The technology sector is vast, comprising gadget makers, software developers, wireless providers, streaming services, semiconductor companies, and cloud computing providers, to name just a few. Any company that sells a product or service heavily infused with technology likely belongs to the tech sector.

What are tech stocks?

What are tech stocks?

Hardware Companies

These design and build devices such as:

- Personal computers

- Networking servers

- Semiconductors

- Smartphones

- Fitness trackers

- Smart speakers

- Enterprise equipment, such as servers and networking gear

Software Companies

These design the software that runs on hardware, such as:

- Operating systems

- Databases

- Cybersecurity software

- Productivity software

- Cloud computing providers

- Artificial intelligence (AI)

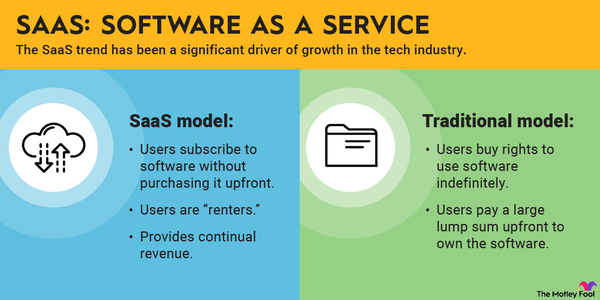

Software companies are increasingly moving to a software-as-a-service (SaaS) model in which customers buy a subscription to a program instead of a one-time license. The arrangement generates recurring revenue for the software company.

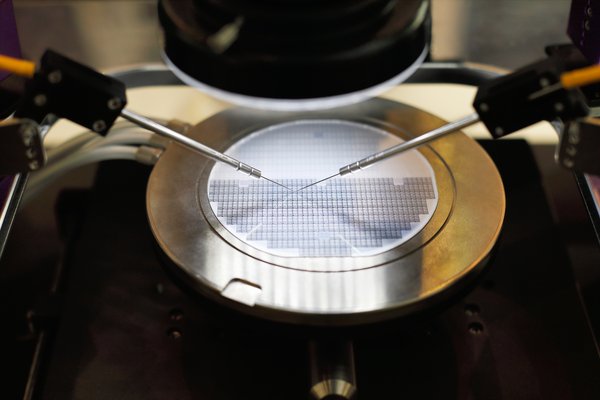

Semiconductor chips largely power the hardware. Semiconductor companies design and/or manufacture central processing units, graphics processing units (GPUs), memory chips, and a wide variety of other chips that help to run today's devices.

Telecom companies that provide wireless services support the tech sector, but actually belong to the communications sector; so do the video streaming companies that provide easy access to high-quality content, and the cloud computing providers that power those streaming services.

Our list of stocks

The best tech stocks in 2025

Many of the most valuable companies in the world are technology companies. Here are three of the most dominant and largest tech stocks that investors should consider:

Microsoft (MSFT -0.01%) is a dominant software company known for its Windows PC operating system and Office productivity software. Microsoft is also the second-largest provider of cloud infrastructure.

Apple (AAPL -1.12%) makes the iPhone, iPad, and Mac computers. Intense customer loyalty ensures plenty of repeat customers, and a growing array of services makes Apple's ecosystem sticky.

Nvidia (NVDA -0.46%) is the premier manufacturer of semiconductors and advanced GPUs critical for not only gaming, but also for AI applications.

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META) are not technically tech stocks, despite often being lumped in with them.

These stocks actually belong to the communications (Meta and Alphabet) and consumer discretionary sectors (Amazon), despite their tech-heavy products and services.

The current market

Tech stocks in the current market

Technology stocks, as tracked by the Technology Select Sector SPDR Fund (XLK -0.08%), which follows S&P 500 technology stocks, have strongly outperformed over the past five years.

While market conditions had favored high-beta assets like tech stocks, which enjoyed magnified returns in the generally bullish market environment, the market turned bearish in early 2025. Through the first two months of the year, the S&P 500 and Nasdaq-100 dipped 1.4% and 0.5%, respectively.

Several macroeconomic factors have contributed to this underperformance. Inflation appears to be cooling, but consumer spending waned at the start of 2025, a sign that many interpret as a harbinger of a market downturn.

During times like these, growth stocks, including technology companies, become less appealing to investors, who instead turn to more conservative options such as stocks in the utilities and consumer staples sectors.

Despite the recent underperformance of the tech sector, the market remains keenly focused on tech stocks that have a focus on artificial intelligence (AI). Multiple companies have committed to accelerating their AI spend or are in the process of commercializing more AI products. Here are a few highlights:

- Nvidia: Nvidia has seen massive increases in quarterly revenue, largely driven by data center revenue for generative AI training and inference. In the fourth quarter of 2025, for example, Nvidia reported record quarterly data center revenue of $35.6 billion, a year-over-year increase of 93%. Nvidia's GPUs are at the forefront of the AI revolution, making it a key player in the tech sector.

- Microsoft: Microsoft has reported double-digit growth in revenue, operating income, net income, and diluted earnings per share (EPS). This growth is largely attributed to the integration and use of AI in its products, such as Copilot which is driving stronger AI integration and increased usage of Microsoft Cloud, including Azure and Intelligent Cloud. Microsoft returned $9.7 billion to shareholders in the form of share repurchases and dividends in the second quarter of fiscal year 2025.

- Apple: In February 2025, Apple announced its plan to spend $500 billion developing projects located in the United States over the next four years, including development of an advanced manufacturing facility in Houston. Expected to open in 2026, the Houston facility will produce servers that support the company's AI initiative, Apple Intelligence.

Related investing topics

Analyzing tech stocks

How to analyze tech stocks

For mature tech companies that produce profits, the price-to-earnings ratio is a useful metric. Divide stock price by per-share earnings, and you get a multiple that tells you how highly the market values the company's current earnings. The higher the multiple, the more value the market is placing on future earnings growth.

Many tech companies aren't profitable, so the price-to-earnings ratio isn't a good metric to evaluate them. Revenue growth matters more for younger companies. If you're investing in something unproven, you want to make sure it has solid growth prospects.

For unprofitable tech companies, it's also important that the bottom line be moving from losses toward profits. As a company grows, it should become more efficient, especially when it comes to the sales and marketing spending necessary to close deals. If it's not, or if spending is growing as a percentage of revenue, that could indicate something is wrong.

Ultimately, a good tech stock is one that trades at a reasonable valuation, given its growth prospects. Accurately figuring out those growth prospects is the hard part. If you expect earnings to skyrocket in the coming years, paying a premium for the stock can make sense. But if you're wrong about those growth prospects, your investment may not work out.

Investing in an exchange-traded fund (ETF) that focuses on tech stocks is one way to avoid making mistakes. The iShares Expanded Tech Sector ETF (IGM 0.29%) is a comprehensive option at a 0.41% expense ratio.

Investing in tech stocks can be risky, but you can reduce your risk by investing only when you feel confident their growth prospects justify their valuations.