Small-cap tech stocks, usually defined as technology companies with market capitalizations of no more than $2 billion, can be risky investments. Many of these small companies are pioneering new technologies. But their share prices can be highly volatile, and they risk being outcompeted by larger businesses with stronger balance sheets.

Some of these emerging technology businesses may be future leaders in their industries and are worth adding to your portfolio today. Investing in a basket of small-cap stocks -- say five to 10 -- is less risky than concentrating your holdings in a single company or two.

Four small-cap tech stocks to watch

New technologies are reshaping the global economy and creating profit opportunities for small businesses and their shareholders. These four small-cap tech companies are worth watching.

1. PubMatic

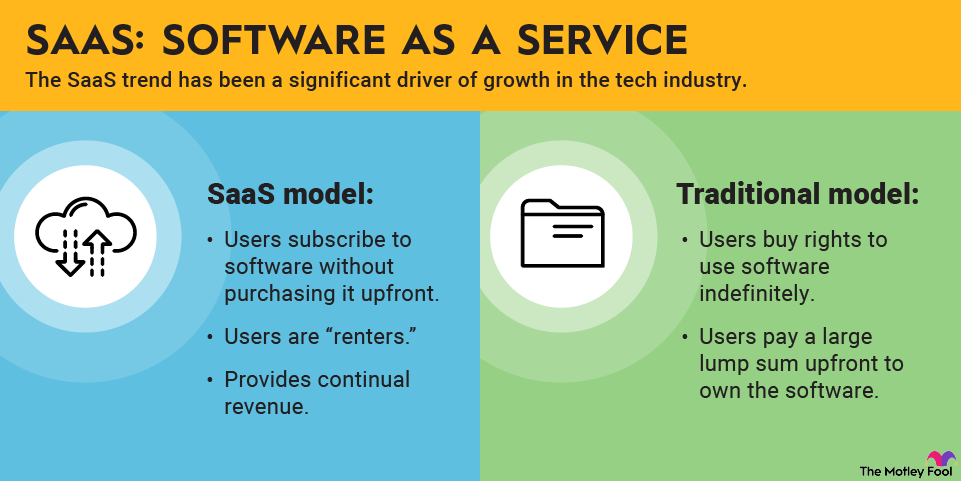

PubMatic is a digital advertising technology firm. Its software provides internet publishers with a means to monetize their work by using artificial intelligence (AI) and automation to sell advertising.

NASDAQ: PUBM

Key Data Points

PubMatic's publisher clients include a diverse group of businesses, including news organizations, e-commerce companies, video game makers, and streaming TV services. The company derives about half of its revenue from internet content formatted for mobile devices.

Mobile represents a growing opportunity for PubMatic, especially outside the U.S., where PubMatic is just beginning to add customers. Digital marketing is another secular growth trend that benefits the company.

NASDAQ: HLIT

Key Data Points

The company smashed analyst expectations in the third quarter of 2025, with earnings per share (EPS) of $0.12, handily surpassing the predicted $.05. It marked the fourth straight quarter that Harmonic had beaten expectations.

Company officials believe that Harmonic's backlog and restructuring have restored it to profitability. It's certainly on the right side of two major secular trends: The continuing rollout of 5G networks and increasing popularity of video streaming are likely to benefit companies that specialize in video delivery.

