PayPal (PYPL -1.18%) is a leader in digital payments, which is why many investors seek to invest in PayPal stock. The company's technology enables people to make digital payments to other PayPal users and merchants that accept PayPal.

NASDAQ: PYPL

Key Data Points

The financial technology (fintech) company operates its namesake payments platform and several branded and non-branded platforms. Notable brands include its peer-to-peer payments app Venmo and shopping experience platform Honey. PayPal also offers a buy now, pay later solution to finance transactions.

PayPal is one of the world's largest and most ubiquitous digital payment platforms. The company processed a staggering $1.7 trillion in total payment volume in 2024. It has more than 434 million users.

Here's a step-by-step guide on buying PayPal shares and some factors to consider before investing in the fintech stock.

How to invest in PayPal

You can buy shares of PayPal through any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying PayPal stock:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Alternative ways to invest in PayPal stock

Instead of actively buying shares of PayPal directly, you can also passively invest in the financial technology company through a fund holding its shares. Exchange-traded funds (ETFs) are an easy way to gain exposure to PayPal stock.

According to ETF.com, 344 ETFs held 163.7 million shares of PayPal as of mid-2025. The biggest holder was the Vanguard Total Stock Market ETF (VTI -0.76%) at 31.8 million shares.

Exchange-Traded Fund (ETF)

PayPal also produces lots of cash. It generated $6.8 billion of free cash flow in 2024 and expects to produce $6 billion to $7 billion in 2025. The company returns most of its free cash flow to shareholders by repurchasing shares.

PayPal revenue

Revenue growth also helps drive stock price appreciation, especially for companies earlier in their growth cycle. PayPal generated $7.8 billion of net revenue in the first quarter of 2025, a 1% increase from the first quarter of 2024. Rising active accounts and total payment volumes are helping drive revenue growth. The company expects to continue growing revenue at a solid rate. PayPal sees its revenue rising 4% to 5% in 2025.

Revenue

PayPal valuation

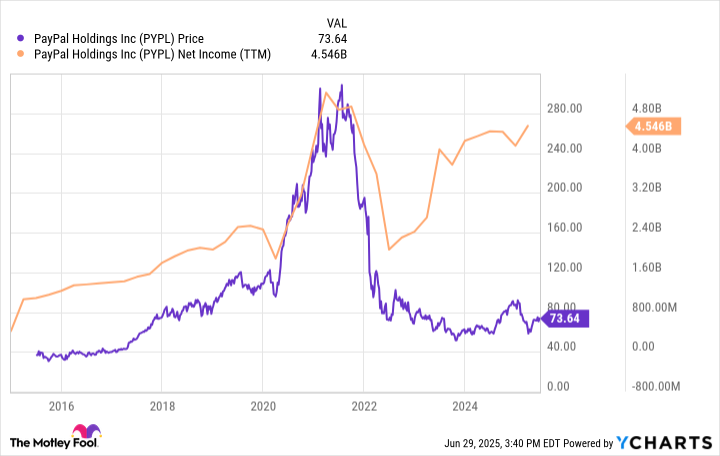

PayPal's stock price has fallen sharply in recent years. As a result, its valuation has become more attractive. With a forward price-to-earnings (P/E) ratio of less than 15 times in mid-2025, PayPal traded at a relatively low valuation. In mid-2025, the S&P 500 traded at about 23 times its forward P/E, and the Nasdaq Composite index was even higher at over 29 times its forward P/E. PayPal's lower forward P/E multiple means it's cheaper than the broad market indexes.

Does PayPal pay a dividend?

PayPal does not pay a dividend. However, it does return cash to investors by repurchasing shares. The company repurchased $6 billion in shares in 2024 and plans to buy back a similar level in 2025. During the 12 months through mid-2025, it had reduced its shares outstanding by 6%.

Cash Flow

Has PayPal stock split?

As of mid-2025, PayPal had never completed a stock split. The payments giant seemed unlikely to split its stock anytime soon. Although shares had surged more than 600% at one point after its separation from eBay (EBAY +0.00%), the stock had returned most of that gain by mid-2025 (doubling to about $75 per share). The stock would need to surge again before PayPal would likely consider a split.

Is PayPal publicly traded?

PayPal is a publicly traded company. It trades on the Nasdaq Stock Exchange under the ticker symbol PYPL. PayPal has a unique history as a public company.

When did PayPal IPO?

PayPal completed its initial public offering (IPO) in 2002. However, eBay acquired the company a few months later for $1.5 billion in stock. PayPal investors received 0.39 shares of eBay for each PayPal share they held.

In 2015, eBay and PayPal separated. Existing eBay investors received one share of PayPal stock for each share of eBay they held. Since the split from the online auction site, PayPal has traded as an independent public company.

Related investing topics

The bottom line on buying PayPal stock

PayPal is a leading digital payment platform that's highly profitable. Although PayPal's profits dipped in recent years, the company resumed its upward trajectory.

The speed bump caused shares to plunge from their peak, which has the stock trading at a very reasonable valuation. PayPal's improving profitability, value-enhancing share repurchases, and attractive valuation mean it could be an incredibly enriching stock to buy for the long term.