Investing in growth stocks can be a great way to earn life-changing wealth in the stock market. The key, of course, is to know which growth stocks to buy and when.

Despite increased volatility in the stock market in 2025, growth stocks continue to outperform. The S&P 500 Growth index climbed 21.4% last year. Its counterpart, the S&P 500 Value index, was up just 11%.

However, growth stocks don't always outperform during periods of volatility. In 2022, the S&P 500 Growth index fell 30% for the year, while the S&P 500 index dropped just 19%.

Picking the right growth stock can help you weather the downside while profiting in the long run from its potential. With these tools and strategies, you can position your portfolio for long-term success with growth stocks.

What is a growth stock?

Growth stocks are companies that increase their earnings faster than the average business in their industry or the market as a whole. Often, a growth company has developed an innovative product or service that is gaining share in existing markets, entering new markets, or creating entirely new industries.

The market tends to reward businesses that can grow faster than average for long periods, delivering handsome returns to shareholders in the process. The faster they grow, the bigger the potential returns.

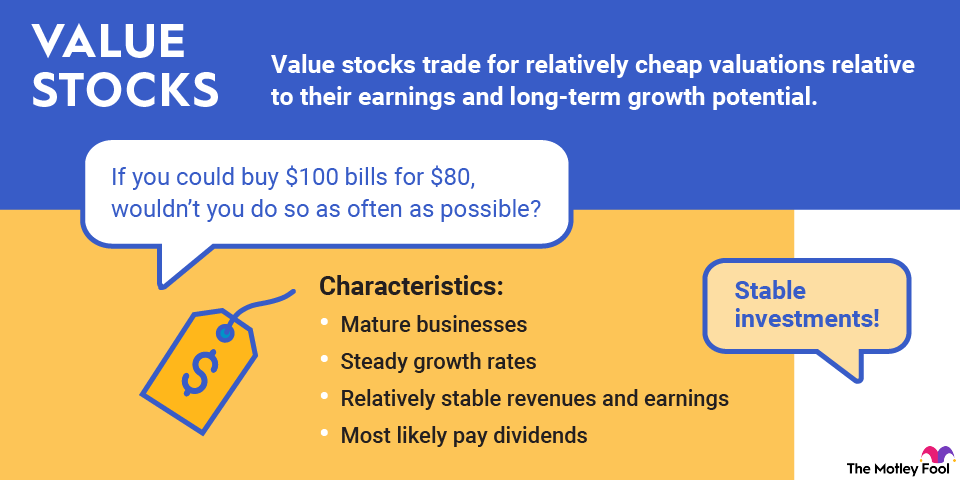

Unlike value stocks, high-growth stocks tend to be more expensive than the average in terms of profitability ratios. Despite their premium price tags, the best growth stocks can still deliver fortune-creating returns to investors. That said, growth stocks can be much more volatile. Big drops in prices may take years to fully recover and catch up with the rest of the market.

High inflation puts pressure on growth stocks because it reduces the future value of their expected earnings. Supply chain constraints also affect the ability of some to expand, and other macroeconomic factors slow the entire economy. However, downturns can give long-term investors a buying opportunity when growth stock prices are low.

Top growth stocks in 2026

To provide you with some examples, here are 10 excellent growth stocks available in the stock market today.

| Company name | Company ticker | Market cap | Industry |

|---|---|---|---|

| Meta Platforms | NASDAQ:META | $1.8 trillion | Interactive Media and Services |

| Shopify | NASDAQ:SHOP | $155.7 billion | IT Services |

| Uber Technologies | NYSE:UBER | $161.9 billion | Road and Rail |

| Block | NYSE:XYZ | $34.5 billion | Diversified Financial Services |

| MercadoLibre | NASDAQ:MELI | $106.5 billion | Multiline Retail |

| Nvidia | NASDAQ:NVDA | $4.4 trillion | Semiconductors and Semiconductor Equipment |

| Netflix | NASDAQ:NFLX | $337.5 billion | Entertainment |

| Amazon | NASDAQ:AMZN | $2.6 trillion | Multiline Retail |

| Salesforce | NYSE:CRM | $184.0 billion | Software |

| Alphabet | NASDAQ:GOOG | $4.1 trillion | Interactive Media and Services |

As this list shows, growth stocks come in all shapes and sizes. They can be found in a variety of industries, both within the U.S. and in international markets. Although all the stocks on this list are from larger businesses, smaller companies can also be fertile ground for growth investors.

