You probably interact with artificial intelligence (AI) more often than you think. AI is powering the algorithm arranging your Netflix (NFLX +0.82%) menu, the software expediting your Amazon (AMZN +1.05%) package, and the brains behind many smartphone apps you use every day. AI ETFs offer one option for investing in AI. AI ETFs are exchange-traded funds made up of AI stocks.

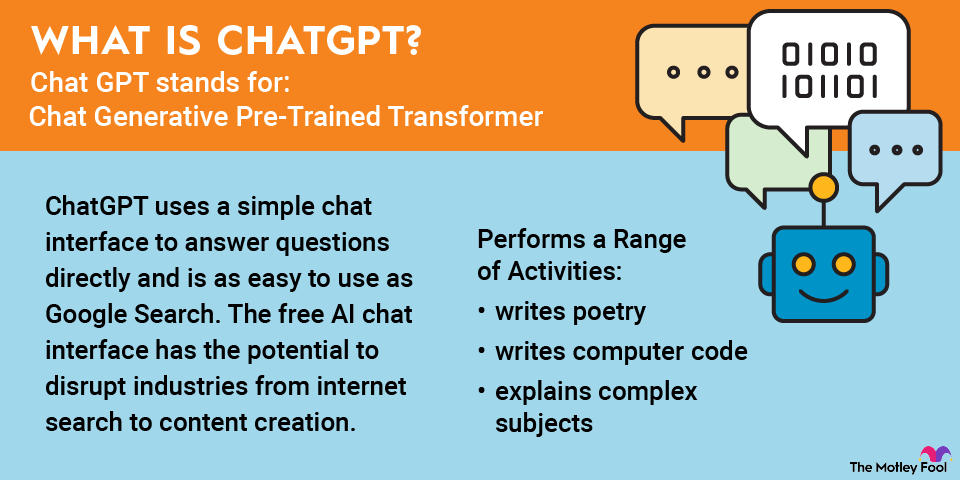

If you've used ChatGPT, the OpenAI chatbot that has wowed users by writing code and instantly answering complex questions, or a similar chatbot, then you've glimpsed into the next frontier in AI, known as generative AI. Big tech companies, including Alphabet (GOOG -0.47%) (GOOGL -0.59%) with Gemini and Meta Platforms' (META +0.15%) with Meta AI, have developed AI chatbots and other generative AI tools, and usage has soared. Meta reported that Meta AI had 1 billion active users by early 2025.

Artificial Intelligence

If you want portfolio exposure to AI companies but don't want to identify individual AI stocks, investing in an AI-focused exchange-traded fund (ETF) is a good option. AI ETFs provide exposure to a broad range of the best AI companies, so you don't need to research and choose individual stocks on your own.

AI ETFs are ETFs that hold AI stocks or have some kind of an AI theme, such as the ones below.

Best AI ETFs to buy in 2025

AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

Global X Artificial Intelligence and Technology ETF (NASDAQ:AIQ) | $5.98 billion | 0.68% |

Global X Robotics and Artificial Intelligence ETF (NASDAQ:BOTZ) | $3 billion | 0.68% |

Robo Global Robotics and Automation Index ETF (NYSEMKT:ROBO) | $1.15 billion | 0.95% |

iShares Future AI and Tech ETF (NYSEMKT:ARTY) | $1.66 billion | 0.47% |

First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ:ROBT) | $609.9 million | 0.65% |

1. Global X Artificial Intelligence and Technology ETF

NASDAQ: AIQ

Key Data Points

The Global X Artificial Intelligence and Technology ETF (AIQ +0.13%) is the largest AI ETF and a good first choice for investors looking for an AI ETF.

The ETF started in 2018 and aims to invest in companies that can benefit from the development of AI technology, as well as companies that make hardware facilitating the use of AI. According to Global X, the global artificial intelligence market is expected to grow from $184 billion in 2024 to $826.7 billion in 2030.

