So, you've decided to invest in the stock market. You even have some ideas about which stocks you want to buy. But how do you actually buy shares of your favorite companies?

Stock

In this article, we'll discuss the basics of how to buy your first stocks in an easy-to-understand way. Follow these simple steps, and you'll be ready to start building a stock portfolio of your own.

How do you actually buy shares of stock?

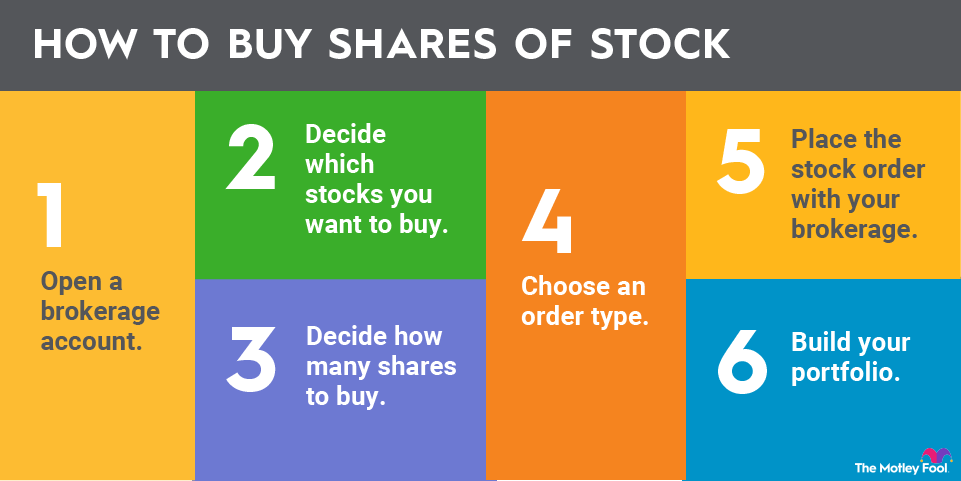

Fortunately, the process of buying stock online is relatively quick and easy.

- First, you'll need to open a brokerage account.

- Next, you must decide which stocks you'd like to buy.

- Determine how many shares of each you want to buy.

- Determine which type of stock order is most suitable for your needs. Typically, this means either a market order or a limit order.

- Enter your order, hit the buy button, and become a shareholder.

- Build your portfolio over time by repeating the process.

Here's a more detailed, step-by-step guide to start your stock investing journey.

1. Open a brokerage account

First, you'll need an investing account, known as a brokerage account, to buy stock.

Think of a brokerage account as a bank account designed to hold investments. It's important to consider two main factors when selecting an online stock brokerage:

What does the brokerage offer?

Some brokerages provide excellent educational resources for new investors. Others provide access to stock research and analytical tools. Some brokerages even maintain branches where you can receive in-person guidance and support.

Perhaps other features, such as the ability to trade international stocks or buy fractional shares, are important to you. Of course, many investors simply want an easy-to-use app for buying and selling stocks, and some platforms certainly offer that.

Is the brokerage platform user-friendly?

Is the brokerage platform easy to navigate? If you want to trade using your mobile device, the brokerage's mobile trading app must be easy to use.

Most brokerages allow you to use play money to experience their trading platforms before you invest your own money. It can be worth trying a few to decide which platform you like most.

One very important thing to know is that brokers typically publish a fee schedule that breaks down all the potential costs of being their customer. It should be fairly easy to find by searching for "[broker name] fee schedule."

Once you've chosen a brokerage, you must complete a new investment account application. This process is typically quick, but you'll need to have certain information handy, such as a driver's license and Social Security number.

Social Security Number (SSN)

You can choose to open a standard brokerage account or establish an individual retirement account (IRA) if you're planning to invest for retirement.

