KFC is a global leader in the chicken restaurant category. It ended 2023 with 29,900 restaurants worldwide, which rang up almost $34 billion in sales. KFC is part of the diversified global restaurant operator Yum! Brands (YUM -0.18%). Its concepts are:

- KFC: A global leader in the chicken category, with 29,900 locations and $33.9 billion in total system sales in 2023.

- Taco Bell: A global leader in Mexican-style food, with 8,564 restaurants and $15.9 billion in sales.

- Pizza Hut: A global leader in the pizza category, with 19,866 restaurants and $13.3 billion in sales.

- The Habit Burger Grill: A fast-casual restaurant specializing in chargrill burgers and sandwiches, with more than 300 locations and $696 million in sales.

KFC is by far the biggest concept within Yum! Brands, at 51% of its total units and 53% of its revenue. It's also the fastest-growing concept within the company:

That growth likely has many of its fans wondering whether they can buy stock in the fast food company. While you can't invest directly in KFC, you can buy shares of Yum! Brands to participate in the growth of KFC. Here's a closer look at how to invest in KFC through its parent, Yum! Brands.

Stock

How to buy

How to buy KFC stock

People interested in investing in KFC through its parent, Yum! Brands, will need to take a few steps before becoming shareholders. This four-step guide will show you how to add the restaurant stock to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in KFC through its parent, Yum! Brands.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (YUM for Yum! Brands).

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.)

Here's a screenshot of an order page from the five-star-rated Fidelity Investment's trading platform:

Once you complete the order page, click to submit your trade and become a shareholder of KFC's parent, Yum! Brands.

Should I invest?

Should I invest in KFC?

You need to take the time to research a company before purchasing shares. Doing your due diligence will hopefully confirm your investment thesis that the shares are a good buy for the long term. However, you might discover something that changes your thoughts about buying shares.

To help jumpstart your research process, here are some reasons you might want to invest in KFC's parent, Yum! Brands:

- You are a fan of KFC and other Yum! Brands concepts (Taco Bell, Pizza Hut, and The Habit Burger Grill).

- You like that KFC is a more diversified restaurant concept.

- You want to invest in a restaurant stock that pays an above-average and growing dividend.

- You think Yum! Brands can deliver solid total returns over the long term.

- Buying shares of Yum! Brands would help diversify your portfolio by adding a restaurant stock.

On the other hand, here are some reasons you might decide not to buy shares of Yum! Brands:

- You only wanted to invest in KFC, not a company that also owns Taco Bell, Pizza Hut, and The Habit Burger Grill.

- You're not really a fan of the food sold by Yum! Brands concepts.

- You're seeking to invest in a restaurant that sells healthier food options.

- You're seeking a company with more growth potential than the already massive Yum! Brands.

- You want a dividend stock with a higher yield than Yum! Brands offers.

- You already own one or more restaurant stocks.

Profitability

Is KFC profitable?

One important factor investors should research when evaluating a company is its profitability. That's because profit growth historically drives stock price performance over the long term.

KFC's parent company, Yum! Brands, breaks out the financial results of its divisions, so we know KFC is very profitable. In 2023, the division reported $2.8 billion in total revenues (i.e., sales at company-owned stores, franchise and property revenues, and franchise contributions for advertising and other services) and $1.2 billion in operating profit.

While revenue was flat year over year, KFC's profits increased by 9%. The company had a very strong operating margin of 46.1% (an improvement from 42.3% in 2022).

Yum! Brands is also a very profitable company. The company reported $7.1 billion in total revenue (i.e., sales at owned locations, franchise and property revenues, and franchise contributions for advertising and other services) in 2023, which was 3% more than in 2022. It also reported $1.6 billion in net income (almost 21% above 2022's total).

The company's growing profitability enables it to continue expanding its store count while also returning cash to shareholders.

Dividends

Does KFC pay a dividend?

