Artificial intelligence is already reshaping industries and driving real revenue growth for the companies building and powering it. From chips and cloud infrastructure to software and automation, AI is becoming a core competitive advantage.

Below are some of the top AI stocks to consider buying now, followed by tips on how to invest in the space.

Seven AI stocks to buy in 2026

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Nvidia (NASDAQ:NVDA) | $4.4 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Alphabet (NASDAQ:GOOG) | $4.1 trillion | 0.24% | Interactive Media and Services |

| Alphabet (NASDAQ:GOOGL) | $4.1 trillion | 0.24% | Interactive Media and Services |

| Microsoft (NASDAQ:MSFT) | $3.1 trillion | 0.83% | Software |

| CoreWeave (NASDAQ:CRWV) | $44.9 billion | 0.00% | IT Services |

| Meta Platforms (NASDAQ:META) | $1.8 trillion | 0.30% | Interactive Media and Services |

| Adobe (NASDAQ:ADBE) | $111.6 billion | 0.00% | Software |

| Alibaba Group (NYSE:BABA) | $367.7 billion | 0.64% | Multiline Retail |

1. Nvidia

NASDAQ: NVDA

Key Data Points

2. Alphabet

NASDAQ: GOOGL

Key Data Points

NASDAQ: MSFT

Key Data Points

NASDAQ: CRWV

Key Data Points

NASDAQ: META

Key Data Points

6. Adobe

NASDAQ: ADBE

Key Data Points

NYSE: BABA

Key Data Points

AI technologies powering these companies

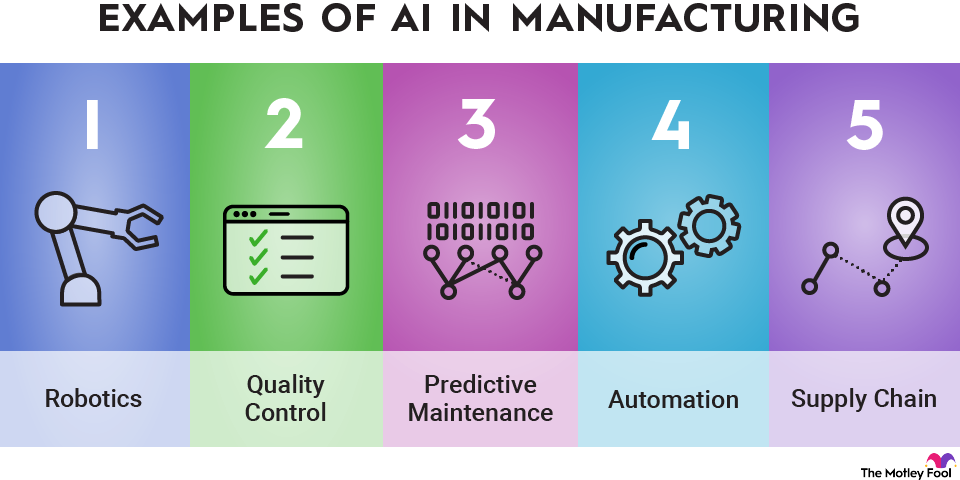

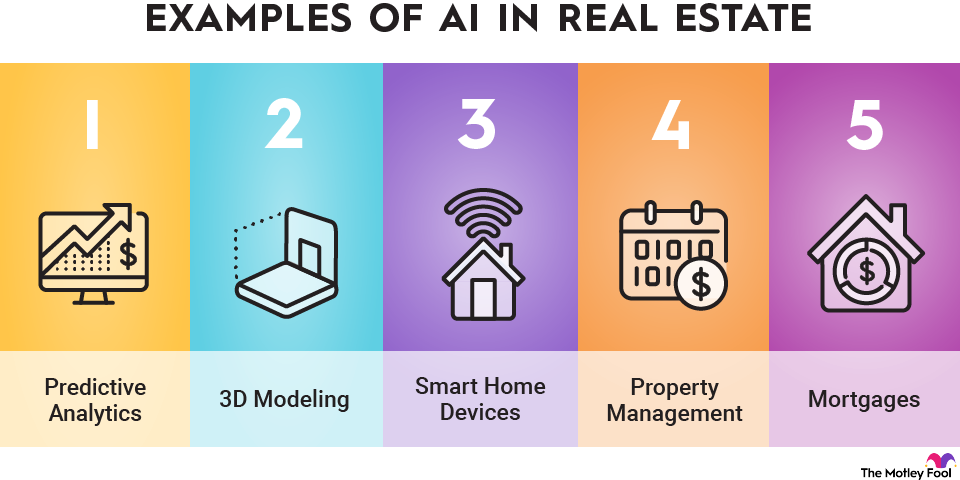

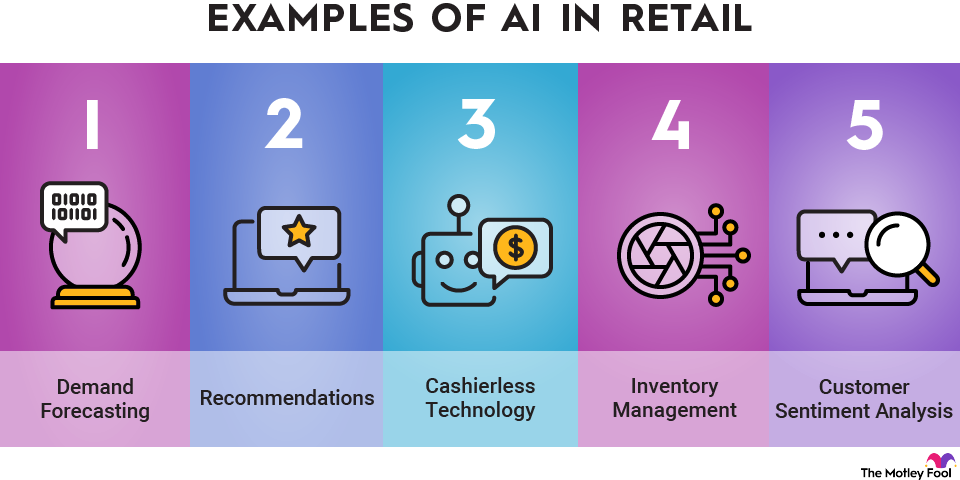

Most AI innovation across these stocks falls into a few core categories:

- Machine learning: Models trained on large datasets to identify patterns and make predictions.

- Deep learning: Advanced neural networks used in language models, image recognition, and autonomous systems.

- Generative AI: Tools that create text, images, video, or code in response to prompts.

Pros and cons of investing in AI stocks

