Facebook is a ubiquitous social media platform. More than 2 billion people log into their Facebook accounts each day, and more than 3 billion actively use the platform every month, making it the biggest social media site in the world. Even more people log into the company's family of social platforms each month, which includes Instagram, Threads, and WhatsApp.

A captive audience provides Facebook with a treasure trove of data that it can use to sell advertising. It generates billions of dollars in ad sales each year.

NASDAQ: META

Key Data Points

As a Facebook user, you might wonder how to invest in the company. Here's a step-by-step guide on investing in Facebook stock and some factors to consider before investing in the technology stock.

Is Facebook publicly traded?

Facebook completed its initial public offering (IPO) in 2012. At the time, it traded on the Nasdaq Stock Exchange using the stock ticker FB.

However, the company has evolved over the past decade. In 2021, the company rebranded to showcase its move beyond social media. Among its biggest investments is in the metaverse, which led the company to change its name to Meta Platforms (META +0.59%) and its stock ticker to META.

In addition to its namesake social media platform and metaverse investments, Meta owns several other technology brands. The most notable ones are:

- The photo and video-sharing app Instagram.

- The text update and public conversation app Threads.

- Mobile messenger service WhatsApp.

- Virtual reality technology company Reality Labs and its Meta Quest VR headsets and Ray-Ban Meta Glasses.

- Meta is also building several artificial intelligence (AI) products and services, including AI chatbot MetaAI.

How to invest in Facebook

While you can't invest specifically in Facebook's social media platform, you can invest in its parent company, Meta Platforms. You can buy shares of Meta with any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Meta stock:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Alternative ways to invest in Meta Platforms

Instead of buying Meta Platforms shares directly, you can passively invest in the technology company through a fund holding its shares.

Meta Platforms is among the world's largest companies by market capitalization and is a widely held stock. Meta is in several stock market indexes, including the Nasdaq Composite and S&P 500 index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Meta stock.

According to ETF.com, roughly 635 ETFs held almost 311 million shares of Meta as of late 2025. The Vanguard Total Stock Market ETF(VTI +0.33%) held the most shares. Meta Platforms was the fund's fifth-largest holding at 2.47% of its assets.

Other ETFs have more exposure to Meta stock. The Vanguard Communications Services ETF (VOX +0.47%) has the largest allocation to Meta stock at 20.02%, making it a potentially attractive way to invest passively in Meta stock.

Should I invest in Meta Platforms?

Before investing in Facebook's parent company's stock, you need to determine whether Meta Platforms shares are a good investment. Here are some factors to consider before investing in Meta stock.

Profitability

Meta Platforms is an immensely profitable company. The social media giant reported $37.7 billion in net income in Q3 of 2025. That was up roughly 64% from the previous year in the same time frame, as Meta focused on increasing revenue and keeping a lid on costs to improve profitability.

The company behind Facebook is also free cash flow-positive. Meta generated $29.5 billion in free cash flow by Q3 of 2025 after funding $50 billion in capital expenses. That enabled the technology giant to return cash to investors by repurchasing shares ($3.16 billion) and paying dividends ($1.33 billion) while maintaining a cash-rich balance sheet ($44.45 billion as of September 30, 2025, in cash, equivalents, and marketable securities against $28.8 billion of long-term debt).

Meta is using its strong cash flow to invest heavily in AI. The company planned to boost its capital spending to the tune of $600 billion in 2026 on things like data center projects and other investments in generative AI, and to expand its core business.

Cash Flow

Meta Platforms' valuation

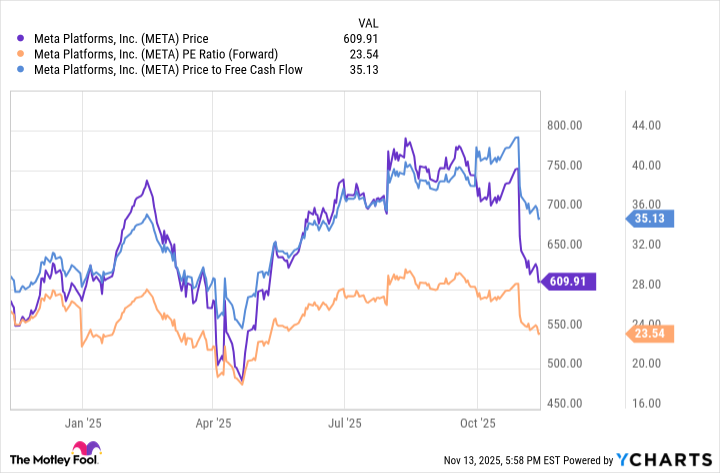

Here's a snapshot of Meta Platform's valuation:

As that chart shows, Meta traded at about 26 times its forward price-to-earnings (P/E) ratio as of late 2025. For comparison, the S&P 500 traded at a forward P/E ratio of more than 25 times. Meanwhile, the Nasdaq-100 traded at more than 25 times its forward P/E. These valuation metrics suggest Meta Platforms' stock trades at a slight premium to the broader market (S&P 500) and is a little cheaper than the tech-heavy Nasdaq.

Does Meta Platforms pay a dividend?

Facebook's parent Meta Platforms initiated its first dividend payment in early 2024. The company increased the payment by 5% one year later. Given the company's growing revenue and cash flow, it could continue to increase its dividend in the future.

Related investing topics

The bottom line on investing in Meta Platforms stock

Facebook is the most popular social media platform on the planet. Facebook's parent company, Meta, is cashing in on all those users by generating billions of dollars in advertising revenue each year, giving it money to invest in expanding into new areas, including AI.

Those investments could drive significant earnings and profit growth in the future. That makes Meta Platforms look like a potentially exciting stock to own for the long term.