Eli Lilly (LLY 1.19%) is a leading pharmaceutical company. It has developed several blockbuster products, including Trulicity (type 2 diabetes), Taltz (plaque psoriasis), and Jardiance (blood sugar). These and other drugs generate billions in sales and profits for the company each year.

The drug company could have another blockbuster drug on its hands in Zepbound. The weight-loss drug launched in late 2023 and is already off to a strong start. New products like Zepbound drive the company's view that 2024 will be a strong year with surging profitability.

The sales potential of Zepbound and the company's other drugs have many investors interested in the stock. Here's everything you need to know about how to invest in Eli Lilly.

Stock

How to buy

How to buy Eli Lilly stock

People interested in investing in Eli Lilly stock will need to take a few steps before becoming shareholders. This four-step guide will show you how to invest in stocks and add the pharmaceutical company to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Eli Lilly stock.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (LLY for Eli Lilly).

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.)

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become an Eli Lilly shareholder.

Should I invest?

Should I invest in Eli Lilly?

You need to decide whether investing in Eli Lilly is right for you. Here are some factors that could lead you to buy the pharmaceutical stock:

- You believe Zepbound has blockbuster sales potential.

- You take one or more medications made by Eli Lilly.

- Adding Eli Lilly to your portfolio would help make it more diversified.

- You understand the risks of investing in pharmaceutical stocks, including that they can lose money.

- You want to invest in a company that pays a growing dividend.

- You believe Eli Lilly can grow into its high valuation.

On the other hand, here are some reasons you might decide Eli Lilly isn't the right stock for you to buy:

- You're wary of pharmaceutical companies and prefer a more natural approach to health and wellness.

- You're unsure whether weight loss drugs like Zepbound will live up to the hype.

- You're in or nearing retirement and need more dividend income than Eli Lilly can supply.

- You're concerned about Eli Lilly's sky-high valuation (it had a forward price-to-earnings (P/E) ratio of more than 60 times in early 2024).

- You already own several pharmaceutical stocks.

Profitability

Is Eli Lilly profitable?

Digging into a company's profitability is essential because earnings tend to drive a stock's price over the long term. Given this dynamic, you'll want to see that the company is increasing its earnings or at least on the path toward profitability.

Eli Lilly is very profitable. The company reported $5.2 billion, or $5.80 per share, of net income in 2023 on $34.1 billion of revenue. While revenue was up 20%, earnings declined by 16% due to higher expenses (including a 30% increase in research and development costs).

However, the company expects to deliver significant earnings growth in 2024. Its initial guidance has revenue growing to a range of $40.4 billion to $41.6 billion, with earnings per share more than doubling to between $11.80 and $12.30. New product sales are a big factor driving this view, including the Food and Drug Administration's approval of the weight loss drug Zepbound in late 2023.

Dividends

Does Eli Lilly pay a dividend?

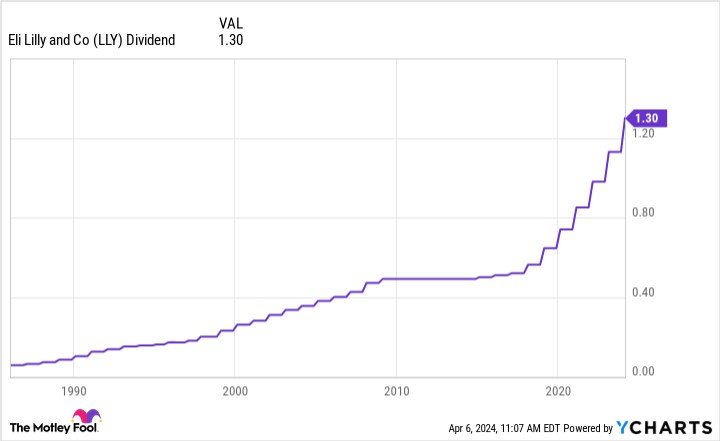

Eli Lilly has a long history of paying dividends. It has increased its payout annually for over a decade, doubling the payment since 2018. The company boosted the payout by 15% in December 2023, its sixth straight year of growing the payment at that rate:

While the company pays a growing dividend, it offered a below-average dividend yield (0.7% in early 2024 compared to around 1.4% for the S&P 500).

ETF options

ETFs with exposure to Eli Lilly

Many investors prefer a passive approach to actively managing a portfolio of stocks. Exchange-traded funds (ETFs) make this easy. They allow you to passively invest in similar companies, market indexes, or other themes.