The ETF has 88 stocks, and the biggest holdings will be familiar to most investors. As of late 2025, the top 10 holdings accounted for about 33% of the fund:

- Advanced Micro Devices (AMD -0.52%): The leading fabless chip company has moved further into AI with several acquisitions, and as it advances franchises like its Instinct GPUs, EPYC data center CPUs, and Ryzen AI CPUs for PCs.

- Meta Platforms (META +0.15%): The social media giant has made AI a clear priority, developing large language models and AI chatbots, making acquisitions like its deal for data-labeling start-up Scale AI, and its partnerships with Ray-Ban and Oakley to make smart glasses.

- Microsoft (MSFT +2.06%): Microsoft has long dominated the market for enterprise software, and it's become a leader in cloud computing as well with Azure. That puts it in a good position to be an AI provider, and its partnership with OpenAI has paid off with products like its Copilot AI assistant.

- Samsung (OTC:SSNL.F): The Korean tech giant is the world's No. 2 chipmaker and well-known for devices like smartphones. It has introduced AI features like live translate and chat assist to help users write messages.

- Broadcom (AVGO +2.99%): A leading maker of networking chips is seeing AI demand for things like custom AI chips and high-performance networking components used to run AI systems.

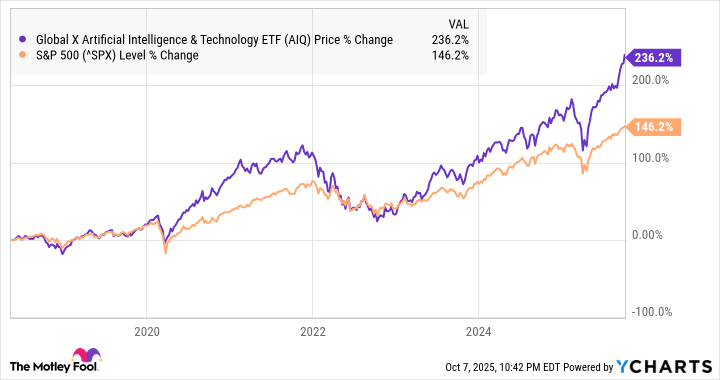

As you can see from the chart below, this Global X ETF has outperformed over its history, likely with the help of stocks like Meta and Broadcom that have soared lately.

