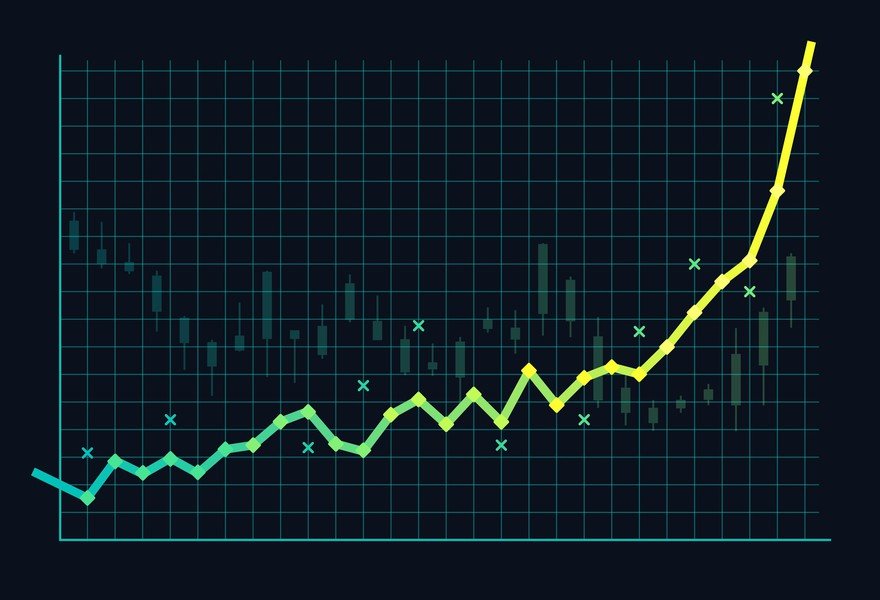

Some of the best investments over the past few years have been growth tech stocks. A growth tech stock is exactly what it sounds like -- the stock of a tech company enjoying rapid growth. Growth tech stocks tend to be comparatively expensive based on valuation metrics, and the companies aren't always profitable. A growth tech stock is highly valued for the company's ability to increase revenue and earnings quickly, and it tends to be more volatile than the market at large.

Growth stocks fell out of favor in 2022 as inflation, supply chain constraints, and worsening economic conditions collided with the sky-high valuations that many growth stocks achieved during the COVID-19 pandemic era. Growth stocks then came roaring back in 2023 and 2024, although they have seen some volatility in 2025.

Top growth tech stocks

Top growth tech stocks in 2025

There are many growth tech stocks to consider, but the best of the bunch have long track records of robust growth, massive profit potential, and major competitive advantages. The top growth tech stocks include Amazon (AMZN 0.3%), Microsoft (MSFT -0.01%), Nvidia (NVDA -0.46%), Palantir (PLTR 4.97%), Salesforce (CRM 0.53%), and Meta Platforms (META 0.46%).

1 - 3

1. Amazon

E-commerce and cloud computing giant Amazon is the premier growth tech stock. The company is dominant in online retail, with more than 200 million paying Amazon Prime members and an unrivaled selection of products and shipping speeds. More than half of the items sold are from third-party sellers who pay Amazon lucrative fees for access to its massive customer base.

The cloud computing business is even more impressive. Amazon Web Services (AWS) is wildly profitable, and it's the leading provider of public cloud infrastructure. AWS generated more than $107 billion in revenue last year, and it's still growing at a strong double-digit pace.

Amazon's advertising segment has also maintained robust growth. The company generated almost $56 billion in high-margin ad services revenue last year, and it's the fastest-growing segment of the company.

While Amazon has many strengths, the company has had to contend with some headwinds in recent years. There's more competition than ever in the cloud computing business, and companies looking to save money are starting to take a hard look at their cloud computing bills. On the retail side, inflation is putting pressure on consumers and affecting their purchasing behavior.

Despite these challenges, Amazon has two dominant businesses that will likely remain dominant for the foreseeable future. While growth may go through periods of unevenness, things should pick back up as the overall economic environment improves and tailwinds from artificial intelligence (AI) accelerate.

