Upstart Holdings (UPST +1.17%) is an artificial intelligence (AI)-powered lending platform. The financial technology company uses machine learning models to recognize true credit risk more accurately. This opens the banking and loan world to more non-traditional lendees, but is it a sound investment? How can you add Upstart stock to your portfolio?

NASDAQ: UPST

Key Data Points

Upstart in a nutshell

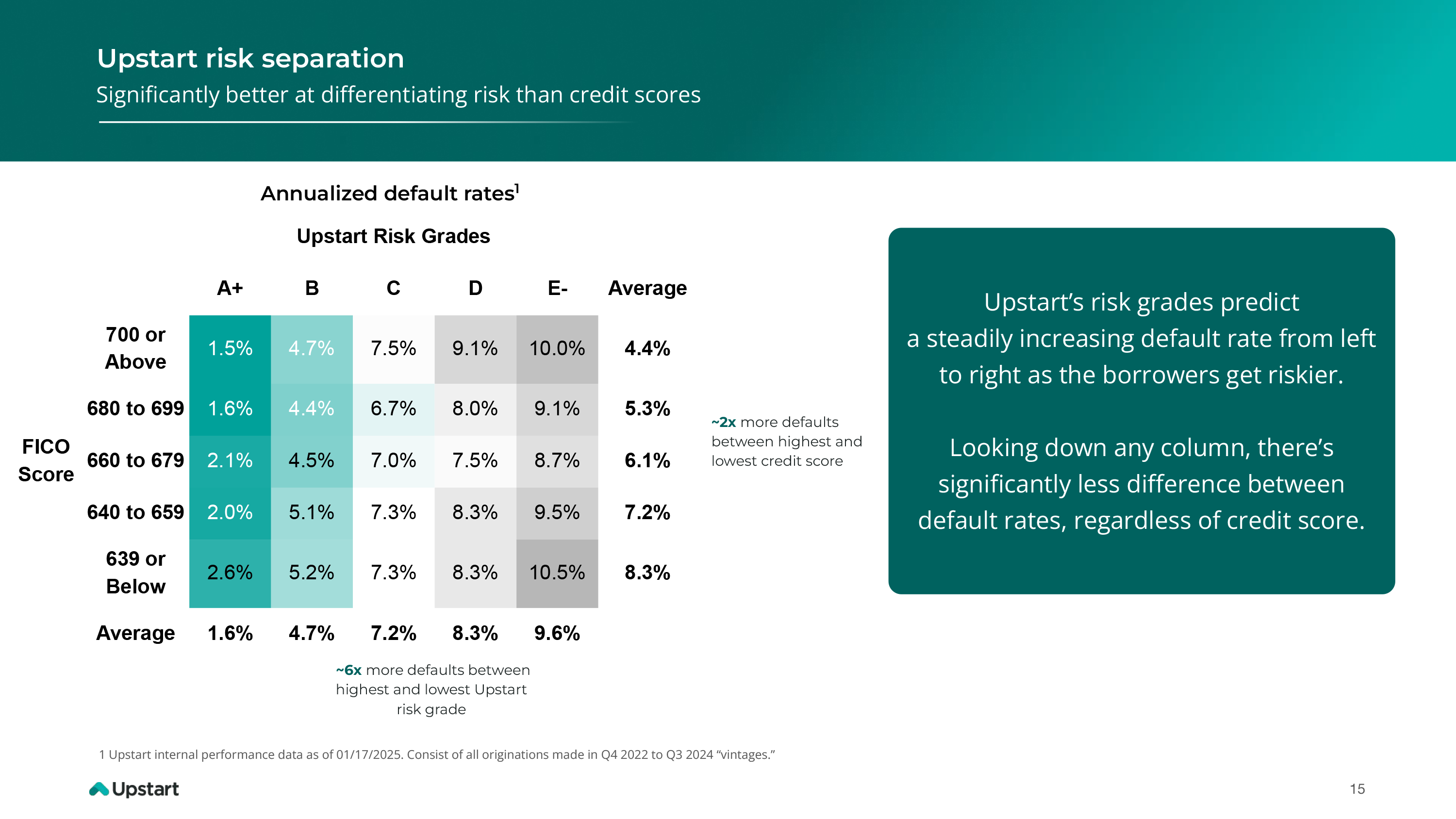

Upstart trains its artificial intelligence model on billions of cells of performance data, such as loan repayment, early payments, types of loans, banking habits, and more. All of this data allows it to more accurately predict loan default risk compared to a credit score alone:

Banks and credit unions have been flocking to Upstart's data-rich platform. The company has grown to partner with more than 100 companies since becoming a publicly traded company in 2020. As of 2024, Upstart had offered over $677 billion worth of auto loans, with a continued decline in the total amount owed in the balance sheet since 2023. In short, it means that people seem to be paying back their loans.

The company has also steadily added new loan types to its platform, growing its total addressable market opportunity. It started in the $170 billion personal loan market. It has since expanded into auto loans ($755 billion opportunity) and home loans ($2.2 trillion). It's also targeting the small business loan market.

The AI-powered lending platform's growth potential likely has many investors interested in the possibility of investing in its stock. Here's a step-by-step guide on how to buy shares of the financial technology stock and some other factors to consider before adding Upstart to your portfolio.

Loan Default

How to buy Upstart stock

You'll need to take a few steps before buying shares in Upstart.

- Step 1: Open a brokerage account: You need to open and fund a brokerage account before buying shares of any stock. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

- Step 2: Figure out your budget: Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

- Step 3: Do your research: It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

- Step 4: Place an order: Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (UPST for Upstart).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Should I invest in Upstart?

Completing your due diligence by fully researching a stock is crucial before making an investment. It could turn you away from the company or confirm your investment ideas.

Here are some reasons why you might want to consider investing in Upstart:

- You think the company's AI-powered lending platform has an edge over traditional credit score-based lending.

- You believe Upstart will continue adding lending partners to its platform.

- You understand how the company makes money.

- You don't need dividend income from your investment.

- You like to invest in founder-led companies.

- You understand the risks of investing in Upstart, including that its business is more sensitive to the economic cycle.

Some reasons you may want to avoid Upstart in your portfolio:

- You're not sure that Upstart's AI-driven approach will displace credit scores.

- You're near or in retirement and need dividend income.

- You're worried about a potential recession and the impact that could have on Upstart's business.

- You're concerned that Upstart holds some loans on its balance sheet that increase its credit risk.

- You're seeking investments with lower volatility.

Is Upstart profitable?

Exploring a company's profitability is a crucial part of an investor's stock research process. That's because profit growth typically plays a major role in driving stock price performance over the long term.

Upstart wasn't consistently profitable as of mid-2025. During the second quarter, Upstart reported a net loss of $5.6 million on $257 million in revenue, which shows they are attempting to close the gap when compared to the same time last year.

However, the company has been profitable in the past:

The bottom line on Upstart

Upstart believes it has built a better way to measure the creditworthiness of borrowers than a traditional credit score. Its platform leverages the power of AI to predict the probability that a borrower will default on their loan. The company believes it's still in the early stages of tapping into a massive opportunity.

However, Upstart isn't without risk. The financial technology company's revenue is more sensitive to economic changes since financial institutions pull back on lending when conditions deteriorate. Its revenue and profitability could be lumpy, causing its shares to be very volatile.