3 Most Important Financial Statements

Futures Trading: Everything You Need to Know

Up-and-Coming Stocks: 11 Stocks for 2025

When to Sell Stocks -- for Profit or Loss

Accounts That Earn Compounding Interest

How Many Shares Should I Buy of a Stock?

Selling Stock: Are There Tax Penalties on Capital Gains?

How Are Stock Prices Determined?

What is Day Trading? How Does it Differ From Investing?

The Definitive Guide: How to Value a Stock

What Happens When a Stock Is Delisted?

GAAP vs. Non-GAAP: Everything You Need to Know

Should I Buy Stock Now or Wait?

How to Calculate Cost Basis for Inherited Stock

What Are Share Repurchases?

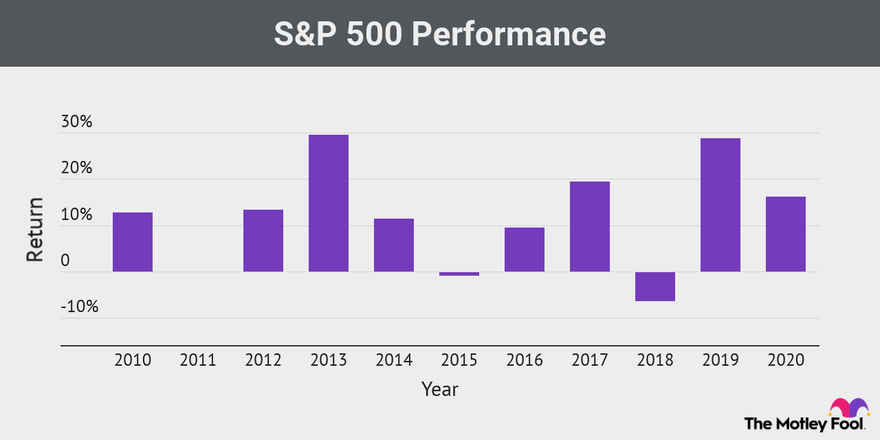

Average Stock Market Return

How to Short a Stock: The Basics of Shorting

Stock vs. Share: What's the Difference?

What is the Difference Between Simple & Compound Interest?

What Makes a Stock Price Go Up?

How to Pick a Stock for the First Time

Can You Owe Money on Stocks?

How Many Stocks Should You Own?

A Beginner's Guide to Buying Stock

How to Calculate Volatility of a Stock

How to Calculate Total Stock Returns

How to Buy Amazon Stock (AMZN)

How to Invest in Tesla Stock in 2025

How to Buy Microsoft Stock (MSFT)

How to Invest in Nvidia Stock

How to Invest in Disney Stock

How to Invest in Google Stock

How to Invest in Berkshire Hathaway Stock

How to Invest in Johnson & Johnson Stock

How to Invest in Exxon Stock

How to Invest in Facebook Stock (META)

How to Invest in Apple Stock

How to Invest in Databricks

How to Invest in Epic Games

How to Invest in Ford Stock

How to Invest in PayPal Stock

How to Invest in Etsy Stock

How to Invest in Pinterest Stock

How to Invest in Block Stock

How to Invest in OpenAI in 2025

How to Invest in SpaceX in 2025

How to Invest in Mistral AI in 2025

How to Invest in C3.ai in 2025

How to Invest in Shopify in 2025

How to Invest in Costco in 2025

How to Invest in Netflix in 2025

How to Invest in Aldi in 2025

Here's How to Calculate Future Expected Stock Price

How to Convert Daily Returns to Annual Returns

How to Calculate Average Stock Price: A Step-By-Step Guide

Best Master Limited Partnership Stocks to Buy in 2025

Upcoming Stock Splits in 2025

Apple's Stock Split History

Futures vs. Options: What's the Difference?

