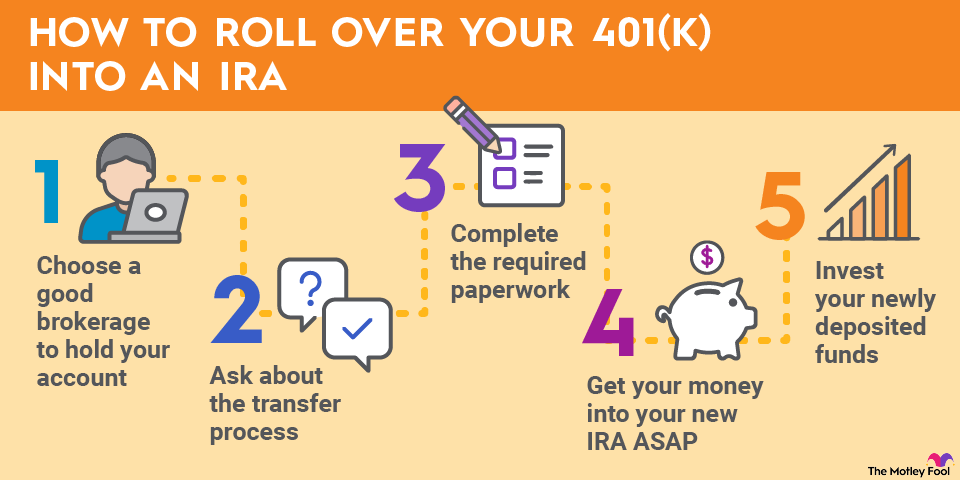

How to roll over your 401(k)

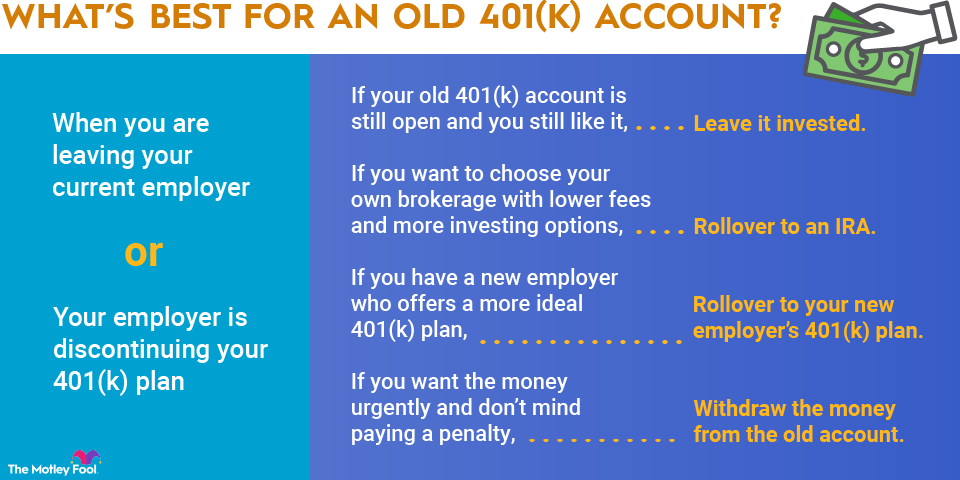

Rolling over your 401(k) typically involves a few basic steps. However, there are various ways to approach the process, so it's best to first clearly understand your priorities and any special circumstances or considerations that may apply to you.

1. Decide where you want your money to go

You have a few destination options to choose from when you roll over a 401(k):

Use a rollover IRA: The most commonly used is a rollover IRA. This is a traditional IRA, except it houses funds rolled over from another retirement account, like a 401(k).

Investors typically roll over funds into similar accounts -- a traditional 401(k) into a traditional IRA and a Roth 401(k) into a Roth IRA. You may also roll over funds from a traditional account into a Roth account, but you'll owe taxes at your current income tax rate on the amount converted. If you expect a year of low income, perhaps from an extended gap between jobs, then this conversion may be advantageous.

Transfer to a new 401(k): The other option is to roll over funds from an old 401(k) into your new employer's 401(k) plan. This consolidates all your retirement investments, making them easier to manage. For high-income earners, another reason to transfer to a new 401(k) may be to keep the backdoor Roth IRA option available by sidestepping (legally) the IRA aggregation rule. As long as the fees are reasonable for the current 401(k) plan, this isn't a bad option.

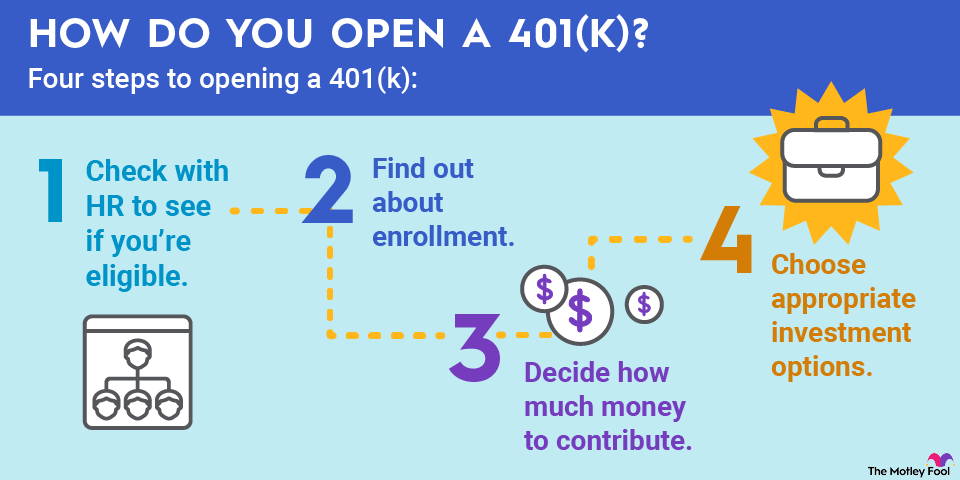

2. Open a new account or use an existing one

You may need to open a new 401(k) or establish an IRA before initiating a rollover. After all, you need an account to roll your funds into. If you already have a 401(k) or IRA you want to use, then you don't need to open a new account. However, if you prefer to keep your rollover funds separate from an existing account, then opening a new account is still an option.

Opening an IRA is a simple and straightforward process with most online brokers. You can do it entirely online with just a few forms and clicks.

3. Contact your old 401(k) plan administrator to begin the rollover process

To transfer funds from your old 401(k), you'll need to get in touch with your former employer's plan administrator and indicate that you want to roll over your account.

There are two ways for administrators to transfer your funds to your rollover destination: direct and indirect rollover.

Direct rollover: A direct rollover is the easiest way to roll over your 401(k). If this is available to you, it's the best option to avoid any pitfalls that could result in taxes and penalties.

With a direct rollover, you provide the administrator of the prior 401(k) plan with the information for the receiving account for your funds, and they (usually) transfer the funds to the new 401(k) account directly.

You may receive a check made out to your new IRA or 401(k) plan, and it's your responsibility to forward the check to the designated recipient. If you have any questions about where to send the check, you can contact your new 401(k) plan administrator or your IRA brokerage for clarification.

Indirect rollover: The other option is an indirect rollover. Instead of transferring funds directly from your old 401(k) to your rollover destination, the plan administrator sends the funds to you. You are then responsible for depositing the funds from your old 401(k) into your rollover account.

The major downside with indirect rollovers is that 401(k) plan administrators are required to withhold 20% of the taxable funds for the IRS. You'll receive the amount back on your tax return if you complete the rollover, but in the meantime, you will be short by 20% for your new 401(k).