A Schedule K-1 is a federal tax form that business partnerships and S corporations use to report a partner's share of its income, losses, capital gains, dividends, and other items.

As pass-through entities, they pass their income and losses through to their partners and shareholders, who pay taxes on any income at their individual rate (instead of the partnership paying taxes on that income at the corporate level). Many investors will receive a Schedule K-1 if they invest in a master limited partnership (MLP) or other limited partnership (LP), such as a real estate partnership.

Understanding a Schedule K-1 federal tax form

Understanding a Schedule K-1 federal tax form

Business partnerships, financial entity partnerships, and S corporations send a Schedule K-1 (also called Form 1065) to their limited partners (LPs), shareholders, or beneficiaries. The schedule reports their share of the entity's income, losses, deductions, credits, and any other distributions (whether paid out or not).

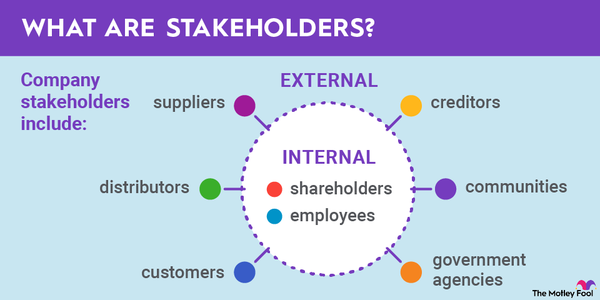

As pass-through entities, they don't pay taxes at the corporate level. Instead, they pass their income and losses through to their partners, who pay taxes on the income at the individual level. Schedule K-1s provide each individual stakeholder with their share of the entity's income and losses so they can report them on their individual taxes.

A Schedule K-1 is similar to a Form 1099 that an investor might receive if they earned dividend income on a stock or interest income from a bank. Investors typically receive a Schedule K-1 if they are a limited partner in an MLP or real estate partnership, or they may receive them from certain exchange-traded funds (ETFs). They will use this tax form to file their individual tax return.

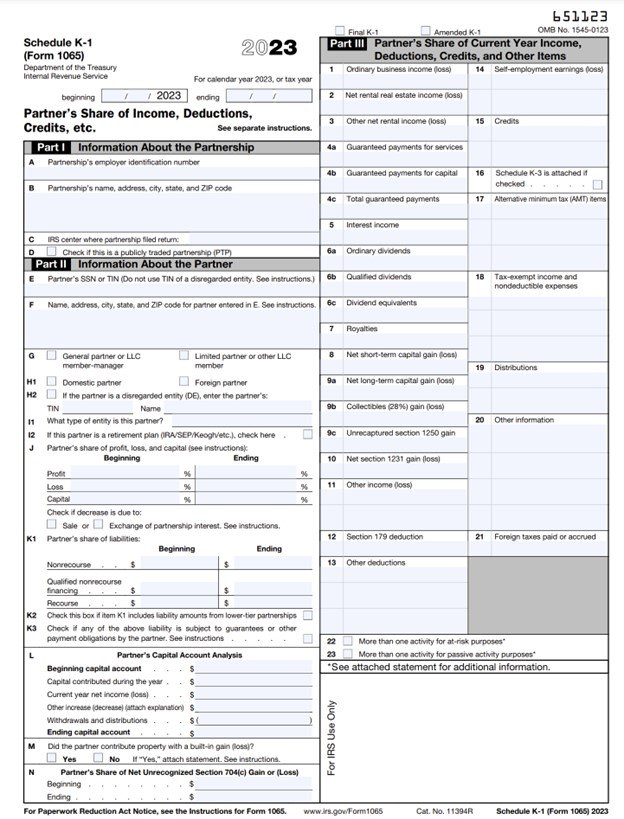

Here's an example of what a Schedule K-1 tax form looks like:

Drawbacks

What are some drawbacks to Schedule K-1 federal tax forms?

Investors should know that a Schedule K-1 federal tax form can complicate their tax filings. Timing can potentially be a major complication.

While most companies will send 1099 forms early in the tax filing season (usually by the end of January), many partnerships don't send Schedule K-1 forms until mid-March (for most publicly traded MLPs) or later (for many real estate partnerships). This is due to the complexities of allocating income and losses to each LP or shareholder individually. The late filing means many LPs must file an extension on their taxes.

Another potential drawback of investing in an entity that sends a Schedule K-1 instead of a 1099 form is that the entity may report a significant income or gain without distributing enough cash to investors to cover their tax liability on that income.

Conversely, an investor might be an LP in a real estate partnership that reports large losses that the LP isn't allowed to record on their taxes because they don't have any offsetting real estate income to record against it. Finally, given the complex nature of many business partnerships, individual investors often need to hire an accountant to complete their taxes when they receive a Schedule K-1.

Positives

What are some positives of receiving a Schedule K-1 federal tax form?

The partnership structure enables these entities to avoid what's known as double taxation. Traditional C corporations pay taxes at the corporate level. In addition, their investors will often pay taxes on the dividends they receive (which they report via a Form 1099).

On the other hand, partnerships and S corps are pass-through entities. Instead of paying taxes at the corporate level, these entities pass through income, losses, credits, deductions, and other items to their LPs or shareholders. As a result, those stakeholders pay taxes at their individual tax rate, which is often lower than the corporate tax rate plus the dividend tax rate.

Another benefit of receiving a Schedule K-1 is that it enables the recipient to record their share of the entity's losses, deductions, and credits, which could lower their reported income and, thus, the taxes they owe. For example, the distributions paid by an MLP are often treated as a return of capital by the IRS instead of dividend income, so the income remains tax-deferred until the unit holder sells their units.

An example

An example of a Schedule K-1 federal tax form

Investors most commonly receive a Schedule K-1 federal tax form if they invest in an MLP. These entities often pay high-yielding distributions, making them attractive to income-seeking investors. Their investors receive a lucrative and often tax-deferred income stream.

Enterprise Products Partners (EPD 0.22%) is one of the top MLPs. It sends its unitholders a Schedule K-1 federal tax form around mid-March.

Related investing topics

For example, let's say it sent a K-1 to a hypothetical investor who owned 300 units in 2023. The Schedule K-1 reported in box one that the investor's share of the entity's ordinary business income was $120. It didn't report any other income, losses, gains, interest, credits, or dividends.

Meanwhile, box 19 reported that the investor earned $595 in distributions from the MLP that year. As a result, the investor reported $120 of income on their taxes. They had a prior-year passive loss, which they recorded against this income, enabling the investor to defer taxes on the entire $595 in distributions that year.