The technology sector is vast, comprising gadget makers, software developers, wireless providers, streaming services, semiconductor companies, and cloud computing providers, to name just a few. Any company that sells a product or service heavily infused with technology likely belongs to the tech sector.

What are tech stocks?

Hardware Companies

These design and build devices such as:

- Personal computers.

- Networking servers.

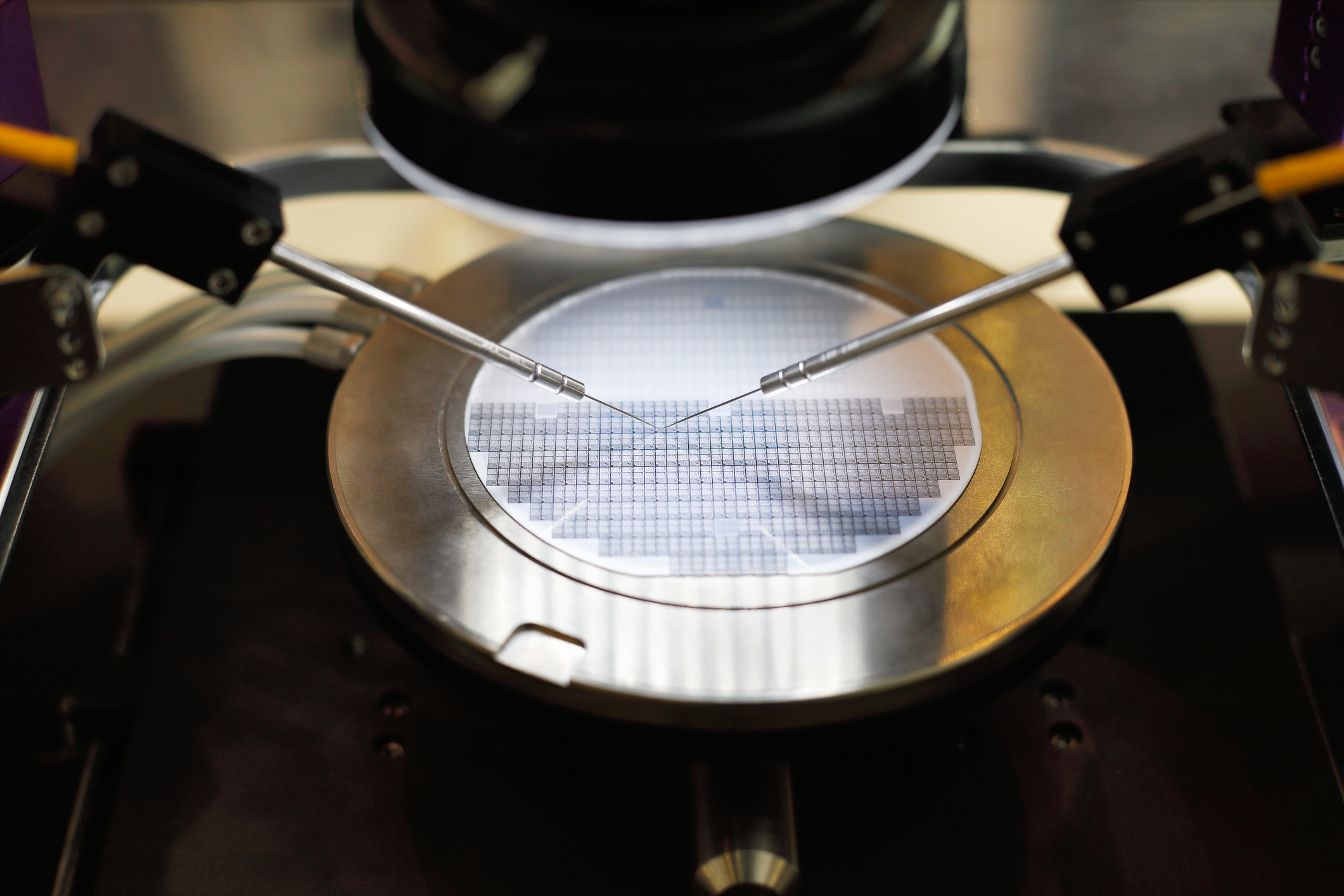

- Semiconductors.