2. Global X Robotics and Artificial Intelligence ETF

NASDAQ: BOTZ

Key Data Points

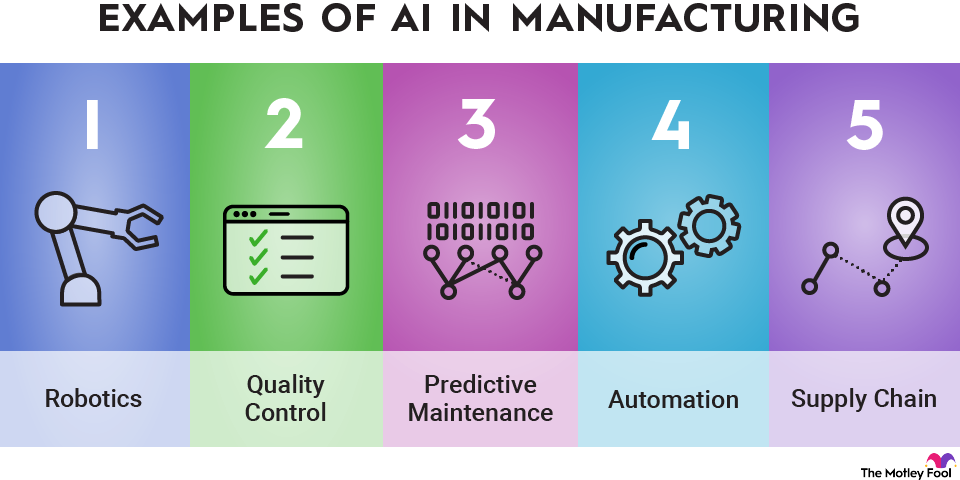

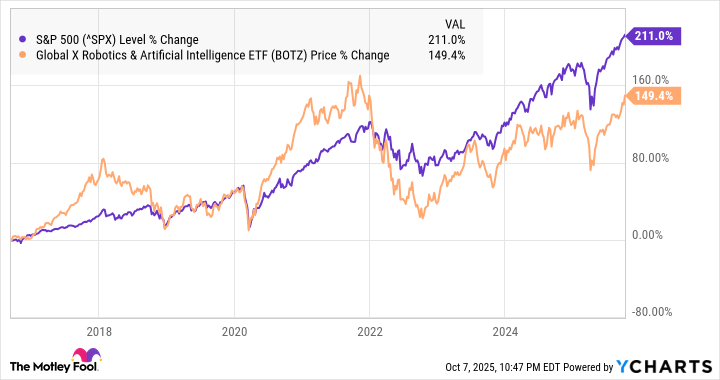

Established in 2016, the Global X Robotics and Artificial Intelligence ETF (BOTZ -0.31%) is similar to the Global X Artificial Intelligence and Technology ETF, but with a focus on robotics. It's a fund that invests in "companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence." This includes enterprises working in industrial robotics, automation, non-industrial robots, and autonomous vehicles. According to Global X, the global robotics market was valued at more than $80 billion in 2022 and could grow to $280 billion by 2032.

The ETF offered a modest dividend yield of 0.24% in mid-2025, but it is better suited as a growth-oriented investment. It's an actively managed fund with an expense ratio of 0.68%, which is more than what you'd pay for most index funds.

Exchange-Traded Fund (ETF)

3. Robo Global Robotics and Automation Index ETF

NYSEMKT: ROBO

Key Data Points

The Robo Global Robotics and Automation Index ETF (ROBO -0.84%) focuses on companies driving "transformative innovations in robotics, automation, and artificial intelligence." This ETF invests in companies primarily focused on AI, cloud computing, and other technology companies.

Cloud Computing

The ETF holds 77 stocks, with no single holding accounting for more than 2.5% of the ETF's value. Its top five holdings comprise only about 10% of the fund's total value. In late 2025, major holdings included Fanuc and four others:

- Symbiotic (SYM -2.96%): A tech company that makes software and robotics for warehouses, including end-to-end systems for automation.

- Yasakawa Electric Corp: A Japanese company that manufactures control products, industrial robots, and related machinery.

- Harmonic Drive Systems: A Japanese manufacturer of high-precision electric and mechatronic components used for industrial robots, semiconductor manufacturing, and other high-tech applications.

- Teradyne (TER -2.12%): A maker of automated test equipment and robotics systems for applications like testing semiconductors and other hardware.

