Best Cloud Computing Stocks of 2026 and How to Invest in Them

By Scott Levine – Updated Jan 27, 2026 at 10:08 AM EST | Fact-checked by Frank Bass

Key Points

- Cloud computing investment continues to grow, with a projected 21.2% CAGR till 2030.

- Top cloud stocks include Amazon AWS, Microsoft Azure, and Google Cloud, among others.

- Generative AI is driving the next expansion phase in cloud computing.

Loading paragraph...

Loading paragraph...

Loading ticker_table...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading company_card...

Loading paragraph...

Loading paragraph...

Loading paragraph...

Loading paragraph...

Loading hub_pages...

Loading paragraph...

Loading faq...

Scott Levine is a contributing Motley Fool stock market analyst covering energy, industrials, technology, and materials. He is also a high school English teacher and a small business owner. He holds a bachelor’s degree in English and creative writing from Binghamton University, a master’s degree in secondary education from Adelphi University, and an advanced certificate in school building leadership from CUNY Queens College. A crossword puzzle enthusiast, he has solved more than 3,100 New York Times puzzles with a 97% solve rate.

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, DigitalOcean, International Business Machines, Meta Platforms, Microsoft, Monday.com, Netflix, Nvidia, Oracle, Salesforce, ServiceNow, Snowflake, The Trade Desk, and Zoom Communications. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.

Stocks Mentioned

Amazon

NASDAQ: AMZN

$208.46

(-0.73%)-$1.54

Zoom Communications

NASDAQ: ZM

$72.64

(-1.76%)-$1.30

Monday.com

NASDAQ: MNDY

$71.12

(-2.09%)-$1.52

Alphabet

NASDAQ: GOOGL

$306.55

(-1.67%)-$5.21

Meta Platforms

NASDAQ: META

$653.56

(+0.83%)+$5.38

Salesforce

NYSE: CRM

$193.15

(-0.84%)-$1.64

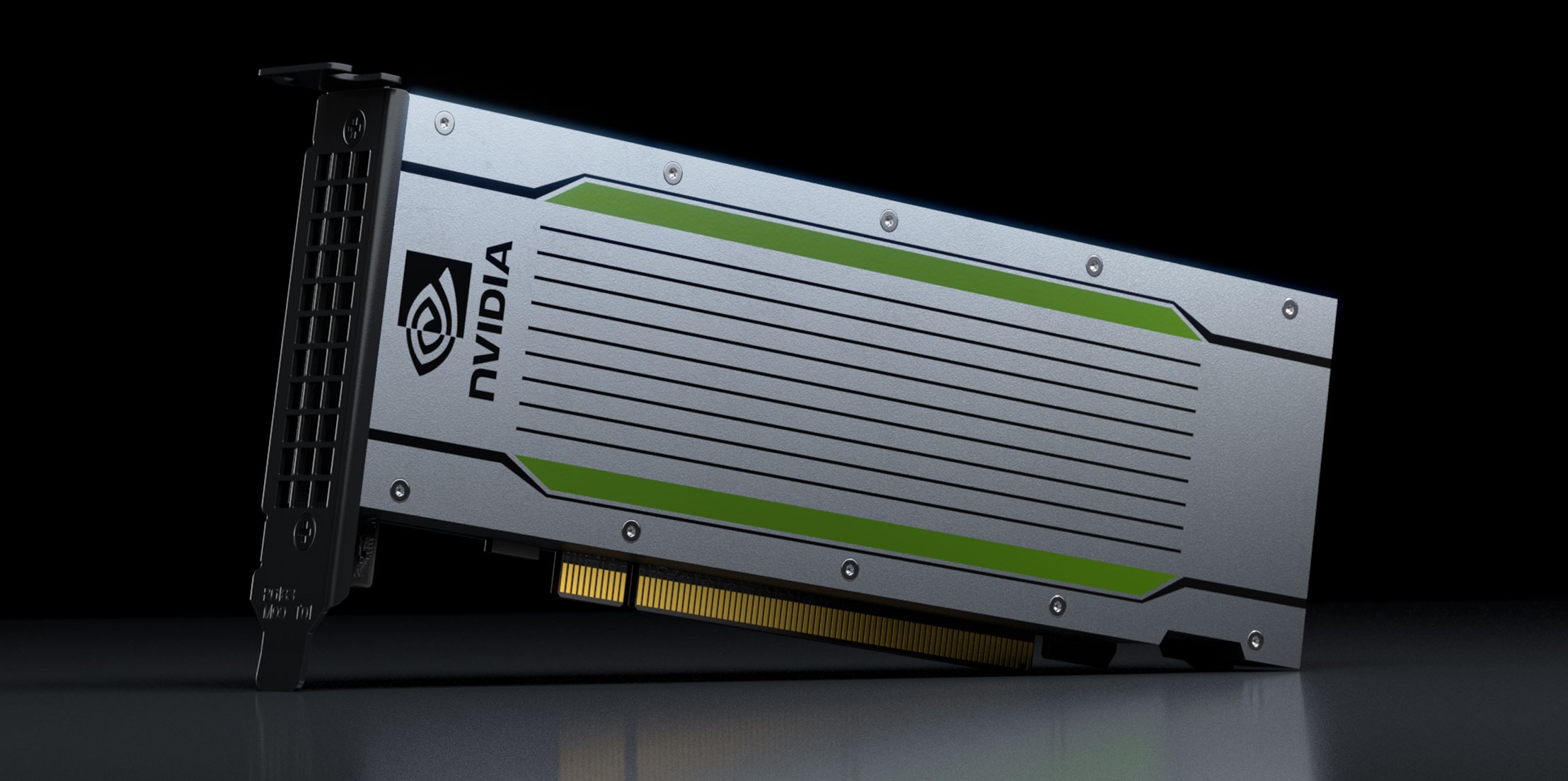

Nvidia

NASDAQ: NVDA

$182.57

(+3.04%)+$5.38

Adobe

NASDAQ: ADBE

$261.19

(-0.47%)-$1.22

The Trade Desk

NASDAQ: TTD

$24.27

(+1.89%)+$0.45

DigitalOcean

NYSE: DOCN

$58.45

(+4.26%)+$2.39

Oracle

NYSE: ORCL

$149.32

(+2.70%)+$3.92

International Business Machines

NYSE: IBM

$239.37

(-0.35%)-$0.84

Alphabet

NASDAQ: GOOG

$306.57

(-1.56%)-$4.86

Microsoft

NASDAQ: MSFT

$398.61

(+1.50%)+$5.87

Netflix

NASDAQ: NFLX

$97.14

(+0.93%)+$0.90

ServiceNow

NYSE: NOW

$109.60

(+1.47%)+$1.59

Snowflake

NYSE: SNOW

$170.12

(+1.01%)+$1.71

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.