How to Invest in Reddit Stock

How to Invest in Coca-Cola Stock (NYSE:KO)

How to Invest in Twilio Stock

How to Invest in Intuitive Surgical Stock

How to Invest in Carnival Cruise Lines

How to Invest in Rivian (RIVN)

How to Invest in SoFi Stock

How to Invest in CRISPR Therapeutics Stock

How to Invest in Advanced Micro Devices

How to Invest in Nu Holdings

How to Invest in Palantir Technologies Stock

How to Invest in Coinbase Stock

How to Invest in AT&T Stock

How to Invest in Pepsi Stock

How to Invest in Walmart (NYSE:WMT)

How to Invest in Palo Alto Networks Stock

How to Invest in Arm Stock

How to Invest in Instacart

How to Invest in Klarna Stock

How to Invest in The Boring Company

How to Invest in Rippling Stock Pre-IPO

How to Invest in Blue Origin

How to Invest in Upside Foods Pre-IPO

Neuralink Stock: How to Invest Before the IPO

How to Invest in Fanatics Stock

How to Invest in Chime Stock

How to Invest in Impossible Foods

How to Invest in Forge Global

How to Invest in Tilray Stock

How to Invest in GE Vernova

How to Invest in Northrop Grumman (NOC)

How to Invest in Bank of America

How to Invest in QuantumScape

How to Invest in Lockheed Martin

How to Invest in Birkenstock

How to Invest in Snowflake

How to Invest in Taiwan Semiconductor

Magnificent 7 Stocks: Your Guide to Investing

How to Invest in Liquid Death

How to Invest in Northvolt

How to Invest in Flexport in 2025

How to Invest in Verizon in 2025

How to Invest in Skims in 2025

How to Invest in Waystar Holding Corp.

How to Invest in BMC Software

How to Invest in Unity Software

How to Invest in Canopy Growth

Shein IPO: Investing in Shein

How to Invest in Panera Bread

How to Invest in Starlink in 2025

How to Invest in Deloitte

How to Invest in Mars Stock

How to Invest in H-E-B Grocery

What Does Procter & Gamble Own?

Buying Trader Joe's Stock: Is It Public?

How to Invest in the Lego Company

How to Invest in Hulu Stock

How to Invest in Arctic Wolf

How to Invest in Rubrik (RBRK)

How to Buy ServiceTitan Stock in 2025 (TTAN)

How to Invest in Checkout.com Pre-IPO

How to Invest in Plaid Pre-IPO

How to Invest in Redwood Materials Stock

What Happens to the Ownership of Stocks After a Person Dies?

How to Invest in American Airlines

How to Invest in United Airlines

How to Invest in Turo Pre-IPO

What Companies Does Amazon Own?

What Does Berkshire Hathaway Own?

What Companies Does SoftBank Own?

List of Companies that Alphabet (Google) Owns

What Companies Does Microsoft Own?

What Companies Does Johnson & Johnson Own?

What Companies Does Apple Own?

What Companies Does Nvidia Own?

What Companies Does Mondelez Own?

Who Owns Amazon? Largest Shareholders

How to Invest in Airbnb (ABNB)

How to Invest in Chevron (CVX)

How to Invest in Ascend Elements

Who Owns X (Formerly Twitter)?

How to Buy Stocks on Behalf of an LLC

How to Invest in Eli Lilly (LLY)

How to Invest in Novo Nordisk (NVO)

How to Invest in MercadoLibre (MELI)

How to Invest in Figure AI Pre-IPO

How to Invest in Cerebras Pre-IPO

How to Invest in Navan Pre-IPO

How to Invest in Intercom Pre-IPO

How to Invest in StubHub (NYSE:STUB)

How to Invest in Perplexity Pre-IPO

How to Invest in Boston Dynamics

How to Invest in Telegram

How to Invest in Valve Pre-IPO

Who Owns Bank of New York Mellon?

Who Owns Bank of America?

Who Owns Jaguar and Land Rover?

Stock Market Holidays & Early Closures in 2025

How to Track Stocks With Google Finance & Google Sheets

How to Invest in Lucid Group (LCID)

How to Invest in Anduril Pre-IPO

How to Invest in Truth Social (DJT)

How to Invest in Anthropic Pre-IPO

How to Invest in L3Harris Technologies

How to Invest in Virgin Galactic

How to Invest in Visa Stock

How to Invest in Super Micro Computer

How to Invest in Micron Technology

How to Invest in Broadcom

How to Invest in Salesforce

Who Owns YouTube? History, Shareholders, Facts

Who Owns Google? History, Shareholders, & Facts

How to Invest in SeatGeek Pre-IPO

How to Invest in Wayve Pre-IPO

How to Invest in Fannie Mae

How to Invest in State Farm

How to Invest in Freddie Mac (FMCC)

How to Invest in New York Life Insurance

How to Invest in Liberty Mutual Pre-IPO

How to Invest in Nationwide

How to Invest in Northwestern Mutual

How to Invest in Stack Overflow

How to Invest in Helion Energy Pre-IPO

How to Invest in Sila Nanotechnologies Pre-IPO

How to Invest in Project Omega

What Companies Does Tencent Own?

