Virtual reality (VR) stocks are equity stakes in businesses that could make substantial contributions to the VR space. The concept of VR began decades ago. But real-world adoption has picked up steam in recent years.

VR is primarily used for gaming and entertainment right now but there's great potential for the technology in several industries and professions, including engineering and design, healthcare, defense, and education.

Moreover, the VR trend could deliver substantial growth opportunities for investors over the next decade. Various research groups forecast a double-digit compound annual growth rate (CAGR) between 2025 and 2030 or beyond. For those looking to start investing in VR, here are seven of the best stocks to consider.

The best virtual reality stock contenders

1. Meta Platforms

NASDAQ: META

Key Data Points

Meta Platforms (META +1.77%), formerly known as Facebook, acquired Oculus, a leading VR technology company, in 2014. It has since helped the company develop and market its virtual reality headsets and software. In 2017, CEO Mark Zuckerberg said he wanted to get 1 billion people using virtual reality.

The Meta Quest 3 is the latest iteration of its flagship product lineup. And Meta also has a partnership with EssilorLuxottica's (OTCMKTS:ESLOY) Ray-Ban brand of sunglasses. These Ray-Ban Meta glasses have been a surprise runaway hit for consumers who appreciate mixed-reality hardware options that are also stylish.

The company changed its name to Meta Platforms in late 2021 to emphasize its focus on building the infrastructure to support the metaverse. "We're focused on the foundational hardware and software that are required to build an immersive, embodied internet that enables better digital social experiences than anything that exists today," CEO Mark Zuckerberg said.

Given the CEO's excitement surrounding the potential of the metaverse, Meta will undoubtedly continue to invest in its suite of VR products, making it a good choice for investors interested in the trend.

