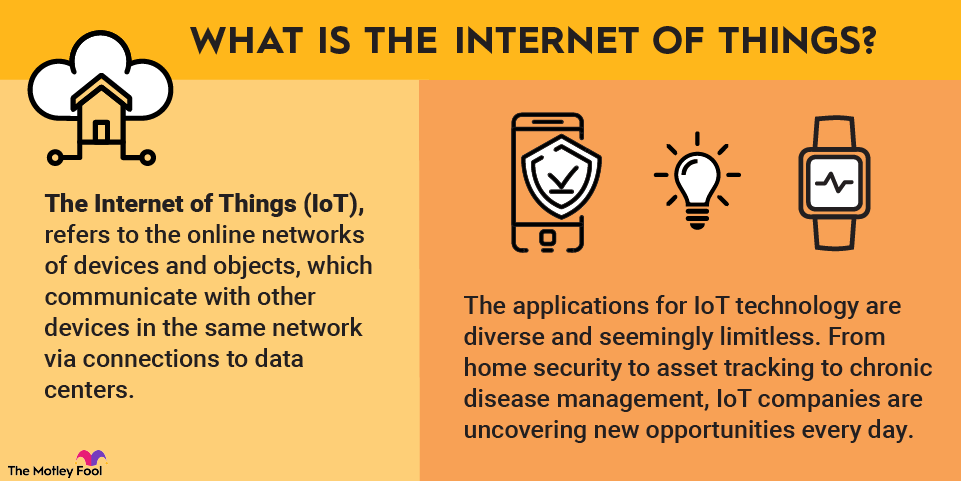

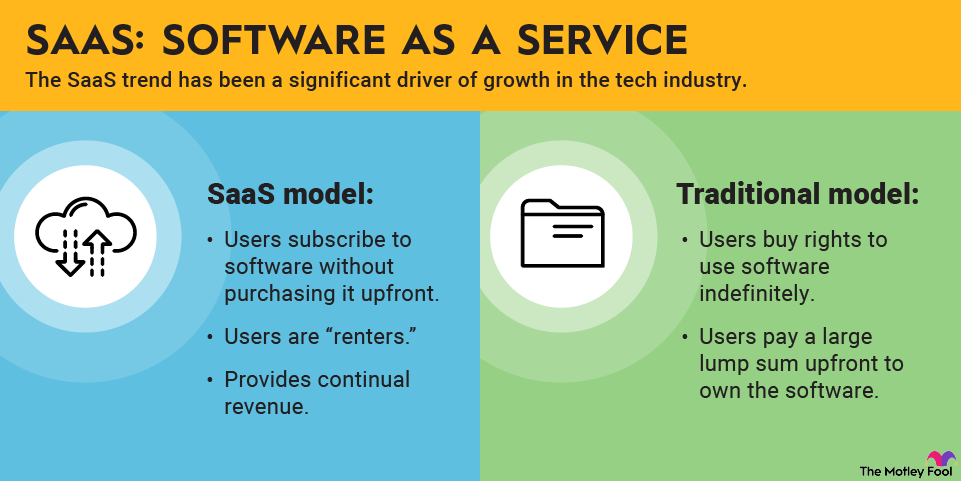

The technology sector has played a leading role in powering the market's gains over the past couple of decades. New hardware, software, and services have driven changes in business and everyday life. Tech's ability to shape and influence almost every industry under the sun means the sector remains one of the best starting places for investors seeking big gains.

Eight cheap tech stocks to watch in 2026

Following bouts of market volatility over the last several years, even some otherwise high-flying growth stocks might be considered a great long-term deal right now. And for many older and slower-growing tech stocks, valuations continue to look attractive. Here are eight "cheap" tech stocks that could deliver strong returns over the long term:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Kyndryl (NYSE:KD) | $5.6 billion | 0.00% | IT Services |

