Compound interest is undoubtedly the most important concept to understand when building wealth for the long term. If you put your money into an account that earns compound interest, you'll see your wealth grow exponentially. Here's a closer look at how it works.

Compound Interest

How it works

How compound interest works

Compounding happens when you put money into an account that earns interest. When the account pays interest, the interest payment stays in the account. As a result, the amount earning interest grows bigger and bigger with each new interest payment.

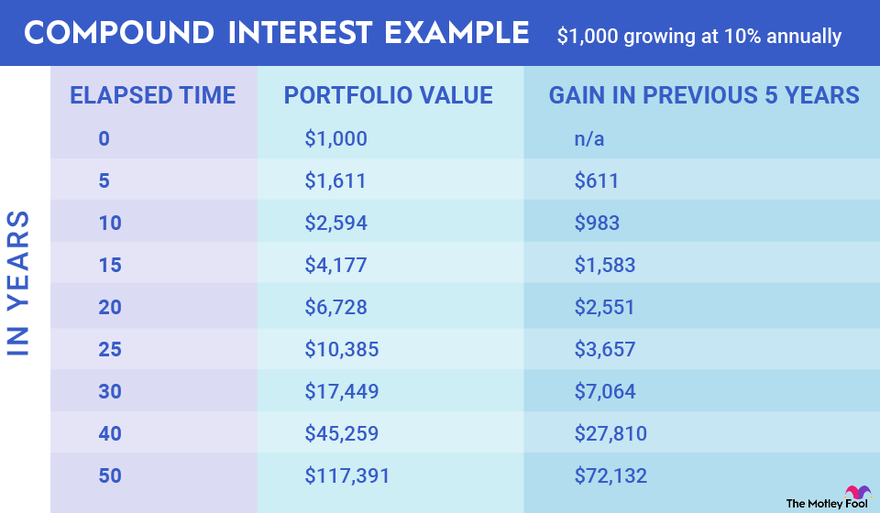

It's a relatively simple concept but one with mind-blowing possibilities. The longer you let your investments grow, the more rapidly they grow. Consider a single $1,000 investment growing at 10% annually:

Notice that over the first five years, the modest $1,000 investment grows by $611. But decades later, without any additional money being invested, that investment is growing by tens of thousands of dollars in the same number of years.

Now, imagine what would happen if you were to start with $5,000 or $10,000 and keep contributing more money to your account regularly and making smart investment choices to increase your returns.

Simple vs. compound

Simple interest versus compound interest

Compound interest includes interest earned on previously generated interest. Simple interest is just the interest rate multiplied by the investment or principal amount.

Interest Rate

Simple interest is often used in a loan or bond context wherein the interest is the same every period, and there is no compounding. Compound interest is used in investment and savings contexts.

The simple interest formula (variables defined in the next section) is:

A = P(1 + R * T)

This means the account value (A) is equal to the original investment amount (P) times 1 plus the rate (R) multiplied by the time (T). The simple interest formula isn't as complicated as the compound formula below.

Formula

Compound interest formula

Let's go over the compound interest formula and define each variable.

P(1 + R/N)^(N*T) = A

- Principal: P is the investment or principal balance at the start of the investment. If you use a spreadsheet or a financial calculator to calculate interest, principal is also known as present value.

- Rate: R is the interest rate earned on the investment.

- Number: N is the number of times interest is compounded per period. For example, many savings accounts compound monthly but have an annual interest rate. In that case, N equals 12.

- Time periods: T is the number of time periods.

- Account value: The formula calculates the account value (A). This variable is also known as future value.

Savings Account

Let's say you invested $10,000 in a savings account offering 5% interest compounding monthly. After five years, you would calculate the savings amount like this:

$10,000(1+.05/12)^(12*5) = $12,833.59

Account types

Which types of accounts offer compound interest?

You have several options for taking advantage of compounding interest to build wealth. Each of these investing strategies generates compound interest:

Savings accounts: Banks lend out the cash you put into a savings account and pay you interest in exchange for not withdrawing the funds. Savings accounts that compound daily, as opposed to weekly or monthly, are the best because frequently compounding interest increases your account balance faster. You can open a savings account with any local or online bank.

Money market accounts: These are almost the same as savings accounts, except that they allow you to write checks and make ATM withdrawals. Money market accounts also often pay slightly higher interest rates than savings accounts. The downsides of money market accounts are that most limit how many transactions you can complete monthly, and some charge a fee if your balance falls below a certain amount.

Certificate of deposit (CD): A CD requires you to lock your money up with a bank for a specified time (typically six months to five years). In exchange for keeping your money in the CD, you'll get a guaranteed interest rate on your money. The interest payments accrue in the account, compounding over the life of the CD.

