What is the Dow Jones Industrial Average Stock Index?

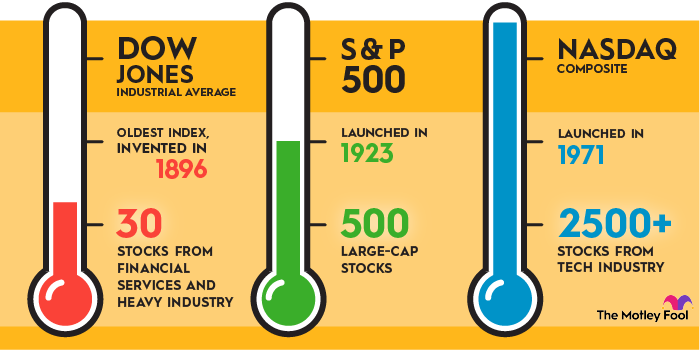

The Dow Jones Industrial Average (^DJI +0.38%) is a stock index that tracks 30 of the largest U.S. companies. Created in 1896, it is one of the oldest stock indexes, and its performance is widely considered to be a useful indicator of the health of the entire U.S. stock market.

The Dow Jones Industrial Average index is managed by S&P Dow Jones Indices, a joint venture majority-controlled by the financial information and analytics company S&P Global (SPGI +1.16%).

The Dow Jones Industrial Average includes not just industrial stocks but also stocks from most sectors and industries, except for utilities and transportation, which are measured by other indexes specific to those fields.

According to S&P Global, the Dow Jones Industrial Average is a "world-renowned gauge of the U.S. equity market." Most Dow Jones Industrial Average–listed companies trade on the New York Stock Exchange.

How is the value of the Dow Jones Industrial Average calculated?

Most stock market indexes are weighted by market capitalization -- equal to share price times the number of shares outstanding. But the Dow Jones Industrial Average is price-weighted.

The value of the Dow Jones Industrial Average is calculated by determining the average value of the stock prices of the 30 listed companies. However, calculating that average value is not as simple as totaling the 30 stock prices and dividing by 30.

Mergers, spinoffs, stock splits, and other developments complicate the arithmetic and require a committee to formally determine a "Dow divisor" -- the denominator by which the sum of the 30 share prices is divided. As of November 2024, the Dow divisor was 0.162684. Using this divisor, you can calculate the value of the Dow Jones Industrial Average by adding up the share prices of all 30 Dow companies and dividing that amount by 0.162684.

Any change in the share price of any Dow-listed company affects the value of the index equally, in accordance with Charles Dow's original vision. But it's important to realize that, on a percentage basis, the movements of the highest-priced stocks have the greatest impact on the index's value.

For example, the highest-priced stock on the Dow in late October 2025 was Goldman Sachs, trading at $769.59. The lowest-priced stock was Verizon, trading at $38.76. Since Goldman's stock price is about 20 times greater than Verizon's, Verizon's share price would have to change by 20% to have the same impact on the Dow as a change of just 1% in the price of Goldman stock.