A stock market sector is a group of stocks that have a lot in common with each other, usually because they are in similar industries. There are 11 different stock market sectors, according to the most commonly used classification system, known as the Global Industry Classification Standard (GICS).

We categorize stocks into sectors to make it easy to compare companies that have similar business models. Sectors also make it easier to compare which stocks are making the most money.

Investing in stock sectors

At a glance, the 11 GICS stock market sectors are:

1. Energy sector

The energy sector covers companies that do business in the oil and natural gas industry. It includes oil and gas exploration and production companies, as well as producers of other consumable fuels like coal and ethanol.

The energy sector also includes the related businesses that provide equipment, materials, and services to oil and gas producers. It doesn't include many renewable energy companies, which instead are considered utilities.

Large U.S. stocks in the energy sector are ExxonMobil (XOM -0.09%) and Chevron (CVX -0.32%).

2. Materials sector

The materials sector includes companies that provide various goods for use in manufacturing and other applications. You'll find makers of chemicals, construction materials, and containers and packaging within the materials sector, along with mining stocks and companies specializing in making paper and forest products.

Well-known materials stocks include paint maker Sherwin-Williams (SHW +0.03%) and chemicals manufacturer DuPont (DD +0.51%).

3. Industrials sector

The industrials sector encompasses a wide range of different businesses that generally involve the use of heavy equipment. Transportation stocks such as airlines, railroads, and logistics companies are found within the industrials sector, as are companies in the aerospace, defense, construction, and engineering industries.

Companies making building products, electrical equipment, and machinery also fall into this sector, as do many conglomerates.

UPS (UPS -0.12%) and RTX (RTX -0.65%) are the largest U.S. industrials stocks.

