It's hard to talk about the general stock market without mentioning one or more FAANG stocks. The tech giants make up a sizable portion of the S&P 500 index, which means many investors already have at least some exposure to them. Because of the heavy weighting of FAANG stocks in indexes such as the S&P 500, it's worthwhile for investors to learn a bit more about them.

What are FAANG stocks?

What are FAANG stocks?

First coined by Jim Cramer in 2013, FAANG is an acronym used to describe some of the most prominent companies in the tech sector. Originally, the acronym was FANG for Facebook, Amazon (AMZN 0.61%), Netflix (NFLX -3.33%), and Google. In 2017, investors started including Apple (AAPL 1.35%) in the group, turning the acronym into FAANG.

Despite some prominent company name changes -- Facebook is now Meta Platforms (META -2.56%), and Google is now Alphabet (GOOGL -0.22%) (GOOG -0.27%) -- the acronym has stuck. But with Netflix falling out of favor with investors, and given the strength of another tech giant, Microsoft (MSFT -1.02%), as well as Tesla and Nvidia, many investors refer to the new version of the group as the "Magnificent Seven."

Over the past decade, the FAANG stocks and Microsoft shares have grown faster than the overall S&P 500 or the more technology-focused Nasdaq. The original four FANG stocks were all internet-based companies.

However, the later inclusion of Apple -- primarily a consumer hardware manufacturer -- made FAANG a broader group of technology stocks. The inclusion of Microsoft, Nvidia, and Tesla cements the mega-cap tech focus instead of the internet focus of the original group.

1. Meta Platforms

1. Meta Platforms

Meta Platforms owns two of the world's largest and most engaging social media apps (Facebook and Instagram) and two of the biggest messaging apps (WhatsApp and Messenger). It makes money by displaying ads to users while they browse photo and video feeds. Meta is investing heavily in virtual reality (VR) technology, led by its Quest headset, and it's also developed its LLaMa large language model and its Meta AI assistant.

CEO Mark Zuckerberg said Meta AI had nearly 1 billion monthly active users, a testament to the company's broad reach and its strategy. Meta is losing more than $10 billion a year on Reality Labs, the division that powers its AI technology, but growth in its advertising has been more than enough to overcome that headwind.

2. Amazon

2. Amazon

Amazon is the world's largest business-to-consumer e-commerce company. Its Prime membership program has more than 200 million global subscribers who have proven extremely loyal to the company's online marketplace.

Although e-commerce accounts for the bulk of its revenue, Amazon also found profit engines in cloud computing services and advertising; most of its profit now comes from its cloud infrastructure business, Amazon Web Services (AWS).

Like its peers, Amazon is also investing in AI, taking a significant stake in Anthropic, an AI start-up and creator of the chatbot Claude, and Bedrock, an AWS service that gives to a range of foundations such as those from Anthropic, Meta, Mistral AI, and DeepSeek.

Cloud Computing

3. Apple

3. Apple

Apple is one of the biggest smartphone manufacturers in the world. Device sales account for most of Apple's revenue. However, in recent years, the company has expanded its focus.

The company now brings in a significant percentage of its profits from higher-margin subscription services, including app store fees, music and video streaming, gaming, news, and cloud storage. The recent launch of its new spatial computing headset, Vision Pro, has been a disappointment thus far, but it could help drive the transition to the next major computing platform. Investors are also hopeful that Apple Intelligence, its new AI platform, though that may need to wait for later iterations.

4. Netflix

4. Netflix

Netflix is one of the first internet-born media companies. In 2007, it started shifting from a DVD-by-mail service to on-demand streaming and began investing in its own original content for the streaming service in 2012.

Today, Netflix is one of the biggest buyers of film and television productions worldwide, serving more than 300 million global subscribers and having strong growth around the world. While legacy media companies have launched their own streaming platforms, Netflix remains the clear leader in the industry, and after a post-pandemic lull, profits have surged with the help of the addition of an advertising tier.

