Computers excel at crunching numbers but struggle with tasks that many people do with ease, like language processing, visual perception, object manipulation, reasoning, planning, and learning. Artificial intelligence (AI), including its offshoots of deep learning and machine learning, uses computers to perform tasks that typically require human intelligence, such as language generation and facial recognition.

AI stocks are publicly traded companies that develop or employ AI technology as part of their business. AI stocks span sectors such as semiconductors, software, robotics, and even beyond technology, representing companies that are using AI in ways that set them apart from their peers.

How do companies use artificial intelligence?

Companies use AI in a number of ways. Keep reading to see some of the biggest ones below.

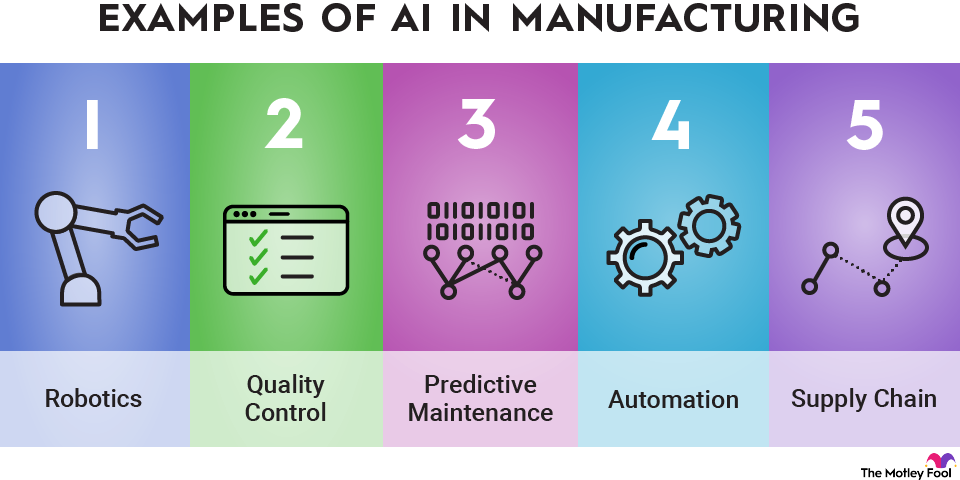

- Machine learning: Training a machine using vast amounts of data so it can make inferences from data it hasn't seen.

- Robotics: Machines that can move and act without human intervention

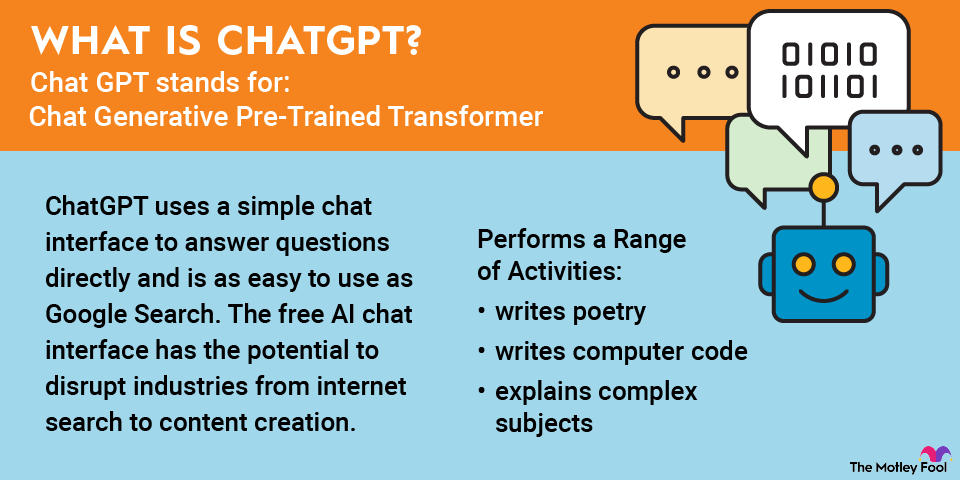

- Generative AI: Creating text, images, and video, typically in response to a prompt from a human.

- Autonomous vehicles: Cars that can drive without human assistance.

- Neural networks: A kind of AI that attempts to mimic the human brain. It's a fundamental technology for AI skills like natural language processing, image recognition, and predictive analytics, and it also forms the basis of deep learning.

- Agentic AI: Agents based on artificial intelligence that can carry out work tasks such as customer service without being prompted.

Seven AI stocks to buy in 2025

| Company name | Company ticker | Current price | Industry |

|---|---|---|---|

| Nvidia | NASDAQ:NVDA | $180.00 | Semiconductors and Semiconductor Equipment |

| Alphabet | NASDAQ:GOOG | $252.16 | Interactive Media and Services |

| Alphabet | NASDAQ:GOOGL | $251.32 | Interactive Media and Services |

| Microsoft | NASDAQ:MSFT | $520.26 | Software |

| CoreWeave | NASDAQ:CRWV | $121.81 | IT Services |

| Meta Platforms | NASDAQ:META | $732.77 | Interactive Media and Services |

| Adobe | NASDAQ:ADBE | $355.20 | Software |

| Alibaba Group | NYSE:BABA | $165.89 | Multiline Retail |

1. Nvidia

NASDAQ: NVDA

Key Data Points

2. Alphabet

NASDAQ: GOOGL

Key Data Points

NASDAQ: MSFT

Key Data Points

NASDAQ: CRWV

Key Data Points

NASDAQ: META

Key Data Points

NASDAQ: ADBE

Key Data Points

NYSE: BABA

Key Data Points

Pros and cons of investing in AI stocks

Investing in AI stocks has gotten popular given the growth in the sector. Let's take a look at the pros and cons related to these stocks.

Pros of investing in AI stocks

- There's a lot of growth potential.

- Momentum is building.

- Valuations still look reasonable.

- The technology could be as disruptive as the internet.

Cons of investing in AI stocks

- A bubble could be forming in AI.

- It's unclear if the capex spending is justified.

- AI stocks are getting riskier as they get more expensive.

- Most new technologies experience a crash at some point.

AI is a growth business

According to International Data Corporation, the global artificial intelligence market is expected to grow from $235 billion in 2024 to more than $631 billion in 2028. While the AI market is already large and continues to grow rapidly, plenty of companies can still profit from AI. Although picking stocks in a growth industry comes with a lot of uncertainty, these top AI stocks are all worth considering.