AT&T (T +2.02%) is an iconic telecommunications company. It can trace its roots all the way back to 1876, when Alexander Graham Bell invented the telephone.

The company has evolved over the years through a series of transactions. Today, AT&T is one of North America's largest communications services providers. It provides mobile and wireline (broadband internet and voice) services to more than 100 million U.S. customers, wired services to almost 2.5 million businesses, and mobile services to consumers and businesses in Mexico.

AT&T is investing heavily to build next-generation 5G and fiber networks across the U.S. to support greater connectivity, faster data movement, and increased data usage. The investments should enable AT&T to increase its revenue and earnings in the future.

They should also help grow the telecom giant's already enormous cash flow, giving it more money for dividend payments, another key draw of AT&T stock. AT&T's lucrative income stream is another reason you might be interested in buying its stock.

How to buy AT&T stock

Those who want to invest in AT&T will need to take a few steps before becoming shareholders. Here's a step-by-step guide to adding the telecommunications company to your portfolio:

- Open your brokerage app: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Search for AT&T: Enter the ticker "T" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in AT&T?

Taking the time to thoroughly research a company before buying shares is vital. You might realize the stock isn't right for you, or it might boost your confidence that shares are a good investment.

With that in mind, here are some reasons why you might want to buy shares of AT&T:

- You're at or nearing retirement and need dividend income.

- You're seeking stocks with a high dividend yield.

- Buying AT&T stock would help diversify your portfolio.

- You think AT&T's investments in 5G and fiber will reignite revenue growth and boost its profitability in the future.

- You think shares of AT&T trade at an attractive valuation.

- You believe AT&T can produce a worthwhile total return.

On the other hand, here are some reasons you might decide not to buy shares of the telecom giant:

- You're years away from retirement and don't need income-generating investments.

- You're seeking dividend stocks that can steadily increase their payouts.

- You already own shares of another telecom stock.

- You're not convinced AT&T's investments in fiber and 5G will reaccelerate its revenue and earnings growth rates.

- You're seeking a faster-growing company than AT&T.

- You're concerned that a recession could affect AT&T's earnings and cash flow.

- You don't think AT&T's total return can beat the S&P 500 over the next three to five years.

NYSE: T

Key Data Points

Is AT&T profitable?

Dialing into a company's profitability is a vital part of investment research. Historically, profit growth is the biggest factor driving stock price performance over the long term. With that in mind, here's a closer look at AT&T's profitability.

AT&T is an incredibly profitable company. The telecom giant produced $19.2 billion of net income in Q3 2025 on $92.1 billion of operating revenue. Meanwhile, the company's cash flow from operations was even higher at $28.9 million. Its strong profitability continued in 2025 as reported above.

AT&T also produces strong free cash flow ($17.6 billion in 2024 and $6.2 billion by the third quarter of 2025). That's more than enough to cover its dividend payment (about $2 billion per quarter). The company had been using its excess free cash flow to repay debt.

That strategy has paid off as AT&T reached its targeted leverage ratio in early 2025. That's giving it the financial flexibility to return additional cash to shareholders by repurchasing shares. It plans to repurchase about $20 billion of its shares between 2025 and 2027.

Does AT&T pay a dividend?

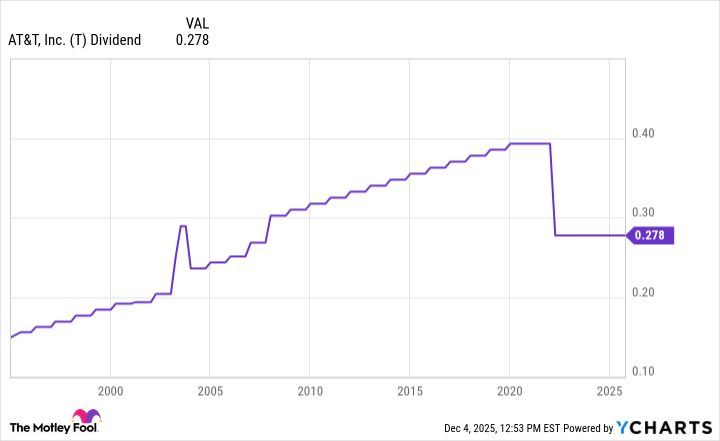

AT&T has a long history of paying dividends. As of late 2025, the company made quarterly dividend payments of roughly $0.28 per share ($1.12 annualized), giving the telecom giant a dividend yield of around 4.3% on its share price. That was much higher than the average (the S&P 500's dividend yield was less than 1.5%).

Despite the company's long history of paying dividends and its attractive yield, AT&T cut its payout in 2022, ending a long period of growth:

AT&T cut its dividend by almost 50% in 2022 to retain more cash to invest in its growth and to reduce debt following the spinoff and merger of its media business to create Warner Bros. Discovery (WBD -1.20%).

While AT&T could certainly increase its dividend now that it has achieved its targeted leverage ratio, the company plans to maintain its current payment level for the time being. Instead, it intends to return additional cash to investors by repurchasing shares.

How to invest in AT&T through ETFs

Those still determining whether they're ready to invest directly in a company like AT&T have alternative options to consider. They can passively invest by purchasing a fund that holds its stock. One of the most common passive investment vehicles is an exchange-traded fund (ETF).

Exchange-Traded Fund (ETF)

Split Year | Split Ratio |

|---|---|

1998 | 2-for-1 |

1993 | 2-for-1 |

1987 | 3-for-1 |

The company also completed a stock spinoff of its former media division in 2022. The transaction entitled investors to receive 0.241917 shares of Warner Bros. Discovery stock for every share of AT&T they owned.

AT&T likely won't complete another stock split soon. Shares traded around $25 in late 2025, a very accessible level for most investors. The stock would have to gain significant value before AT&T would need to consider another split.

The bottom line

Iconic telecom giant AT&T believes its best days are still ahead. The company is investing heavily in building faster 5G and fiber networks, which it believes will increase its already copious cash flows. The increasing cash flows could enable it to grow value for its investors.

The company reached its targeted leverage level in early 2025, giving it the flexibility to start returning more cash to investors by repurchasing shares. That combination of earnings growth, dividend income, and value-enhancing share repurchases could enable AT&T to be a solid investment in the coming years.