You probably interact with artificial intelligence (AI) more often than you think. AI is powering the algorithm arranging your Netflix (NFLX -0.01%) menu, the software expediting your Amazon (AMZN +1.23%) package, and the brains behind many smartphone apps you use every day. AI ETFs offer one option for investing in AI. AI ETFs are exchange-traded funds made up of AI stocks.

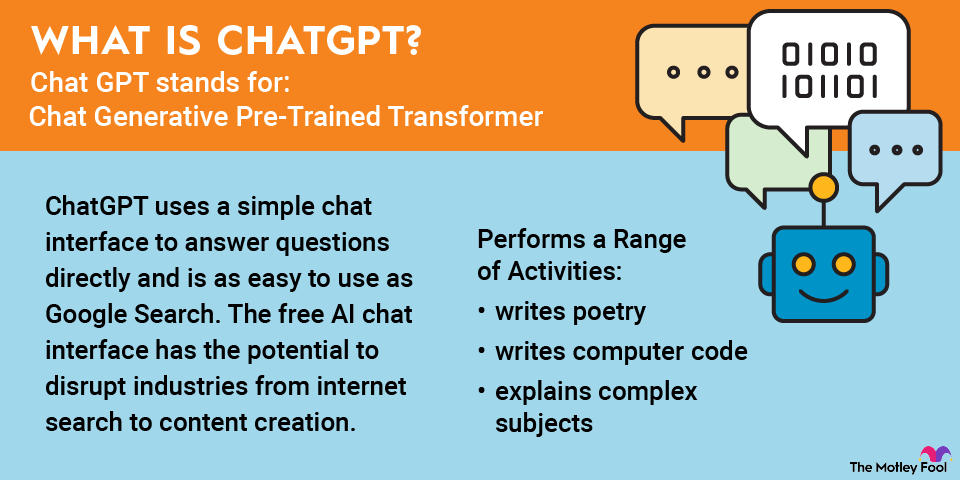

If you've used ChatGPT, the OpenAI chatbot that has wowed users by writing code and instantly answering complex questions, or a similar chatbot, then you've glimpsed into the next frontier in AI, known as generative AI. Big tech companies, including Alphabet (GOOG +3.60%) (GOOGL +3.62%) with Gemini and Meta Platforms' (META +1.69%) with Meta AI, have developed AI chatbots and other generative AI tools, and usage has soared. Meta reported that Meta AI had 1 billion active users by early 2025.

Artificial Intelligence

If you want portfolio exposure to AI companies but don't want to identify individual AI stocks, investing in an AI-focused exchange-traded fund (ETF) is a good option. AI ETFs provide exposure to a broad range of the best AI companies, so you don't need to research and choose individual stocks on your own.

AI ETFs are ETFs that hold AI stocks or have some kind of an AI theme, such as the ones below.

Best AI ETFs to buy in 2025

AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

Global X Artificial Intelligence and Technology ETF (NASDAQ:AIQ) | $5.98 billion | 0.68% |

Global X Robotics and Artificial Intelligence ETF (NASDAQ:BOTZ) | $3 billion | 0.68% |

Robo Global Robotics and Automation Index ETF (NYSEMKT:ROBO) | $1.15 billion | 0.95% |

iShares Future AI and Tech ETF (NYSEMKT:ARTY) | $1.66 billion | 0.47% |

First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ:ROBT) | $609.9 million | 0.65% |