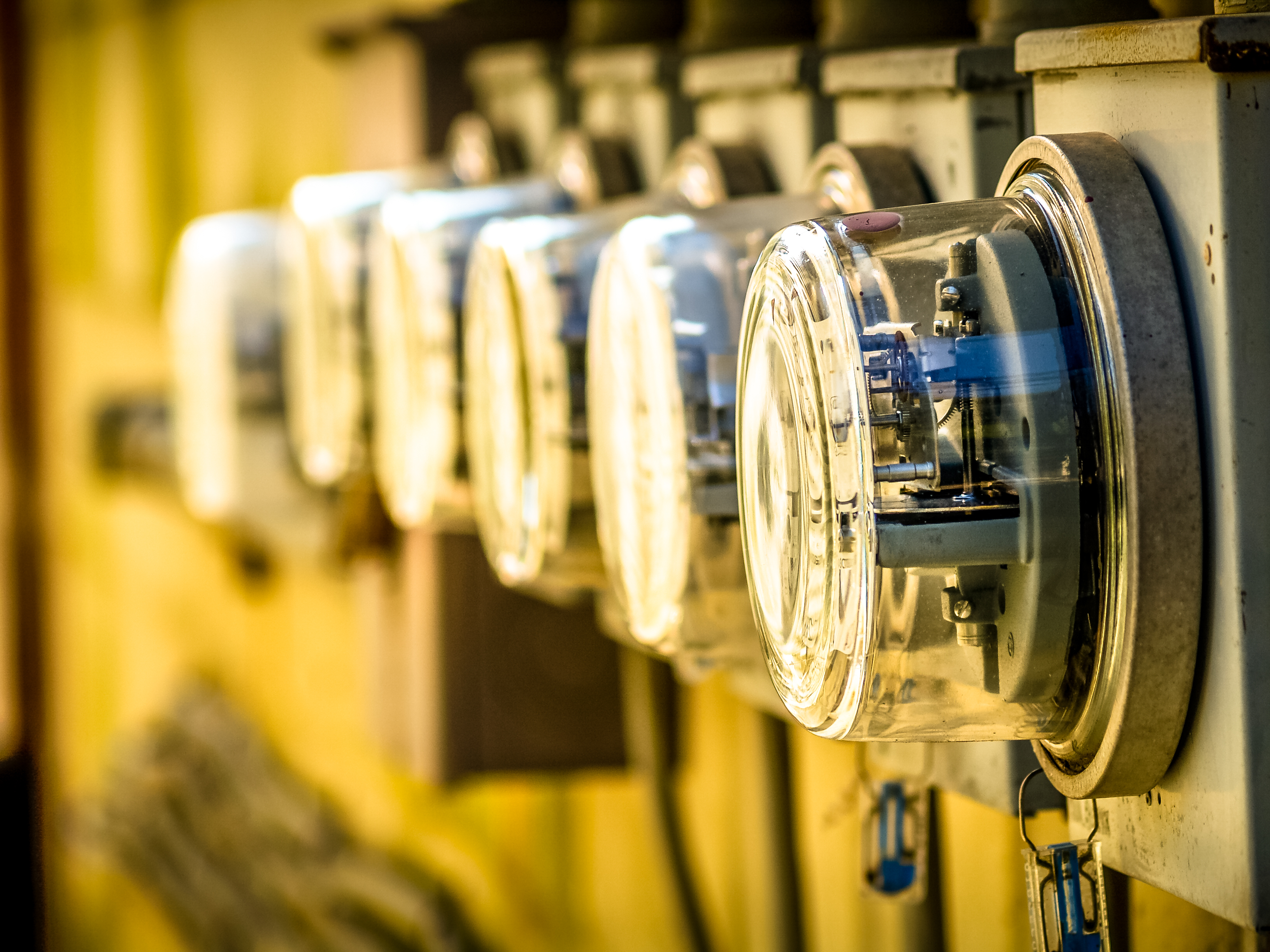

4. Utilities sector

The utilities sector encompasses every different type of utility company you can imagine. Within the sector, you'll find utilities specializing in making electrical power available to residential and commercial customers, as well as specialists in natural gas transmission and distribution. Other utilities are responsible for delivering water to customers.

Some utility companies engage in more than one of these different subspecialties. Independent producers of power and renewable electricity also land in the utilities sector, even though they don't exactly resemble the traditional regulated utility.

Utilities tend to be regional in scope, so you might have heard of Duke Energy (DUK -0.26%) in the Southeast U.S., Consolidated Edison (ED -0.23%) in the Northeast, and American Electric Power (AEP +0.31%) across much of the Ohio Valley and the Southern Plains states.

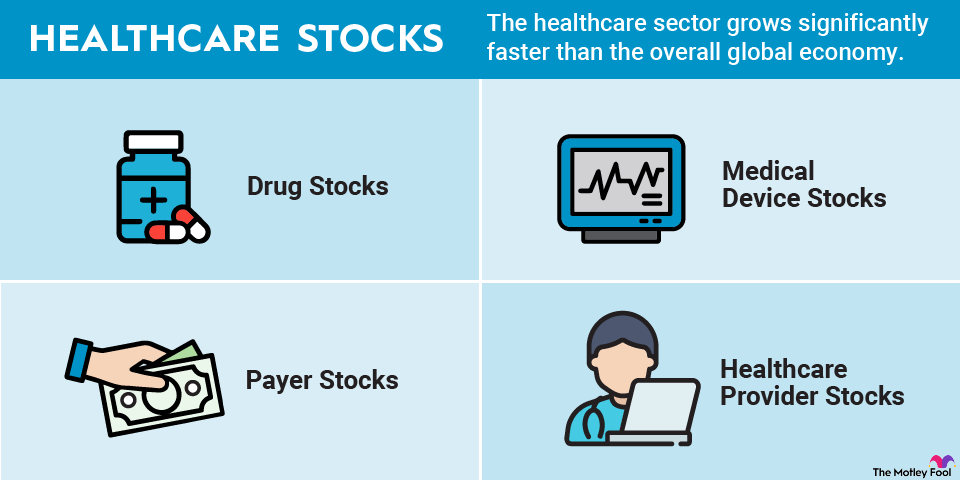

5. Healthcare sector

The healthcare sector has two primary components. One component includes companies that develop pharmaceuticals and treatments based on biotechnology, as well as the analytical tools and supplies needed for the clinical trials that test those treatments.

