You probably interact with artificial intelligence (AI) more often than you think. AI is powering the algorithm arranging your Netflix (NFLX 1.3%) menu, the software expediting your Amazon (AMZN 2.66%) package, and the brains behind many smartphone apps you use every day.

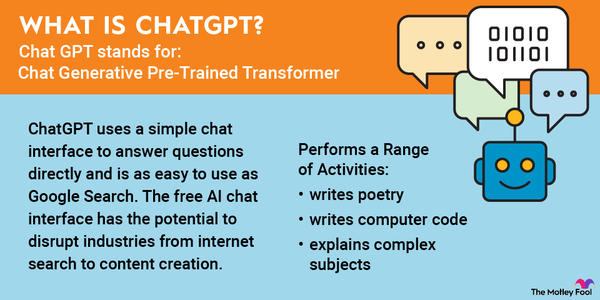

If you've used ChatGPT, the OpenAI chatbot that has wowed users by writing code and instantly answering complex questions or a similar chatbot, then you've glimpsed into the next frontier in AI, known as generative AI. Big tech companies, including Alphabet's (GOOG 2.3%) (GOOGL 2.7%) Gemini and Meta Platforms' (META 1.04%) Meta AI, have developed AI chatbots and other generative AI technologies. Meta reported that Meta AI had 1 billion active users by early 2025.

Artificial Intelligence

If you want portfolio exposure to AI companies but don't want to identify individual AI stocks, investing in an AI-focused exchange-traded fund (ETF) is a good option. AI ETFs provide exposure to a broad range of the best AI companies, so you don't need to research and choose individual stocks on your own.

Best AI ETFs

Best AI ETFs to buy in 2025

| AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

| Global X Artificial Intelligence and Technology ETF (NASDAQ:AIQ) | $3.21 billion | 0.68% |

| Global X Robotics and Artificial Intelligence ETF (NASDAQ:BOTZ) | $2.34 billion | 0.68% |

| Robo Global Robotics and Automation Index ETF (NYSEMKT:ROBO) | $905.9 million | 0.95% |

| iShares Future AI and Tech ETF (NYSEMKT:ARTY) | $788.1 million | 0.47% |

| First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ:ROBT) | $424 million | 0.65% |

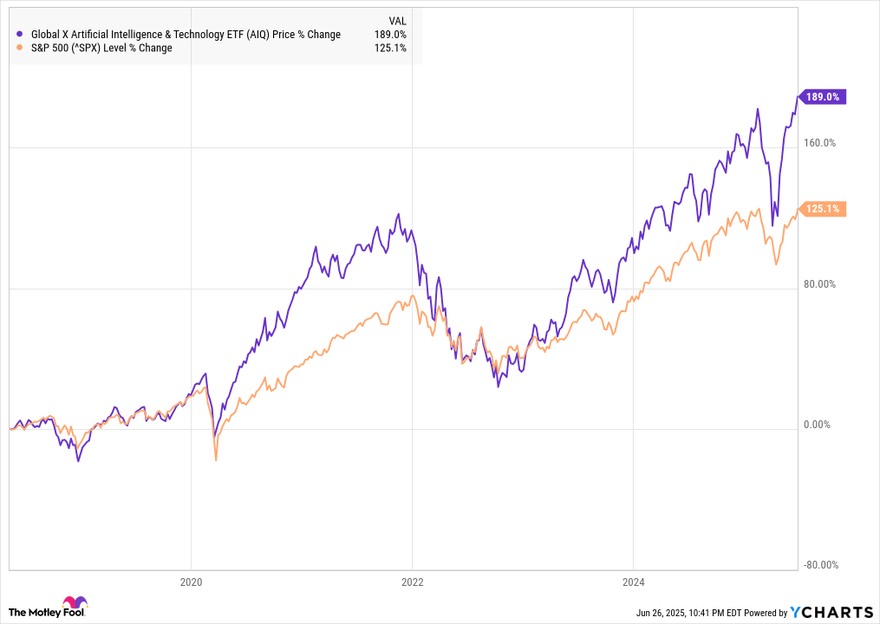

1. Global X Artificial Intelligence and Technology ETF

1. Global X Artificial Intelligence and Technology ETF

The Global X Artificial Intelligence and Technology ETF (AIQ -0.14%) is the largest AI ETF and a good first choice for investors looking for an AI ETF.