- Smartphones.

- Fitness trackers.

- Smart speakers.

- Enterprise equipment, such as servers and networking gear.

Software Companies

These design the software that runs on hardware, such as:

- Operating systems.

- Databases.

- Cybersecurity software.

- Productivity software.

- Cloud computing providers.

- Artificial intelligence (AI).

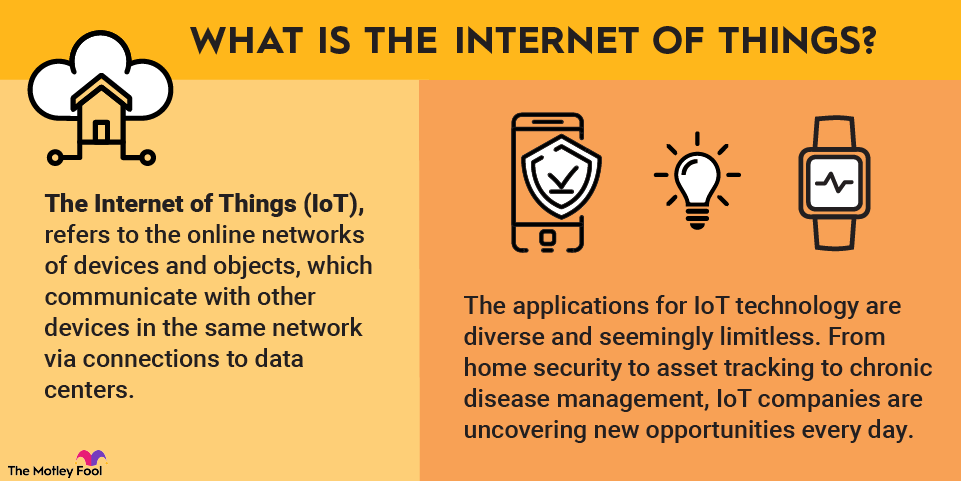

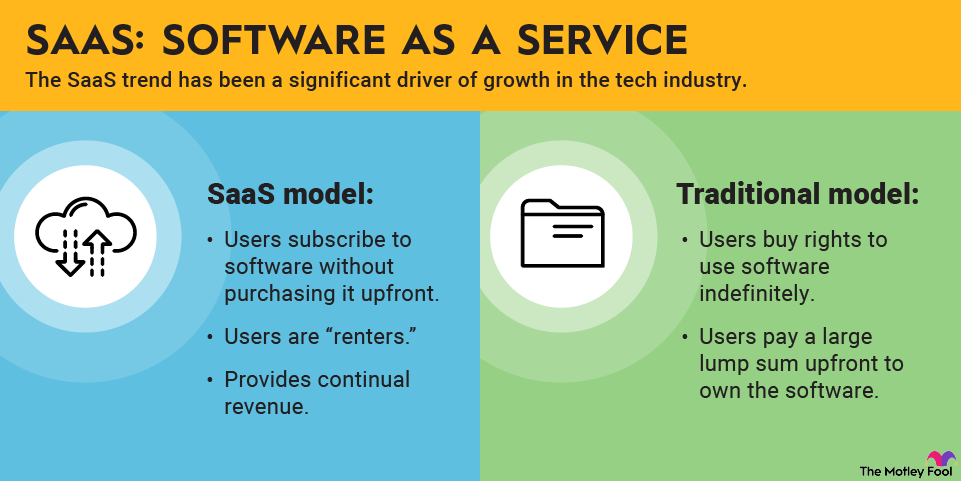

Software companies are increasingly moving to a software-as-a-service (SaaS) model in which customers buy a subscription to a program instead of a one-time license. The arrangement generates recurring revenue for the software company.

Semiconductor chips largely power the hardware. Semiconductor companies design and/or manufacture central processing units (CPUs), graphics processing units (GPUs), memory chips, and a wide variety of other chips that help to run today's devices.

Telecom companies that provide wireless services support the tech sector, but actually belong to the communications sector; so do the video streaming companies that provide easy access to high-quality content, and the cloud computing providers that power those streaming services.