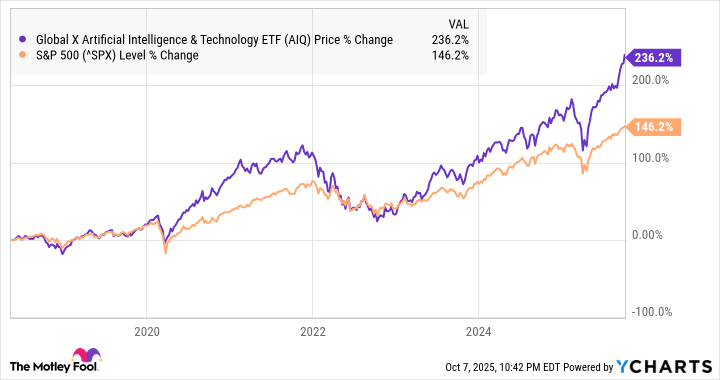

1. Global X Artificial Intelligence and Technology ETF

NASDAQ: AIQ

Key Data Points

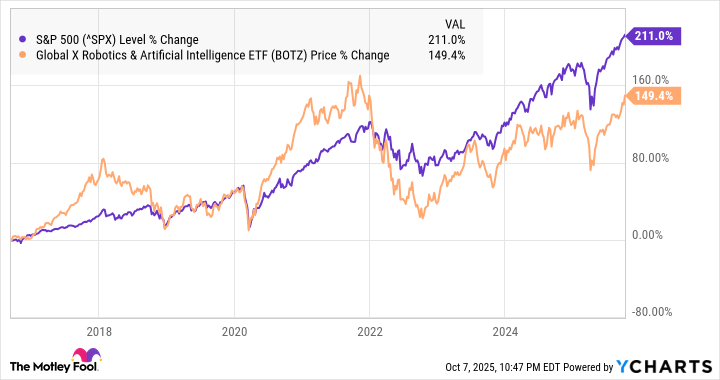

2. Global X Robotics and Artificial Intelligence ETF

The ETF offered a modest dividend yield of 0.24% in mid-2025, but it is better suited as a growth-oriented investment. It's an actively managed fund with an expense ratio of 0.68%, which is more than what you'd pay for most index funds.

Exchange-Traded Fund (ETF)

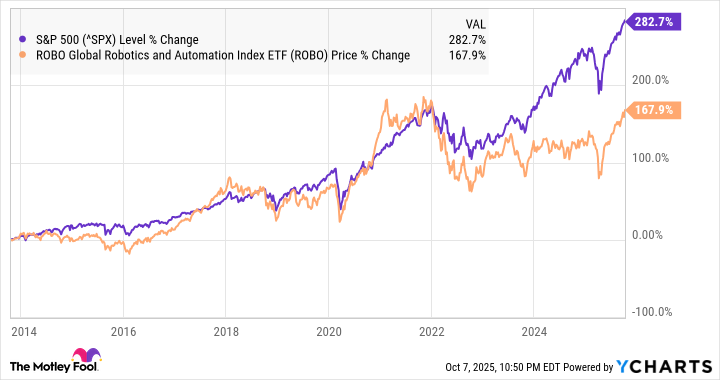

3. Robo Global Robotics and Automation Index ETF

Cloud Computing

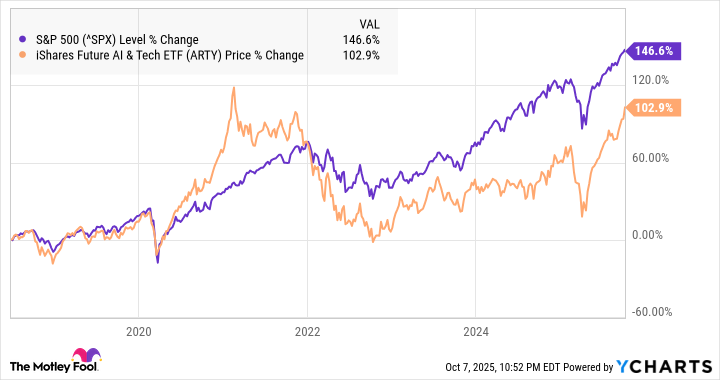

4. iShares Future AI and Tech ETF

The expense ratio is competitive at 0.47%, and the trailing-12-month yield as of September 2025 was 0.15%. The fund's performance will likely be heavily influenced by the overall performance of cloud and chip stocks since they're the largest areas of exposure for the fund.

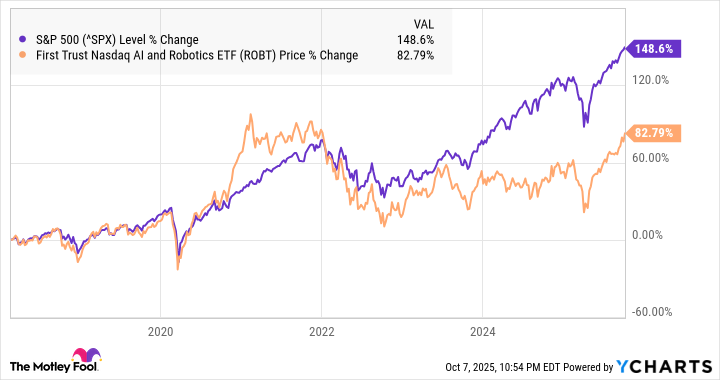

5. First Trust Nasdaq Artificial Intelligence and Robotics ETF

Pros and cons of investing in AI ETFs

Here are some pros and cons of investing in AI ETFs.

Pros:

- They're an easy way to get exposure to AI stocks.

- They save time and effort compared to buying individual stocks.

- AIQ, the biggest AI ETF, has a track record of outperforming the S&P 500.

- They can give you exposure to lesser-known robotics and international stocks.

Cons:

- Most AI ETFs have underperformed the S&P 500.

- They tend to be more expensive than other ETFs.

- They have lagged behind high-profile AI stocks like Nvidia.

- High-performing chip stocks aren't always included in AI ETFs.