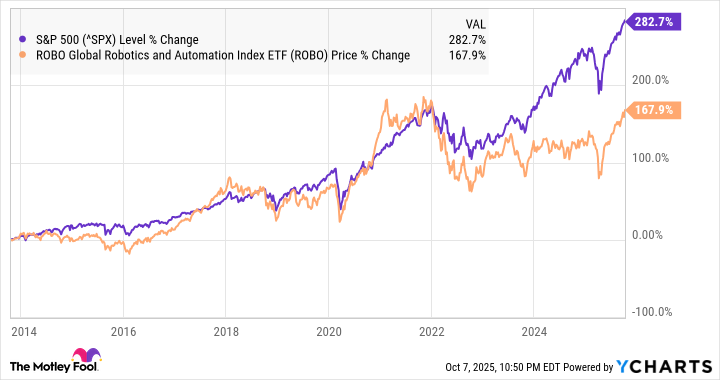

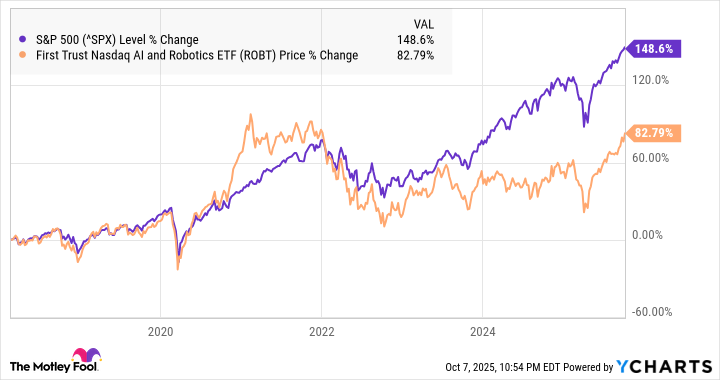

Since its inception in 2013, this Robo ETF has underperformed the S&P 500, as the chart below shows. It trails the broad market index, with dividends factored into the return. The ETF pays a dividend yield of 0.5%, and its expense ratio is 0.95%.

4. iShares Future AI and Tech ETF

NYSEMKT: ARTY

Key Data Points

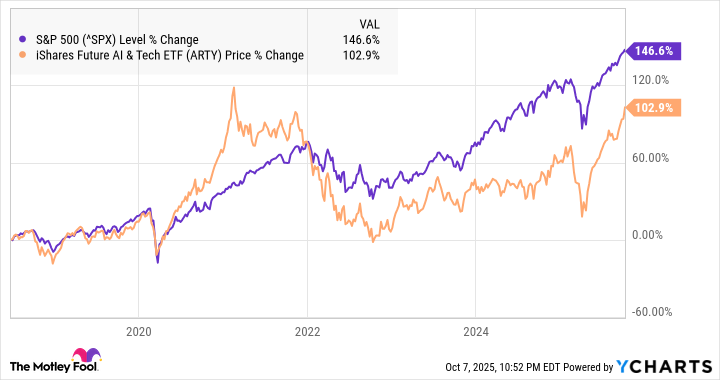

The expense ratio is competitive at 0.47%, and the trailing-12-month yield as of September 2025 was 0.15%. The fund's performance will likely be heavily influenced by the overall performance of cloud and chip stocks since they're the largest areas of exposure for the fund.

5. First Trust Nasdaq Artificial Intelligence and Robotics ETF

NASDAQ: ROBT

Key Data Points

Pros and cons of investing in AI ETFs

Here are some pros and cons of investing in AI ETFs.

Pros:

- They're an easy way to get exposure to AI stocks.

- They save time and effort compared to buying individual stocks.

- AIQ, the biggest AI ETF, has a track record of outperforming the S&P 500.

- They can give you exposure to lesser-known robotics and international stocks.

Cons:

- Most AI ETFs have underperformed the S&P 500.

- They tend to be more expensive than other ETFs.

- They have lagged behind high-profile AI stocks like Nvidia.

- High-performing chip stocks aren't always included in AI ETFs.

Criteria for selecting AI ETFs

If you're thinking of buying an AI ETF, you'll want to choose the right one for you.

Some criteria to help you choose an AI ETF include:

- Past performance: ETFs with a stronger track record are more likely to outperform.

- Top holdings: This can give you a quick sense of where the ETF is allocating its funds.

- Strategy: Some ETFs are actively managed, while others follow an index or an underlying group of stocks.

- Valuation: Some ETFs are cheaper than others.

- Expense ratio: Some ETFs cost more to own than others.

- Dividend yield: A healthy dividend yield can make up for slower growth.

Should I buy AI ETFs?

The best way to decide which ETF to buy is to consider which stocks a fund holds and how many are true AI companies. A fund's expense ratio, dividend yield, and past performance are also important, and you can opt to invest in a basket of all five of these AI ETFs to maximize your diversification.