The other encompasses healthcare equipment and services, including surgical supplies, medical diagnostic tools, and health insurance. Telemedicine is a particularly interesting part of the healthcare sector that falls into the latter category.

UnitedHealth Group (UNH +1.30%) and Johnson & Johnson (JNJ -0.07%) are the two stocks at the top of the healthcare sector, with a combined market cap of more than $740 billion between them as of late 2025.

6. Financials sector

The financials sector includes businesses that are primarily related to handling money. Banks are a key industry group within the sector, but you'll also find insurance companies, brokerage houses, consumer finance providers, and mortgage-related real estate investment trusts among financials. The financial sector also includes some of the best-known financial technology, or fintech, companies.

Warren Buffett's Berkshire Hathaway (NYSE:BRK-A) (NYSE:BRK-B) and financial giant JPMorgan Chase (JPM -0.38%) are among the best-known stocks in the financials sector.

Fintech

7. Consumer discretionary sector

The consumer discretionary sector covers goods and services for which consumer demand depends upon consumer financial status. For example, if you make $25,000 per year, you probably buy a different car than someone who makes $25 million per year.

The sector includes companies that sell higher-priced items like automobiles and luxury goods, as well as leisure products. You'll find both brick-and-mortar and e-commerce-based retail companies in this category, along with hotel and restaurant stocks.

Amazon (AMZN +0.06%) and McDonald's (MCD -0.85%) are among the biggest stocks in the sector.

8. Consumer staples sector

The consumer staples sector includes goods and services that consumers need, regardless of their current financial condition or the current economic climate. The category includes companies in the food, beverage, and tobacco industries, as well as household and personal care products. You'll also find retail companies that specialize in selling staples, such as grocery retailers, in this group.

Coca-Cola (KO -0.31%) and Procter & Gamble (PG +0.17%) are two of the most valuable consumer staples stocks in the U.S. market.

9. Information technology sector

Also commonly referred to as simply the "tech sector," the information technology sector covers companies involved in the different categories of technological innovation.

Some companies in information technology focus on creating software or providing services related to implementing technological solutions like cybersecurity, while others are more involved in building the equipment, components, and hardware that make tech possible.

Information technology also includes makers of semiconductors and the equipment used to produce semiconductor chips.

Apple (AAPL -0.19%) and Nvidia (NVDA +1.09%) have been switching places at the top of the list of large U.S. stocks in the information technology sector.

10. Communication services sector

The communication services sector is among the newest of the GICS sectors and includes a couple of major areas that used to be part of other sectors. Telecommunication services providers make up one wing of the sector. At the other end are media and entertainment companies, including both older media like television and radio and interactive media via the internet and newer forms of communication.

Social media giant Meta (META -0.56%) and search engine pioneer Alphabet (GOOG -0.23%) (GOOGL -0.20%) are among the biggest stocks in communication services.

11. Real estate sector

The real estate sector is the newest GICS sector, having formerly been part of the financial sector. It generally includes two different types of investments related to real estate.

Some stocks in the sector are responsible for developing new real estate projects and then managing them by obtaining tenants for various spaces within the project property. In addition, most real estate investment trusts, or REITs (pronounced REETS), which are special tax-favored business entities that operate in various areas of the real estate industry, get counted within the real estate sector.

Among the top stocks in the real estate sector, you'll find cellular communications tower specialist American Tower (AMT +0.92%) and major shopping mall owner and operator Simon Property Group (SPG -0.31%).

Related investing topics

Sector investing

If you are interested in a certain sector but are not ready to invest in a specific company within that sector, you can still participate in sector investing. Seek out lower-risk investments like exchange-traded funds (ETFs) and mutual funds that are specifically tied to a sector.

For example, if you aren't comfortable evaluating health care stocks but want exposure in your portfolio, an index fund that tracks the sector could be the best way to go. Sector investing plays an increasingly important role in the strategies that investors use today.