The best tech stocks in 2025

Many of the most valuable companies in the world are technology companies. Here are three of the most dominant and largest tech stocks that investors should consider:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.6 trillion | 0.70% | Software |

| Apple (NASDAQ:AAPL) | $4.0 trillion | 0.38% | Technology Hardware, Storage and Peripherals |

| Nvidia (NASDAQ:NVDA) | $4.6 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

1. Microsoft

NASDAQ: MSFT

Key Data Points

Microsoft (MSFT +0.08%) is a dominant software company known for its Windows PC operating system and Office productivity software. Microsoft is also the second-largest provider of cloud infrastructure, and it provides AI exposure through Copilot, which is available in many different Microsoft products.

2. Apple

NASDAQ: AAPL

Key Data Points

Apple (AAPL -0.25%) makes the iPhone, iPad, and Mac computers. Intense customer loyalty ensures plenty of repeat customers, and a growing array of services makes Apple's ecosystem sticky.

3. Nvidia

NASDAQ: NVDA

Key Data Points

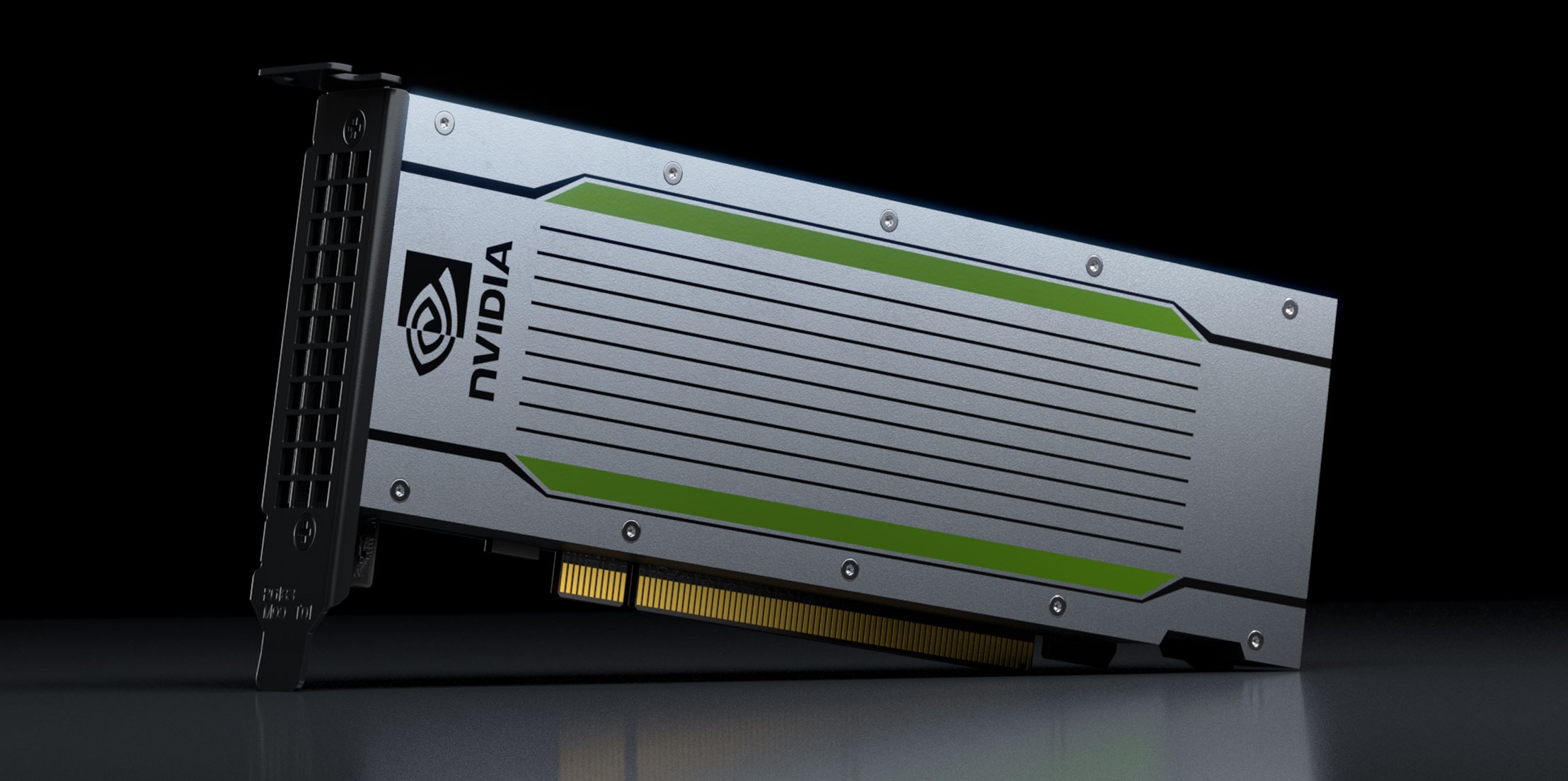

Nvidia (NVDA -0.26%) is the premier manufacturer of semiconductors and advanced GPUs critical for not only gaming, but also for AI applications.

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META) are not technically tech stocks, despite often being lumped in with them.

These stocks actually belong to the communications (Meta and Alphabet) and consumer discretionary sectors (Amazon), despite their tech-heavy products and services.

Tech stocks in the current market

Technology stocks, as tracked by the Technology Select Sector SPDR Fund (XLK -0.32%), which follows S&P 500 technology stocks, have strongly outperformed for the past several years, and the trend has continued in 2025.

While the S&P 500 climbed 16.5% in the first 11 months of 2025, the Technology Select Sector SPDR Fund ripped 23.1% higher during the same period.

With the market downturn in April now in the rearview mirror, investors returned to growth stocks as the market remained keenly focused on tech stocks with a focus on artificial intelligence (AI). It was less interested in conservative options such as stocks in the utilities and consumer staples sectors.

Multiple companies have committed to accelerating their AI spend or are in the process of commercializing more AI products. Here are a few highlights:

- Nvidia: Nvidia has seen massive increases in quarterly revenue, largely driven by data center revenue for generative AI training and inference. In the third quarter of 2026, for example, Nvidia reported quarterly data center revenue of $51.2 billion, a year-over-year increase of 66%. Nvidia's GPUs are at the forefront of the AI revolution, making it a key player in the tech sector.