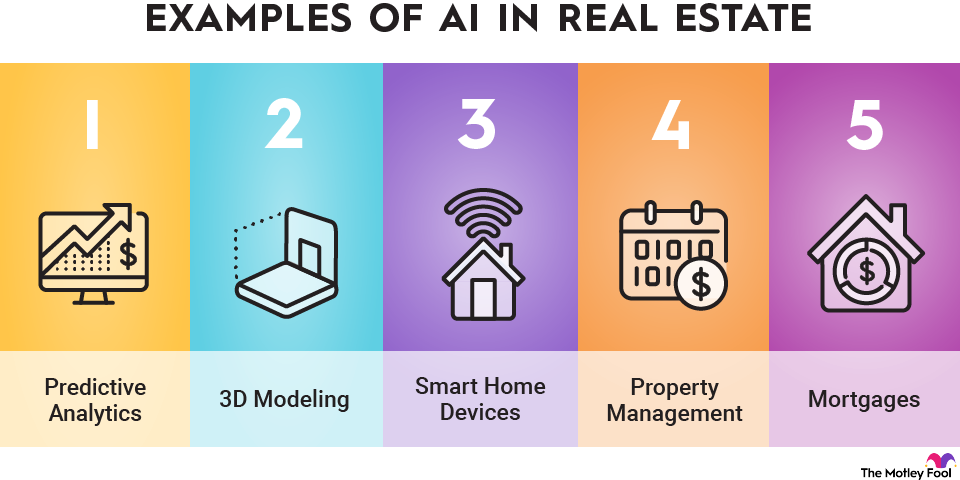

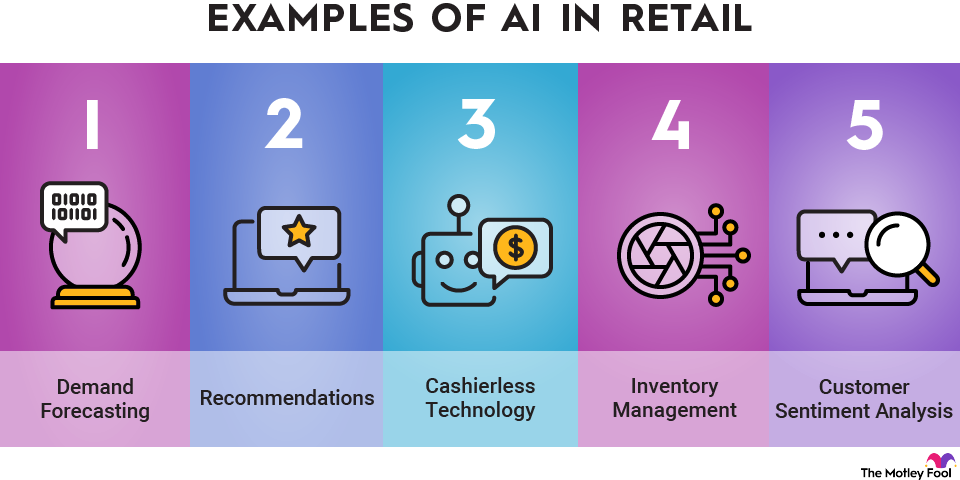

Over time, AI will grow smarter and play a greater role in our daily lives. Already, AI represents a global market worth hundreds of billions of dollars, and its wide range of practical applications includes facial recognition, predictive algorithms in internet search, smart-home devices, and autonomous vehicles. So, pay attention to the AI market now, and you may find yourself reaping the rewards in years to come.

Related investing topics

Who should invest in AI ETFs?

AI ETFs aren't right for everybody, but they're a good fit for some investors. If these descriptions fit your investing style, AI ETFs could work for you.

- You have a high risk tolerance.

- You have a long time horizon.

- You'd prefer one investment of several individual stocks.

- You like the convenience of an ETF compared to individual stocks.

- You're looking for a wide range of exposure to AI stocks.