Repurchase shares

A company that repurchases its own stock can increase shareholder value because share buybacks usually have a beneficial effect on the company's stock price. Companies that buy back shares typically opt to retire those shares from circulation, resulting in a reduction of the company's outstanding share count. Fewer shares outstanding indirectly boosts shareholder value by increasing per-share earnings, even if a company's total earnings are essentially unchanged.

Merge with or acquire a company

A company can create shareholder value by purchasing or merging with another company. The combined entity can benefit from increased market share, may be better positioned to expand into new markets, and can likely cut costs by consolidating back-end operations. The new organization is also likely to generate greater EPS, thereby boosting the company's share price.

How to measure your shareholder value

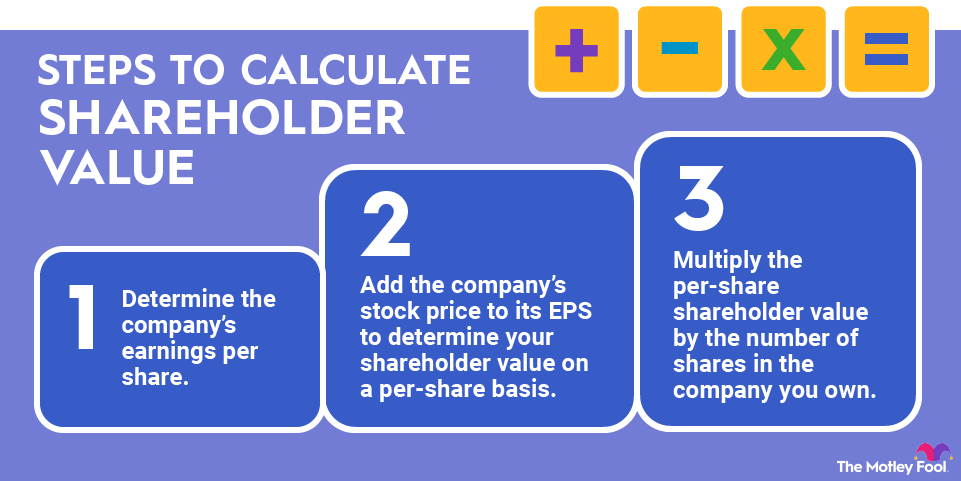

Your shareholder value is directly correlated with how many shares of a company you own. Here's how to compute your portion of shareholder value:

- Determine the company's earnings per share.

- Add the company's stock price to its EPS to determine your shareholder value on a per-share basis.

- Multiply the per-share shareholder value by the number of shares in the company you own.

If a company has EPS of $2 and a stock price of $40, then the shareholder value on a per-share basis is $42. If you own 10 shares of the company's stock, then your individual shareholder value is $420.