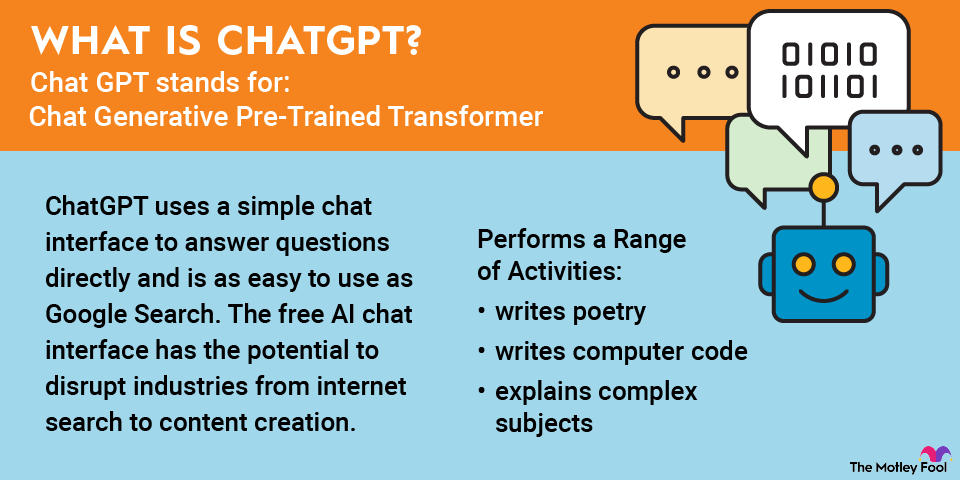

Machine learning stocks represent companies specializing in a branch of artificial intelligence (AI) that enables computers to emulate how humans learn and adapt by using data and experience. While it may seem like the stuff of science fiction, machine learning is hardly new. Early work began in the late 1950s, and the coining of the term "machine learning" is credited to IBM (IBM -0.93%) scientist Arthur Samuel.

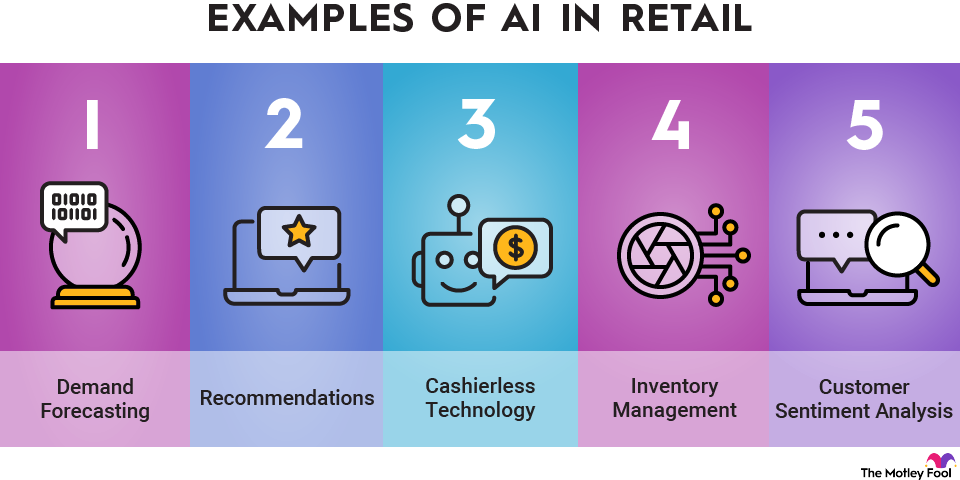

In the early 1960s, a machine learning-equipped computer beat researchers at a game of checkers. Today, machine learning systems are tackling far more complex problems. On a daily basis, you benefit from machine learning when you do an internet search on Alphabet's (GOOGL -0.07%)(GOOG +0.00%) Google or get a recommended television show or movie from Netflix (NFLX +2.79%).

Businesses of all kinds are trying to apply machine learning to their operations. According to researcher Statista, global spending on machine learning will total about $113 billion in 2025 and rise at a compound annual growth rate of almost 35% until 2030, when the market is projected to reach $503 billion. Given those projections, investing in companies with exposure to machine learning could yield rich rewards.

Machine Learning

Best machine learning stocks in 2025

Although they're not pure plays on machine learning, here are some top companies participating in the machine learning sector:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Nvidia (NASDAQ:NVDA) | $4.9 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Tesla (NASDAQ:TSLA) | $1.5 trillion | 0.00% | Automobiles |

| Accenture Plc (NYSE:ACN) | $154.6 billion | 2.44% | IT Services |

| ServiceNow (NYSE:NOW) | $194.4 billion | 0.00% | Software |

| Snowflake (NYSE:SNOW) | $91.9 billion | 0.00% | IT Services |

| CrowdStrike (NASDAQ:CRWD) | $135.2 billion | 0.00% | Software |

| Palantir Technologies (NASDAQ:PLTR) | $461.5 billion | 0.00% | Software |

1. Nvidia

NASDAQ: NVDA

Key Data Points

Nvidia's (NVDA -0.04%) hardware made a name for itself in powering high-end video game graphics, but in recent years, the company's bet on AI and machine learning has started to pay off. Machines require massive amounts of information to learn, and Nvidia's graphics processing units (GPUs) are well suited to the task.

