Cloud computing boomed during the 2010s, but growth in this next-gen IT industry is still in the early innings. For years, organizations around the globe have been migrating their operations to the cloud -- digital data and services stored within a remote data center and accessed via the internet. However, the rise of remote work during the COVID-19 pandemic accelerated the trend. Now, generative AI has kicked off the next wave of cloud expansion.

Business research provider Grand View Research projects that spending on global cloud computing (including data center infrastructure and edge computing) will increase at a 21.2% compound annual growth rate (CAGR) from an estimated $752.4 billion in 2024 to $2.4 trillion in 2030.

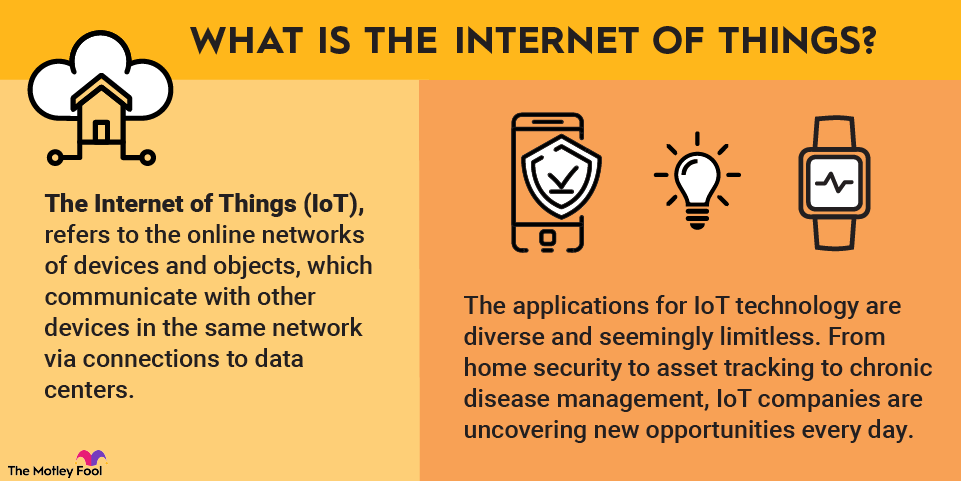

Cloud computing is also closely tied to other tech developments such as mobile 5G networks, the Internet of Things (IoT), and artificial intelligence (AI). Clearly, cloud computing stocks are a top investment theme for 2025 and the decade ahead.

Investing in the best cloud computing stocks of 2025

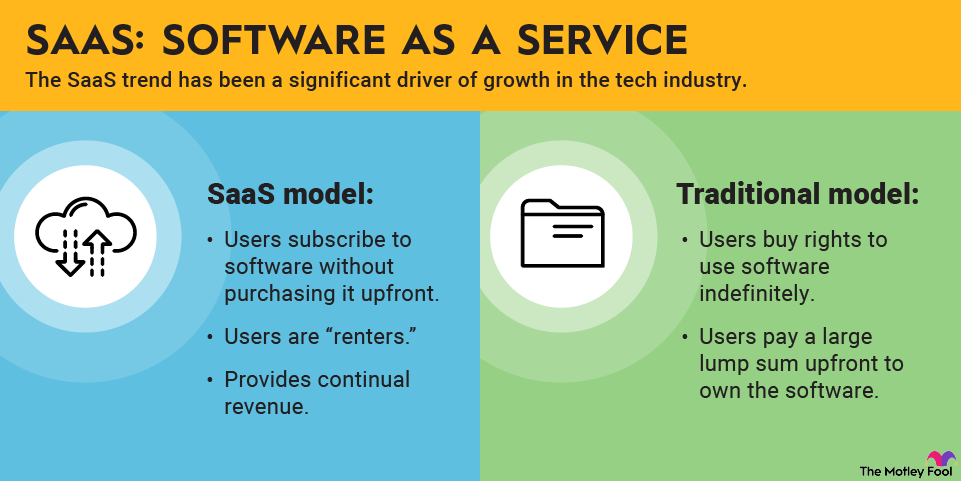

To get started, the best cloud stocks to invest in are the five largest public cloud giants: Amazon (AMZN -1.79%) Web Services (AWS); Microsoft (MSFT +0.50%) Azure; Alphabet (GOOGL +0.39%) (GOOG +0.31%) Google Cloud; Oracle (ORCL -0.54%) Cloud; and IBM (IBM +2.51%) Cloud. Although these companies aren’t pure plays in the cloud industry, all five provide infrastructure and services for organizations undertaking a digital transformation (a phrase that encompasses the migration to cloud-based operations). They have the most complete ecosystems of software and partnerships with third-party software-as-a-service (SaaS) providers.

Cloud Computing

Beyond those big five, here are seven more focused companies that provide portfolio exposure to the development of the cloud:

1. Salesforce

2. Adobe

The cloud increases a company's flexibility, often unlocks cost savings, and helps it get more done with the data it has on its operations and customers. However, with the adoption of the cloud comes an explosion of digital data and new security risk considerations. Managing that data is a complex task.

That's where Snowflake comes in. It hit the public markets in 2020 with incredible fanfare due to its triple-digit-percentage revenue growth. The stock has fallen since then, and revenue growth has moderated a bit, but Snowflake is now much more reasonably valued.