The ETF started in 2018 and aims to invest in companies that can benefit from the development of AI technology, as well as companies that make hardware facilitating the use of AI. According to Global X, the global artificial intelligence market is expected to grow from $184 billion in 2024 to $826.7 billion in 2030.

The ETF has 86 stocks, and the biggest holdings will be familiar to most investors. As of mid-2025, the top five holdings accounted for roughly 18% of the fund:

- Tencent (TCEHY -0.29%): The Chinese tech giant is best known as the owner of WeChat, the superapp that does everything from payments to messaging to entertainment, which is a focus of its AI investments. Tencent is also a prolific investor in other tech companies in the region.

- Netflix: The leading video streamer has long used machine learning for its recommendation engine, and it also uses to help choose what content to create and to improve streaming quality.

- Palantir (PLTR -9.04%): Palantir has been one of the best-performing AI stocks thanks largely to its AI Platform, a software layer that allows its customers to apply generative AI tools to Palantir's deep data analytics software suite.

- Samsung (SSNL.F 9.01%): The Korean tech giant is the world's No. 2 chipmaker and well-known for devices like smartphones. It's introduced AI features like live translate and chat assist to help users write messages.

- Oracle (ORCL -1.21%): Oracle is capitalizing on the AI boom through its cloud infrastructure business, which has seen rapid growth thanks in part to its reputation for data security and database management.

As you can see from the chart below, this Global X ETF has outperformed over its history, likely with the help of stocks like Netflix and Palantir that have soared lately.

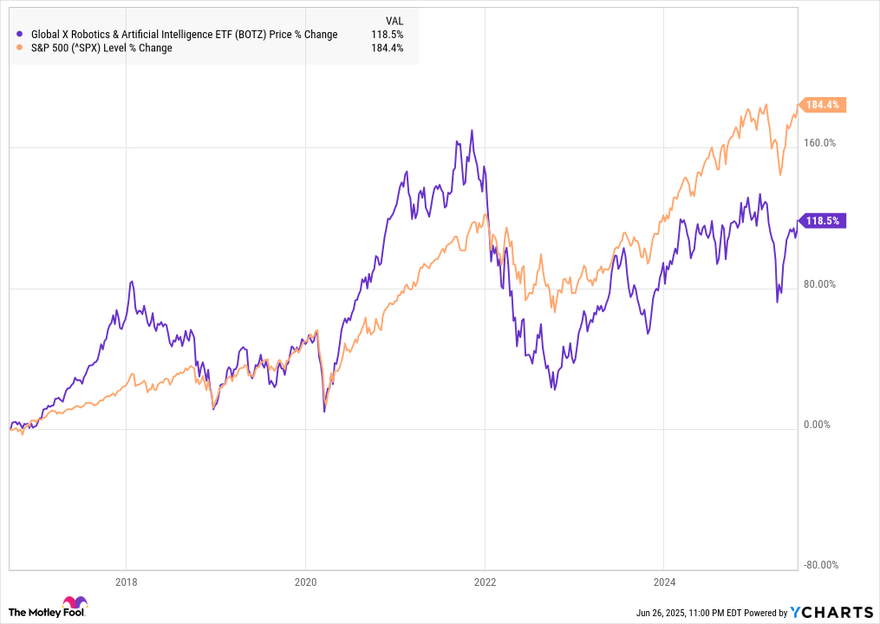

2. Global X Robotics and Artificial Intelligence ETF

2. Global X Robotics and Artificial Intelligence ETF

Established in 2016, the Global X Robotics and Artificial Intelligence ETF (BOTZ 0.99%) is similar to the Global X Artificial Intelligence and Technology ETF, but with a focus on robotics. It's a fund that invests in "companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence." This includes enterprises working in industrial robotics, automation, nonindustrial robots, and autonomous vehicles. According to Global X, the global robotics market was valued at more than $80 billion in 2022 and could grow to $280 billion by 2032.

The ETF held 50 stocks in mid-2025. Accounting for about 41% of the fund's assets, its top five holdings were:

- Nvidia (NVDA 1.74%): This semiconductor maker's chips are used in a wide variety of applications -- including autonomous vehicles, virtual computing, and cryptocurrency mining -- and are central to many AI technologies.

