Investing refers to the practice of putting your money into an asset with the goal of making more money. To name a few examples, buying stocks, investing in a rental property, and even putting money into a certificate of deposit at your bank are all forms of investing.

When done the right way, investing can be an extremely reliable way to build wealth over time. But how should you get started? What is the best way for you to put your money to work?

If you're a new investor, or an experienced one who wants to invest better, we're here for you. It's time to make your money work for you.

Before you put your money into the stock market or other investments, you'll need a basic understanding of how to invest your money the right way. Unfortunately, there's no one-size-fits-all answer here.

The best way to invest your money is the way that works best for you. To figure that out, you'll want to determine your investing style, budget, and risk tolerance. So, let's briefly take those one at a time.

Why is investing important?

Why is investing important?

There are more reasons why investing is important that we can realistically list here. But to name some of the most important:

- Build wealth: Investing -- especially in the stock market -- can be an extremely reliable way to grow your money over the long term.

- Achieve financial freedom: Investing can help you be prepared for whatever life throws at you and to retire on your own terms.

- Preserve your spending power: If you put your money under your mattress (or in a low-paying savings account), it will actually be worth less over time, thanks to inflation. There are low-risk investments that can reliably help you keep up with, or outpace, inflation.

Now, let's get to the steps you'll need to take to invest money the right way.

How to invest

How to invest money

- Identify your investing style.

- Determine your budget for investing.

- Assess your risk tolerance.

- Decide what to invest your money in.

Investing style

1. Your investing style

How much time do you want to put into investing your money?

The investing world has two major camps when it comes to how to invest money: active investing and passive investing. Neither is a clear winner.

Both can be great ways to build wealth as long as you focus on the long term and aren't just looking for short-term gains, but your lifestyle, budget, risk tolerance, and interests might give you a preference for one type.

Active investing

Active investing means taking time to research your investments and constructing and maintaining your portfolio on your own. In simple terms, if you plan to buy and sell individual stocks through an online broker, you're planning to be an active investor. To successfully be an active investor, you'll need three things:

- Time: You'll need to research stocks, perform some basic investment analysis, and keep up with your investments after you buy them.

- Knowledge: All the time in the world won't help if you don't know how to analyze investments and properly research stocks. While you don't need a mathematics degree to be an effective investor, you should at least be familiar with some of the basics of analyzing stocks before you invest.

- Desire: Many people simply don't want to spend hours on their investments or learn how to analyze stocks. And there's absolutely nothing wrong with that.

It's also important to understand what we don't mean by active investing. Active investing doesn't mean buying and selling stocks frequently, it certainly doesn't mean day trading, and it doesn't mean buying stocks because you think they will go up over the next few weeks or months.

Passive investing

Passive investing is the equivalent of an airplane on autopilot. You'll still get good results over the long run with nothing more than some occasional maintenance or adjustments. In a nutshell, passive investing involves putting your money to work in investment vehicles where someone else does the hard work.

Mutual fund investing is an example of this strategy, as are exchange-traded funds (ETFs). Alternatively, you can hire a financial or investment advisor or use a robo-advisor to design and implement an investment strategy on your behalf.

Passive investing

More simplicity, more stability, more predictability

- A hands-off approach

- Moderate returns

- Tax advantages

Active investing

More work, more risk, more potential reward

- Investing yourself (or through a portfolio manager)

- Lots of research

- Potential for huge, life-changing returns

Budget

2. Your budget

How much money do you have to invest?

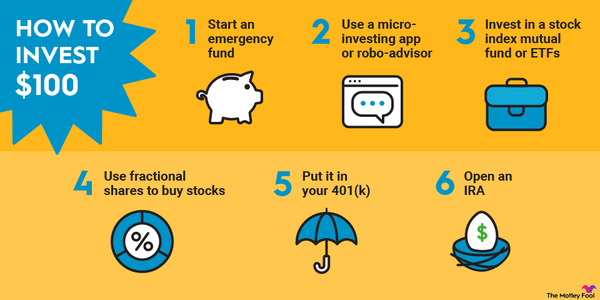

You may think you need a large sum of money to start a portfolio, but you can begin investing with $100. We also have great ideas for investing $1,000.

In fact, many of today's stock trading platforms will let you get started with as little as $1.

Here's the point: The amount of money you're starting with isn't the most important thing. The big question is whether you're financially ready to invest and to invest frequently over time.

One important step to take before investing is to establish an emergency fund. This is cash set aside in a form, such as a savings account, that makes it available for quick withdrawal.

Most investments, whether stocks, mutual funds, or real estate, have some level of risk. You never want to be forced to sell, or divest, these investments in a time of need. The emergency fund is your safety net to avoid this.

