It’s hard to talk about the stock market without mentioning one or more FAANG stocks. These tech giants make up a sizable portion of the S&P 500 index, which means many investors already have at least some exposure to them.

Because of their heavy weighting in major indexes, FAANG stocks play an outsized role in market performance. That makes it worthwhile for investors to understand what FAANG means today, how the group has evolved, and whether adding direct exposure makes sense.

What does FAANG stand for?

FAANG is an acronym coined by Jim Cramer in 2013 to describe a group of fast-growing technology leaders. Originally, the acronym was FANG, which stood for:

- Amazon (AMZN)

- Netflix (NFLX)

In 2017, investors began including Apple (AAPL), turning the group into FAANG.

Over time, company names changed. Facebook became Meta Platforms (META), and Google became Alphabet (GOOGL/GOOG), but the acronym stuck. However, as Netflix’s growth cooled and other tech giants surged, many investors began using updated labels.

One popular variation is MAMAA, which replaces Netflix with Microsoft:

- Meta

- Apple

- Microsoft

- Amazon

- Alphabet

You’ll also hear references to the “Magnificent Seven,” a broader group that typically includes Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla. While the names differ, all of these terms point to the same idea: a small set of mega-cap tech companies driving a large share of market returns.

The FAANG stocks at a glance

| Name and ticker | Market cap | Current price | Industry |

|---|---|---|---|

| Meta Platforms (NASDAQ:META) | $1.7 trillion | $722.62 | Interactive Media and Services |

| Amazon (NASDAQ:AMZN) | $2.6 trillion | $238.56 | Multiline Retail |

| Apple (NASDAQ:AAPL) | $3.8 trillion | $255.90 | Technology Hardware, Storage and Peripherals |

| Netflix (NASDAQ:NFLX) | $357.4 billion | $83.12 | Entertainment |

| Alphabet (NASDAQ:GOOGL) | $4.1 trillion | $329.05 | Interactive Media and Services |

1. Meta Platforms

NASDAQ: META

Key Data Points

Meta Platforms owns two of the world's largest and most engaging social media apps (Facebook and Instagram) and two of the biggest messaging apps (WhatsApp and Messenger). It makes money by displaying ads to users while they browse photo and video feeds. Meta is investing heavily in virtual reality (VR) technology, led by its Quest headset, and it's also developed its LLaMa large language model and its Meta AI assistant.

CEO Mark Zuckerberg said Meta AI had almost 1 billion monthly active users, a testament to the company's broad reach and its strategy. Meta is losing more than $10 billion a year on Reality Labs, the division that powers its AI technology, but growth in its advertising has been more than enough to overcome that headwind.

2. Amazon

NASDAQ: AMZN

Key Data Points

Amazon is the world's largest business-to-consumer e-commerce company. Its Prime membership program has more than 200 million global subscribers who have proven extremely loyal to the company's online marketplace.