Criteria for selecting AI ETFs

If you're thinking of buying an AI ETF, you'll want to choose the right one for you.

Some criteria to help you choose an AI ETF include:

- Past performance: ETFs with a stronger track record are more likely to outperform.

- Top holdings: This can give you a quick sense of where the ETF is allocating its funds.

- Strategy: Some ETFs are actively managed, while others follow an index or an underlying group of stocks.

- Valuation: Some ETFs are cheaper than others.

- Expense ratio: Some ETFs cost more to own than others.

- Dividend yield: A healthy dividend yield can make up for slower growth.

Should I buy AI ETFs?

The best way to decide which ETF to buy is to consider which stocks a fund holds and how many are true AI companies. A fund's expense ratio, dividend yield, and past performance are also important, and you can opt to invest in a basket of all five of these AI ETFs to maximize your diversification.

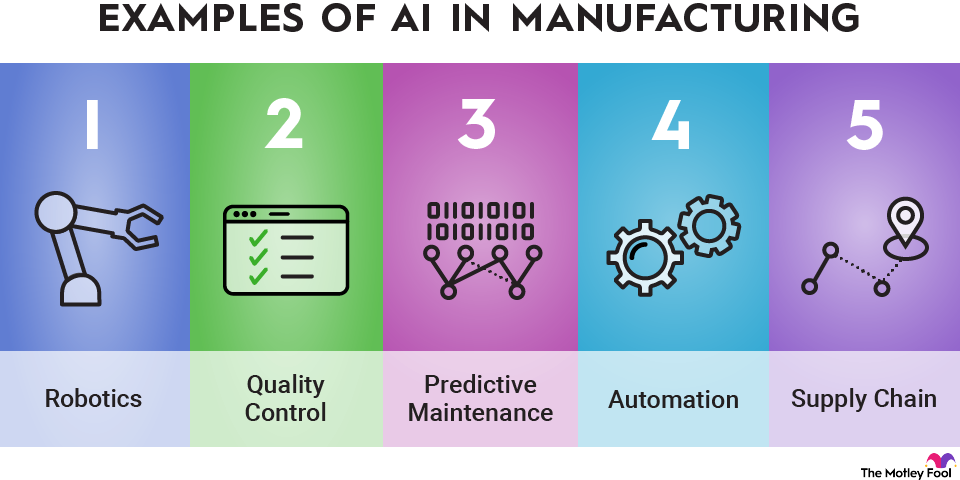

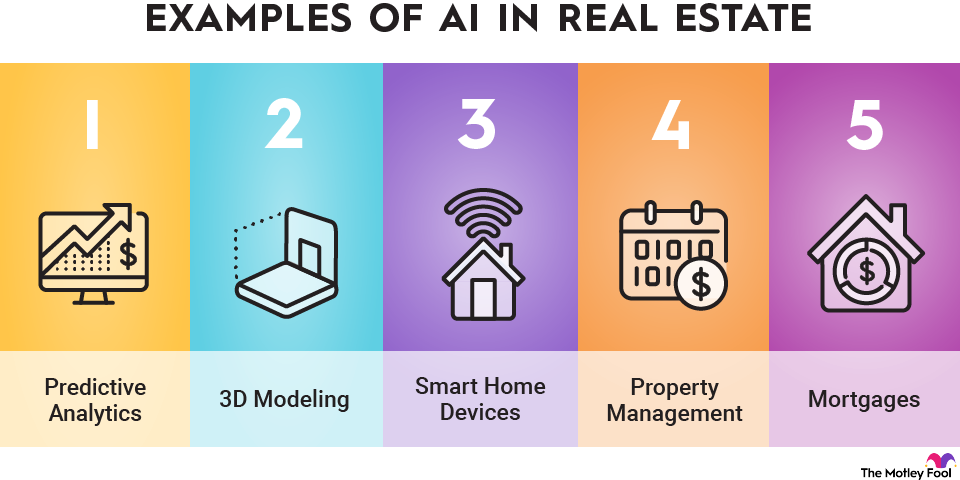

Over time, AI will grow smarter and play a greater role in our daily lives. Already, AI represents a global market worth hundreds of billions of dollars, and its wide range of practical applications includes facial recognition, predictive algorithms in internet search, smart-home devices, and autonomous vehicles. So, pay attention to the AI market now, and you may find yourself reaping the rewards in years to come.

Related investing topics

Who should invest in AI ETFs?

AI ETFs aren't right for everybody, but they're a good fit for some investors. If these descriptions fit your investing style, AI ETFs could work for you.

- You have a high risk tolerance.

- You have a long time horizon.

- You'd prefer one investment of several individual stocks.

- You like the convenience of an ETF compared to individual stocks.

- You're looking for a wide range of exposure to AI stocks.