Divest

It's also smart to get rid of any high-interest debt (like credit cards) before investing.

Think of it this way: The stock market has historically produced returns of 9% to 10% annually over long periods, depending on the time frame you're viewing. If you invest your money at these types of returns and pay your creditors 24% interest (roughly the average credit card interest rate in July 2025), you'll put yourself in a position to lose money over the long run, even if your investments perform well.

Risk tolerance

3. Your risk tolerance

How much financial risk are you willing to take?

Not all investments are successful. Each type of investment has its own level of risk, but this risk is often correlated with returns.

It's important to find a balance between maximizing the returns on your money and finding a comfortable risk level. For example, high-quality bonds, such as Treasury bonds, offer predictable returns with very low risk. But they also have relatively low returns (between 3.8% and 4.9% as of July 2025), depending on the maturity term you choose and the current interest rate environment.

By contrast, stock returns can vary widely depending on the company and time frame. However, the overall stock market has historically produced average returns of almost 10% per year.

There can be huge differences in risk, even within the broad categories of stocks and bonds. For example, Treasury bonds or AAA-rated corporate bonds are very low-risk investments. However, they pay relatively low interest rates. Savings accounts represent an even lower risk but offer less reward. On the other hand, a high-yield bond can produce greater income but will come with a greater risk of default.

Interest Rate

In the world of stocks, the spectrum of risk between blue chip stocks, like Apple (AAPL 0.07%), and penny stocks is enormous. One good solution for beginners is to use a robo-advisor to formulate an investment plan that meets your risk tolerance and financial goals.

In a nutshell, a robo-advisor is a service offered by a brokerage. It will construct and maintain a portfolio of stock- and bond-based index funds designed to maximize your return potential while keeping your risk level appropriate for your needs.

What to invest in

4. What should you invest your money in?

How do you decide where to invest your money?

This is a tough question; unfortunately, there isn't a perfect answer. The best type of investment for you depends on your investment goals and risk tolerance. But with the guidelines discussed above in mind, you should be far better positioned to decide what to invest in.

For example, if you have a relatively high risk tolerance, along with the time and desire to research individual stocks (and learn how to do it right), that could be the best way to go. If you have a low risk tolerance but want higher returns than you'd get from a savings account, bond investments (or bond funds) might be more appropriate.

If you're like most Americans and don't want to spend hours on your portfolio, putting your money in passive investments like index funds or mutual funds can be a smart choice. And if you really want to take a hands-off approach, a robo-advisor could be right for you.

Related investing topics

The bottom line

The bottom line on investing

Investing money may seem intimidating, especially if you've never done it before. However, if you figure out how you want to invest, how much money you should invest, and your risk tolerance, you'll be well positioned to make smart decisions with your money that will serve you well for decades to come.

FAQ

How to invest money FAQ

How do I start investing money?

Before you start investing money, you need to determine your budget and risk tolerance. That is, are you willing to take on more risk for the potential of superior returns, or is your main priority to make sure you don't lose money?

Then, you can determine your investment style and decide whether you should buy individual stocks or use passive investment vehicles like exchange-traded funds (ETFs) or mutual funds. Once you've decided on all that and done some investment research, you can open a brokerage account and get started.

How long should I invest for?

The time horizon of your investment depends on your goals. For example, if you plan to use the money to put your kids through college in a few years, you'll have a different length than if you're investing for retirement in a few decades.

How can I start investing with little money?

You don't need much money to get started with investing. Some of the top stock trading platforms will let you get started with as little as $1, and if they offer fractional share investing, you can put your money to work immediately.

How do I invest my money to make money?

There are many ways you can invest money, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), certificates of deposit (CDs), savings accounts, and more. The best option for you depends on your particular risk tolerance and financial goals.

How can a beginner make money investing?

There are several beginner-friendly ways to invest. You can open a brokerage account and buy passive investments like index funds and mutual funds. Another (even easier) option is to open an account with an automated investing app -- also known as a robo-advisor -- which will use your money to create an appropriate portfolio of investments.

Where can you invest money to get good returns?

Over time, the stock market has produced annualized returns of 9% to 10%, although performance can vary dramatically from year to year. On the other hand, fixed-income investments, like bonds, have historically generated 4% to 6% per year but with far less volatility.

How can I invest $1,000 to make more money?

There are plenty of ways to invest $1,000 to make more money. If you don't want to spend a ton of time researching and planning investments, opening an account with a robo-advisor (an automated investment platform) or buying ETFs or mutual funds could be a smart way to go.

Alternatively, if you want to own individual stocks, $1,000 can be enough to create a diversified portfolio. That's especially true if your broker allows you to buy fractional shares of stock.