Savings bonds: Both the Series EE and Series I savings bonds issued by the U.S. Treasury earn interest monthly. That interest compounds every six months, meaning the interest earned over the previous six months is automatically added to the bond's principal value and starts earning interest.

Generally speaking, if you stay within Federal Deposit Insurance Corp. (FDIC) limits, both savings and money market accounts are extremely safe options. They've become even more attractive since interest rates rose quickly in 2022 and 2023. However, to profit significantly from compounding interest, it's important to diversify your money with different types of accounts and investments.

Compound faster

Investments that can compound your money a little faster

While compound interest can provide consistent and safe returns for investors, you can get better returns over the long run by investing in other assets. In particular, dividend stocks and real estate investment trusts (REITs) offer consistent cash flow while providing additional upside in capital appreciation.

Dividend stocks: Stocks that pay dividends compound similarly to compound interest if you reinvest the dividends. You can instruct your brokerage to automatically reinvest all dividend payments you receive and buy more shares.

The risk, however, is that the share price will decline more than the amount received in dividends. A good dividend stock will, over the long run, provide both capital appreciation and a bigger dividend payment.

Real estate investment trusts: A REIT is an entity that holds a portfolio of real estate or real estate loans. Either strategy can produce consistent cash flow, which a REIT is required to pass on to its shareholders. That means shareholders receive sizable distribution checks every year and can reinvest them in the REIT and compound over time.

In the news

Compound interest in the news

Interest rates on savings accounts, money market funds, and CDs are driven primarily by the federal funds rate. The Federal Reserve raised interest rates between 2022 and 2023, began making rate cuts in late 2024, and indicated further rate cuts may happen in 2025 and 2026.

At its Federal Open Market Committee (FOMC) meeting in December 2024, the Fed indicated that two interest rate cuts in 2025 are possible.

FOMC (Federal Open Market Committee)

Meanwhile, the rate you can get on plain savings accounts has remained relatively high. Some providers offer fully liquid savings accounts that pay between 4% and 4.75% and perhaps even slightly higher rates if you sign up for a CD. In fact, locking in a longer-term CD rate today could be a good choice for some in the face of impending interest rate cuts.

Over the past decade, keeping money in cash has been seen as a drag on your investment portfolio. The game is different now, though.

Holding cash in readily available savings can provide a more-than-acceptable return, especially considering you won't experience the same day-to-day volatility while holding cash as you would with the stock market. A sizable cash position now makes sense, particularly for those nearing or in retirement.

The power

The power of compounding interest

Compounding interest can turn meager investments into wealth over time, but only if you start investing as soon as possible and stay invested. The sooner you start investing, the more time you have for interest to compound.

The $1,000 investment in the example above increased by $983 from the fifth year to the 10th year and by $7,064 from year 25 to year 30. The longer you wait to start investing, the older you will be when you reach year 30.

Related investing topics

Staying invested is key to maximizing the effects of compound interest. If you're constantly moving or withdrawing your money, you lose out on a lot of potential compounded interest.

There are plenty of good reasons to withdraw your savings, though. You could have reached your savings goal and now need to spend the cash. Or you could be moving from a compound interest account to a riskier investment, like stocks or real estate, which have more attractive return potential.

But heed Charlie Munger's wisdom: "The first rule of compounding is to never interrupt it unnecessarily."

FAQ

Compounding interest FAQ

What types of accounts have compound interest?

Several types of accounts will earn compound interest. Savings accounts and money market accounts are the most liquid of all compound interest accounts. You can also earn compound interest from a CD or a savings bond.

Do banks still offer compound interest?

Yes. Many banks offer savings accounts with interest rates topping 4%. If your bank doesn't offer a high interest rate, it's likely worth opening a new account at a bank that does. You can also find CDs offering similar yields, which would allow you to lock in a higher interest rate for longer.

How do I open a compound interest account?

Opening an account that earns compound interest is as simple as going to your preferred bank and providing it with the information needed to open a savings or money market account. The bank may also offer CDs. Then, you can simply send money from your current financial institution to your new account.

Is a Roth IRA a compound interest account?

No. A Roth IRA is a tax-advantaged retirement savings account. You can invest in vehicles, such as a money market fund or CD, that earn compound interest inside a Roth IRA.

Where can I get 7% compound interest on my money?

No financial institutions are offering 7% or more on any meaningful deposits. You might be able to find some accounts offering that rate as a short-term promotion or on a small sum, but there is no way to put all your money to work in a 7% interest product in the current rate environment.

However, long-term investors have historically earned more than 7% per year over the long run by investing in simple index funds. Few investments outperform stocks in the long run.