way many people had hoped.

How to invest in metaverse stocks

- Open your brokerage app: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly