Tech ETFs, or exchange-traded funds, are vehicles that allow you to invest in an entire basket of technology stocks in a single investment that trades just like a common stock. There have been some massive winners in the tech sector in recent years, but there has also been considerable turbulence.

Exchange-Traded Fund (ETF)

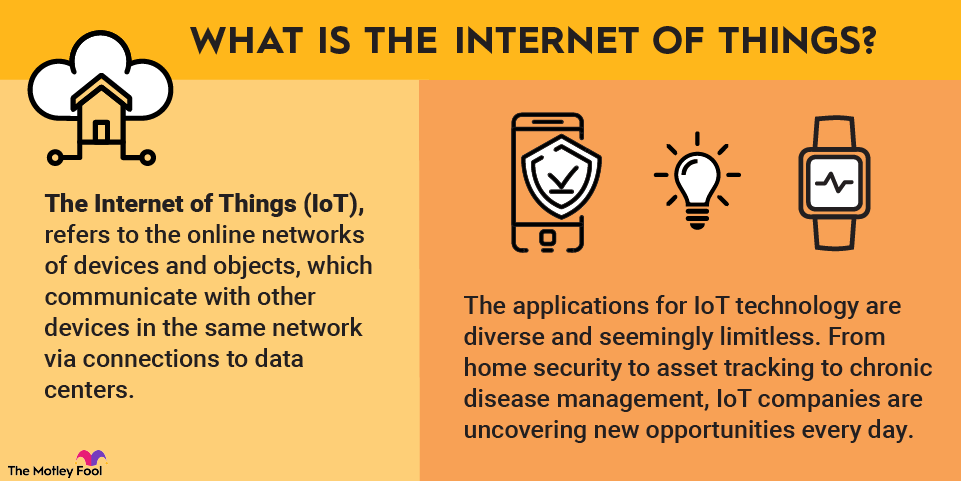

On the one hand, exciting new technologies like artificial intelligence (AI) have created many potential investment opportunities. But on the other hand, stock market volatility makes many investors hesitant to pick individual tech stocks.

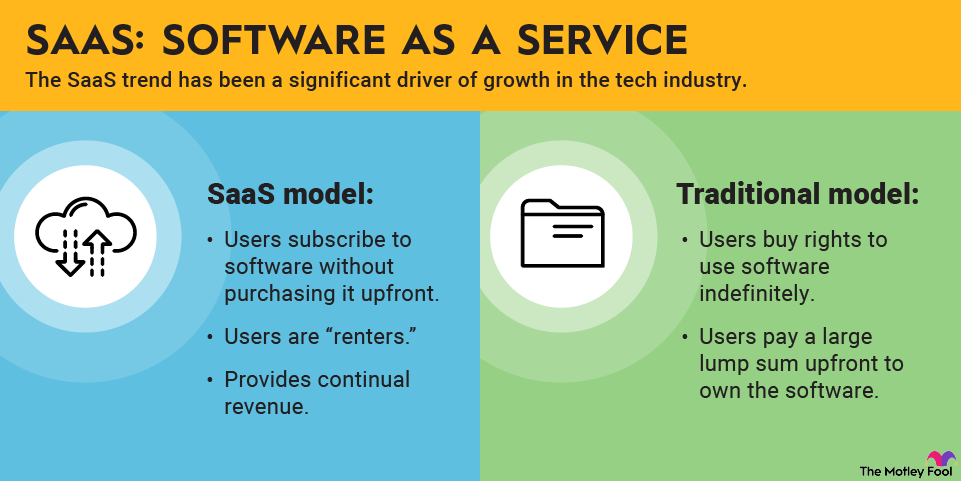

That's where exchange-traded fund (ETF) investing comes in. An ETF allows you to invest in a specific area of the stock market without the downsides of picking individual stocks.

There are several excellent ETFs that focus on either the overall tech sector or a specific part of it. These can provide exposure to the high-potential tech space in your portfolio, but without the risks associated with investing in individual companies. In this article, we'll discuss seven top tech ETFs that are worth considering for investors looking to add diversified tech exposure to their portfolios.

Seven best tech ETFs

Asset

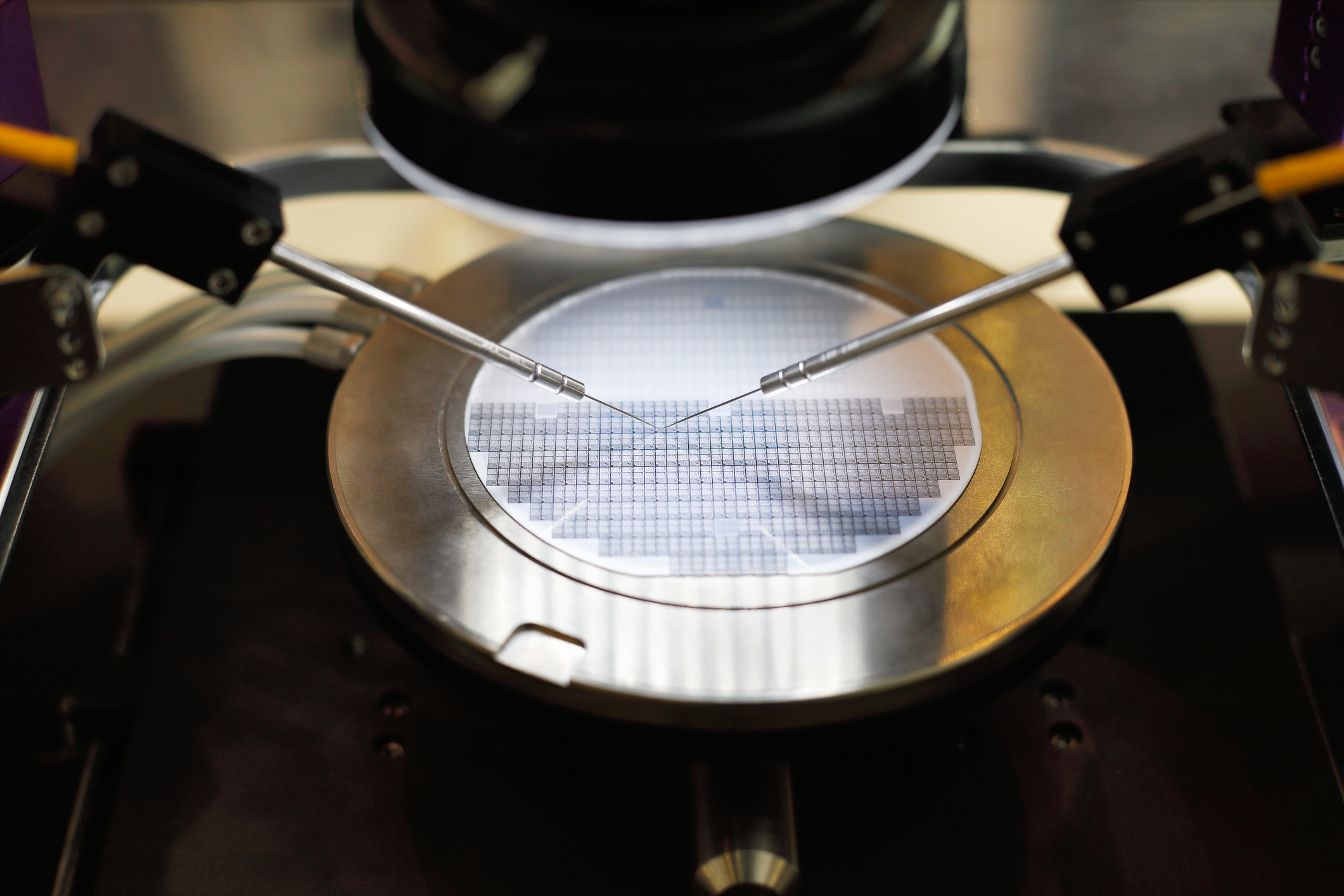

Semiconductor

Risks and challenges of investing in tech ETFs

All stocks have the risk of volatility and losing money. And while ETFs can help you minimize the risk of your entire investment getting wiped out, or of losing a ton of money due to the poor performance of any single stock, there's considerable risk involved with stock market investing.

That's especially true with tech ETFs, which tend to be more volatile than the overall stock market. For example, the Ark Innovation ETF has a beta that suggest it's roughly twice as volatile as the typical S&P 500 ETF.

Specific risks and challenges to consider when investing in tech ETFs include:

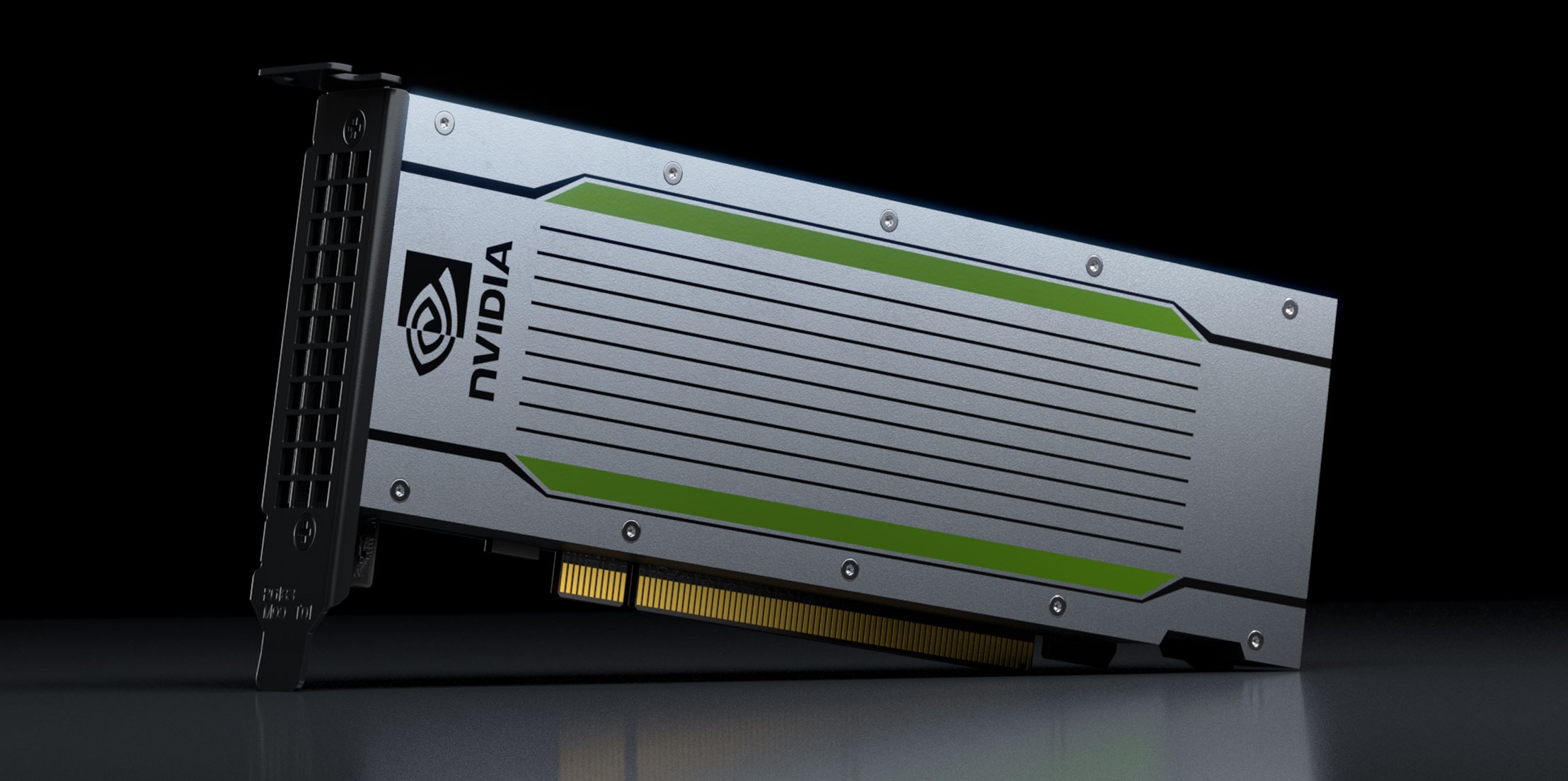

- Company concentration - One of the main reasons to invest in ETFs is to minimize your exposure to any single stock, but as you've seen with some of these ETFs, the exposure to mega-cap tech stocks like Nvidia and Microsoft can be substantial.

- Sector concentration - If AI investment slows down, for example, your investment could suffer more than if you owned a diversified index fund.

- Valuation risk - Technology stocks (especially in 2026) tend to command premium valuations due to the growth of AI and other tech trends.

Related investing topics

The bottom line on investing in tech ETFs

As you can see, not all tech ETFs are identical. Some track a broad index of tech companies. Others track more specialized baskets of stocks. And some take an actively managed approach or weigh their portfolios differently.

The best course of action, if you're thinking about adding some tech exposure to your portfolio, is to compare each to see which is best suited to your goals and risk tolerance.