Pros

- Significant long-term growth potential

- Broad adoption across industries

- Potentially transformative technology

Cons

- Valuations can be volatile

- Heavy capital spending may not pay off

- Competition and disruption remain intense

What to consider when investing in AI stocks

Investing in AI stocks requires a lot of the same analysis and considerations as investing in any stock. Here are some things to consider if you're investing in AI stocks.

Look for durable advantages

Most AI stocks are well-established tech companies, but some have stronger competitive advantages than others in AI. Nvidia, for example, dominates the market for data center GPUs, giving it a strong competitive advantage.

Understand the business model

There are lots of different ways to make money in AI. There are chip companies like Nvidia, infrastructure companies like CoreWeave, software companies like Adobe, and companies like Microsoft that are diversified across verticals. Each one of these subsectors offers a different set of risks and opportunities, and it's important to understand how they differ from each other.

Assess AI exposure

Most tech stocks are doing something with AI, but some companies have more exposure than others. Nvidia and CoreWeave, for example, are virtually pure-play AI stocks, making most of their revenue directly by powering AI. Meta, on the other hand, makes almost all of its revenue from advertising, though it says that AI has enhanced its advertising product.

The bottom line

AI is already translating into real revenue and sustained investment, and the strongest opportunities in 2026 are coming from the companies building and deploying AI at scale.

If you’re investing in AI stocks, a long-term mindset and diversification across several leaders can help balance growth potential with risk.