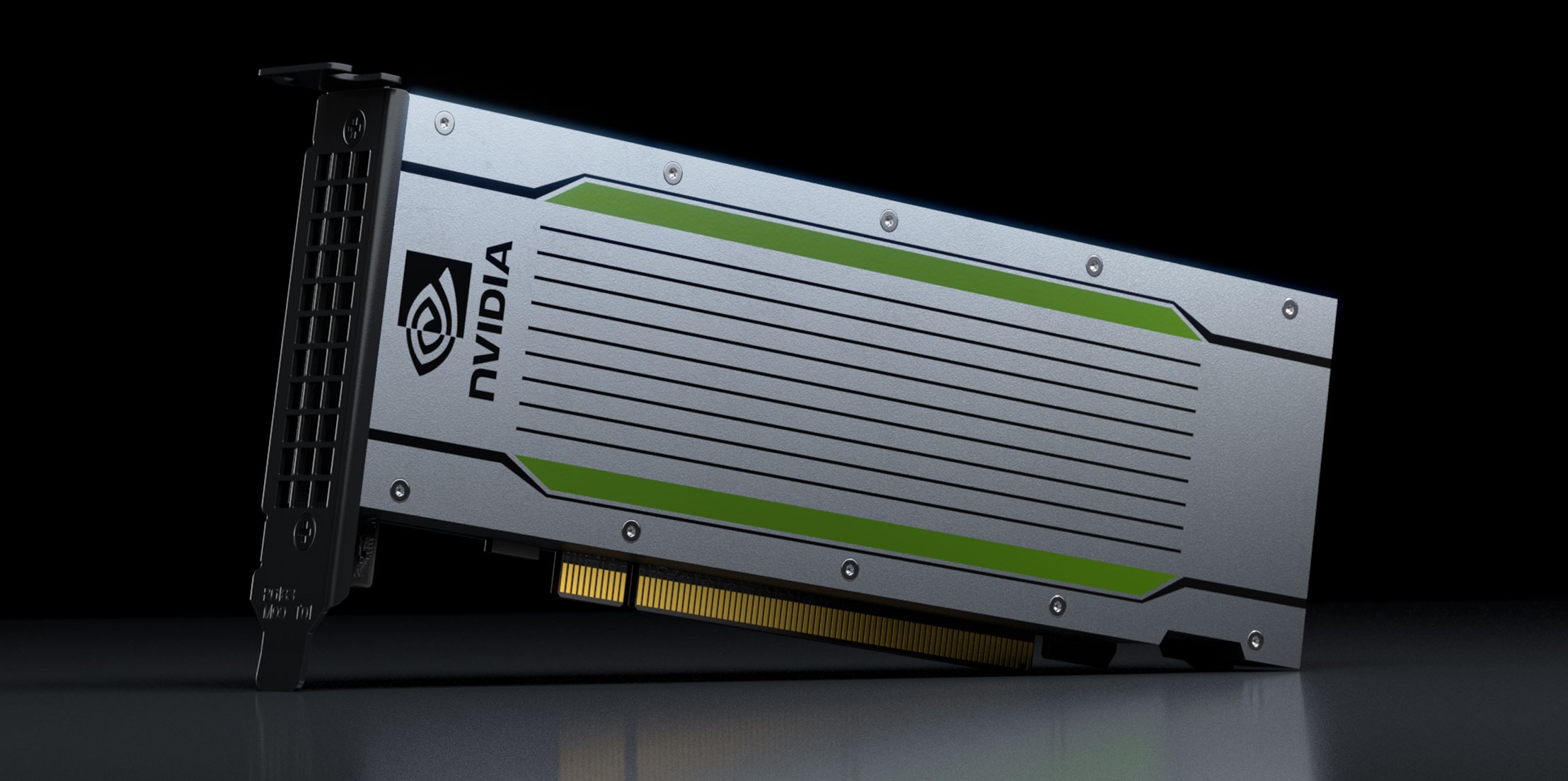

Although e-commerce accounts for the bulk of its revenue, Amazon also found profit engines in cloud computing services and advertising; most of its profit now comes from its cloud infrastructure business, Amazon Web Services (AWS).

Like its peers, Amazon is also investing in AI, taking a significant stake in Anthropic, an AI start-up and creator of the chatbot Claude, and Bedrock, an AWS service that gives to a range of foundations such as those from Anthropic, Meta, Mistral AI, and DeepSeek.

3. Apple

NASDAQ: AAPL

Key Data Points

Apple is one of the biggest smartphone manufacturers in the world. Device sales account for most of Apple's revenue. However, in recent years, the company has expanded its focus.

The company now brings in a significant percentage of its profits from higher-margin subscription services, including app store fees, music and video streaming, gaming, news, and cloud storage. The recent launch of its new spatial computing headset, Vision Pro, has been a disappointment thus far, but it could help drive the transition to the next major computing platform. Investors are also hopeful that Apple Intelligence, its new artificial intelligence (AI) platform, will have an impact, though that may need to wait for later iterations.

4. Netflix

NASDAQ: NFLX

Key Data Points

Netflix is one of the first internet-born media companies. In 2007, it started shifting from a DVD-by-mail service to on-demand streaming and began investing in its own original content for the streaming service in 2012.

Today, Netflix is one of the biggest buyers of film and television productions worldwide, serving more than 300 million global subscribers and having strong growth around the world. While legacy media companies have launched their own streaming platforms, Netflix remains the clear leader in the industry, and after a post-pandemic lull, profits have surged with the help of the addition of an advertising tier.

In December 2025, Netflix announced a deal to buy Warner Bros for $82.7 billion. In January 2026, they upped their offer from a cash-and-stock deal to an all-cash offer. This deal is set to finish by Q3 of 2026 after the split of WBD’s Global Networks division into Discovery Global.

5. Alphabet

NASDAQ: GOOGL

Key Data Points

Alphabet is a tech conglomerate primarily split between Google and its "other bets" segment. Although Google started as an internet search company, it has continued acquiring and developing consumer-facing products -- nine boasting more than 1 billion users each. Google also encompasses a growing cloud computing business and a relatively small hardware business, though search advertising still brings in a majority of its profits.

The other bets segment includes Alphabet's moonshots, such as automated-vehicle business Waymo and health researcher Verily. Since OpenAI's ChatGPT launched, Alphabet has touted its own AI capabilities and introduced its own chatbot interface and AI assistant, Gemini, staking its claim as an AI leader.