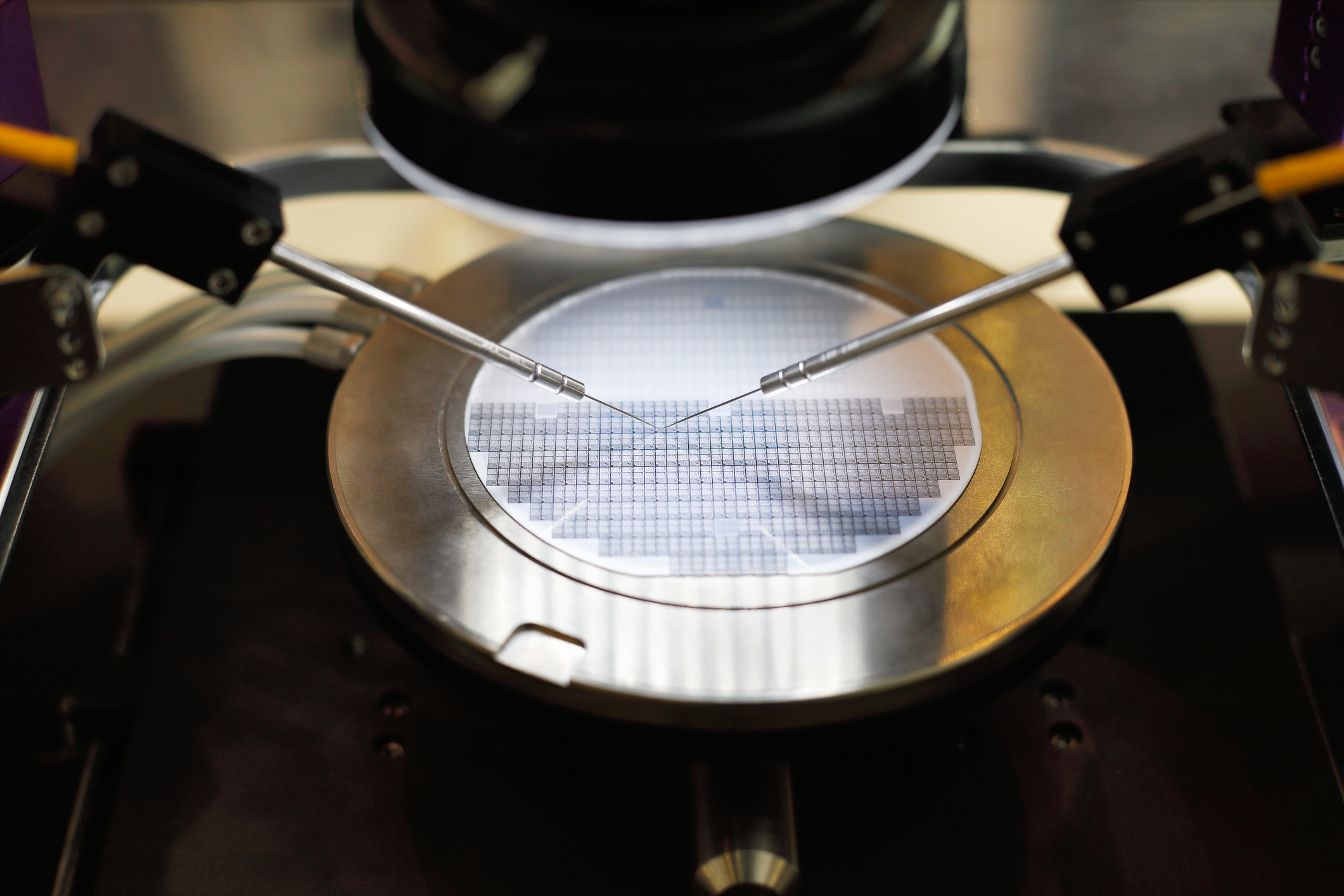

| Applied Materials (NASDAQ:AMAT) | $252.3 billion | 0.56% | Semiconductors and Semiconductor Equipment |

| Alphabet (NASDAQ:GOOGL) | $3.9 trillion | 0.26% | Interactive Media and Services |

| AT&T (NYSE:T) | $166.2 billion | 4.73% | Diversified Telecommunication Services |