- Microsoft: Microsoft has reported double-digit growth in revenue, operating income, net income, and diluted earnings per share (EPS). This growth is largely attributed to the integration and use of AI in its products, such as Copilot, which is driving stronger AI integration and increased usage of Microsoft Cloud, including Azure and Intelligent Cloud. Microsoft returned $10.7 billion to shareholders in the form of share repurchases and dividends in the first quarter of fiscal year 2026.

- Apple: In August 2025, Apple announced a further $100 billion commitment -- adding to the $500 billion it plans to allocate to developing projects located in the United States over the next four years. Included in the various U.S.-based projects, Apple is developing an advanced manufacturing facility in Houston. Expected to open in 2026, the Houston facility will produce servers that support the company's AI initiative, Apple Intelligence.

Related investing topics

Pros and cons of investing in tech stocks

While there's no definitive answer as to whether tech stocks are an ideal choice for your portfolio, there are some undeniable advantages and disadvantages to investing in these stocks.

Some of the potential pros of investing in tech stocks:

- Tech stocks represent a considerable growth opportunity. According to research provider Business Research Insights, the technology market was valued at $5 trillion in 2024, and it's projected to soar to $7 trillion by 2033.

- Investors have unique goals, yet portfolio diversification remains an essential element of any investment strategy, and tech stocks can help achieve this.

- Companies across a wide range of industries rely on the valuable tools that tech companies provide

Of course, it's essential for investors to recognize the risks related to tech stock investments:

- Because businesses often reduce the degree to which they invest in themselves during market downturns, tech companies could suffer during times of economic uncertainty.

- There is a strong political interest in implementing tariffs as well as potentially limiting sales of semiconductors to China. These factors could place pressure on the financials of tech companies.

- Tech companies often invest heavily in research and development to stay ahead of their competitors. These reinvestments in their business often come at the sacrifice of returning large amounts of capital to shareholders with dividends, so those looking to generate passive income may have limited options with tech stocks.

How to invest in tech stocks

Those interested in clicking the buy button on tech stocks only have a few simple steps to take in order to get started.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.