Nonetheless, it's worth significantly less than its fellow FAANG members.

5. Alphabet

5. Alphabet

Alphabet is a tech conglomerate primarily split between Google and its "other bets" segment. Although Google started as an internet search company, it's continued acquiring and developing consumer-facing products -- nine boasting more than 1 billion users each. Google also encompasses a growing cloud computing business and a relatively small hardware business, though search advertising still brings in a majority of its profits.

The other bets segment includes Alphabet's moonshots, such as automated-vehicle business Waymo and health researcher Verily. Since OpenAI's ChatGPT launched, Alphabet has touted its own AI capabilities and introduced its own chatbot interface and AI assistant, Gemini, staking its claim as a leader in artificial intelligence (AI).

However, the company has faced increased scrutiny by regulators on both its ad tech business and its search business, and the company could face fines or even a potential breakup.

6. Microsoft

6. Microsoft

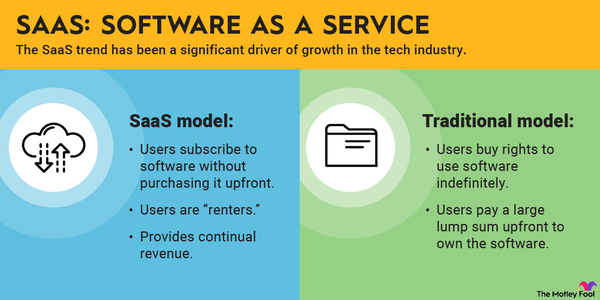

Microsoft started out by licensing its Windows operating system to PC manufacturers, but it's a much broader company 40 years later. Windows licensing sales are now exceeded by its cloud computing operation, Azure, and its Office productivity suite.

The company also operates a gaming segment led by Xbox and Activision Blizzard, an advertising business across its search engine, web portal, and the LinkedIn social network. Additionally, it has a relatively small consumer device segment.

Driven by its relationship with OpenAI, in which it's a major investor, the company sees AI as the next major frontier and has invested significantly in new products like the Azure OpenAI and its Copilot AI assistant.

Should I invest?

Are FAANG companies a good investment?

FAANG stocks have historically outperformed the S&P 500 index. Alphabet has been the worst performer of the bunch since June 2013, but it's still more than doubled the performance of the S&P 500. The strongest performer in that time has been Netflix, up roughly 34-fold.

| Stock/Index | Total Return Since June 19, 2013 |

|---|---|

| NFLX | 3,340% |

| META | 2,350% |

| MSFT | 1,440% |

| AMZN | 1,290% |

| AAPL | 1,210% |

| GOOGL | 580% |

| S&P 500 | 332% |

The five FAANG companies combined account for close to 20% of the S&P 500 and close to 40% of the Nasdaq-100 index. Replacing Netflix with Microsoft bumps those percentages up to about 26% and nearly 50%, respectively.

As every investor should know, past results don't guarantee future success. Indeed, the FAANG stocks and Microsoft all underperformed the S&P 500 in 2022 during the bear market. That said, FAANG companies exhibit several competitive advantages that make them appealing long-term investments. Most of the companies benefit from network effects.

- Meta's billions of active users make its products valuable to new users.

- Alphabet products, including YouTube and Search, benefit from their billion-plus users.

- Amazon's Prime service brings tens of millions of shoppers to its marketplace daily, making its seller services more attractive to third-party merchants.

- Netflix's tens of millions of viewers share feedback about the content the company should invest in and provide the revenue to support its massive budget.

- The lock-in effect of the Apple ecosystem creates significant switching costs for iOS users. That competitive advantage is getting stronger as Apple develops more services, such as Apple Music and Apple Arcade.