There is a changing of the guard in the semiconductor industry, and Nvidia is quickly emerging as the technological leader in the space. It's powering high-end computing with its GPUs that accelerate the production of data centers and training of AI models. In the first quarter of fiscal 2026, Nvidia reported revenue of $39.1 billion for its data center business, a 73% year-over-year increase.

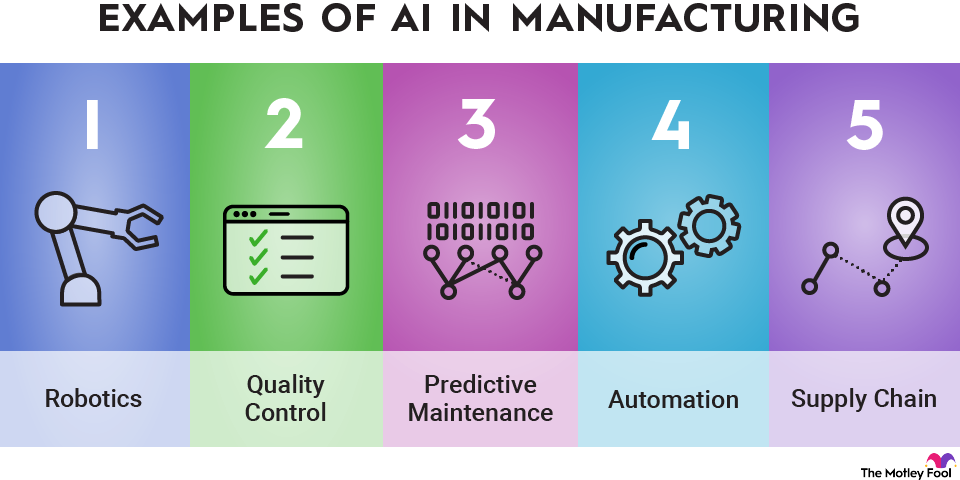

The semiconductor company is also continually researching next-gen circuitry. It provides machine learning and other AI customers with an extensive software library to help with the deployment of their technologies. Its customers include automakers developing self-driving vehicles, biotech researchers searching for cures for diseases, and retailers seeking to improve their supply chains. The company consistently generates operating profit margins well into double-digit percentages while spending billions of dollars every year on research and development.

2. Tesla

NASDAQ: TSLA

Key Data Points

Semiconductor

3. Accenture

NYSE: ACN

Key Data Points

4. ServiceNow

NYSE: NOW

Key Data Points

ServiceNow (NOW -1.79%) is a cloud computing platform powered in part by machine learning. As a provider of workflow automation software, the company uses machine learning to help its customers eliminate monotonous and redundant tasks. This ensures that employees are spending more time working rather than discussing how to do work.

ServiceNow's use of machine learning also means that its capabilities are always improving. The longer the platform operates using machine learning, the better the company gets at predicting how workflows can be improved and tasks flagged or prioritized. Although it's not a household name, ServiceNow is deeply engaged with machine learning and is changing work, software development, and customer relationship management.

ServiceNow is a large software firm at this point, but it's still expanding revenue at a rate that is better than 20% annually. And it's generating strong free cash flow, too. In 2024, ServiceNow reported a 31.5% free cash flow margin, and management projects the figure will expand to 32% in 2025. This applied machine learning company still has a long runway ahead.

Artificial Intelligence

5. Snowflake

NYSE: SNOW

Key Data Points

NASDAQ: CRWD

Key Data Points

NASDAQ: PLTR

Key Data Points

Related investing topics

Should you invest in machine learning stocks?

Companies around the world are pouring resources into developing AI and machine learning software for diverse purposes, but this alone doesn't mean that investing in machine learning stocks is right for everyone.

Here are some of the potential benefits of an investment in machine learning stocks:

- These stocks provide great growth opportunities as the machine learning sector is poised to expand significantly.

- Portfolio diversification.

- Gaining exposure to a wide swath of industries as various businesses are adopting machine learning solutions.

Naturally, there are some risks that investors must recognize before buying machine learning stocks:

- During market downturns, businesses may invest less in their businesses and decide against adopting new machine learning solutions.

- A more compelling technology may emerge that makes machine learning less desirable.

- Machine learning companies may invest heavily in R&D, compromising profits in the near-term for long-term success.

As the technology continues to improve, it will increasingly influence the ways many companies operate and interact with customers.

But the sector is still emerging, so machine learning stocks are generally best suited for buy-and-hold investors who are comfortable with plenty of price volatility. As the machine learning industry advances and matures, investors who stay invested in machine learning stocks for many years could realize substantial returns.