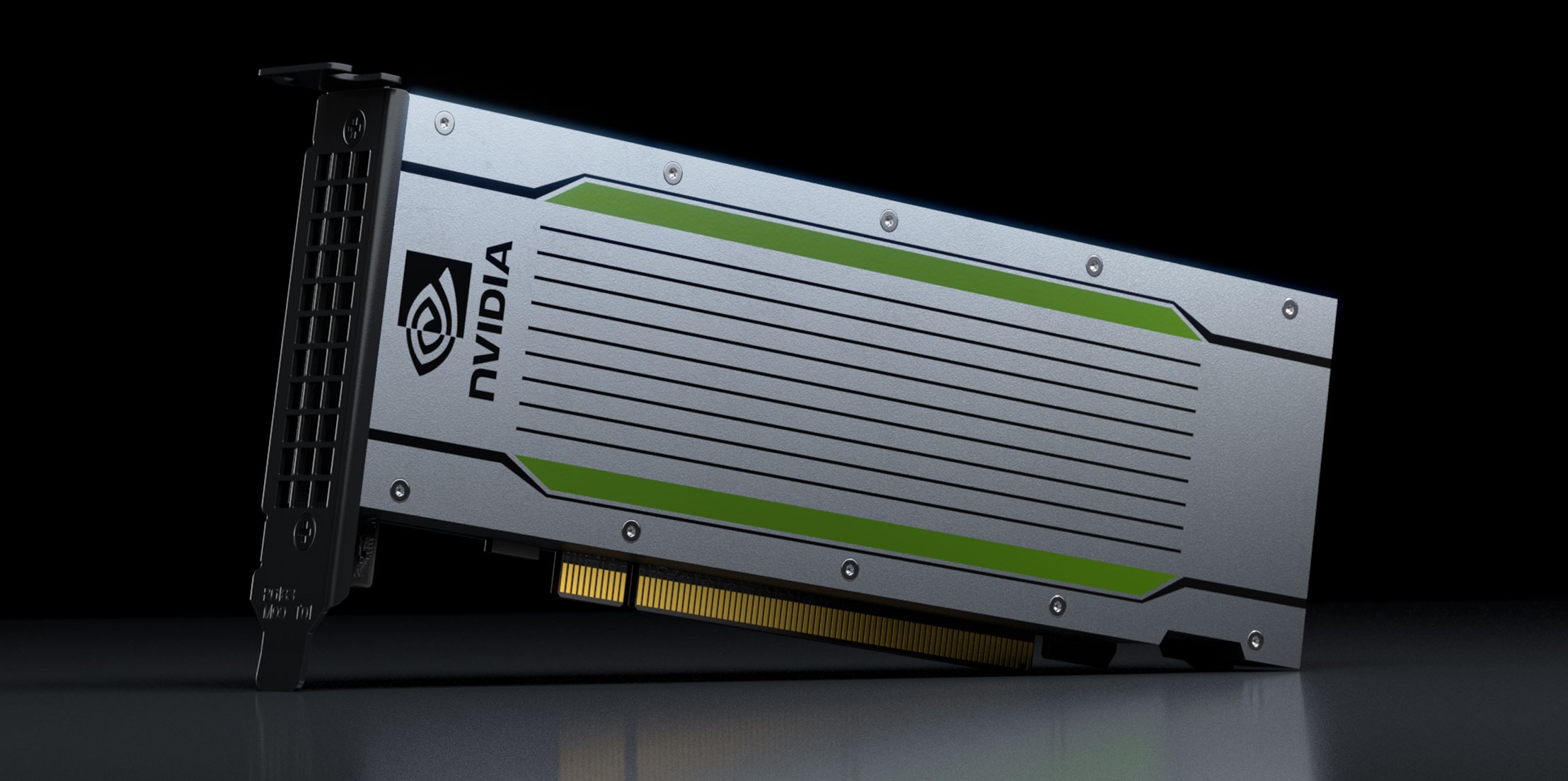

| Himax Technologies (NASDAQ:HIMX) | $1.4 billion | 4.53% | Semiconductors and Semiconductor Equipment |

| Intel (NASDAQ:INTC) | $242.1 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Qualcomm (NASDAQ:QCOM) | $165.0 billion | 2.28% | Semiconductors and Semiconductor Equipment |

| Micron Technology (NASDAQ:MU) | $410.8 billion | 0.13% | Semiconductors and Semiconductor Equipment |

1. Kyndryl Holdings

NYSE: KD

Key Data Points

2. Applied Materials

NASDAQ: AMAT

Key Data Points

3. Alphabet

NASDAQ: GOOGL

Key Data Points

NYSE: T

Key Data Points

NASDAQ: HIMX

Key Data Points

6. Intel

NASDAQ: INTC

Key Data Points

NASDAQ: QCOM

Key Data Points

NASDAQ: MU

Key Data Points

Related investing topics

How to buy cheap tech stocks

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

What to look for in tech stocks

- Investors are generally well served by keeping an eye on tech companies' sales and earnings growth, as well as valuation metrics such as price-to-sales and price-to-earnings ratios.

- It's helpful to keep an eye on each company's number of active users or its customer count, plus how much per-user or per-client sales and profit a business is generating.

- There's no reliable one-size-fits-all approach for evaluating stocks in the space, but charting business momentum and keeping intrinsic value in mind can make it easier to identify winners.