Snowflake is an important business that has pioneered new ways for businesses to store, migrate, and process massive amounts of digital information. It continued to expand at a rapid pace, even during the bear market of 2022 and despite fears of a recession in 2023. It also began turning a healthy profit, as measured by free cash flow. In fiscal 2023 and 2024, for example, Snowflake reported free cash flow of $496.5 million and $778.9 million, respectively, and it has continued to grow. In fiscal 2025, Snowflake reported free cash flow of $884.1 million.

Snowflake is a young company, though, and the stock will likely be highly volatile for some time. It's all about growth for this business right now, and even small changes in management's expectations can cause some wild fluctuations in share price. Snowflake could, nevertheless, be a very promising investment for the long term.

4. Zoom Video Communications

Artificial Intelligence

5. ServiceNow

6. The Trade Desk

Related investing topics

Cloud computing is a long-term growth trend

Cloud computing picked up steam during the COVID-19 pandemic and has remained an enduring growth story during the ensuing years for the following reasons:

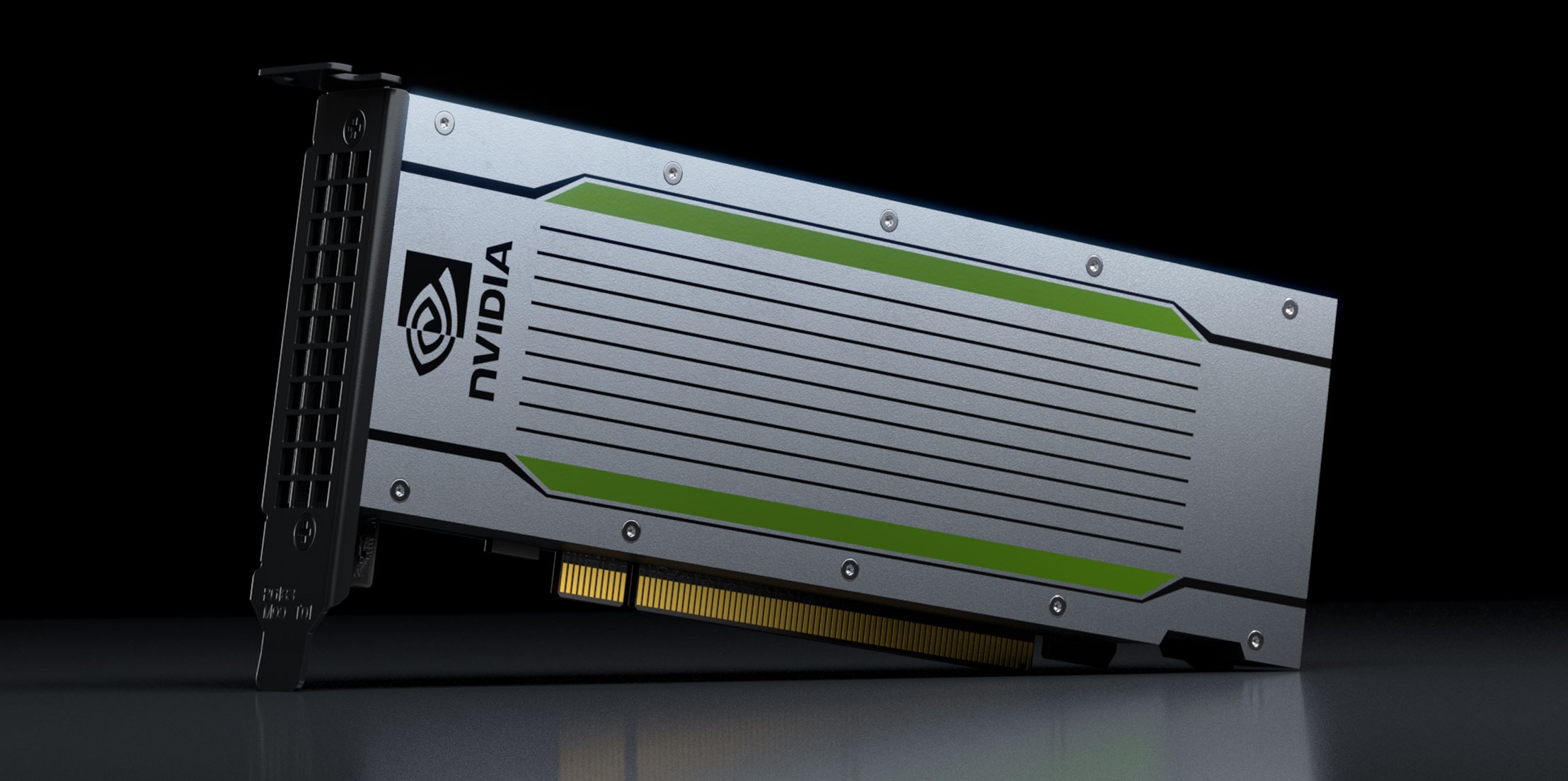

- More efficient than legacy IT, it enhances technology such as artificial intelligence (AI), machine learning, and gaming.

- Organizations and their employees gain more flexibility with important functions such as remote work.

- Adopting cloud computing solutions is more cost-effective than developing more expensive hardware.

- It provides more sophisticated safety measures, helping users to protect their data against cyberattacks.

As is the case with all high-growth stocks, though, investing in cloud companies will have bumps in the road. Investors should stay focused on the long-term potential, not just stock price performance over the course of a year or two.