Alpha and beta are vital concepts for investors looking to assess portfolio performance by adjusting for risk. They are essential to measuring fund and portfolio performance and a valuable tool for anyone investing on their own or putting money into a fund.

Conceptually speaking, alpha helps you understand the manager's skills and how much value they add to performance. Meanwhile, beta enables you to understand the portfolio's performance coming down to the market and the portfolio's volatility relative to the market.

Alpha vs. Beta

Alpha vs. beta

Before getting into the formulas, consider the following scenario: You invest in a fund manager who tends to buy many stocks that can be volatile against the market (so-called high-beta stocks). The market goes up 10% in the year, taking the fund up 13%. The fund manager is hailed as a genius because the manager outperformed the index.

Next year, the manager keeps the same stocks in the portfolio. The market goes down by 5%, the fund goes down by 7%, and the fund manager is widely criticized.

What is the real value the fund manager is adding, and how much of the fund's performance is down to the market and the portfolio's volatility? Alpha and beta will help to answer these questions.

What is beta?

What is beta?

Beta is a measure of asset volatility relative to the market, in this case, the S&P 500 index. It's created by using regression analysis of the asset's performance compared to the market. This produces a beta coefficient, or beta, which indicates how a stock will move in relation to the market.

That's what you were looking at in the example of the "high-beta" fund above, when the fund moved in line with the index but exceeded the gain and loss because it had a high beta.

Beta

Don't worry too much about calculating beta; it can be found published on, say, a Yahoo! Finance stock summary page or fund literature.

Before continuing, here's a note of caution. When calculating beta, the asset must have a high coefficient of determination (R^2, or "r squared"). This measures how much a variable (in this case, the asset) is predictable from the independent variable (the market return). A beta coefficient without a relatively high R^2 figure is meaningless since it is just two numbers together rather than a strong relationship.

In addition, be aware that this analysis focuses on market risk. A measure like the Sharpe Ratio will help you risk-adjust returns for volatile investments.

An asset with a beta of 1 implies the stock will move perfectly in line with the market. A stock with a beta of 0.5 is a low beta; if the market does 10%, it could return 5%. A stock with a beta of 1.5 is a high beta and could return 15%.

Alpha

What is alpha?

What is alpha?

As noted earlier, alpha measures the value a manager adds to a portfolio when adjusting for risk and market returns. It's usually measured by factoring in a risk-free rate because you would want an investment manager to produce returns over and above what you could earn risk free.

The formula for calculating alpha:

Rp = alpha + Rf + beta * (Rm - Rf)

Where Rp = return on portfolio, Rf = risk-free rate, Rm = market return

This formula can easily be rearranged to calculate alpha directly:

alpha = Rp - (Rf + beta * (Rm - Rf))

Alpha vs. beta: When to use which metric?

Alpha vs. beta: When to use which metric?

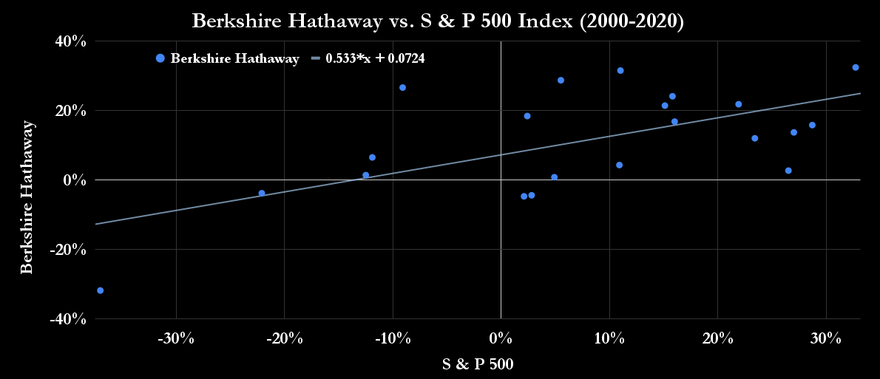

To help illustrate all these points, I will use an example of Warren Buffett's Berkshire Hathaway (BRK.A -1.27%)(BRK.B 0.18%) annual returns compared to the S&P 500 over the years from 2000-2020. I'm factoring out the risk-free rate to simplify matters, and I'm also not looking at the coefficient of determination since this analysis is for illustrative purposes.

The chart shows Berkshire Hathaway's returns on the y-axis compared to the S&P 500 on the x-axis. The trend line is statistically the best fit of the data. In other words, for any given value on the x-axis (meaning the S&P 500 return), you might expect Berkshire Hathaway to return what the trend line shows on the y-axis.

The equation on the chart is for the trend line. So, if the S&P 500 returns 10%, Berkshire Hathaway would return 0.553 * 10% + 7.24 % = 12.77%.

A few points to note:

- The slope of the trend line is the beta, so beta = .553

- The x-axis intercept represents alpha, so alpha = 7.24%; in other words, if the market returns nothing, Berkshire Hathaway will return 7.24%.

Related investing topics

The chart and the alpha and beta numbers suggest Warren Buffett is a highly skilled manager running a low-beta portfolio. His consistent record of alpha generation suggests Berkshire Hathaway is an excellent investing option, provided you do not hold a bullish opinion on the market.

After all, even in a flat market, Berkshire Hathaway should still deliver 7.24%. The S&P 500 would have to decline more than 13.6% for Berkshire’s returns to turn negative. Such an investment would suit investors with a relatively low risk tolerance.

This demonstration shows the importance of alpha generation. Still, there are scenarios where investors might look more at a fund's beta. For example, if an investor is bullish on the market overall, they might favor a fund with a history of not generating any alpha but having a high beta.

For example, if the market returns 15%, Berkshire might return 15.2%, according to the trend line above. That’s fine, but a fund with no alpha and a beta coefficient of 1.2 would generate 1.2* 15% = 18%, even if its manager is less skilled than Warren Buffett.

FAQs

Alpha and Beta: FAQs

What is the difference between an alpha and beta strategy?

An alpha strategy is explicitly looking to take advantage of a manager's skill in generating market-beating returns. For example, a hedge fund might hedge the long side of its investments and short the index to take advantage of the return that the manager will generate over the index (alpha).

In contrast, a beta strategy seeks to outperform the index by investing in rules-based factors believed to drive returns.

Is a lower alpha better?

It's never better to invest in a less skillful manager.

What is a pure alpha?

Pure alpha investing seeks to generate returns solely based on alpha generation, and not expose investors to any market risk or beta at all.