Exchange-Traded Fund (ETF)

According to ETF.com, 357 ETFs held 106 million shares of Eli Lilly in early 2024. The Vanguard Total Stock Market ETF (VTI 0.93%) was the largest holder, with 26.8 million shares. However, the broad market ETF had a rather small allocation to the pharmaceutical giant, at 1.1% of its holdings.

Investors seeking greater exposure to Eli Lilly have several ETF options, including those focused on top healthcare stocks:

- iShares U.S. Pharmaceutical ETF (IHE 0.93%): The fund tracks an index focused on U.S. pharmaceutical stocks. It held shares of 34 companies in early 2024, led by Eli Lilly at 23% of its net assets. The fund had a 0.4% ETF expense ratio.

- Health Care Select Sector SPDR Fund (XLV 0.03%): The fund tracks the healthcare sector of the S&P 500. The ETF had 64 holdings in early 2024, led by Eli Lilly at 11.6%, with a very low expense ratio of 0.09%.

Stock splits

Will Eli Lilly stock split?

Eli Lilly didn't have an upcoming stock split as of early 2024. However, the pharmaceutical company has split its stock several times over the years. Here's a snapshot of Eli Lilly's stock split history:

| Split Year | Split Ratio |

| 1997 | 2-for-1 |

| 1995 | 2-for-1 |

| 1989 | 2-for-1 |

| 1986 | 2-for-1 |

| 1971 | 2-for-1 |

The company's last split came in 1997. Shares have gained significant value since then, trading around the $800 level in early 2024. Its high share price makes shares less accessible to many investors, so Eli Lilly is an excellent candidate to complete a stock split in the future.

Related investing topics

The bottom line on Eli Lilly

Eli Lilly has grown into one of the world's largest pharmaceutical companies thanks to the blockbuster success of its drug development efforts. The company expects its revenue and profitability to continue rising, driven by new products like Zepbound. That profit growth could send its stock even higher in the future, potentially making it a very rewarding long-term investment.

FAQ

Investing in Eli Lilly FAQ

Is Eli Lilly stock a good investment?

Eli Lilly stock has been a very good investment over the years. The company has delivered an annual return of almost 30% over the last decade, almost three times the average S&P 500 return. A big driver has been its success in developing blockbuster drugs.

The company's portfolio features several growth products and new drugs that should continue driving its revenue and profitability higher. Its profit growth should enable Eli Lilly to grow its dividend while potentially helping it to continue producing strong stock price appreciation.

However, the company does trade at a high valuation (more than 60 times forward earnings in early 2024). It can grow into that valuation as long as its new and growth products continue increasing sales and earnings at brisk rates.

How do I buy shares of Eli Lilly?

It's easy to buy shares of Eli Lilly. You need to open a brokerage account (if you don't have one already), figure out your budget, thoroughly research the company, and place an order when you're ready to buy shares. To place an order, you'd fill out the order page in your brokerage account, including:

- The number of shares you want to buy

- The correct stock ticker (LLY for Eli Lilly)

- The order type (limit order or market order)

Once you fill out the order page, click to submit your trade to buy shares of Eli Lilly.

Is Eli Lilly a good long-term stock?

Eli Lilly has historically been a good long-term stock investment. Over the last decade, the pharmaceutical stock has delivered an average annual return of 30%, about three times the return of the S&P 500 (around 10% annually).

While past performance is no guarantee that the company will deliver strong returns in the future, it has a lot going for it these days. Growth products like Jardiance, Taltz, and Trulicity are increasing sales rapidly. Meanwhile, new product launches like Mounjaro and Zepbound are off to a strong start and could become notable growth products in the future.

Rising sales from these and other drugs should drive the company's profits higher, giving it more money to invest in R&D and return to shareholders through a growing dividend and share repurchases. Those factors have historically been key hallmarks of good long-term investments.

Who owns the most Eli Lilly stock?

The Lilly Endowment owned the most Eli Lilly stock in early 2024. It held almost 99 million shares (about 10.4% of its outstanding shares) worth roughly $74.5 billion. The Lilly Endowment is a private philanthropic foundation formed by J. K. Lilly, Sr., and his sons Eli and J. K., Jr., through gifts of stock in their pharmaceutical company, Eli Lilly.