2. Microsoft

Microsoft has a lot going on. The software giant has a lock on the PC market with its Windows OS; it dominates the productivity software market with Office; it sells devices and the Xbox gaming console; and its Azure cloud platform is the second-largest behind Amazon Web Services.

Microsoft is thriving, and robust demand for the company's Azure cloud infrastructure services is powering strong sales and earnings growth. The Azure business is poised to see strong sales expansion as more AI applications are launched and scaled on the network.

Cloud computing is one of Microsoft's key growth engines, and other AI services, features, and initiatives also have huge long-term potential. Microsoft is a major investor in OpenAI, the company behind ChatGPT, and it's working to integrate AI into its many products and services. AI has the potential to be the most disruptive technology since the internet.

With cloud computing and AI tailwinds driving its growth in the long run, Microsoft is one of the best growth tech stocks.

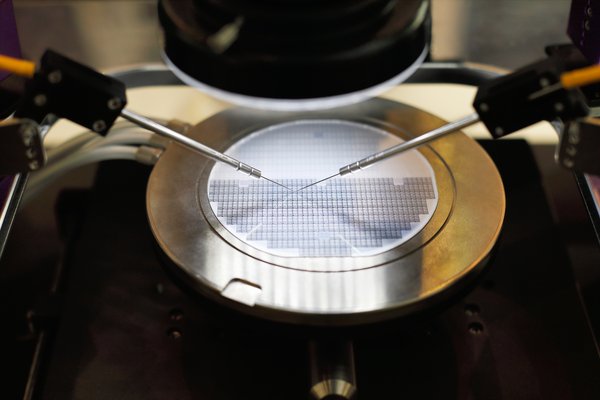

3. Nvidia

Nvidia designs graphics processing units (GPUs), which are in high demand for a variety of reasons. Computer gamers buy Nvidia GPUs to enjoy higher-quality graphics and functionality. More importantly, data center customers buy its GPUs to accelerate workloads, particularly AI workloads. People mining certain cryptocurrencies also buy Nvidia GPUs for their processing power.

Soaring demand for for Nvidia's data center GPUs has been powering incredible growth for the company. The explosion in interest in AI, particularly generative AI, has turbocharged sales for its AI-focused chips. While Nvidia isn't the only game in town, the company has spent years building up an ecosystem of software that makes its AI solutions the de facto standard.

AI has the potential to be a revolutionary technology, and for now, the revolution is being enabled by ultra-powerful Nvidia GPUs.

4 - 6

4. Palantir

Palantir is a leading provider of data analytics and AI software. The company sells services to both public sector and private sector customers, and it's seeing huge growth in both of these client segments.

In 2023, Palantir launched Artificial Intelligence Platform (AIP) -- a suite of tools that helps customers integrate large language models (LLMs) and other AI features across their networks. AIP stands out as one of the premier services in the AI software space and has played a substantial role in accelerating Palantir's growth.

The software leader's revenue increased 29% annually in 2024, thanks in large part to strong sales for AIP, and the impressive expansion momentum is continuing in 2025. With strong pricing power and the relatively low cost of goods for its software-focused business, Palantir is also posting very strong gross margins and free-cash-flow margins.

While Palantir has been serving up great business results, it also has a highly growth-dependent valuation that stands out even among its tech sector peers. On the other hand, the company's software business is highly scalable and had a long runway for expansion -- and the strength of its margins suggests the potential for huge earnings growth over the next decade and beyond.

5. Salesforce

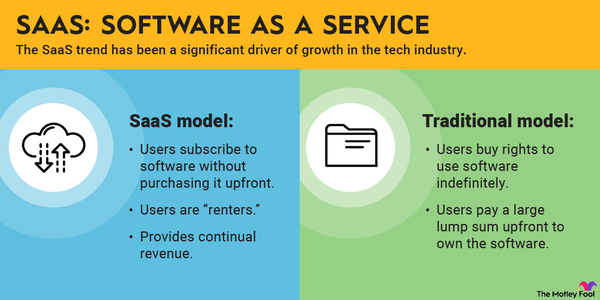

Salesforce is the leader in cloud-based customer relationship applications for sales, marketing, and more. As more businesses shift to digital and omnichannel customer relationships, Salesforce's software-as-a-service (SaaS) plays an important role in helping businesses of all sizes.