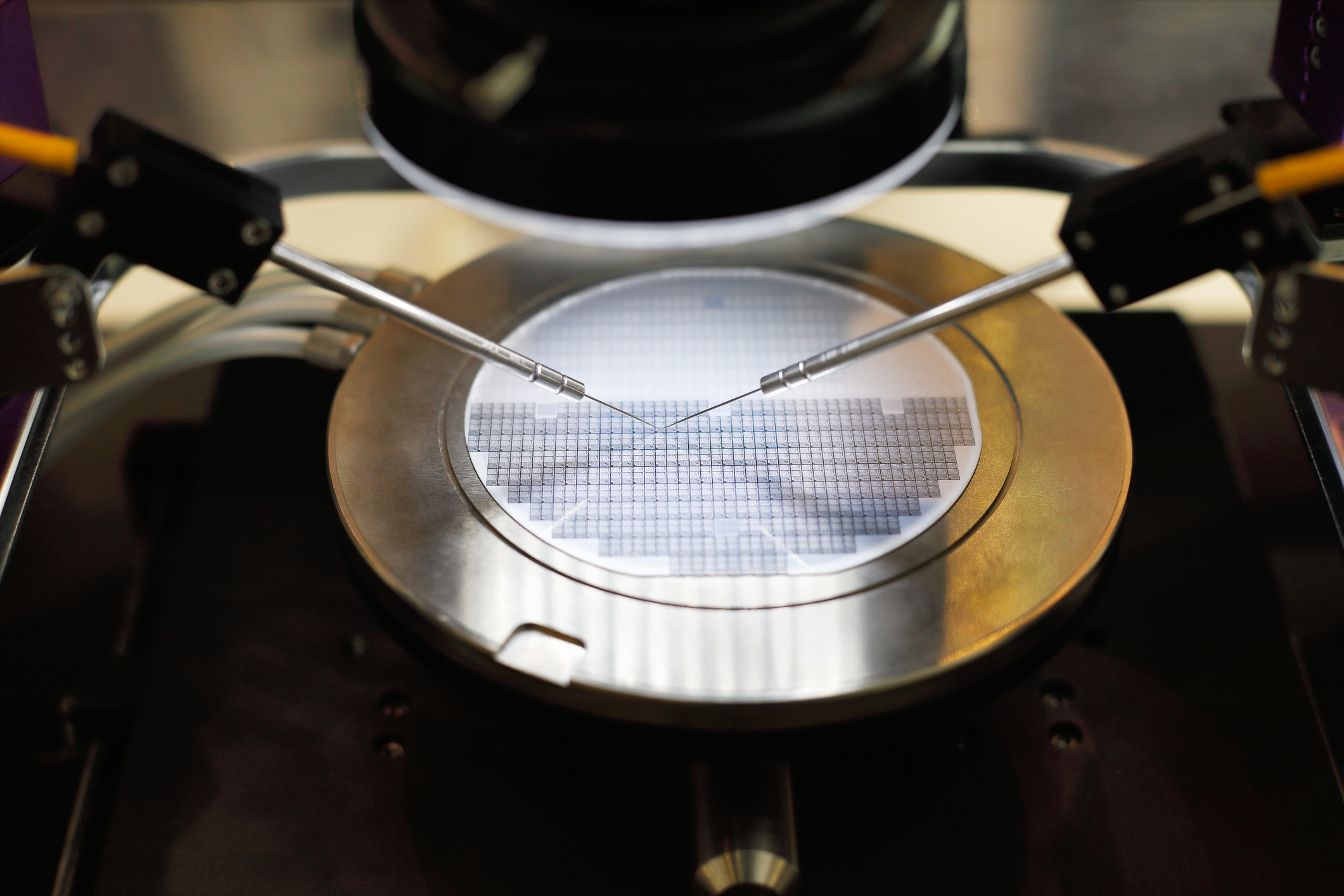

3. ACM Research

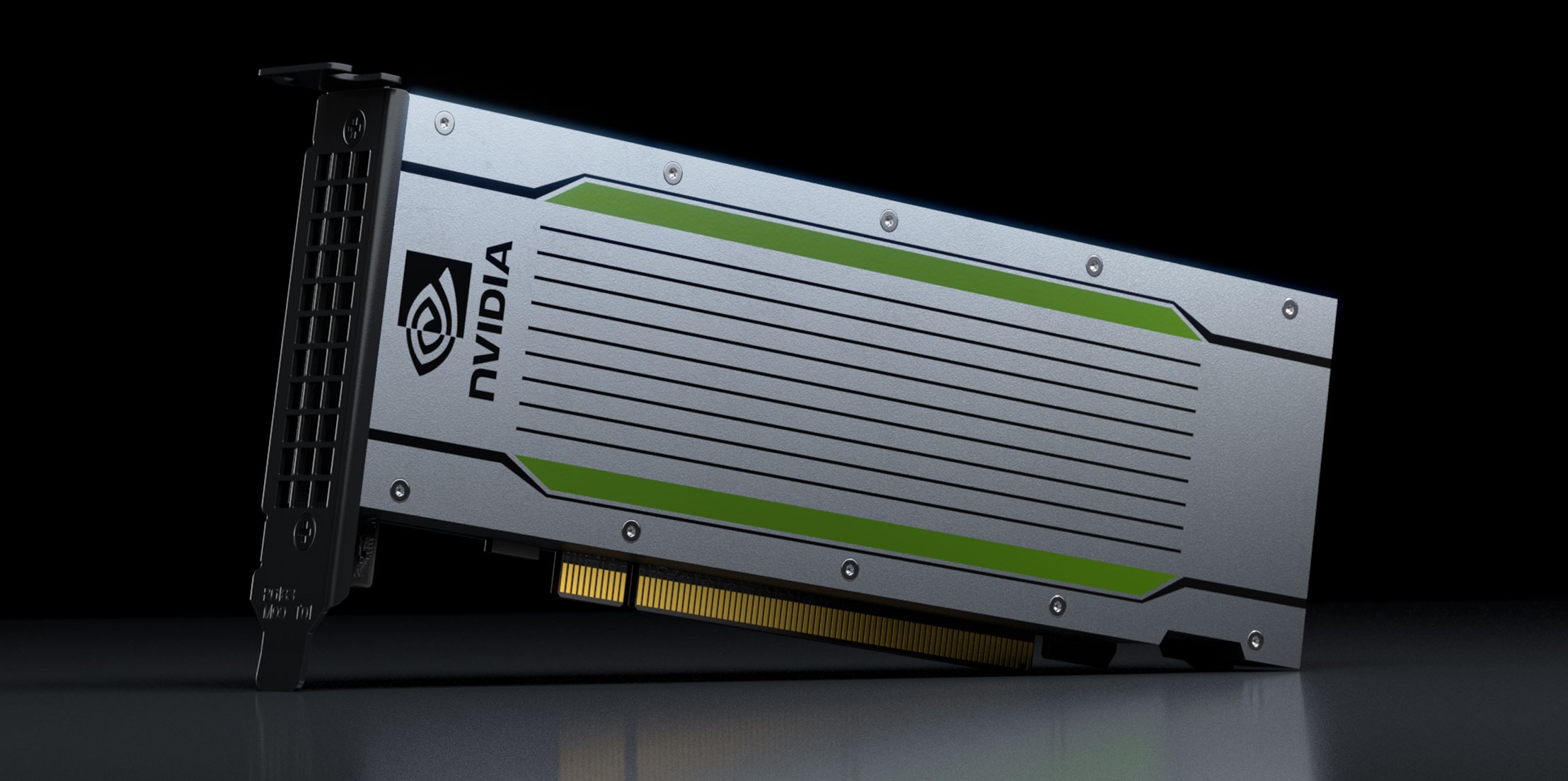

It's not just giant tech companies like Nvidia (NVDA +1.59%), Apple (AAPL +0.64%), and Microsoft (MSFT -0.97%) that are looking at major profits from the AI boom. Several smaller, more-focused companies could ride the wave to big profits, as well. ACM Research, a manufacturer of semiconductor cleaning equipment, may be a good small-cap bet for investors seeking opportunities from growth stocks.

Although much of the company's demand comes from Chinese chip foundries -- a lucrative but potentially unstable market, given current trade tensions between the U.S. and China -- its equipment generally isn't used for advanced chips that are subject to sanctions.

The company reported a 32% year-over-year increase in revenue during the third quarter. But it fell far short of analyst expectations with a non-GAAP (non-generally accepted accounting principles) diluted EPS of $0.36, only a little more than half of the $0.55 projected by analysts.

