Taiwan Semiconductor (TSM +0.70%) is a leading semiconductor manufacturing company based in Taiwan. In 1987, it created the industry's Dedicated IC Foundry business model. Instead of developing its own semiconductors, Taiwan Semiconductor manufactures them for others.

In 2024, the company produced almost 11,900 different products for 522 customers. It manufactures semiconductors for companies in the computing, smartphone, Internet of Things (IoT), automotive, and consumer electronics industries.

Taiwan Semiconductor is investing to expand its semiconductor manufacturing capacity. It's building new fabrication plants to produce state-of-the-art semiconductors to support its customers' growing needs.

The company's growth has many people interested in learning how to invest in its stock. Here's a step-by-step guide to investing in the semiconductor stock and some factors to consider before adding it to your portfolio.

How to buy Taiwan Semiconductor stock

Even though Taiwan Semiconductor is a foreign company, it's still relatively easy to buy shares of the semiconductor maker. Its American depository receipts (ADRs) trade on the New York Stock Exchange (NYSE) under the stock ticker TSM. Here's a step-by-step guide on how to add the company to your portfolio.

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Taiwan Semiconductor?

Investors need to spend time researching a stock before buying shares.

Reasons to consider it

- You like Taiwan Semiconductor's business model of being a contract manufacturer instead of a developer of semiconductors.

- Buying shares would increase your portfolio's diversification by adding more international exposure.

- You're comfortable with the geopolitical risk of investing in a company based in Taiwan.

- You think Taiwan Semiconductor can grow its revenue and earnings at above-average rates in the future.

- You believe Taiwan Semiconductor's stock can outperform the S&P 500 over the next three to five years.

- You're seeking dividend income and are OK with the foreign exchange risk of investing in Taiwan Semiconductor's stock.

NYSE: TSM

Key Data Points

Reasons to be cautious

- You don't understand what Taiwan Semiconductor does or how it makes money.

- You're not sure Taiwan Semiconductor can be a market-beating stock over the long term.

- You're not convinced that Taiwan Semiconductor's investments to increase its capacity will grow shareholder value.

- You'd prefer not to invest in a company headquartered outside the U.S.

- While you desire dividend income, you're concerned about the foreign exchange risk that could cause the payout to fluctuate.

- You're not sure whether the additional geopolitical and foreign exchange risks are worth the reward potential Taiwan Semiconductor stock offers investors.

- You're concerned about growing competition from companies like Intel (INTC -0.52%).

Is Taiwan Semiconductor profitable?

Taiwan Semiconductor is a profitable company. It reported more than $30 billion in net revenue during the second quarter of 2025, up 50% from the prior-year period. Meanwhile, the company delivered a strong net profit margin of 42.6%. It also has a history of producing positive free cash flow. The company uses its cash flow to make new investments and pay dividends.

For example, in late 2023, it bought a 10% interest in Intel's IMS Nanofabrication business for more than $400 million. It also invested about $100 million into the initial public offering (IPO) of Arm Holdings (ARM -0.42%).

Taiwan Semiconductor also continues to invest in expanding its semiconductor manufacturing capacity. These investments should help grow its revenue and profitability in the future.

Does Taiwan Semiconductor pay a dividend?

Taiwan Semiconductor makes dividend payments to its investors. The company declares dividend payments based on the New Taiwan dollar (NT), Taiwan's official currency. However, it pays dividends to American depositary receipt (ADR) holders in U.S. dollars.

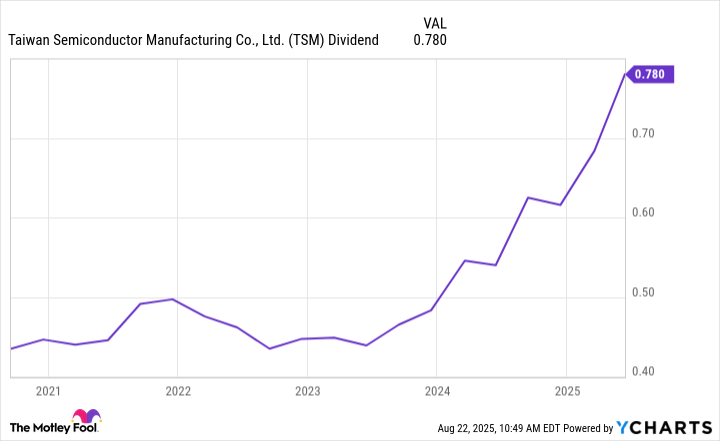

Taiwan Semiconductor has routinely increased its dividend over the years. However, actual dividend payments received by ADR holders tend to fluctuate due to changes in the exchange rate between the NT and U.S. dollars:

That foreign exchange risk is something investors need to be aware of since it could cause dividend payments received to fluctuate from quarter to quarter.

How to invest in Taiwan Semiconductor through ETFs

Lots of investors prefer to invest passively as opposed to directly owning stocks they must actively manage. They can easily do that through exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

The bottom line

Taiwan Semiconductor has been a trailblazer in the semiconductor industry since its founding in 1987. It has grown into a leading contract manufacturer in the industry and expects to continue growing as it expands its capacity and makes additional investments.

However, the company has some unique risks. As a Taiwan-based company, it faces geopolitical and foreign exchange risks. Investors need to consider these factors carefully before buying shares.