On a currency-adjusted basis, Salesforce's revenue increased 10% annually to reach $37.9 billion in its last fiscal year, which ended Jan. 31, 2025. Meanwhile, net income increased roughly 50% in the period. The company generates plenty of cash flow, which allows it to buy back billions of dollars worth of its own shares.

Salesforce's lead in customer relationship management (CRM) software is supported by very high switching costs. Few managers will risk changing from a market-leading software solution that works fine for an unproven product requiring setup and training expenses.

Salesforce operates four software suites (clouds) that it can cross-sell to existing customers. That has fueled revenue growth -- and, more importantly, its margin expansion -- in recent years. The company should continue producing strong growth for years to come.

6. Meta Platforms

Facebook changed its name to Meta Platforms at the end of 2021 to signify its shifting focus toward the metaverse, artificial intelligence, and other growth initiatives. While the metaverse presents a significant growth opportunity for the leader in virtual reality (VR) hardware, digital advertising is still its core business.

After a brief slowdown, Meta's growth has come roaring back in conjunction with a rebound for the digital advertising market. Revenue grew by 22% annually last year, and net income surged 59%.

Meta's dominance in the social media space makes its ad platform appealing to small and large businesses. The company has more than 3 billion users across its family of apps, which includes Facebook, Instagram, Messenger, and WhatsApp. Meta is also pushing social commerce solutions to enable better ad measurement and performance on its platforms amid privacy restrictions. Even though virtual reality and the metaverse are still in early growth phases, the company has continued to invest heavily in these opportunities as well.

Meta is also investing heavily in AI, using the technology to better serve content to users, and it's offering advertisers AI tools to develop ad campaigns. These technologies are leading to better monetization and, ultimately, higher revenue and profit.

With a strong core advertising business and an eye toward the future, Meta Platforms is setting itself up for continued growth.

Cloud Computing

How to find growth tech stocks

How to find tech stocks poised for growth

The two most important factors to help you identify tech stocks poised for growth are the company's industry sector and its rate of sales growth:

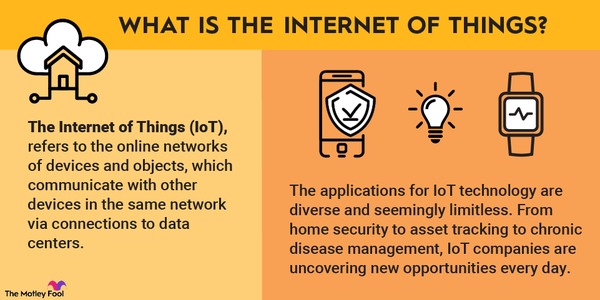

- Industry sector: Tech companies in some sectors are growing more rapidly than others. Focus on those companies in industries likely to be much larger in the future, such as e-commerce, cloud computing, and AI.

- Rate of sales growth: This metric is an important one to consider when judging the attractiveness of a growth stock. The ability to consistently expand revenues at double-digit rates is critical, especially as a company gets bigger. It's much easier to increase sales of $10 million by 30% than it is to expand $1 billion in sales by the same percentage. The best growth tech stocks maintain rapid growth rates as they scale.

Related investing topics

Profitability

The role of profitability

Immediate profitability isn't all that important if you're looking for the next big tech stock. Many tech companies aggressively focus on growing as fast as possible, sacrificing profit for increasing scale. That's not a bad idea if the customer base is likely to stick around for the long haul. It makes sense for a subscription software company, for example, to spend heavily to win a customer who may generate revenue for many years to come.

When it comes to profitability, it's important that the company's performance is at least improving. Gross margin should be rising, and the company's path to turning a profit should be clear and viable.

Some growth-focused companies never turn a profit and ultimately turn out to be poor investments. And, even if you do identify the next top tech stock, remember that pricey growth stocks often have much higher volatility than the S&P 500 (SNPINDEX:^GSPC). Massive, painful declines in stock price are common with fast-growing tech stocks, and it can take an iron constitution to endure those declines without panicking.

Growth tech stocks can provide outsized returns over the long term, and the best growth tech stocks can yield life-changing returns. But choose wisely to avoid the pitfalls that are inherent to growth investing.