On a worrisome note, operating expenses continued to climb, rising almost 40% year over year due to higher spending on research and development (R&D), sales and marketing, inventory buildup, and materials and labor.

The company's reliance on the Chinese market may also worry some investors. However, it still stands to benefit from the CHIPS Act of 2022, which provides $52 billion in manufacturing grants and research investments to boost the domestic semiconductor market.

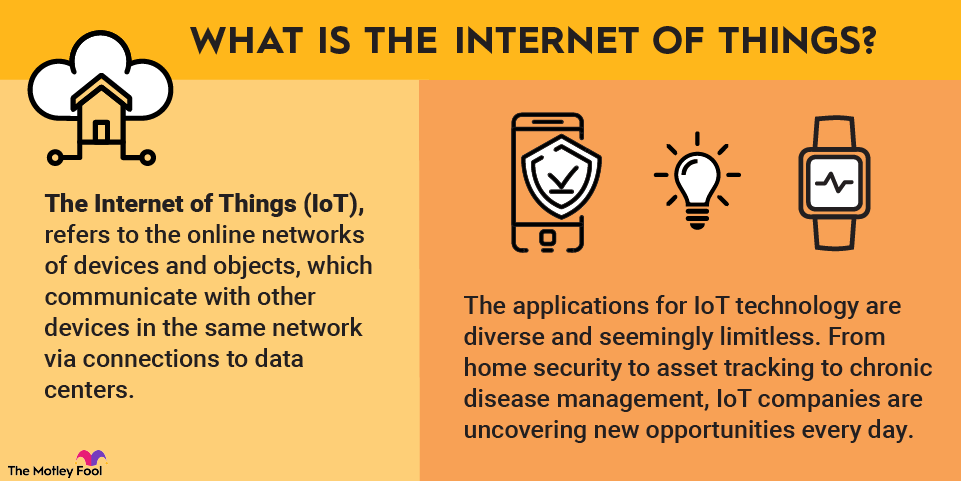

4. Inseego

Inseego designs and sells wireless network hardware and provides software for companies to deploy and remotely manage devices connected to their networks. As next-gen 5G technology networks are being built, demand for Inseego's antennae and other infrastructure gear is accelerating.

How to invest in small-cap tech stocks

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.