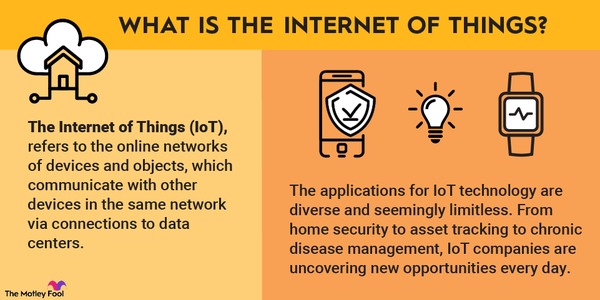

- The popularity of Microsoft's Windows supports the development of applications for Windows, which locks customers into the operating system. Its move to cloud computing and software-as-a-service has enabled it to maintain its position in an increasingly platform-agnostic market.

Profitability

Are FAANG stocks profitable?

All five FAANG companies and Microsoft have intangible assets that should make them more profitable than their rivals. Meta, Amazon, and Alphabet have troves of user data they can tap into to target advertisements. Netflix's move to original content and exclusive licenses makes its content library irreplaceable.

Apple is one of the few companies that makes both the hardware and the software for its devices -- and it is certainly the only one at its scale. It's hard to find an enterprise operation that doesn't use Microsoft's Office suite. Switching costs are too high for a manager to risk his job by selecting another suite of services and training everyone on how to use it.

These competitive advantages can make the FAANG stocks great potential investments. Still, investors should examine each stock's valuation relative to its own historical value and comparable competitors before buying.

ETF options

Can I invest in a FAANG stocks index ETF?

No fund or exchange-traded fund (ETF) exclusively contains FAANG stocks. However, the NYSE FANG+ index tracks the five FAANG stocks and five other tech and tech-enabled leaders, including Microsoft.

Exchange-Traded Fund (ETF)

In November 2019, BMO Financial Group issued an exchange-traded note that tracks the FANG+ index. It trades on the NYSE Arca exchange under the ticker FNGS (NYSEARCA:FNGS). Owning it is the simplest way for investors to gain added exposure to the returns of FAANG stocks. The ETN has an expense ratio of 0.58%.

With such a small index, investors may be better off building their own portfolio of FAANG stocks and avoiding the ETN expenses. That's especially true now that most discount brokers charge no commissions and allow fractional share purchases.

Related investing topics

Bottom line on investing in FAANG or MAMAA stocks

Building your own portfolio allows you to optimize stock purchases and sales for your own unique capital gains tax situation. Considering they're a major component of the S&P 500, FAANG stocks probably play at least a small role in your portfolio. But if you want additional exposure to these excellent companies, you can buy the FANG+ ETN or simply dedicate a portion of your portfolio to the stocks themselves.

FAQ

FAQ about FAANG and MAMAA stocks

What is a FAANG Stock?

FAANG stocks refer to a group of big tech stocks traditionally made up of Facebook (Meta Platforms), Amazon, Apple, Netflix, and Google (Alphabet). These tech stocks were named as a group because they have long records of outperformance and dominate their respective markets.

What does FAANG stand for?

When the term was coined in 2013, FAANG referred to Facebook, Amazon, Apple, Netflix, and Google. Today, the original FAANG term is sometimes used. There are also alternatives like FAAMNG (to include Microsoft) and the "Magnificent Seven," which includes Tesla and Nvidia, but not Netflix.

What is the best ETF for FAANG?

No ETF offers exclusive exposure to FAANG stocks. Your best bet among exchange-traded investments is the MicroSectors FANG+ ETN, which counts FAANG stocks as about half its total portfolio. Since there are only five stocks in the FAANG, it wouldn't be difficult to buy and hold all of them if you are looking for direct exposure.

How much of the S&P 500 is FAANG?

The percentage of the S&P 500 market cap comprising FAANG stocks varies, but as of mid-2025, it was close to 20%. If you substituted Microsoft for Netflix, it would be closer to 26%. That figure shows how influential FAANG stocks are on the market, as these are just five of the 500 stocks in the broad-market index, but their weight on the index is roughly 25 times that.