- ABB (ABBN.Y -0.29%): This Swiss company makes industrial automation and robotics products used in utilities and infrastructure.

- Intuitive Surgical (ISRG -0.09%): This company makes the da Vinci robotic surgical system, which allows for minimally invasive surgeries with precise control.

- Keyence (KYCCF 1.62%): This Japanese company makes factory automation products, such as sensors and scanners.

- Fanuc (FANUY 1.72%): This Japanese maker of factory automation products includes motors, lasers, and robots in its product lineup.

As the chart below shows, shares of the ETF have underperformed the S&P 500 index since its 2016 launch. The share price fell sharply in 2022 in line with the broad sell-off in tech stocks, although it has rebounded since then.

The ETF offered a modest dividend yield of 0.14% in early 2025, but it is better suited as a growth-oriented investment. It's an actively managed fund with an expense ratio of 0.68%, which is higher than what you'd pay for most index funds.

Exchange-Traded Fund (ETF)

3. Robo Global Robotics and Automation Index ETF

3. Robo Global Robotics and Automation Index ETF

The Robo Global Robotics and Automation Index ETF (ROBO 1.01%) focuses on companies driving "transformative innovations in robotics, automation, and artificial intelligence." This ETF invests in companies primarily focused on AI, cloud computing, and other technology companies.

Cloud Computing

The ETF holds 76 stocks, with no single holding accounting for more than 3.5% of the ETF's value. Its top five holdings comprise only about 10% of the fund's total value. In mid-2025, major holdings included Fanuc and four others:

- Ambarella (AMBA -3.23%): A maker of semiconductors, including system-on-a-chip (SoC) components, Ambarella is focusing on edge AI, or making AI run on edge devices like smartphones.

- Celestica (CLS 1.68%): The tech company provides services like design, manufacturing, and logistics, and its components are used for AI infrastructure.

- Novanta (NOVT 2.0%): A maker of high-precision components like lasers, AI-powered collaborative robots and warehouse automation systems.

- Symbotic (SYM 0.24%): A tech company that makes software and robotics for warehouses, including end-to-end systems for automation.

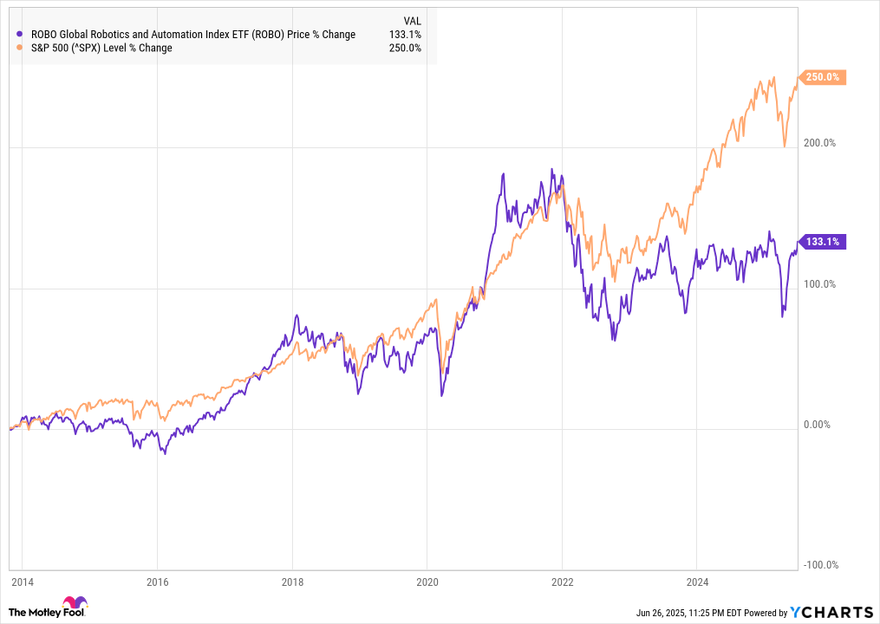

Since its inception in 2013, the Robo Global Robotics and Automation Index ETF has underperformed the S&P 500, as the chart below shows. It trails the broad market index, with dividends factored into the return. The ETF pays a dividend yield of 0.6%, and its expense ratio is 0.95%.