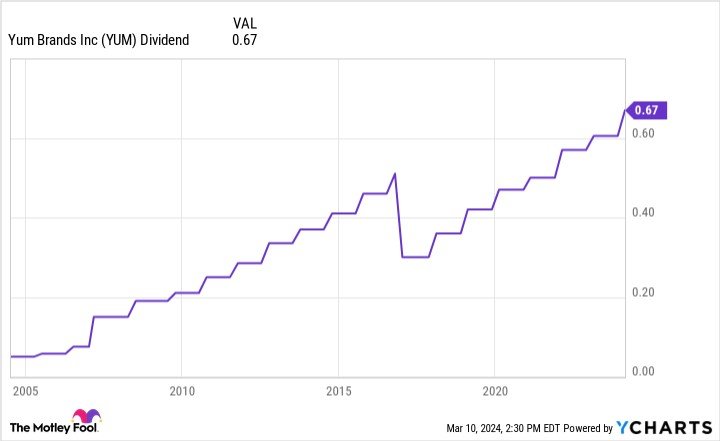

KFC's parent Yum! Brands pays a dividend. The restaurant operator initiated its dividend in 2004. In early 2024, it raised its dividend payment by 11% to $0.67 per quarter ($2.68 annualized) and offered a dividend yield of slightly less than 2%, which was above the S&P 500's 1.4% dividend yield.

The company has steadily increased its dividend since initiating the payout in 2004. While Yum! Brands did reduce its dividend payment in 2016 following the separation of Yum China (YUMC 0.62%), it resumed growth the next year and now pays more than its pre-separation rate:

With an above-average yield and a solid history of increases, Yum! Brands is an appealing dividend stock offering above-average income and growth potential.

ETF options

ETFs with exposure to KFC

Not everyone wants to invest actively in a portfolio of stocks they must manage. Many would prefer to be passive investors. And that's easy to do with exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

Many ETFs own shares of KFC's parent, Yum! Brands. According to ETF.com, 232 ETFs held 42 million shares of Yum! Brands in early 2024.

The Vanguard Total Stock Market ETF (VTI -0.47%) was the biggest holder, at 8.6 million shares. However, the broad market fund had a tiny allocation at 0.08%, so it's not the best ETF option for those seeking more exposure to Yum! Brands.

BTD Capital Fund (NYSEMKT:DIP) had one of the highest allocations to Yum! Brands in early 2024 at 3.7%. The fund uses artificial intelligence (AI) and data modeling to select and weight individual stock positions. It held shares of 32 stocks in early 2024, led by Yum! Brands. The fund had a 0.79% ETF expense ratio.

The AdvisorShares Restaurant ETF (EATZ 0.42%) is a noteworthy ETF for people interested in KFC because it invests exclusively in the restaurant and food service industry. Yum! Brands was its eighth-largest holding in early 2024 at 4.5% of its assets. The restaurant ETF had a 0.6% expense ratio.

Stock splits

Will KFC stock split?

KFC's parent, Yum! Brands didn't have an upcoming stock split on the calendar as of early 2024. The restaurant operator has split its stock twice. Yum! Brands completed 2-for-1 stock splits in 2002 and 2007.

It's possible that Yum! Brands might split its stock again. Shares traded at roughly $140 each in early 2024. Although that wasn't as high as some stocks, it is a higher price than some investors can comfortably afford. If the share price keeps rising, Yum! Brands might split its stock again to ensure it remains accessible to more investors.

Related investing topics

The bottom line on KFC

KFC is part of Yum! Brands, a worldwide leader in the chicken, Mexican-style, and pizza categories. KFC is its top brand, comprising over half its restaurants and sales. It's also a big contributor to its profitability. The company's rising profitability should enable it to grow shareholder value through a rising stock price and dividend, making it a potentially compelling restaurant stock to own long term.

FAQ

Investing in KFC FAQ

Can I buy KFC stock?

You can't buy stock in KFC directly, but you can buy shares of its parent company, Yum! Brands. The company trades on the New York Stock Exchange under the stock ticker YUM. Yum! Brands also owns Pizza Hut, Taco Bell, and The Habit Burger Grill.

Is it good to invest in KFC?

KFC's parent, Yum! Brands, has been a good investment over the years. As of early 2023, it delivered a 12% average annual total return over the past decade. While that had slightly underperformed the S&P 500's 12.6% average annual total return during that period, it's a strong return.

KFC is helping drive growth for Yum! Brands by leading the organization in same-store and system sales growth in 2023. That's helping drive profit growth, which is key to growing shareholder value over the years.