A great way to invest in a wide variety of small-cap growth stocks is via an exchange-traded fund (ETF), such as Vanguard Small-Cap Growth Index Fund ETF (VBK -1.71%). This fund tracks the performance of the CRSP U.S. Small Cap Growth index, which gives investors an easy way to invest in roughly 560 small-cap growth companies all at once.

The Vanguard Small-Cap Growth Index Fund ETF has an ultra-low expense ratio of 0.07%. This means investors will receive almost all the fund's returns, with only a small amount in fees going to Vanguard. (An annual expense ratio of 0.07% works out to only $0.70 in fees per $1,000 invested annually.)

How to find growth stocks

To find great growth stocks, you'll need to:

- Identify powerful long-term market trends and the companies best positioned to profit from them.

- Narrow your list to businesses with strong competitive advantages.

- Further narrow your list to companies with large addressable markets.

Identify trends and the companies driving them

Companies that capitalize on powerful long-term trends can increase their sales and profits for many years, generating wealth for their shareholders along the way. Here are some examples, along with the companies that can help you profit from those trends.

E-commerce

As more people shop online, Amazon (AMZN -1.89%), Shopify (SHOP -4.33%), and Etsy (ETSY -1.39%) are well-positioned to profit within the U.S. (and many international markets). MercadoLibre (MELI -1.45%) holds a leading share of the online retail market in Latin America. Despite the consistent presence of brick-and-mortar retail, e-commerce still has tons of growth potential as an industry.

Digital advertising

Meta Platforms (META -2.68%), formerly Facebook, and Alphabet (GOOGL -2.12%), which owns Google, own the lion's share of the digital ad market. The businesses are poised to profit handsomely as marketing budgets shift from TV and print to online channels.

Amazon has built a massive advertising business, which continues to expand into new formats. Even Netflix (NFLX +0.95%) has come around to advertising to increase its subscriber base and boost its revenue.

Digital payments

PayPal (PYPL -2.01%) and Block (NASDAQ:XYZ) are helping accelerate the global shift from cash to digital payment forms by allowing businesses of all sizes to accept debit and credit card transactions and giving consumers easier access to cashless payments.

Cloud computing

Computing power is migrating from on-premises data centers to cloud-based servers. Amazon's and Google's cloud infrastructure services help make this possible, while Salesforce (CRM +1.13%) provides some of the best cloud-based enterprise software available. The rise of artificial intelligence (AI) will require vast amounts of computing power that cloud providers are ready, willing, and able to offer.

Cloud Computing

Streaming entertainment

Millions are canceling their cable subscriptions and replacing them with less expensive and more convenient streaming options. As the global leader in streaming entertainment, Netflix offers a great way to profit from this trend, but it faces growing competition from other media companies.

Electric and autonomous vehicles

The world is shifting from its reliance on gasoline to using electricity to power vehicles. According to a survey of industry executives, half of all auto sales could be electric vehicles (EVs) by 2030.

Tesla (TSLA -3.10%) has been the leader in the space, with its lineup of vehicles and battery technology. Chinese company BYD's (BYDDY -0.53%) (BYDD.F -0.81%) automotive segment has ascended rapidly to become the leading EV maker in the world, thanks to its low-priced vehicles. Both EV makers have made significant progress in developing self-driving technology for their cars.