4. iShares Future AI and Tech ETF

4. iShares Future AI and Tech ETF

The iShares Future AI and Tech ETF (ARTY -0.17%), formerly traded under the ticker IRBO, aims to track the results of an index of developed and emerging market companies that could benefit from long-term opportunities in robotics companies and AI. The ETF was formed in 2018 and has less than $1 billion in assets under management.

With 49 stock holdings, it's now well diversified. Many of its top holdings also give investors exposure to fast-growing small-cap companies. The fund's top five investments as of mid-2025 accounted for about 25% of the ETF's assets and included Nvidia and:

- Advanced Micro Devices (AMD 0.09%): The chipmaker is best known for making chips for PCs and gaming platforms, but investors have hoped it would break into AI with its MI300 accelerator. However, the company has struggled to gain market share.

- Vertiv Holdings (VRT 3.0%): A maker of infrastructure technologies for data centers, communication networks, and industrial applications, its systems help manage power supply, cooling, and monitoring.

- Broadcom (AVGO -0.3%): A semiconductor giant best known for its prowess in areas like networking and custom chips, Broadcom is seen as a winner in AI. The company has also grown by acquisitions over the years, taking over VMware in November 2023.

- Super Micro Computer (SMCI -3.43%): Supermicro, as the company is also known, makes servers and is well-regarded as a leader in AI servers and for its close relationship with Nvidia.

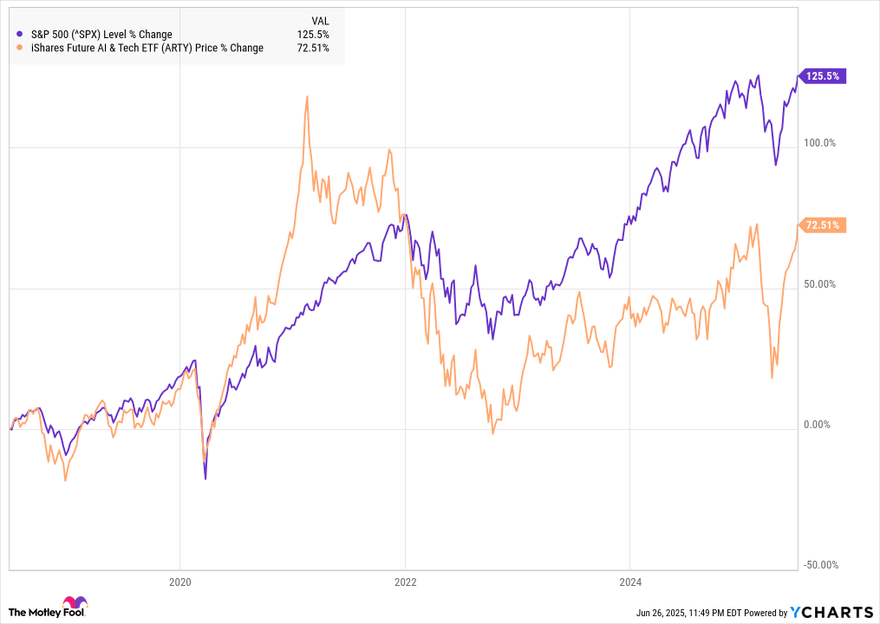

As you can see from the chart below, the ETF has underperformed the S&P 500 since its founding. The ETF fell in 2022 when tech stocks crashed.

The expense ratio is competitive at 0.47%, and the trailing-12-month yield in April 2025 was 0.51%. The fund's performance will likely be heavily influenced by the overall performance of cloud and chip stocks since they're the largest areas of exposure for the fund.