2. Decide which stocks you want to buy

In this article, we won't delve too deeply into the various methods for researching and selecting individual stocks to buy. However, the next step is to determine which stocks you'd like to own. Here are a couple of pointers:

Follow a buy-and-hold strategy

Buy stocks because you believe their underlying businesses will be worth more in a few years. Don't buy a stock just because you think it will perform well over the next few weeks or months. It's worth specifically stating that day trading -- buying and selling a stock on the same day or even within a few weeks -- is best left to the professionals.

Diversify your holdings

Don't put all your money into just one or two stocks. Even if you're investing only a relatively small amount of money to start, diversify your portfolio by buying a few shares of several different stocks. With fractional share investing available through many brokers, you can create a diversified stock portfolio even with a small amount of money.

Learn more about how to choose which stocks to buy by checking out our comprehensive guide to investing in the stock market. Or check out some of the top stocks to buy right now if you need some inspiration.

3. Decide how many shares to buy

To determine how many shares you should buy, first decide how much money you want to invest in each stock that interests you, and then divide this amount by the stock's current share price. You can find stock prices on your brokerage's platform by searching for either the stock's ticker symbol or the company's name.

Some brokerages allow you to buy or sell fractional shares. This is especially common with app-focused brokers.

For example, let's say you want to invest $800 in Microsoft (MSFT +0.77%). You use Microsoft's stock ticker symbol (MSFT) to check its share price and find that it was about $480 (as of January 2026). Dividing $800 by this share price indicates you could have bought as many as 1.67 shares.

If your broker doesn't trade fractional shares, you would purchase one share of Microsoft stock and have $320 left over. With fractional shares, you can invest your entire $800.

4. Choose an order type

Different types of orders exist for stock purchases. For our purposes, there are two types of orders you should know about.

- A market order, which instructs your broker to buy the stock immediately and at the best available price, is typically the best order type for buy-and-hold investors.

- On the other hand, you may want to place a limit order, which indicates to your broker the maximum price you're willing to pay for a stock.

For example, let's say a stock is currently trading for $20.50 per share. You want to buy it only when the price is less than $20, so you place a limit order. Your broker then buys shares on your behalf only if the stock's price dips below $20.

Order Type | What It Is | When to Use It |

|---|---|---|

Market order | Instructs the broker to immediately buy the stock at the best available price. | For most buy-and-hold investments, especially stocks with high trading volumes. |

Limit order | Instructs the broker to execute the order only if a stock is trading at or below a certain price. | If you want to wait for a pullback to buy a stock, or the stock is thinly traded. |

Stop-loss order | Instructs the broker to execute the order if a stock reaches a certain price. | If you have a specific exit point in mind for a stock investment, either to the upside or downside. |

5. Place the stock order with your brokerage

To place a stock order, go to the appropriate section of your online broker's platform and enter the required information. You will enter the company name or stock ticker, and whether you want to buy or sell shares (the exact process varies slightly). You'll also enter either the dollar amount you want to spend or the number of shares you want to buy.

After you tap the button to place your order, your stock purchase should be executed in seconds (if you've made a market order).

6. Build your portfolio

The final step in this process is to build out your investment portfolio. The best way to build wealth is by adding money to your brokerage account and investing in stocks you'd like to own.

As a final thought, it can be tempting to monitor your stocks' performance every day, especially at first. However, it's essential not to get too caught up in the short-term market noise and to maintain a long-term perspective.

Why buy stocks?

There are several compelling reasons to invest in stocks, but the primary motivation is to accumulate wealth over the long term. Stocks can be quite volatile in the short term, but have historically been the best-performing major asset class over periods of several decades.

Stocks can also be valuable tools for retirees or anyone looking to generate a stream of passive income. Many stocks pay dividends, which are distributions of a company's profits made to shareholders. There are some with incredibly consistent track records of not only paying dividends but also increasing them over time.

Key risks of investing in stocks

Let's be perfectly clear. Regardless of how safe a stock may seem or how well its business is doing, when you invest in stocks, there is a chance you will lose money. Period. There are more things that could cause any or all of your stocks to go down than I can reasonably list here, but just to name a few:

- Economic weakness or recession.