However, Alphabet's Waymo has a clear lead in the space, offering a commercial service in several U.S. cities and completing more than 250,000 rides per week. Uber (UBER -4.73%) has emerged as a key partner for autonomous vehicle companies looking to deploy their fleet and maximize their capital utilization. It could be a hidden beneficiary of the growing number of self-driving cars on the road.

Artificial intelligence

Companies have recently poured billions into accelerating their AI development and applying it to their businesses. Nvidia (NVDA -2.83%) has been a big beneficiary since it designs the chips used to train many large language models (the foundation of generative AI).

Alphabet, Amazon, Microsoft (MSFT +1.30%), and Oracle (ORCL -4.35%) also benefit from growth in AI applications since many run on their cloud computing platforms. Salesforce is leveraging its position in enterprise software to help companies use their own data to create AI-powered agents.

The key is to invest in these trends and companies as early as possible. The earlier you get in, the more you stand to profit. However, the most powerful trends can last for many years -- even decades -- giving you plenty of time to claim your share of the profits they create.

Prioritize companies with competitive advantages

It's also important to invest in growth companies that possess strong competitive advantages. Otherwise, their competitors may pass them, and their growth may not last long. A strong competitive advantage will help companies survive and thrive through market downturns, while those without one will struggle.

If you can identify stocks of companies with strong competitive advantages being sold off along with the rest of the market, it can be an opportunity to generate massive returns as they recover. Some competitive advantages are:

- Network effects: Meta's Instagram is a prime example here. Each person who joins its social media platform makes it more valuable to other members. Network effects can make it difficult for new entrants to displace the current market share leader. Meta's 3.5 billion users across its family of apps certainly make it unlikely that a new social media company will displace it.

- Scale advantages: Size can be another powerful advantage. Amazon is a great example in this category because smaller rivals will find it extremely difficult to replicate its massive global fulfillment network.

- High switching costs: Switching costs are the expenses and difficulties associated with switching to a rival's product or service. Shopify, an online retail system for more than 1 million businesses, is a perfect example of a business with high switching costs. Once a company begins using Shopify as the core of its online operations, it's unlikely to go through the hassle of switching to a competitor.

Why invest in growth stocks?

- They have high return potential.

- Less demand for immediate capital returns allows management to invest in the future.

- One excellent growth stock investment can make up for a handful that don't work out.

Risks of investing in growth stocks

Growth stocks can offer excellent long-term returns, but there are no free lunches in the stock market. The cost of better returns is greater risk.

Growth stocks generally exhibit greater price volatility. That's partly due to their higher valuations. Any changes in expectations for the future are multiplied by a greater factor when valuations are high. As such, investors need to be able to stomach severe drawdowns in the value of their growth stocks.

Individual growth stocks also hold significantly more risk than individual value stocks. By their nature, growth stocks are less predictable, so an individual investment could face setbacks from poor execution, challenges scaling the business, or another company disrupting its product or market. So, growth stock investors should maintain a portfolio of companies across industries and in different phases of growth.

Strategies for investing in growth stocks

Growth stocks can produce market-beating returns, but they can also quickly drag your portfolio lower. A key strategy to successful growth stock investing is to build a portfolio of stocks based on the opportunities and risks presented by each company you're considering. If two companies are highly correlated (perhaps they're both highly exposed to growing AI spending), you might reduce your exposure to both stocks while increasing your allocation toward another company that's not related to that industry.

You only need a handful of great growth stocks to build a good portfolio. Each stock you add beyond your best ideas could detract from your long-term returns, but if it has the potential to smooth out the ride, it could be worth owning.

Related investing topics

Find companies with large addressable markets

Finally, you'll want to invest in businesses with large addressable markets and long runways for growth still ahead. Industry reports from research firms -- such as Gartner (IT +0.28%) and Insider Intelligence, which provide estimates of industry sizes, projections for growth, and market share figures -- can be very helpful.

The larger the opportunity, the larger a business can ultimately become. And the earlier in its growth cycle it is, the longer it can continue to grow at an impressive rate.