5. First Trust Nasdaq Artificial Intelligence and Robotics ETF

5. First Trust Nasdaq Artificial Intelligence and Robotics ETF

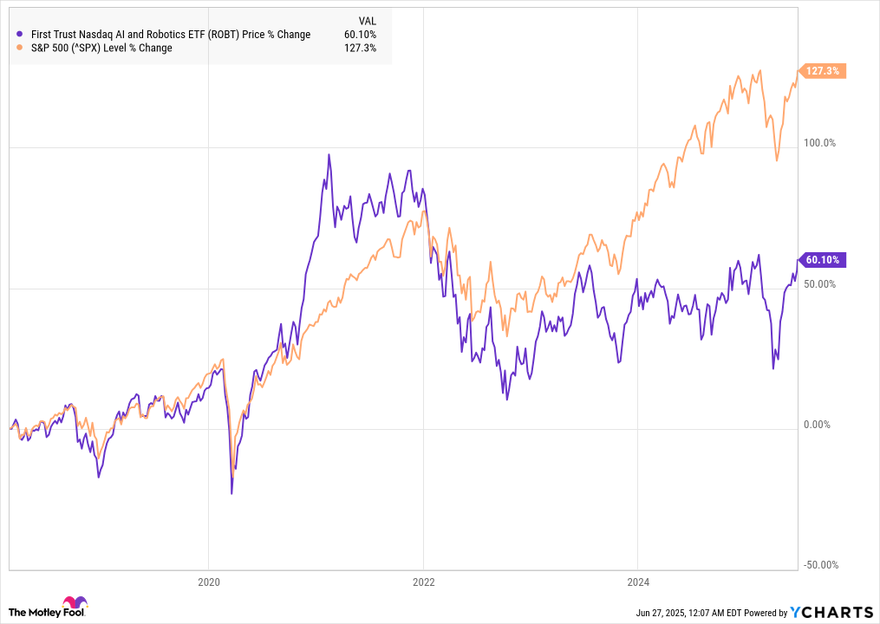

The First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT 0.12%) tracks the Nasdaq CTA Artificial and Robotics index, which comprises companies engaged in AI and robotics in technology, industrials, and other sectors. The fund currently holds 101 stocks. Top holdings in mid-2025 were Ambarella, Symbotic and three others:

- Upstart Holdings (UPST 0.13%): This lending platform uses AI to model creditworthiness to improve default and approval rates.

- AeroVironment (AVAV 2.11%): A company manufactures unmanned aircraft systems, as well as tactical missile systems, and logistics, support, and engineering services.

- Recursion Pharmaceuticals (RXRX -7.04%): This clinical-stage biotech company uses AI and machine learning for drug discovery with focus on rare diseases. Its Recursion OS platform is at the center of its technology.

Related investing topics

Should I buy?

Should I buy AI ETFs?

The best way to decide which ETF to buy is to consider which stocks a fund holds and how many are true AI companies. A fund's expense ratio, dividend yield, and past performance are also important, and you can opt to invest in a basket of all five of these AI ETFs to maximize your diversification.

Over time, AI will grow smarter and play a greater role in our daily lives. Already, AI represents a global market worth hundreds of billions of dollars, and its wide range of practical applications includes face recognition, predictive algorithms in internet search, smart-home devices, and autonomous vehicles. So, pay attention to the AI market now, and you may find yourself reaping the rewards in years to come.

FAQs

Investing in artificial intelligence ETFs: FAQs

Which ETF is best for AI?

AI investors have several options in ETFs. The best-known of the AI ETFs above is Global X Artificial Intelligence and Technology ETF, which holds a number of well-known AI stocks, including Netflix and Palantir. AI investors may also want to consider an ETF that tracks the Nasdaq-100, such as the Invesco QQQ ETF (NASDAQ: QQQ), because big tech companies with exposure to AI make up almost half of the fund.

Does Vanguard have an AI ETF?

Vanguard does not currently offer an AI-focused ETF. However, the asset manager offers an information technology ETF that includes several AI stocks.

What is the best AI to invest in?

Nvidia is currently the best-known AI stock and has also been the most successful stock in AI. Past performance does not guarantee future returns, but it makes sense to invest in ETFs with exposure to Nvidia and other AI chip stocks as they emerge.

Does Charles Schwab have an AI ETF?

Charles Schwab (NYSE: SCHW) does not have an AI ETF. However, the brokerage firm does have an AI "theme" that contains as many as 25 AI stocks that Schwab account holders can buy together, based on Schwab's proprietary algorithms and research.

What ETF has the highest exposure to AI?

There's no simple answer to which ETF has the most exposure to AI, but of the five ETFs above, the iShares Future AI and Tech ETF has the most direct exposure to stocks that have gained in the AI era, thanks to its ownership of companies like Nvidia, Broadcom, and Vertiv.