- Competitors are taking market share.

- Rising or falling interest rates (depending on the nature of the business).

- Political headwinds, such as legislation that negatively affects an industry.

- Inflation.

- Geopolitical tensions, including wars and trade tensions.

- Negative company news, which can take many forms (e.g., key executives leaving, lawsuits, or weaker-than-expected earnings guidance).

Growth Stock

Common types of stocks to invest in

Here are some of the common categories of stocks:

- Growth stocks: Companies that are growing sales (or are expected to) faster than their peers or the overall stock market average.

- Value stocks: Companies whose stocks are trading for a discount to the intrinsic value of the business.

- Dividend stocks: Stocks that distribute some of the company's profits to investors in the form of dividends.

- Blue chip stocks: Stocks of long-established businesses with consistent profitability and financial strength.

- Large-cap stocks: A term used to refer to the largest companies in the stock market. The traditional definition is those with a $10 billion market capitalization or higher.

- Mid-cap stocks: Traditionally defined as a company with a market cap ranging from $2 billion to $10 billion.

- Small-cap stocks: Stocks of smaller companies, usually defined as less than $2 billion in market cap.

This is not an exhaustive list of stock categories. And it's worth noting that stocks can (and usually do) fit into more than one of these categories. For example, you can hold a large-cap stock that also pays dividends.

Tax implications of buying stocks

Buying stocks can have a couple of big tax implications you need to be aware of -- capital gains and dividend taxes.

- Capital gains tax applies when you sell an asset for more than you paid for it. If you have short-term capital gains from stocks you've owned for a year or less, they are taxed as ordinary income. Long-term capital gains are subject to more favorable tax rates.

- Dividends are taxable, but most dividends paid by common stocks in the United States are considered qualified dividends, which receive the same favorable tax treatment as long-term capital gains. Not all dividends meet the definition of qualified, and those that don't are treated as ordinary income.

Common mistakes to avoid when investing in stocks

Equally important as knowing the right ways to invest in stocks is avoiding some of the key mistakes. While there are too many potential mistakes to list them all here, these are some of the most common and potentially costly mistakes:

- Investing emotionally -- When stocks rise, that's when our emotions compel us to put our money into the market. When stocks fall, it's our instinct to sell before things get worse. It's common knowledge that the general goal of investing is to buy low and sell high. Unfortunately, our emotions compel us to do the exact opposite.

- Following the crowd -- Don't buy trendy stocks just because everyone else is. This is exactly how many investors lost lots of money in the 2020-21 "meme stock" frenzy. Do your research and invest in great businesses.

- Market timing -- There is no reliable way to determine when a stock will rise or fall, and it's a common mistake to try to wait for a pullback before investing. A smarter approach is to gradually build a position over time, a strategy known as dollar-cost averaging.

- Ignoring tax implications -- If you sell a stock at a profit, the gain can be considered taxable income. The same applies to the dividends you receive. Unless you're investing in a tax-advantaged retirement account, you need to understand the tax implications of investing before you get an unexpected large tax bill.

Related investing topics

Is now a good time to buy stocks?

There's no perfect answer to this question, especially from a short-term perspective. There is absolutely no way to know what any individual stock or the overall stock market could do over any period of days, weeks, or even months.

Having said that, it is almost always a good time to buy stocks if you're planning on holding for the long term. Think of some of the worst possible times to invest in the stock market in recent decades -- just before the dot-com crash in 2000, just before the 2008 financial crisis, and right before the COVID-19 pandemic virtually shut down the world in 2020.

Investors who bought stocks before these events and held on to them throughout the turbulent times did just fine in the long run.

The bottom line is that while nobody can tell you what the stock market will do in the near future, it's almost a certainty that a well-constructed portfolio of stocks or stock-based investment funds will be worth considerably more in 10, 20, 30, or more years from now.