2. Sony

NYSE: SONY

Key Data Points

3. Axon Enterprise

NASDAQ: AXON

Key Data Points

NASDAQ: QCOM

Key Data Points

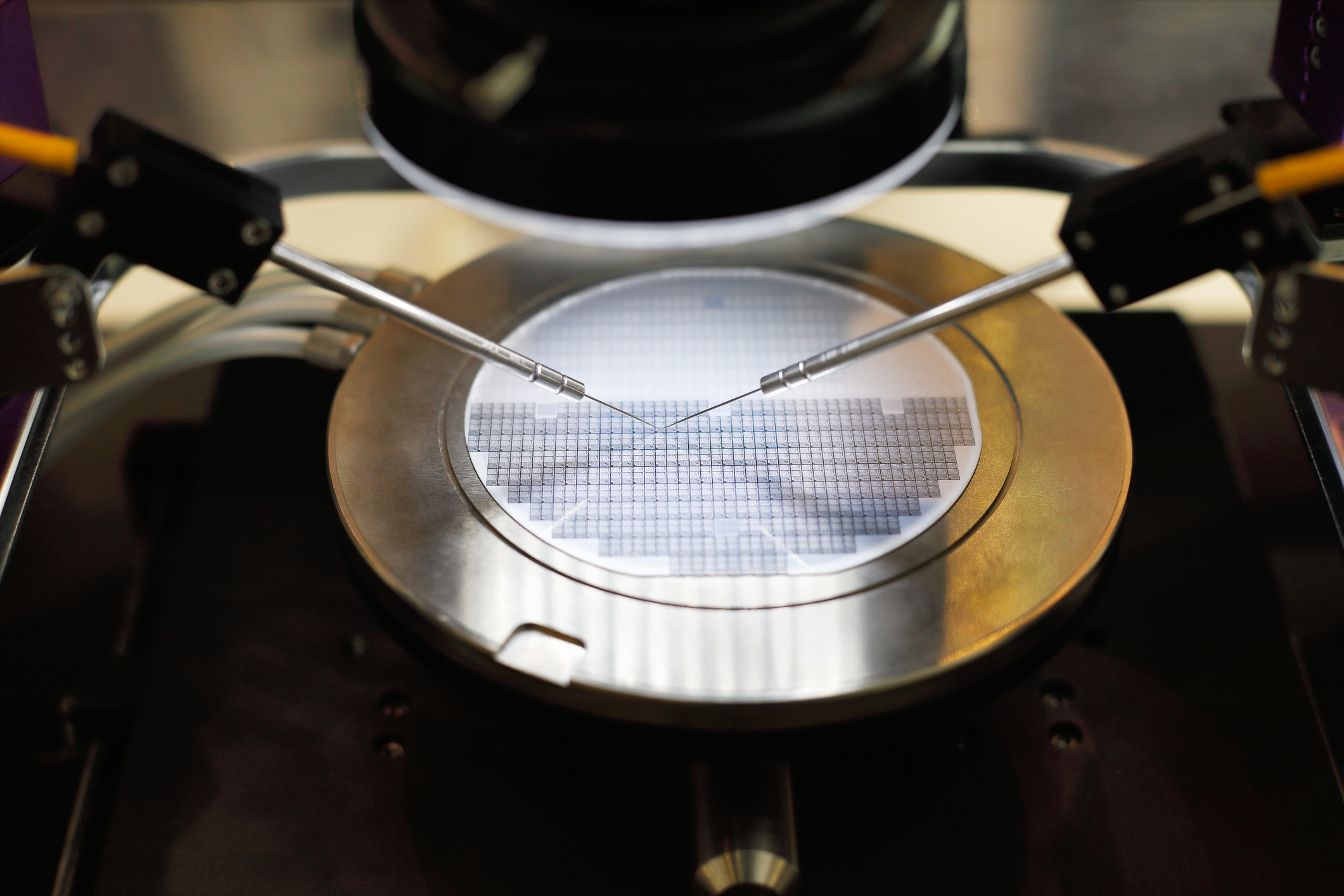

Qualcomm (QCOM -1.13%) specializes in wireless technology, but it has a range of other products, including software, processors, and modems. Its system-on-chip (SoC) Snapdragon brand of semiconductor products powers many top VR devices today.

For example, Axon's VR training uses the HTC Vive Focus 3 headset, which is powered by a Snapdragon XR2 from Qualcomm. Meta Platforms also uses Snapdragon products to power both the Meta Quest 3 and the Ray-Ban Meta glasses.

Qualcomm isn't necessarily a household name because its products aren't usually consumer-facing. But pop the hood on some of the most popular VR hardware devices on the market, and one will often find something from Qualcomm, which enables it to make this list of top VR stocks.