Who Owns eBay? Top eBay Shareholders

Which Company Owns Spotify?

Which Company Owns Cash App?

How to Invest in xAI Pre-IPO

How to Invest in FedNow Pre-IPO

How to Invest in Stellantis (STLA)

How to Invest in Hims & Hers Health (HIMS)

How to Invest in Assurant Shares (AIZ)

How to Invest in Trump Media (DJT)

How to Invest in Pershing Square Pre-IPO

How to Invest in Dell Technologies

Which Company Owns Forever 21?

Which Company Owns Volvo?

Which Company Owns Corona Beer?

How to Invest in Accent Microcell Stock Pre-IPO

How to Invest in Fox News Stock

How to Buy Hilton Hotels Stock

How to Invest in DreamWorks Animation (DWA)

How to Invest in Nuro Pre-IPO

How to Invest in Warner Bros Discovery

How to Invest in Red Bull Pre-IPO

How to Invest in ESPN Stock

How to Invest in Target Stock (TGT)

How to Invest in EnergyX Pre-IPO

How to Invest in Safe Superintelligence

How to Invest in Waymo Pre-IPO

How to Invest in Chipotle Stock (CMG)

How to Invest in Adobe (ADBE)

How to Invest in Twitch Pre-IPO

How to Invest in Huawei Pre-IPO

How to Invest in American Express

How to Invest in TerraPower Pre-IPO

Which Company Owns Warner Bros?

How to Buy Zoom Stock (ZM)

How to Buy Delta Airlines Stock (DAL)

How to Invest in GE Aerospace (GE)

How to Buy GE HealthCare Stock (GEHC)

How to Invest in ADP Stock (ADP)

How to Invest in Lineage Inc.

How to Invest in Kairos Power Pre-IPO

How to Invest in Intuitive Machines

How to Invest in Live Nation Entertainment Stock (LYV)

How to Invest in Golden Goose Pre-IPO

How to Buy Pony AI Stock in 2025

How to Invest in Paycor Stock (PYCR)

How to Invest in Joby Aviation

How to Buy Archer Aviation (ACHR)

How to Invest in CoreWeave

How to Buy Gecko Robotics Stock Pre-IPO

How to Buy Constellation Energy Stock (CEG)

How to Buy BigBear.ai Stock (BBAI)

How to Invest in DeepSeek Pre-IPO

How to Buy Axiom Space Stock Pre-IPO

How to Buy Boom Supersonic Stock Pre-IPO

How to Invest in SoundHound AI (SOUN)

How to Invest in IonQ (IONQ)

5 Wide-Moat Stocks for 2025

How to Invest in Newsmax (NMAX)

How to Invest in Firefly Aerospace Stock

How to Invest in Rocket Lab (RKLB)

How to Invest in MicroStrategy (MSTR)

Who Owns Walmart? Walton Family, Shareholders

Who Owns Samsung? Overview and Shareholders

How to Invest in GLP-1 Stocks

How to Invest in Hugging Face Pre-IPO

How to Invest in Mounjaro

How to Invest in Toyota Motor

How to Invest in X-Energy Pre-IPO

How to Invest in Radiant Pre-IPO

How to Invest in Beta Technologies Pre-IPO

How to Invest in Figma (FIG)

How to Invest in Datadog (DDOG)

How to Invest in MP Materials (NYSE: MP)

How to Invest in Grammarly Pre-IPO

How to Invest in Webull Stock (BULL)

How to Invest in Circle Internet Group (CRCL)

How to Invest in Ambiq Micro (AMBQ)

How to Buy Medline Industries Stock Pre-IPO

How to Invest in Showrunner

How Does Temu Make Money?