However, the company has faced increased scrutiny by regulators on both its ad tech business and its search business, and the company could face fines or even a potential breakup.

6. Microsoft

NASDAQ: MSFT

Key Data Points

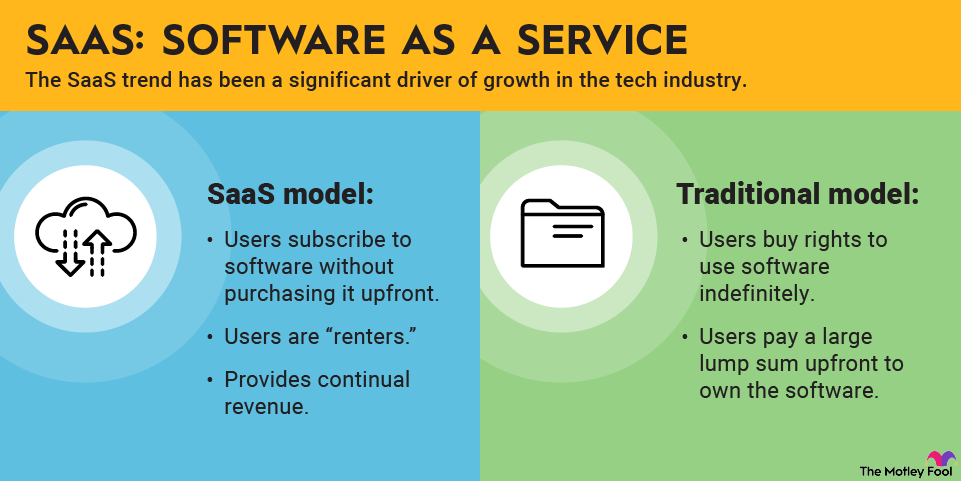

Microsoft started out by licensing its Windows operating system to PC manufacturers, but it's a much broader company 40 years later. Windows licensing sales are now exceeded by its cloud computing operation, Azure, and its Office productivity suite.

The company also operates a gaming segment led by Xbox and Activision Blizzard, an advertising business across its search engine, web portal, and the LinkedIn social network. Additionally, it has a relatively small consumer device segment.

Driven by its relationship with OpenAI, in which it's a major investor, the company sees AI as the next major frontier and has invested significantly in new products like the Azure OpenAI and its Copilot AI assistant.

How to Invest in FAANG Stocks

If you want to buy a FAANG stock, the process is simple. Just follow the steps below.

- Open your brokerage app: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Are FAANG companies a good investment?

FAANG stocks have historically outperformed the S&P 500 index. Alphabet has been the worst performer of the bunch since June 2013, but it's still more than doubled the performance of the S&P 500. The strongest performer in that time has been Netflix, up roughly 34-fold.

Stock/Index | Total Return Since June 19, 2013 |

|---|---|

NFLX | 3,560% |

META | 2,570% |

AAPL | 1,530% |

MSFT | 1,220% |

AMZN | 1,600% |

GOOGL | 1,380% |

S&P 500 | 424% |

The five FAANG companies combined account for close to 20% of the S&P 500 and close to 40% of the Nasdaq-100 index. Replacing Netflix with Microsoft bumps those percentages up to about 26% and almost 50%, respectively.

Are FAANG stocks profitable?

All five FAANG companies and Microsoft have intangible assets that should make them more profitable than their rivals. Meta, Amazon, and Alphabet have troves of user data they can tap into to target advertisements. Netflix's move to original content and exclusive licenses makes its content library irreplaceable.

Apple is one of the few companies that makes both the hardware and the software for its devices -- and it is certainly the only one at its scale. It's hard to find an enterprise operation that doesn't use Microsoft's Office suite. Switching costs are too high for a manager to risk his job by selecting another suite of services and training everyone on how to use it.

Can you invest in a FAANG ETF?

There is no traditional exchange-traded fund (ETF) that exclusively tracks FAANG stocks. However, the NYSE FANG+ Index tracks the five FAANG stocks along with five additional technology leaders, including Microsoft.

One way to gain exposure is through the MicroSectors FANG+ ETN (FNGS). Because it’s an ETN rather than an ETF, investors should understand the additional risks involved.

Given the concentration of the index, some investors may prefer building their own FAANG allocation using individual stocks, especially since most brokers now offer commission-free trading and fractional shares.

The bottom line

FAANG stocks remain some of the most important companies in the global market. Given their size, most investors already own them indirectly through index funds.

If you choose to add direct exposure, do so intentionally. Understand how much of your portfolio is already tied to big tech, and balance growth potential with concentration risk.