5. Nvidia

NASDAQ: NVDA

Key Data Points

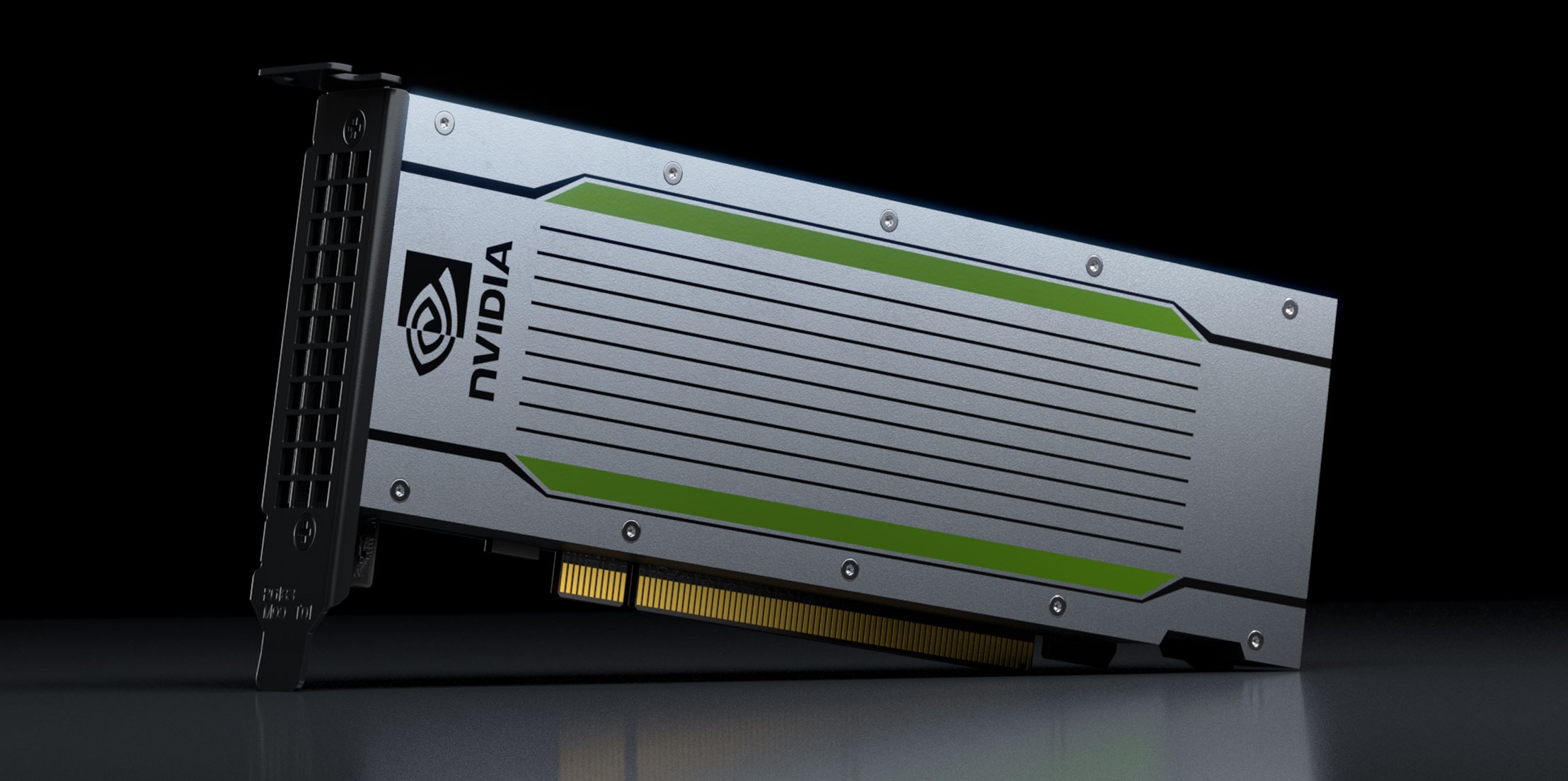

Some of the companies on this list build and sell finished VR hardware products. However, companies that supply essential technology to hardware manufacturers are just as important. For this reason, Nvidia (NVDA +1.60%) is a top choice when it comes to VR stocks because it's the leading designer of graphics processing units (GPUs) for PCs and game consoles.

For more advanced VR applications -- not just video games -- Nvidia's VR-specific GeForce GTX GPUs are doing a lot of work. Developers can also use the company's software developer kit (SDK), called VRWorks. Whether it's for hardware or for applications, developers can use the SDK to make images, sounds, and touch interactions more realistic for the VR world.

Given the graphics-intensive nature of virtual reality, Nvidia is poised to benefit, regardless of which company's hardware winds up becoming the industry standard.

6. Unity Software

NYSE: U

Key Data Points

There's no point in having high-resolution VR displays and powerful processors unless there are also high-quality 3D images to go with them. That is why Unity Software (U +0.59%) is included in this list of best VR stocks.

Unity Software has tools for 3D image creation that are used by video game developers, movie studios, industrial companies, and more. And since realism is so important, Unity has real promise in the world of VR.

According to the company, more than 70% of the top-selling games for Meta's Quest platform are made using Unity's software. This is a strong data point that showcases the company's positioning in the VR space. As VR adoption grows, more developers will likely look to Unity's image-creation tools when building quality VR content.

7. Roblox Corporation

Adding virtual reality to your portfolio

There are several ways to invest in the future of virtual reality. From consumer hardware to enterprise computing and software companies to chipmakers, all present various opportunities to invest in this fast-growing industry.

The seven companies above represent just a handful at the top of the field. Many others are working to develop and further the adoption of VR, which should fuel growth across this fast-changing space.

Related investing topics

How to invest in virtual reality stocks

For those who are excited about VR stocks and want to invest, here's a step-by-step breakdown for how to get started:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.